In an email to clients, BlockFi has announced the commencement of estate withdrawals and further details of its distribution partners.

The email from BlockFiBankruptcyNoticing@noticing.ra.kroll.com (Kroll is BlockFi’s official distribution agent), advises that Kroll will be working with Digital Disbursements, a third-party payment provider, to provide account holders with a distribution of their BlockFi Wallet assets.

The company says some time in March, clients will receive an email from noreply@digitaldisbursements.com, which will include a unique link for choosing the preferred method of receiving payments from BlockFi. On following the link, users will be prompted to enter their Payee ID and the email address on file with BlockFi to verify their identity.

The Payee ID can be found in a confirmation email from blockfibankruptcynoticing@noticing.ra.kroll.com, which should be received around the same time as the one from noreply@digitaldisbursements.com.

If an account holder has previously selected a payment method from Digital Disbursements, BlockFi says no further action is required, although clients can also choose to update their distribution method at this time using the link.

The deadline for selecting a payment method from Digital Disbursements has been updated from March 25, 2024 to March 26th Any US-based clients who have not made a choice by then will have their payments processed through Zelle. Non-US clients will be processed via PayPal.

CHECK THE LATEST CRYPTO DEPOSIT RATES

What BlockFi Accounts Are Affected?

To date, BlockFi says it has returned over $500 million in crypto to nearly 130,000 clients from its Wallet Product as of January 22, 2024. Estate withdrawals are the next phase of distributions.

This phase targets clients with BlockFi Interest Accounts (BIA), retail loans, and BlockFi Private Client (BPC) with an initial return of 20-40% of allowed claims expected. Eligibility for distributions hinges on having an “allowed claim,” a status determined through a reconciliation process for those who have filed claims.

What Cryptos Can Be Withdrawn?

BlockFi’s web app now provides clients with detailed insights into their claim status, including the USD value of BIA/BPC funds, accrued interest, and the total recoverable claims authorized for distribution. This transparency is crucial for clients to understand their position and potential recovery from the estate.

Digital assets available for withdrawal include BTC, ETH, GUSD, USDC, and USDT, with conversion prices set based on market values as of January 22, 2024.

However, clients may encounter a message indicating their account is not currently open for distributions, a situation that arises when claims have not been reconciled or allowed. BlockFi says that further accounts will be eligible for distributions in the near future.

CHECK THE LATEST CRYPTO BORROWING RATES

Eligibility and Timeline for Withdrawals

Eligibility extends to Convenience Class clients, those opting to receive digital assets or cash, and all non-preference clients with an allowed claim, barring those with unresolved AML, KYC, or account issues. The withdrawal process kicked off on March 1, 2024, with BlockFi planning to release new waves of eligible withdrawals throughout the month. Clients have until March 31, 2024, to initiate their withdrawal requests, with a recommendation to start the process immediately due to the time-sensitive nature of the identity verification process.

Blockfi Says Recovery Efforts Are Continuing

As noted above, BlockFi says the initial returns will be in the region of 20-40% of eligible claims, but recovery efforts to increase the percentage return to clients continue. Key to this has been efforts to maximize returns from the FTX exchange bankruptcy.

BlockFi now says it has reached a tentative agreement to settle all ongoing legal disputes with FTX and its associated debtors. This resolution, pending court approval, will hasten the returns process, and affects approximately a billion dollars in claims BlockFi held against FTX, alongside defending against FTX’s substantial counterclaims.

Under the proposed settlement, BlockFi is set to receive a total claim of $689.3 million against Alameda Research, related to loans provided to the firm, with $250 million of this amount recognized as a secured claim. Additionally, BlockFi will secure an allowed customer claim of $185.2 million against FTX.com, corresponding to the full value of BlockFi’s assets held on the FTX exchange as of the bankruptcy filing date. Finally, FTX agrees to drop all claims aimed at reducing BlockFi’s claims, further agreeing to waive or subordinate any other claims against BlockFi.

Process Overview

In an email to clients in January, BlockFi said any digital assets remaining in client accounts after its Identity Verification Window closed on January 12, 2024 at 11:59 PM UTC, would be converted to cash and distributed to BlockFi clients as U.S. dollars.

