Coinbase Staking Rewards – First Validator Report Released

1.8 min read

Updated: Jun 13, 2025 - 03:06:37

Coinbase has released its inaugural Ethereum Validator Performance Report, offering transparency into its staking operations – and key metrics for validator comparisons.

This move is significant for investors, as validator performance directly influences the security and efficiency of the Ethereum network, impacting staking rewards and overall investment returns.

In simple terms, validators are like the gatekeepers of a blockchain, ensuring that all transactions are legitimate and preventing fraudulent activities. A validator’s performance is typically measured by metrics such as uptime (the percentage of time they are operational) and participation rate (how effectively they perform their duties).

High performance in these areas means the network is secure and transactions are processed smoothly, which is beneficial for investors and empowers the delivery of crypto-staking rewards.

Key Highlights from the Report:

-

Validator Count and Stake: Coinbase operates approximately 120,000 validators, collectively staking around 3.84 million ETH. This represents 11.42% of the total ETH staked network-wide, underscoring Coinbase’s significant role in Ethereum’s infrastructure.

-

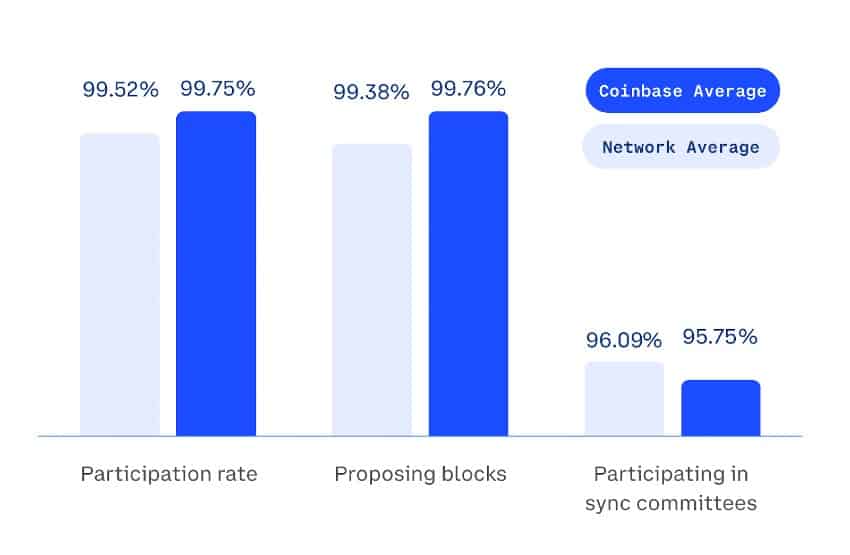

Uptime and Participation Rate: The report indicates a validator uptime and participation rate of 99.75% for February 2025. High uptime ensures validators are consistently operational, while a strong participation rate reflects active involvement in transaction validation—both critical for network reliability.

-

Security Record: Notably, Coinbase reported zero incidents of slashing or double-signing since its staking services began. Slashing penalties occur when validators act maliciously or negligently, leading to a loss of staked assets.

-

Client and Relay Diversity: The platform employs two consensus clients (Lighthouse and Prysm), two execution clients (Geth and Nethermind), and utilizes six different relays. This diversity enhances network resilience by mitigating risks associated with potential client-specific vulnerabilities.

-

Geographical Distribution: Coinbase’s validators are distributed across five countries and two cloud service providers, further bolstering decentralization and reducing regional risks.

Implications for Investors:

For investors, this report provides previously unavailable insights into Coinbase’s staking operations, allowing for informed decisions regarding staking service providers.

By choosing a provider with a robust performance record, investors can enhance their staking rewards while minimizing potential risks associated with validator downtime or security breaches.

Further reading:

- Crypto Staking Vs Crypto Lending – What’s the Difference, And Why Does It Matter?

- Current Crypto Staking Rewards Comparison