A new report from Nexo shines light on the market opportunity and interesting usage patterns of crypto credit cards.

In the fourth quarter of 2023, the Nexo Card, developed with Mastercard, saw transactions surpass $50 million, marking a 43% increase from the previous quarter.

Nexo Card

Features: Hybrid debit/credit lets you spend from your crypto balance without selling your assets, offering up to 2% cashback in the form of NEXO tokens or 0.5% BTC.

Availability: Europe (EEC) and the UK only.

Rewards Program: Cashback is credited to your Nexo account.

Terms and Conditions: No annual or monthly fees, but funding terms apply for maximum cashback rewards and spending limits.

While still only available in Europe, Nexo says its card’s user base also expanded significantly, with a 4.5-fold increase in the same period (no base figure provided). The Nexo card differs from other cards in that it operates as a type of hybrid card which can be used as either a typical debit card (manually topped up) or holders can choose to switch to ‘Credit Mode’, in which the card essentially issues a loan against the user’s crypto balance on Nexo.

This means users can utilise the spending power of the assets (typically up to 50% LTV), without having to spend (liquidate) their crypto,

Nexo says that this growth in activity helped conserve cryptocurrency assets, with 2,200 BTC and 41,000 ETH remaining unliquidated due to the card’s credit feature.

The Nexo Card 2023/24 Holiday Spending Analysis report details a 43.05% increase in transaction volume compared to the preceding quarter, with a 4.5-fold rise in user numbers attributed to the new Crypto Spend Debit Mode.

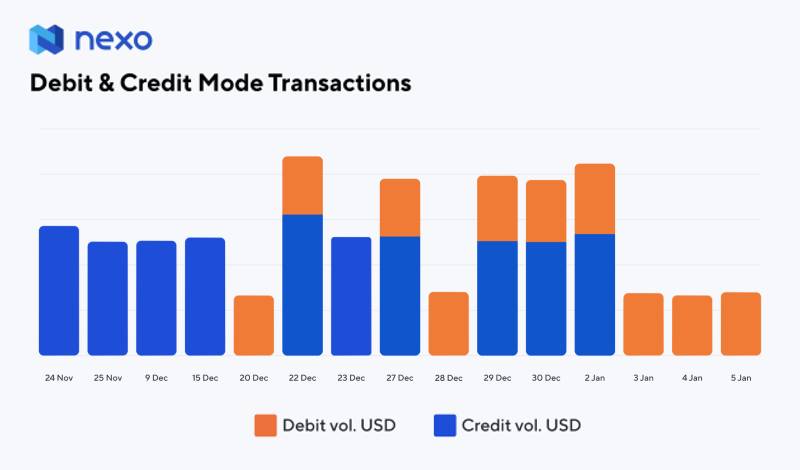

Interestingly, Credit Mode emerged as the preferred spending method (despite interest being charged), with transactions in this mode being three times more common than those in Debit Mode, accounting for 75% of the total volume.

Spending patterns varied with the season, with credit spending dominating the pre-Christmas period and a balanced use of both modes observed by New Year’s Eve. This trend aligns with global spending habits, where credit cards are typically used for significant online purchases, offering additional protections. Users earned over half a million dollars in cashback rewards (approximately 1%).

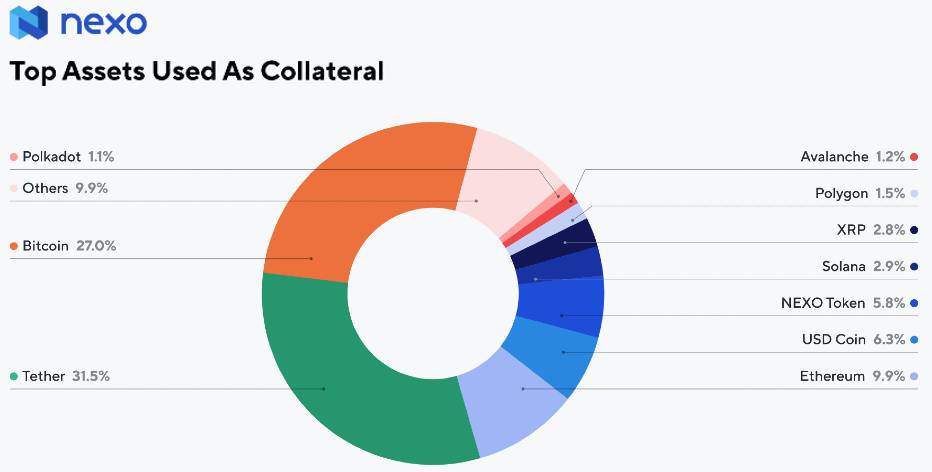

The top assets used as collateral were USDT, BTC, and ETH. Spending categories ranged from retail and groceries to dining, travel, and technology.

Overall, the report illustrates the way forward for crypto credit cards – showcasing how digital currencies can be integrated into everyday spending via a credit card, with users having to liquidate balances.