Presumedly this means any remaining funds will be distributed by Digital Disbursements, as noted above.

BlockFi previously advised account holders that the window to withdraw digital assets from their BlockFi wallets would close on December 31, 2023 at 11:59 PM UTC.

BlockFi allowed non-US account holders and those with de minimis (small) balances, to begin withdrawing assets from their BlockFi wallet account on December 15th.

BlockFi said clients should follow the steps below to ensure they can transfer funds to an external crypto wallet before the December 31st deadline.

1. Create an External Wallet: BlockFi will only support withdrawal of digital assets to external digital asset wallets. You will be able to make withdrawals to the third-party provider of your choice.

2. Login to BlockFi.com to submit a withdrawal request: You must ensure that you submit a withdrawal request before the Wallet Withdrawal Window closes.

3. Complete the Identity Verification Process: You will need to complete an Identity Verification Process for your withdrawal to be effectuated. Withdrawal requests from account holders who have not completed the verification process by January 12th will be canceled.

BlockFi’s Chapter 11 Recovery Plan

In an email to account holders, BlockFi announced that on Tuesday, September 26, 2023, the company had successfully secured confirmation for its Chapter 11 Plan, marking a crucial step towards its financial recovery.

It said over 90% of stakeholders approved its bankruptcy plan across all voting classes, including backing from BlockFi management and the Unsecured Creditors’ Committee (UCC).

The confirmation of the Chapter 11 Plan followed months of work by BlockFi’s management and advisors in collaboration with the UCC.

What’s In BlockFi’s Chapter 11 Plan

BlockFi and the Unsecured Creditors’ Committee say the newly approved plan has the following key objectives:

- Recoveries: The company aims to recover assets it believes are owed to it by entities such as FTX and 3AC (companies that are also going through bankruptcy proceedings).BlockFi says success in these litigation efforts could potentially result in increased client recoveries, dependent on product types and jurisdiction.

- Withdrawals: The distribution of digital assets back to clients, including BlockFi Interest Account (BIA) holders, will continue under the Plan.

- Claims: The claims process will persist to ensure clients receive the correct amount of assets owed to them while addressing any erroneous claim amounts.

Implications for BlockFi Clients

The confirmation of the Chapter 11 Plan and the opening of withdrawals to non-US account holders signifies that BlockFi is now in the final stages of its winding-down process.

The timing of BlockFi’s exit from bankruptcy was contingent on several factors, including recognition by the Bermuda court, which oversees international clients, of the U.S. bankruptcy court’s approval of the plan.

Upon the establishment and passing of its effective date, BlockFi officially emerged from bankruptcy and commenced implementing the actions detailed in the Plan.

Client Actions

For BlockFi clients holding funds in the BlockFi Interest Account (BIA) or Retail Loans:

- All clients should now have received emails instructing them to withdraw their funds based on the recovery amounts approved in the Plan.

For clients with funds in the BlockFi Wallet:

- BlockFi is currently in the process of distributing funds to clients with assets in the BlockFi Wallet product. Eligible clients are encouraged to submit a withdrawal request promptly to receive their funds in cryptocurrency before the Wallet withdrawal window closes.

After the Wallet withdrawal window concludes, BlockFi will focus on facilitating initial distributions of estate funds to BIA and Retail Loan holders.

Clients are encouraged to consult BlockFi’s blog for additional information, including Wallet Withdrawal FAQs, instructions on enabling 2FA, and guidance on identity verification and account security.

Creditors – Tell us about your experiences so far with the BlockFi bankruptcy proceedings and your interactions with Kroll. DM us on X (Twitter) @MoolooNet or email contact@mooloo.net. We want to hear your stories.

US Residents Were Prioritized For Withdrawal

Unfortunately, not all BlockFi clients were able to withdraw in the early stages at least, as many are deemed by the company to be not “eligible.” In mid-August BlockFi advised a broad range of account holders that they will not be able to withdraw funds yet, as they are not US residents.

