Crypto custody platforms use a lot of jargon to promote their services. Most of it is marketing speak. Only some phrases actually mean anything in a legal sense – “Qualified Custodian” is one of them.

If you’re reading the websites of many crypto custody platforms, you’re going see a lot of impression sounds terms like ‘Bank Grade Security’, ‘Hardened Vaults’ and ‘Fully Regulated’. Unfortunately, the vast majority of it means nothing from a legal or compliance perspective – but a few terms do carry some weight from the perspective of reassuring a potential depositor. Thus, if a firm claims to be a “Qualified Custodian”, it’s a real thing, under law and it’s checkable.

What Is A Qualified Custodian?

In the United States, a “Qualified Custodian” refers to an entity that is permitted under US Federal securities laws to hold clients’ funds and securities on behalf of registered investment advisers. In other countries, similar laws may apply, but the term Qualified Custodian, in a legal sense, is specific to entities operating in the United States. Therefore, the credentials of a platform operating from Gibraltar, for example, and claiming to be a Qualified Custodian, should not carry much weight.

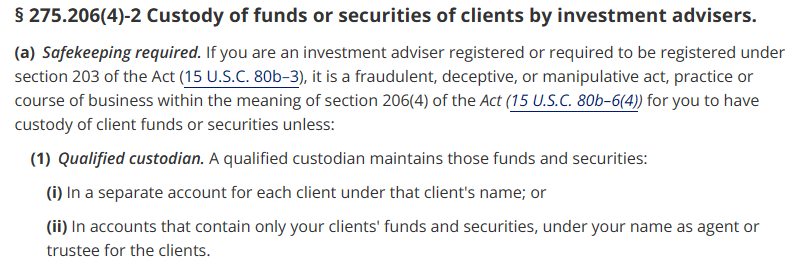

The concept is primarily regulated by the Securities and Exchange Commission (SEC) under the Investment Advisers Act of 1940, particularly under Rule 206(4)-2, also known as the “Custody Rule”. The Custody Rule is designed to protect advisory clients from the risk of misappropriation or misuse of their assets.

Source: Cornell Law School

Qualified Custodians include specific types of financial institutions that meet certain regulatory standards and are considered capable of safely holding client assets. These institutions typically include:

- Banks and Savings Associations: That are federally insured and regulated.

- Registered Broker-Dealers: Holding client assets in customer accounts.

- Registered Futures Commission Merchants: Holding client assets in customer accounts related to futures contracts and options on futures contracts.

- Foreign Financial Institutions: That customarily hold financial assets for their customers, provided that they also meet equivalent standards of care as U.S. institutions.

Approval Process

The process for an institution to become a Qualified Custodian involves meeting the regulatory and compliance standards set by the appropriate regulatory bodies, such as the SEC, FINRA (for broker-dealers), or other relevant authorities. This typically involves:

- Demonstrating robust financial health and operational integrity.

- Implementing stringent security measures for asset protection.

- Ensuring compliance with applicable laws and regulations.

Regular Audit Process

To ensure ongoing compliance and the safety of client assets, Qualified Custodians are subject to regular audits and examinations. These audits can be conducted by independent auditors or regulatory bodies and include reviews of:

- Compliance with custodial rules and regulations.

- The accuracy of financial statements and records.

- The effectiveness of internal controls over client assets.

- Adherence to safekeeping practices.

The regulatory framework around Qualified Custodians aims to create a secure environment for the management and storage of client assets, minimizing the risk of fraud and providing investors with greater confidence in the financial system.

What Does ‘Fully Regulated’ Mean?

From the perspective of the safety of your funds, the phrase ‘fully regulated’ should be treated with maximum scepticism. While it alludes to government oversight and legal compliance, in reality it is just marketing speak.

The recent collapse of numerous crypto lending platforms underscores a crucial lesson: government-issued ‘credentials,’ such as licenses and registrations, offered little to no protection to investors.

Consider the cases of Celsius, Hodlnaut, Lendingblock, and BlockFi. Celsius was registered under the UK Money Laundering, Terrorist Financing and Transfer Regulations as a crypto asset business. It was also registered as a Money Services Business with the US Financial Crimes Enforcement Network (FinCen). In Singapore, failed lender Hodlnaut was a Certified Fintech company by the Singapore Fintech Association. Before it rug pulled, Lendingblock operated under a Distributed Ledger Technology Provider licence issued by the Gibraltar Financial Services Commission. In the US, BlockFi was registered to operate in almost every US state and had a Digital Assets Business license from Bermuda. None of it meant much in terms of protecting customer deposits.

Months after declaring bankruptcy, Coinloan.io continued to emphasize its government credentials and insurance coverage.

Months after declaring bankruptcy, Coinloan.io continued to emphasize its government credentials and insurance coverage.

Despite holding various licenses and registrations, these credentials did not safeguard customer deposits. Unlike traditional banks, which benefit from deposit insurance provided by organizations like the Federal Deposit Insurance Corporation (FDIC) in the US, crypto finance companies lack such protection. If your crypto savings are stolen or a crypto finance company goes out of business, there is no government safety net.