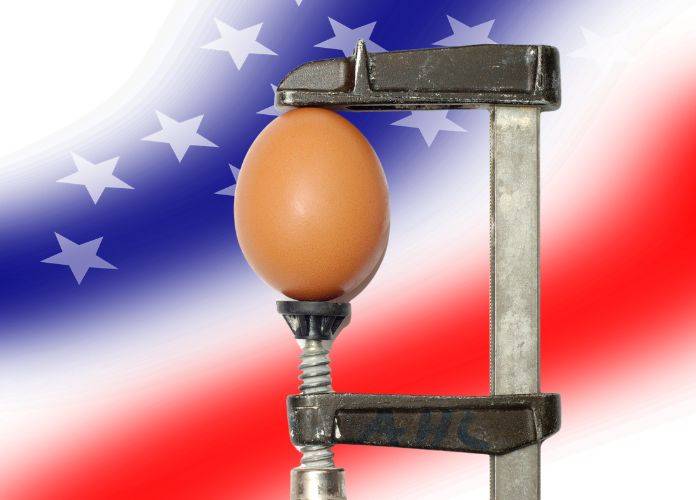

Crypto ‘earn’ products are retreating from the US as numerous agencies and states take action against the platforms offering yield on cryptocurrency staking, lending and borrowing.

The future of the crypto ‘Earn’ sector in the United States seems to be at a crossroads. With regulatory bodies taking an increasingly aggressive stance, crypto platforms are having to adapt rapidly to an ever-changing legal environment.

While agencies and prosecutors say the end result will be more secure and regulated services for consumers, it remains to be seen who will be left to offer such services, as most platforms are instead opting (or being forced) to leave.

Crypto Earn Platforms In The Crosshairs

In the most recent high-profile case, the KuCoin crypto exchange has agreed to pay $22 million and stop operating in New York to settle a lawsuit filed by the state’s attorney general Letitia James.

The lawsuit alleged that KuCoin violated New York’s Martin Act, which prohibits fraud and deception in securities and commodities trading, by offering unregistered crypto products to New York investors.

KuCoin did not admit or deny the allegations but agreed to the settlement terms to avoid further litigation. As part of the settlement, KuCoin will have to cease offering any services to New York residents and provide a list of its New York customers to the attorney general’s office.

KuCoin will also have to submit regular reports on its compliance with the settlement terms and cooperate with any future investigations by the office.

The settlement is the latest in a series of actions taken by the New York attorney general’s (NYAG) office to crack down on crypto platforms that it says operate without proper oversight and consumer protection. In 2023 alone, the NYAG has taken action against CoinEx, Bitfinex, Tether, BitMEX, and Binance and more.

In October the office brought a sweeping lawsuit against cryptocurrency companies Gemini Trust Company (Gemini), Genesis Global Capital, LLC and its affiliates (Genesis), and Digital Currency Group, Inc. (DCG) for defrauding more than 230,000 investors, including at least 29,000 New Yorkers, of more than $1 billion.

An investigation by the Office of the Attorney General (OAG) found that Gemini lied to investors about an investment program it ran with Genesis called Gemini Earn.

Investigators say Gemini repeatedly assured investors that investing with Genesis through their Gemini Earn program was a low-risk investment. However, the investigation found that Gemini’s internal analyses of Genesis showed that the company’s financials were risky.

The lawsuit alleges that Gemini knew Genesis’ loans were under-secured and at one point highly concentrated with one entity, Sam Bankman-Fried’s Alameda, but did not reveal this information to investors.

The lawsuit also charges Genesis, its former CEO Soichiro Moro, its parent company, DCG, and DCG’s CEO Barry Silbert with defrauding investors and the public by trying to conceal more than $1.1 billion in losses, which were borne by investors.

As a result of these misleading claims and deceptions, the OAG says thousands of investors lost millions of dollars and, in some instances, their lifesavings. Through this lawsuit, Attorney General James seeks to ban Gemini, Genesis, and DCG from the financial investment industry in New York, and seeks restitution for investors and disgorgement of ill-gotten gains. At the time of writing, Gemini continues to promote another yield bearing product Gemini Staking.

Federal agencies are also hot on the case. Back in January 2023, the SEC hit Nexo with 44.5 million in fines for its ‘Earn’ product which the SEC said was an unregistered security. Nexo agreed to pay a $22.5 million penalty and cease its unregistered offer and sale of the EIP to U.S. investors and to also pay an additional $22.5 million in fines to settle similar charges by state regulatory authorities.

As part of its settlement, Nexo was able to make no comment either admitting or denying the charges against it, and the Earn product is still operating today – most prominently in Europe.

Implications for Consumers and the Industry

While there is a recurring cry that actions like those above are ‘stifling innovation’, there is no denying that the crypto earn sector worldwide has had a shocking couple of years. Celsius, BlockFi, Hodlnaut, Coinloan, Vauld, LendingBlock and literally dozens of other platforms have either gone broke or rug pulled, taking their client’s funds with them.

These cases represent a significant shift in the regulatory landscape for the crypto ‘Earn’ sector in the United States. The actions taken by authorities like the SEC and state regulators indicate a move towards stricter enforcement of existing securities and financial laws in the cryptocurrency domain. For consumers, this could mean more protection but also limited access to some crypto services. For the industry, it signals the need for greater compliance and possibly a re-evaluation of business models to align with U.S. laws and regulations.