Crypto debit and credit cards represent a significant milestone at the intersection of traditional banking and the burgeoning cryptocurrency economy. Here we explain what they are, how they differ, how much they cost – and how to get maximum value from them.

Crypto debit and credit cards function similarly to their traditional counterparts but with a crucial distinction: they allow users to spend their cryptocurrency holdings or earn rewards in crypto for their purchases. This dual functionality not only enhances the utility and liquidity of digital currencies but also integrates them more closely with conventional purchasing habits and financial systems.

Crypto credit cards are all debit cards

While some cards market themselves as ‘credit cards’, in reality they are all debit cards. A traditional credit card will typically be issued by a customer’s bank. The issuer will check your income, your credit rating etc – and then offer a credit limit from as low as $500 up to tens of thousands or more. So even though you might not have $10,000 on hand to buy a car, you can use a credit card to buy one, then as long as you pay your monthly minimum (usually 2-5%) you can carry the debt for as long as you like, and pay interest at around 20% for the privilege. That’s ‘credit’.

Crypto cards don’t work like that. They all require you to actually have the funds available – they don’t advance credit. You can easily top them up manually with your cryptocurrency, or they can draw from the balance of your crypto account on the platform that issued the card.

Cards from Nexo, Coinbase and Crypto.com all use this balance drawdown method. With some it is automated and with others it’s a manually selected process, but none of the cards we surveyed actually offer ‘credit’.

Crypto Card Reward Schemes

About half the crypto cards we surveyed also offer cashbacks and rewards. The rewards are typically in the form of a cryptocurrency which will usually be the cryptocurrency that the card provider is affiliated with. For example, the CoinZoom card provides its rewards in ZOOM – which is the native token of the CoinZoom project. Similarly Crypto.com offers rewards in its CRO token.

Rewards rates vary a lot and most providers require that you stake a huge sum of their native tokens in order to receive the highest tier of rewards or cashbacks. Staking in crypto terms is comparable to a fixed-term deposit or savings account with a traditional bank. It means you transfer or otherwise ‘lock’ an amount of cryptocurrency with a provider like Crypto.com and they pay you interest or provide other perks in return for you staking your crypto with them.

Crypto Cards – All Fees Compared

The issue with staking is that in order to qualify for the highest level of card awards, the amount of crypto you need to stake is unrealistically high with all of the cards. For example, in order to qualify for the 8% reward rate from Crypto.com with its Obsidian tier card, you need to stake $400,000 worth of Crypto.com’s CRO token. Mental. Similarly, the Coinzoom card also requires staking for its maximum 5% cashback (paid in ZOOM) but is priced more reasonably at only 100,000 tokens staked, which is around $3500.

The types of purchases that can earn rewards are also restricted with many of the cards. For example, if you pay to fill your car with gas with the Crypto.com card, that will not earn any rewards, and nor will paying your electric bill, buying gifts in a novelty store, paying for health insurance, hiring a graphic artist and 100 other obscure payment types with their card.

Rewards should also be considered in context with what the transaction fee is for using a cryptocurrency. In many cases this is around 2.5%. So a $10,000 transaction with the Coinbase Europe Visa card paying from your BTC balance will earn you $100 in BTC rewards from the card – but cost you $250 in transaction fees. Ouch.

Crypto Cards Features And Benefits

Although their fee structures are generally designed to remove you from your money, there are some positives to crypto cards, especially when it comes to actually being able to use your funds for something other than hodling. These cards are designed to offer users a seamless way to access, spend, and manage their digital assets, alongside fiat currencies. Here are the basic features common to most crypto cards:

- Cashback in Cryptocurrency: You can earn cashback rewards in various cryptocurrencies instead of traditional fiat cashback. This allows users to potentially benefit from the appreciation of these digital assets over time. Plenty of strings attached though, as explained above.

- Conversion of Crypto to Fiat for Spending: Crypto cards facilitate the instant conversion of cryptocurrencies to fiat currencies, enabling users to spend their digital assets at merchants that do not directly accept crypto payments. This feature bridges the gap between the crypto economy and the traditional retail ecosystem, making digital currencies more usable in everyday transactions. It’s probably their No.1 benefit.

- Management of Both Crypto and Fiat Currencies: These cards often come with associated mobile apps or web platforms that allow users to manage their cryptocurrency and fiat currency holdings in one place. Users can easily monitor their balances, transaction history, and the value of their assets in real-time. Some platforms also offer the ability to exchange between different cryptocurrencies or between crypto and fiat within the app.