In addition, the company said account holders who were able to extract more than $7,575 from their accounts between November the 2nd and November the 10th 2022, can also not withdraw.

This is the period where the company looked shaky but had not stopped withdrawals. BlockFi says as authorized by the bankruptcy court in the Wallet Order, the following clients are eligible for withdrawals -U.S.-based BlockFi Wallet account holders who:

1. Did not withdraw or transfer more than $7,575 worth of digital assets from their BlockFi Interest Account (BIA) or BlockFi Private Client (BPC) on or after November 2, 2022;

2. Did not hold any trade-only assets in their Wallet at the time of Platform Pause on November 10, 2022, at 8:15 P.M. E.T.

BlockFi says that it expects “additional clients, including BlockFi International clients”, will become eligible for withdrawals.

BlockFi Says Most Accounts Will Receive 50% Of Their Balance Back

So how much will account holders receive? In an email to account holders on August 3rd, BlockFi advised that most people will receive 50% of their balances back.

The email stated that BlockFi wants to class all its account holders with balances of between $10 and $3000 as “convenience” claims – stating;

Convenience Claim Class: All creditors with claims between $10 – $3,000 will be included in a “Convenience Class.” Creditors in the Convenience Class will receive a one-time distribution of 50% of their claim in cash. Certain creditors whose claims exceed $3,000 will also have the option to elect to have their claim amount reduced to $3,000 and treated as a Convenience Claim.

With questions or for additional information about the Plan or how to vote, creditors can visit the Kroll website. Creditors can also contact Kroll by email at blockfiinfo@ra.kroll.com.

BlockFi Warns Emails Compromised – Expects Phishing Scams

BlockFi is warning that it expects a marked increase in phishing scams targeting its account holders. This warning came into stark focus on August 25th when BlockFi revealed that its claims administration platform

vendors, Kroll, had been hacked and BlockFi client data housed on its platform had been accessed.

The company says BlockFi’s internal systems and client funds were not impacted. Although BlockFi says no action is needed on client’s accounts, it warns that similar incidents have impacted other crypto platforms in bankruptcy recently. “In the following weeks, you should expect an uptick in phishing attempts and spam phone calls. As we get closer to opening withdrawals for certain BlockFi clients in accordance with the Wallet Order [Docket No. 923] entered by the Court, we urge you to remain vigilant as we anticipate an increase in phishing emails and scams.”

The company warns that scammers may attempt to connect on social media platforms pretending to be BlockFi or a BlockFi team member. It says legitimate contact from BlockFi will only come through its official BlockFi channels (e.g., @BlockFi on Twitter or through the BlockFi app) or via its claims agent, Kroll (BlockfiBankruptcyNoticing@noticing.ra.kroll.com).

To ensure user accounts remain protected, BlockFi says it will never ask for passwords or personal identification over social media and it also encourages account holders to take the following security steps:

- Two-Factor Authentication: Ensure your two-factor authentication, or 2FA, is enabled on your BlockFi account. To turn on 2FA, please log in to your BlockFi account through the web app and visit the Security page within your Profile Settings. Under ‘Two-Factor Authentication,’ click ‘Enable 2FA’ and follow the instructions to set up your 2FA via the Authenticator app. For instructions on how to reset your 2FA, click here.

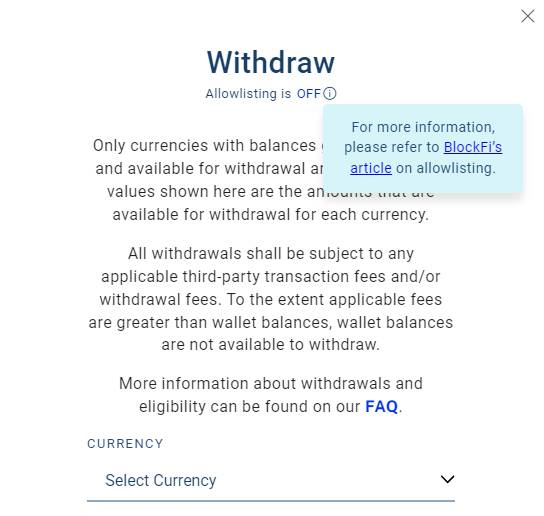

- Turn on Allowlisting for BlockFi: Allowlisting is a security feature which, when enabled, only allows you to withdraw from your BlockFi account to addresses that have been saved in your Wallet Address Book. We recommend all clients take this action as it significantly reduces the risk of impact to your account by a bad actor. You can find instructions on how to turn on Allowlisting here

The update follows the news that Block-Fi has settled with its management team over the crypto lender’s collapse – freeing the way for it to pursue funds from the FTX and Three-Arrows Capital bankruptcies.

