In the dynamic world of cryptocurrency, the advent of Crypto Loans has introduced a novel avenue for financial flexibility and investment strategy. This article will explore the key risks and advantages of Crypto Loans.

Unlike traditional banking systems, crypto loans offer a bridge between the burgeoning potential of digital assets and the liquidity needs of their holders. This comprehensive guide explores the landscape of crypto loans, highlighting the benefits, risks, and key considerations for choosing the right blockchain platform for your borrowing needs.

What Are Crypto Loans?

Crypto loans are an innovative financial product that allows borrowers to leverage their cryptocurrency holdings as collateral to secure a loan in fiat currency or another cryptocurrency. This mechanism enables investors to access liquid funds without selling their digital assets, preserving the potential for future appreciation.

The Appeal of Crypto Loans

The primary allure of crypto loans lies in their ability to provide liquidity while allowing borrowers to retain ownership of their crypto assets. In a market characterized by volatility and rapid price movements, the opportunity to access cash without liquidating one’s investment is invaluable.

Furthermore, crypto loans bypass traditional credit checks, making them accessible to a broader range of borrowers, including those with limited credit history or lower credit scores.

Choosing the Right Platform

Several key factors influence the choice of a crypto loan platform:

Interest Rates and Fees: Compare the interest rates and fees charged by different platforms. Some may offer lower rates for certain cryptocurrencies or have different fee structures based on the loan amount and term. Up-to-date rates for all the major platforms can be found here.

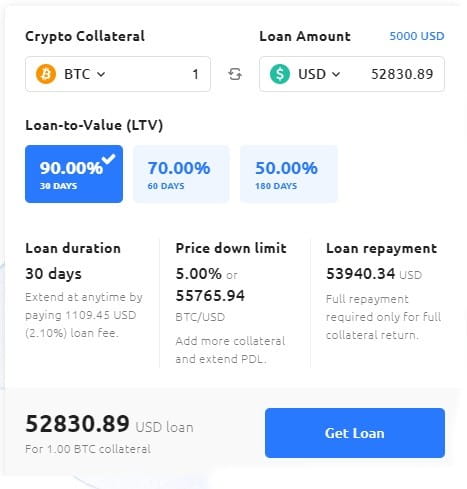

Loan-to-Value (LTV) Ratios: The LTV ratio determines how much you can borrow against your crypto collateral. Platforms offering higher LTV ratios may allow you to borrow more against your assets, but they also carry higher risks, especially in volatile market conditions.

Higher Loan-to-Value ratios are more risky and can be liquidated quickly in the event of a sudden price drop. Supported Cryptocurrencies: Ensure the platform supports the cryptocurrency you intend to use as collateral. While Bitcoin and Ethereum are widely accepted, other altcoins may not be supported on all platforms.

Security Measures: Investigate the platform’s security protocols to protect your collateral from hacking and theft. Look for platforms that employ cold storage, multi-signature wallets, and have insurance policies in place to cover potential losses. Most platforms do reveal who is managing the custody of their assets, and the extent of any insurance coverage.

Regulatory Compliance: Choose platforms that adhere to regulatory standards and have transparent operating procedures. This can provide an additional layer of security and peace of mind. Nonetheless, regulatory approaches globally are difficult to track, with the United States, in particular, being a challenging environment for crypto lenders.

The Risks of Crypto Loans

While crypto loans offer numerous advantages, they are not without risks:

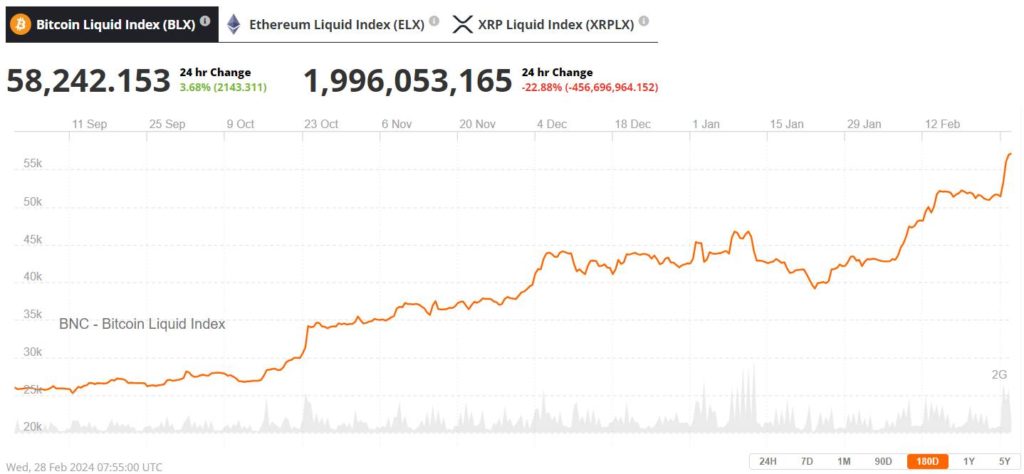

- Market Volatility: The value of your collateral can fluctuate significantly, potentially leading to margin calls or liquidation if the value falls below a certain threshold.

- Platform Stability: It is entirely plausible that a major brand crypto lender could collapse at any time. Celsius and BlockFi are two examples, but there has been literally dozens of others. The crypto lending space has witnessed the collapse of several platforms due to mismanagement or regulatory issues. It’s crucial to select a platform with a strong track record and financial stability.

- Regulatory Changes: The regulatory environment for cryptocurrencies is still evolving. Changes in regulations can impact the availability and terms of crypto loans.

Emerging Trends and Innovations

The crypto lending market is continuously evolving, with new platforms and products emerging to meet the diverse needs of borrowers. Decentralized finance (DeFi) platforms are gaining popularity, offering crypto loans without intermediaries, thereby reducing costs and increasing efficiency. At the same time, the DeFi sector has a dismal track record in from the perspective of smart contract hacks.

Additionally, some platforms are introducing novel features such as interest-earning accounts on collateral and the ability to switch collateral types mid-loan.

Conclusion

Crypto loans represent a significant advancement in the financial utility of digital assets, offering a flexible solution for liquidity without the need to sell off valuable investments. As the market matures, the range of options and features available to borrowers is expanding, making it more important than ever to carefully consider your platform choice. By understanding the benefits, risks, and key selection criteria, you can navigate the crypto loan landscape with confidence, unlocking the full potential of your cryptocurrency holdings. Check the latest interest rates here.