- Global Usability: Many crypto cards are issued in partnership with major payment networks like Visa or Mastercard, ensuring wide acceptance around the globe. This means cardholders can use their crypto cards for purchases at millions of locations worldwide, just as they would with a conventional debit or credit card. Ordinary cards can do this too though – and cheaper.

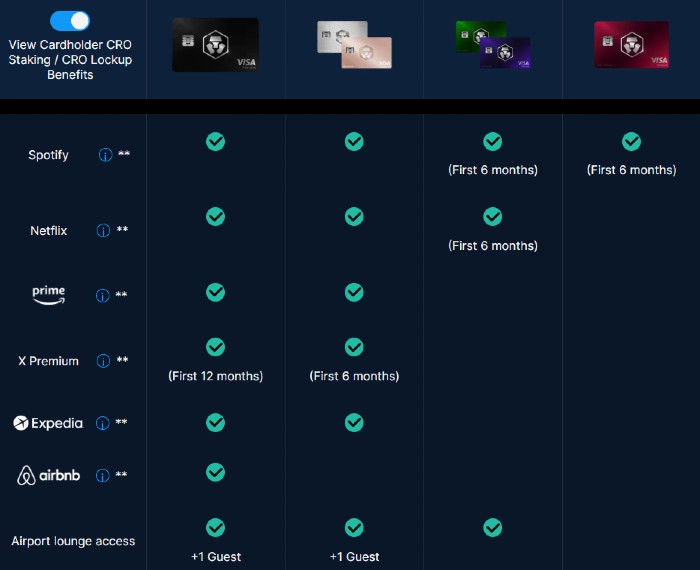

- Additional Perks and Benefits: Depending on the issuer and the specific card product, users may also enjoy a range of additional perks such as no foreign transaction fees, free ATM withdrawals, airport lounge access, and subscriptions to entertainment services. Higher-tier cards might offer more exclusive benefits, usually tied to the amount of cryptocurrency staked or held within the issuer’s platform.

Crypto.com’s card rewards perks require massive staking of the CRO token. Staking for rewards is high risk

Crypto.com’s Obsidian offers cashbacks on Netflix, Spotify and Amazon Prime, for example. The value of these refunds is around $50 a month, for which you must stake $400,000 worth of Crypto.com’s CRO token. If you had made this decision at the time of CRO’s all-time high of $0.81 in November 2021, your $400,000 stake would have been worth $24,800 by November 2023. Even now, during Bitcoin’s 2024 bull run, that $400,000 stake would still only be worth $76,000.Crypto Card Risks

- Volatility of Cryptocurrency: As noted in the CRO example above, the value of rewards earned or the balance held in cryptocurrencies can fluctuate significantly due to the volatile nature of digital currencies. This volatility can impact the real-world value of rewards and staked holdings, introducing a layer of risk not typically associated with traditional financial products.

- Regulatory Challenges: The regulatory landscape for cryptocurrencies and related financial products like crypto cards is still evolving. This can lead to uncertainty regarding the use, availability, and future status of crypto cards, particularly as governments and financial regulators worldwide are still determining how to best oversee these products. Must cards we surveyed are only available regionally (Europe or the US, for example), and in the last year In Binance, Bitpay, Bitwala, Monolith and Ternio have all withdrawn or paused their cards with most citing regulatory concerns.

- Geographical Availability: Not all crypto cards are available globally, with some being restricted to specific countries or regions due to regulatory restrictions or operational limitations. This can limit the accessibility of certain crypto cards, making it challenging for international users to find a card that meets their needs.

By carefully weighing these benefits and challenges, users can make informed decisions about whether crypto cards align with their financial goals and lifestyle. As the crypto economy continues to mature, it’s likely that both the advantages and considerations associated with these innovative financial tools will evolve as well.

Conclusion

The crypto finance sector is currently in its infancy. For anyone with a standard credit card issued by their bank, or a non-bank provider like American Express, the current crypto debit and credit cards available don’t offer any compelling reason to switch.

Overall their rewards schemes are complicated and require a massive financial commitment. Their fee structures are potentially expensive and need to be closely monitored to ensure you don’t end up with a lot of unexpected charges. They’re not widely available, they’re not anonymous and they’re restrictive in terms of how much of your own money you can spend and where you can spend it.

In addition to all that they’re also exposed to the huge price and security volatility that plagues the crypto space in general. For now, the only customer these cards will likely appeal to is someone who has made a firm personal decision to ‘unbank’ themselves – for better or for worse.