If a Bitcoin ETF has $100,000,000 in AUM and 200,000 shares outstanding – what should its buy-in price be?

Do arbitrage opportunities exist between the current range of Bitcoin ETFs available today? What is the relationship between the value of an ETF’s assets under management (AUM), its shares outstanding and its buy-in price? How do you know if an ETF is priced fairly?

How to Evaluate An ETF’s Buy-In Price

To understand the relationship between an ETF’s assets under management (AUM) and its buy-in price, let’s clarify what these terms mean and how they are related.

-

Assets Under Management: An ETF’s AUM is the total market value of all the investments that an ETF holds. It can fluctuate based on the performance of the underlying assets and the inflow or outflow of money from investors. In the case of a volatile asset like Bitcoin, this value can fluctuate widely across the day.

-

Buy-in Price (or Share Price): This is the price at which investors can purchase a share of the ETF. This price changes throughout the trading day based on supply and demand dynamics in the market.

The buy-in price of an ETF is not directly determined by its AUM. Instead, the AUM can give you an idea of the ETF’s size and, indirectly, its liquidity and market acceptance. The buy-in price, on the other hand, is influenced by the value of the underlying assets the ETF holds. For a Bitcoin ETF, this would be the current market price of Bitcoin and how many bitcoins or fractions thereof each share represents.

Understanding the Buy-In Price

To analyze whether a Bitcoin ETF’s buy-in price is fair, consider the following steps:

-

Determine the Net Asset Value (NAV): The NAV per share is the value of the ETF’s assets minus its liabilities, divided by the number of shares outstanding. This gives you the per-share value of the ETF’s holdings.

-

Compare NAV to the Buy-In Price: The buy-in price should closely track the NAV. If the buy-in price is much higher than the NAV, the ETF might be overvalued (or in a premium state). If it’s lower, the ETF might be undervalued (or at a discount).

Example Calculation

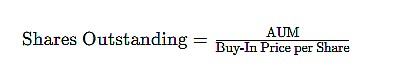

If an ETF has $100,000,000 AUM and a buy-in price of $65 per share, you can calculate how many shares are outstanding:

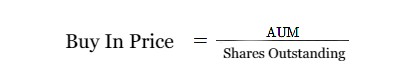

In this case, the Shares Outstanding should be 1538461. Calculated another way, if you know the value of the AUM and the number of shares outstanding you can calculate a fair buy in price. Using the same numbers as above, if the buy in price should be the sum of the AUM, divided by the shares outstanding.  As expected, the buy-in price calculation is $65. Thus if you know the total market value of the Bitcoin holdings or can estimate it based on the ETF’s disclosures, you can determine if the buy-in price is fair by comparing it to the NAV.

As expected, the buy-in price calculation is $65. Thus if you know the total market value of the Bitcoin holdings or can estimate it based on the ETF’s disclosures, you can determine if the buy-in price is fair by comparing it to the NAV.

Keep in mind, for something like a Bitcoin ETF, the NAV would closely follow the current market price of Bitcoin, assuming the ETF holds Bitcoin directly.