In a groundbreaking move for the crypto finance sector, Nexo has announced it will begin accepting NFTs as loan collateral.

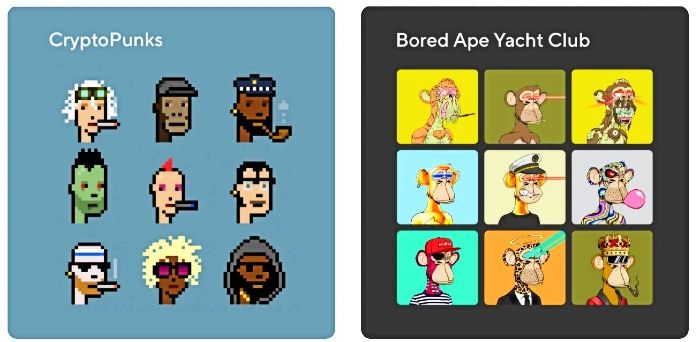

The move by Nexo further integrates NFTs into the crypto finance sector in a way that recognises their value as financial instruments with wider application than just as collectables. Although only NFTs from the two most famous NFT collections—CryptoPunks and Bored Ape Yacht Club–are currently accepted as loan collateral, Nexo says it will be expanding the number of available collections soon.

Applicants with NFT assets not from those collections can still apply, though, as Nexo has included an ‘other’ option in its online application form.

Nonetheless, the range of potential NFTs that could be accepted by Nexo will likely remain small, as the lending platform has advised it will only accept assets valued at over US$500,000 as loan collateral. Applicants are not required to go through an extensive credit check and funds will be provided in Ethereum or stablecoins such as Tether, DAI, USDC and PAX.

Annual interest rates on loans with NFT collateral will range from 12% to 15%, which is similar to the rates Nexo offers to borrowers using cryptocurrency as collateral for other loans, and who do not have a significant portion of NEXO tokens in their portfolio balance.

Interestingly, while Nexo will accept an LTV ratio of up to 50% on cryptocurrencies and 90% on stablecoins, its LTV on NFT loans starts at 10% and maxes out at 20% – meaning a $100,000 loan is the maximum someone could borrow against a $500,000 NFT.

Loan agreements are required and Nexo will take custody of the NFT during the loan agreement’s fixed term. Unlike with Nexo’s other lending, if the value of the NFT decreases during the term of the loan there is no liquidation. Loans must be repaid in full by the end of the loan term or the asset will be transferred to Nexo as payment.