Celsius says it has exited bankruptcy on January 31st and has begun distributing over $3 billion in cryptocurrency and fiat to account holders and other creditors.

PayPal and Coinbase will act as distribution partners as there will be no distributions from the Celsius app. The restructuring plan, receiving overwhelming support from about 98% of Celsius’ account holders, was ratified by the Bankruptcy Court for the Southern District of New York on November 9, 2023. Celsius says additional information relating to a refund timeline will be sent to creditors in the “coming days”.

The company says it has increased the assets available for creditor compensation by nearly $250 million through the conversion of altcoins to BTC or ETH and other settlements. These transactions were greenlit by the Bankruptcy Court on December 27, 2023.

Celsius Client Receives 32% Refund

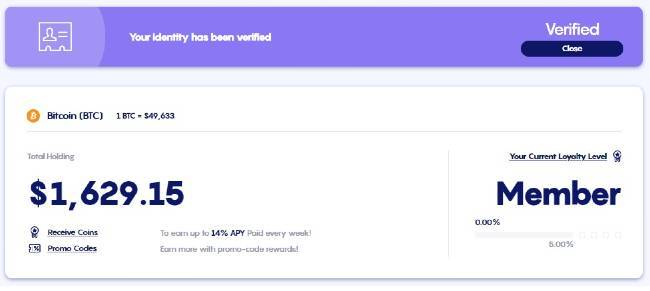

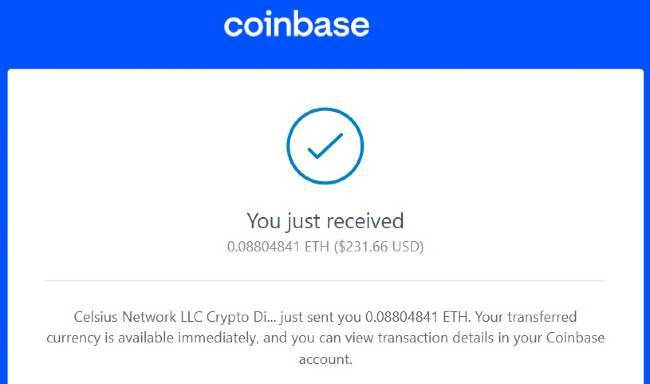

Verified Celsius client ‘Jason’ (full name withheld) from New Zealand, says he received 32% of his Celsius holdings back via Coinbase on the 13th of February. “I received no notification from Celsius,” he says, “and my balance at Celsius today remains at US$1629 according to their app.”

“But I got two emails from Coinbase saying Celsius had sent me $290 of BTC and $231 of ETH. It’s weird because I never had any ETH on Celsius.”

“It adds up to about 32 cents on the dollar. I don’t know if that’s going to be it, but still, I’m grateful to get anything back really.”

Mashinsky Charged

Alexander Mashinsky, the founder and former CEO of Celsius Network LLC, was charged with multiple counts of fraud in 2023, including securities fraud, commodities fraud, and wire fraud. The charges stemmed from allegations that he defrauded customers and misled them about various aspects of Celsius’s operations, such as the company’s success, profitability, and the investments made with customer funds.

Additionally, Mashinsky and Roni Cohen-Pavon, the former Chief Revenue Officer of Celsius, are accused of manipulating the market for Celsius’s proprietary crypto token, CEL, while secretly selling their own CEL tokens at inflated prices.

The United States entered into a non-prosecution agreement with Celsius the company, under which the company agreed to accept responsibility for its role in the fraudulent schemes. This agreement was considered in light of Celsius’s bankruptcy proceedings and its efforts to maximize recovery for victims.

Celsius Clients Must Open A Coinbase Account

Celsius has previously advised that clients hoping to withdraw their funds will need to open an account with Coinbase as Celsius will be shutting down its platform and related apps in late February 2024.

In line with the winding down of operations, and its exit from bankruptcy, the Celsius mobile and web apps will be discontinued. Starting around February 27, 2024, these apps will no longer be available on iOS, Android devices, or the web. Creditors are encouraged to download their transaction history before this date.

Preparation for Celsius Refunds

Creditors are advised to update their personal information in their Celsius Account now to ensure a smooth distribution process. This includes verifying details like full legal name, contact email, and date of birth, which should match the information on government-issued IDs.

Additionally, any changes in residency or mailing addresses should be updated promptly. For those receiving cryptocurrency, the distribution will be sent via Coinbase shortly after the “Effective Date” (which is currently said to be sometime in Q1 2024). Celsius customers who do not currently have a Coinbase account will need to create one now.

To avoid delays, creditors should ensure that the personal information on their Celsius Account matches that on their Coinbase account. This includes having the same email address for both accounts.

If there is a discrepancy in the email addresses, changing the email address at Coinbase is recommended over altering the Celsius account email, due to potential delays in processing support emails at Celsius.

For those entitled to receive dollars (USD), specific instructions will be provided at a later date detailing how these funds will be accessible.

Legitimate Email Addresses

Like BlockFi before it, Celsius is warning creditors about a potential uptick in phishing attacks as the potential distribution of assets draws nearer. It says Celsius, the Official Committee of Unsecured Creditors, Fahrenheit LLC, or their respective advisors will never contact account holders directly by phone, text message, or social media to request account or personal information.

Celsius says Stretto is its official claims agent and emails from noreply@cases-cr.stretto-services.com are legitimate. Account holders can contact Stretto directly at Celsiusinquiries@stretto.com. Emails from hello@celsius.network are also legitimate. Kirkland & Ellis LLP is serving as Celsius’ legal counsel and creditors can direct any legal questions to CelsiusCreditorQuestions@kirkland.com