With bankruptcy proceedings for failed crypto platforms likely to take many years, customers with locked funds are moving to sell their accounts in online marketplaces.

In what was the first major crypto exchange implosion, the Mt. Gox exchange declared bankruptcy in 2014. Nine years later its account holders still have no confirmed date for a payout. The latest ‘maybe’ date is set for September this year, but the day for this distribution of funds has been pushed back many times already – and could be again.

In a more recent exchange collapse, the New Zealand exchange Cryptopia ceased withdrawals in January 2019 after a massive hack. Four years on and Cryptopia account holders have yet to see a satoshi of their deposits returned. In both cases, a significant portion of Bitcoin and other assets held on the two exchanges at the time of their bankruptcies has been recovered – but despite this, none has been returned to account holders.

In terms of ‘size’, the Mt. Gox and Cryptopia failures are on the opposite ends of the scale, but they are typical of what’s happening with a very long list of failed crypto platforms that have locked their customer’s accounts and disappeared into the mists of corporate bankruptcy. It’s a process that can easily take three years to resolve, with five and 10 years not unheard of. One complicating factor extending the timeline in the case of the crypto bankruptcies declared in the wake of the FTX collapse in November last year, is that many of the crypto platforms that declared bankruptcy after FTX claimed that exposure to FTX is what caused their collapse. In doing so they have implied (some have stated it specifically) that it will only be after the FTX bankruptcy is completed that will be able to complete their own process.

A Marketplace For Locked Accounts

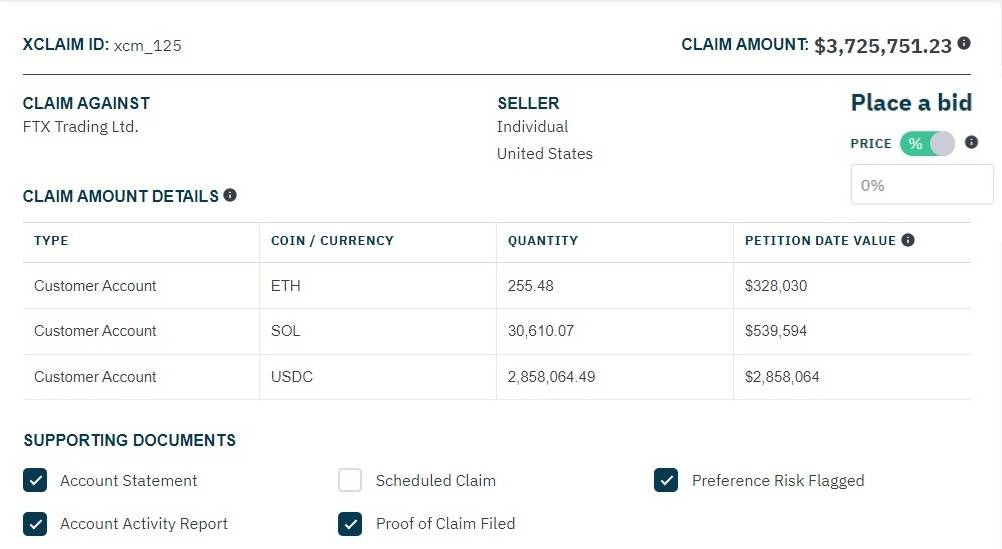

In such an environment, it’s no surprise that many people are looking to platforms like Xclaim in an attempt to be made at least partially whole in a much shorter time frame. Founded in 2018 by Matthew Sedigh, Xclaim operates a marketplace for crypto traders to unlock the value of their frozen accounts by settling their account for cash. While bankruptcy can be a painstakingly slow and complex process, Xclaim offers a market-based solution for account holders to access immediate liquidity.

In simple terms, sellers list their locked accounts on Xclaim and provide verification of the funds being held. An auction process is established and buyers bid against each other for the account. When the auction closes the winning bid has the account assigned to them, via the ‘transfer of claim’ clause in Section 502 of the U.S. Bankruptcy Code. This means the buyer will ultimately receive any assets if and when the crypto platform’s bankruptcy resolves and the account holders receive a payout.

Xclaim says that thousands of customers of several crypto exchanges that have declared Chapter 11 bankruptcy, including FTX, BlockFi, Celsius and Voyager have listed their accounts for sale, representing more than $200 million of crypto assets. Xclaim enables crypto account holders to recover the market value of accounts that are inaccessible during the pendency of a bankruptcy.

“I’ve spent my entire career helping parties navigate how to recover maximum value in difficult, complex situations. Bankruptcy is usually a painful process, especially for those that have to wait years to recover their own property. Our mission at Xclaim is to provide a new alternative to that frustration. We are giving people a choice to act for their own best interest.” – Xclain founder Matthew Sedigh.

Although there’s no guarantee of a pay day and as an investment strategy buying distressed accounts is clearly high risk, the upside for buyers is potentially huge, as they receive the assets at the value they will be when the bankruptcy process has ended – not the cash value of the assets when the process began.

Applying this scenario to Mt. Gox, the potential gains would be eye-watering. At the time of its failure in February 2014, for example, the Bitcoin price was around $400. So an account containing 1000 Bitcoin then would have been valued at around $400,000. Let’s suppose a generous offer of 75 cents on the dollar was accepted at the time. The distressed account holder would have no doubt been happy to walk away with $300,000. However, by October 2021 if Mt. Gox had paid out then, the value of the account would have risen to around $67,000,000. Even if Mt. Gox only paid out 1 cent on the dollar, the buyer would still have doubled their investment.

With bankruptcies like FTX and Celsius likely to take many years, investors are hoping that the value of the frozen assets will have increased in a similar way. Currently, approximately $30 billion of crypto bankruptcy claims are held by more than 15 million account holders globally. By connecting the buyers and sellers of these frozen accounts in a competitive marketplace, businesses like Xclaim help ensure that market participants have access to the most accurate data in terms of the market’s perceived value of their distressed asset, and if they do decide to sell, are transacting at open-market prices.