Instead of holding cryptocurrency directly, investors can gain exposure through ETFs that track publicly traded companies in the Bitcoin mining sector. This article explores the Grayscale Bitcoin Miners ETF – its features and benefits – and the risks of this alternative investment approach.

It started as a niche industry—Bitcoin mining, a computational arms race where powerful machines solved cryptographic puzzles for digital gold. Today, mining has become an industrialized business, with publicly traded companies operating massive facilities across the globe.

While it’s possible to invest in these companies individually, investors looking for exposure to this world have a new option: the Grayscale Bitcoin Miners ETF (MNRS). The ETF, launched on January 30, 2025, tracks the Indxx Bitcoin Miners Index, a benchmark designed to capture the performance of companies driving the mining sector forward.

Traded on the NYSE Arca, MNRS offers a straightforward way to invest in the Bitcoin mining industry – without the complexities of purchasing and storing digital assets.

At the time of publication, the fund trades at $20.45 per share, down 5.19% for the day, with assets under management totaling $5.72 million. The ETF holds 28 companies that make up the backbone of the Bitcoin network, from mining operators to hardware manufacturers.

Betting on the Backbone of Bitcoin

Bitcoin mining is the process that validates transactions and secures the network. Miners deploy high-powered computers to compete for new Bitcoin, rewarded in return for their efforts. It’s an energy-intensive process, one that has sparked debate over its environmental impact. Yet for investors, it represents an opportunity to gain exposure to a sector with direct ties to Bitcoin’s success.

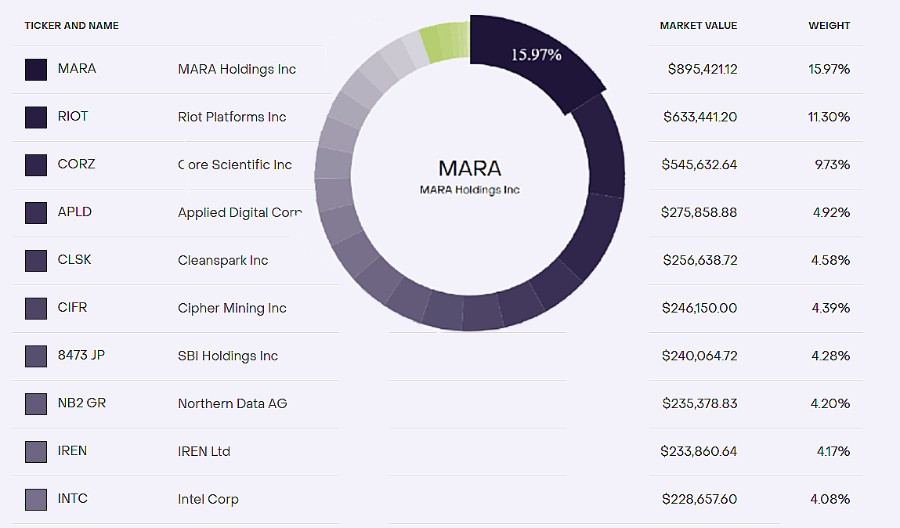

The largest holdings in MNRS reflect the dominance of key mining firms. Marathon Holdings Inc. (MARA) leads the pack with around a 16% weighting, followed by Riot Platforms Inc. (RIOT) at 11% and Core Scientific Inc. (CORZ) at close to 10%. These companies operate sprawling mining farms, many powered by renewable energy sources, in a bid to stay competitive and profitable.

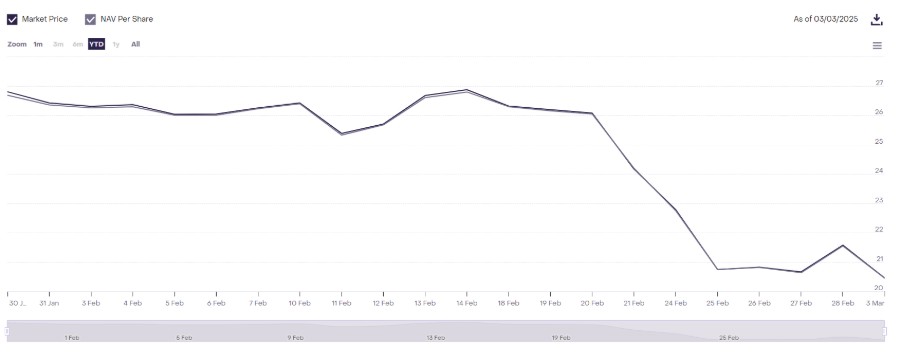

Bitcoin’s price movements are closely linked to the fortunes of these miners. A surge in Bitcoin often means higher revenues, while downturns can squeeze margins. For example, since its launch the Grayscale MNRS has declined 23.7%, mirroring Bitcoin’s broader volatility. The fund’s benchmark index, the Indxx Bitcoin Miners Index, has shown a similar trajectory, down 18.21% in the same period.

The Risk and Reward of a High-Volatility Industry

The promise of MNRS is clear: targeted exposure to Bitcoin miners without the need to navigate individual stocks – a relief for many, but that is not to say the MNRS is not without risk. For example, the ETF is not sector diversified, meaning its fate is tied to the performance of a single industry. Regulatory uncertainties loom, with policymakers scrutinizing mining’s energy consumption and its impact on financial stability.

In terms of price fluctuations, unlike direct Bitcoin investments, MNRS does not hold digital assets or derivatives. Instead, it provides indirect exposure through publicly traded firms that either mine Bitcoin or supply critical infrastructure. This approach can shield investors from some of the risks associated with cryptocurrency custody, but it also means MNRS won’t always track Bitcoin’s exact price movements.

For example, Bitcoin’s recent 10% surge on March 2nd following President Trump’s US Strategic Crypto Reserve Announcement, was not reflected in the MNRS price, which continued its downward trend.

Market Performance and Investor Sentiment

As of March 5, 2025, MNRS is trading at a slight premium to its net asset value (NAV), with a spread of just 0.02%. The median 30-day bid/ask spread sits at 0.28%, a sign of relatively strong liquidity. The fund distributes income semi-annually, though given its very recent launch, no distributions have been recorded yet.

The ETF’s early performance is a reflection of the volatility inherent in the Bitcoin mining sector. Over the past month, its market price has dropped 18.36%, a stark reminder of the challenges mining companies face. Yet for long-term investors, the fund offers a way to bet on Bitcoin’s future without holding the asset directly.

A final note of caution. While products like the Grayscale MNRS provide significant consumer protection, Crypto ‘mining’ scams are one of the most prolific frauds operating in the crypto sector today – with ‘Cloud Mining’ scams being the most common. Therefore it is important for investors not to lump all ‘crypto mining’ investments into the same risk profile.