The crypto lender said its management team had no reason to doubt FTX’s officers before the exchange melted down amid allegations of fraud last year.

The findings of the seven-month investigation were made public Monday in a New Jersey bankruptcy court to support a BlockFi settlement that would resolve potential legal claims related to the crypto lenders’ collapse against its co-founders Zac Prince and Flori Marquez, as well as other company officers.

In exchange, the management team has agreed to assist company lawyers in potentially lucrative actions against firms they blame for BlockFi’s collapse including FTX and failed crypto hedge-fund Three Arrows Capital.

BlockFi management will serve as key witnesses in pending litigation involving FTX and Three Arrows, the outcome of which could result in $1 billion in value for creditors, the failed crypto lender said.

The move follows recent Court orders in New Jersey and Bermuda, which saw BlockFi update its clients and creditors about a potential funds return for frozen account holders.

BlockFi says account holders should be able to withdraw funds from their locked accounts in Q4 2023. The news follows an order from the United States Bankruptcy Court for the District of New Jersey and a similar order from a court in Bermuda (where its subsidiary BlockFi International Ltd is registered). The orders confirm the following;

- That BlockFi’s clients (not BlockFi) own the assets in their BlockFi Wallet accounts;

- That BlockFi may proceed with updating its user interface to reflect transactions and client account balances as of the date and time it ceased operating (November 10, 2022, at 8:15 P.M. );

- That the withdrawal of assets not subject to potential preference claims from BlockFi Wallet accounts could begin.

The company says that to proceed with these withdrawals “accurately and safely” it will need to update its user interface to reflect account balances at the time of what it refers to as its “Platform Pause”, in addition to building new functionality into its system. “We anticipate that this work and the necessary testing will be completed this summer. At that time, we will be in a position to begin allowing clients to withdraw digital assets held in BlockFi Wallet accounts that are not subject to potential preference claims.”

BlockFi says all funds will not be available to be withdrawn at once, instead BlockFi Wallet account withdrawals will be done in batches and clients will be notified by email when it is their turn to withdraw their assets. US residents will be prioritized. The company says customers will only be able to withdraw the crypto assets they have – and cannot request a cash withdrawal equivalent. Customers must have created an external crypto wallet capable of receiving the withdrawal before any funds can be returned.

In a January 30th hearing, BlockFi’s proposal for its claims process was approved by the Court and the company also received interim approval to redact its clients’ names and other personal information from its declared Schedule of Assets and Liabilities.

BlockFi Claims Process

BlockFi says clients hoping for a refund will need to contact its claims agent, Kroll, who will provide information about how to view account balances, details regarding the client’s individual claims, and instructions on how to file a proof of claim. Kroll should have contacted clients via mail and/or by email to the address associated with the user’s BlockFi account at this time. Anyone who has not been contacted should contact Kroll directly to update their information by emailing blockfiinfo@ra.kroll.com.

Will You Have To Pay Your BlockFi Loan Back?

Anyone who took a loan from BlockFi will most likely have secured it using their BlockFi cryptocurrency balance as collateral. This collateral has been frozen along with all BlockFi’s other assets and the company says clients should not repay their loans at this time.

The interest rate on BlockFi loans was set to 0% from November 11, 2022, and no additional interest has been applied to the loans since that date. When a loan hits its maturity date, BlockFi says borrowers should also not make any payment and outstanding loans are not being reported as delinquent to any credit bureaus. BlockFi has maintained its blog and Twitter pages and says clients should check there for updates regularly