In the last 12 months Nexo has reworked its product offering in an initiative it has branded ‘Nexonomics’. The Nexo Booster is the latest in a series of innovations from the company, but what exactly is it – and what is its risk profile?

In the last year, Nexo has developed an impressive track record of introducing interesting digital asset product offerings to its user base – most recently its decision to accept NFTs as collateral for loans.

On the 18th of January in an email to its subscriber base, Nexo announced the launch of its “brand new and unique” Nexo Booster which it is positioning as a one-of-a-kind way for users to increase their crypto holdings without having to allocate additional funds.

What is the Nexo Booster?

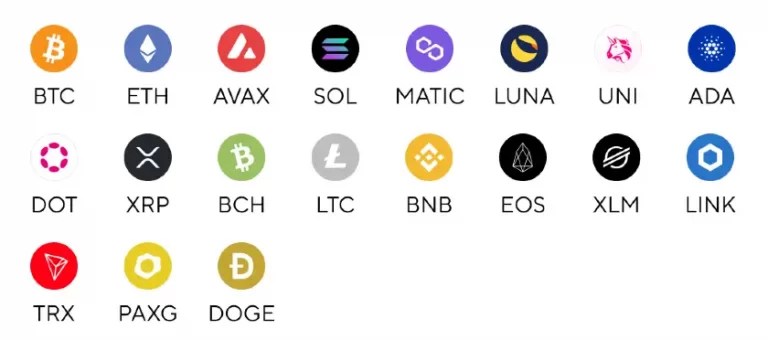

In simple terms, the Nexo Booster is just leveraged buying – very similar to leveraged trading products such as Bybit’s Smart Leverage and others on exchanges like Binance or Kraken. Rather than letting their Bitcoin holdings sit idly on the Nexo platform, account holders can use that asset to buy 19 other crypto assets – using their existing holdings as collateral.

The Nexo Booster works by collateralizing a leveraged user’s existing holdings by up to 100% to ensure the security of assets. But this does not mean a Loan to Value (LTV) ratio of 100% is permitted. So in instances where the existing holdings of users are not enough for a 70% LTV, Nexo will also collateralize the assets that have been acquired using leverage.

Thus, if you’re holding bitcoin and you use leverage to buy AVAX and SOL, for example, all three assets will be collateralized to the extent required to bring your LTV to 70% or less. Nexo users can boost a single cryptocurrency to up to 3 times its value or boost one crypto asset to get a different digital asset. For example, users can either boost BTC to get more BTC, or boost BTC to get SOL.

The maximum amount per transaction is $250,000 but users can make an unlimited number of boosts on their crypto holdings. The NEXO token cannot be boosted and users cannot receive fiat or stablecoins as their receiving currency.

What are the risks of the Nexo Booster?

In very small print at the bottom of its launch email, the company says “Needless to say, as a leverage product, the Nexo Booster can work in both ways – it amplifies your gains when the chosen asset appreciates, yet magnifies the losses when prices are falling.” They then go on to say that customers should educate themselves about Loan to Value ratios and how liquidations work. Although the use of the phrase “Needless to say” is curious, the point here is important – if the market falls, users can quickly lose their investments.

For Nexo and other leveraged lenders, liquidations work like this. A 70% LTV ratio means that the sum of all your borrowing would only add up to 70% of your total assets. So for example, if your total borrowings were $7000 then your total assets would be $10,000. This means the loans are over collateralized. But cryptocurrency prices are volatile and can move up or down quickly. Borrowers need to have enough collateral to back their loans, even if the value of their holdings drops.

If prices do fall, lenders will urgently require you to invest more to bring your LTV ratio back to the agreed level. So in the case of the 70% LTV ratio discussed above, if the value of your crypto assets fell by 30%, then instead of being worth $10,000, they would only be worth $7000. This would mean a loan to value ratio of 100%. In this case, the lender would notify you to top up your account to $10,000 to return the LTV ratio to 70%. If you did not do so immediately they would call in part of the loan or liquidate it entirely to protect their investment.

Although this doesn’t happen that often, it is also not a rare event. For example, the Bitcoin price fell by about 50% in early March 2020. The sudden drop meant that many borrowers’ collateral fell below the required LTV ratio and lenders like Nexo, MakerDAO and others were forced to liquidate many client loans – resulting in millions in losses for their customers.

Nexo CEO Antoni Trenchev even wrote about it in an article on Brave New Coin entitled “Why Liquidations Are Needed And How They Protect Us All.”

The same thing occurred after the price of Bitcoin fell by about 50% in May 2021, and there’s no doubt it has happened to many borrowers during Bitcoin’s most recent bear run, given that, at the time of writing, the price of Bitcoin is down around 31% since the Nexo Booster launched in mid-January.

Fees Associated With Using The Nexo Booster

Fees for boosting are between 1% and 3%, depending on the desired LTV. For an LTV below 50%, the fee accruable is 1%, while if the LTV is between 50% and 60%, a 2% fee is required. A 3% fee is charged on an LTV between 60-70%.

These fees are added into the “outstanding credit line balance” and will come from a percentage of the assets that will be added to the holdings after the boost. So for example, if you have $10,000 in Bitcoin and you use the booster to acquire an additional $5000 in Bitcoin, you will have an LTV ratio of 50% and your fee will be 2% of $5000 which is $100.

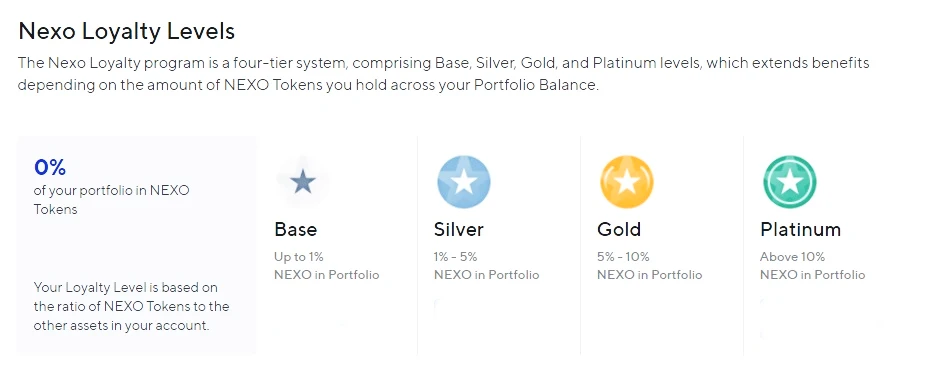

Fee’s can be negated to an extent for users whose accounts are part of Nexo’s Loyalty program – with Platinum members receiving a 0.5% Exchange Loyalty Cashback on all swaps. By leveraging the exchange infrastructure to Boost, holdings are collateralized and the needed balance is issued as a stablecoin that is now “exchanged” into the original asset of the holdings. This triggers the cashback feature of 0.5% for users and can also work if the boost will involve two cryptocurrencies. It is important to note that Boost users will receive a cashback only as long as they are holding sufficient Nexo tokens in their portfolios. Cashback for Silver tier users is .10% and for Gold .25%.

Available on the Nexo app only

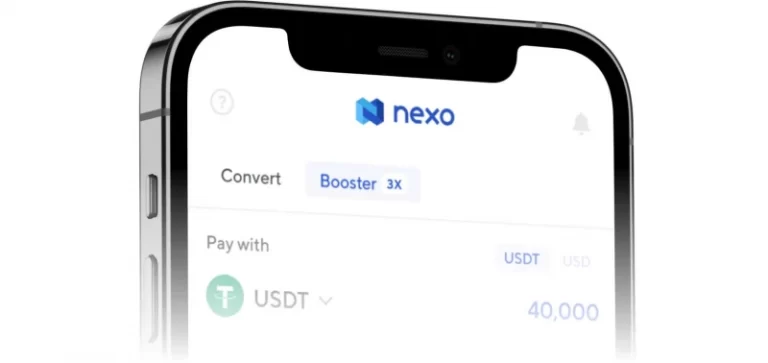

The Boost feature is only available using the Nexo mobile app and cannot be accessed via the Nexo website at this time. The app’s user interface has been updated and the Buy, Sell and Swap tabs have been replaced with new Convert and Booster Tabs.

Users click on the convert tab to access buying, selling, and swapping assets while the Booster tab will offer users the opportunity to enter into leveraged trades.

Users can access the Booster feature by clicking the Exchange Tab and selecting Booster. Then, they select the currency that they want to leverage against by clicking on the “Pay With” option, After this, users will be required to select the amount of leverage that they want by dragging the leverage marker between 1.25 – 3x.

The next requirement is for users to add their “Receive” currency which is the cryptocurrency that is to be acquired and then, preview the order to ensure that everything tallies. Clicking “Exchange” will add the asset to the user’s Credit Line Wallet for the Booster Transaction. There is also an option for users to see the profit projection of the Booster transaction and another that allows users to see the details of the transaction for record purposes.

Currently, users in the United States, Canada, Australia, Bulgaria and Estonia cannot access the Booster product.

The Nexo Booster explainer video provides a good summary of the service – but neglects to mention the downside risk.