For the second time in three months, Hodlnaut has announced plans to lower its deposit rates as crypto volatility continues to impact crypto finance platforms.

Interest rates for deposits on most coins via DeFi platforms have fallen significantly since last November. For example, as the Bitcoin price peaked around US$68,000 on November 10th last year, AAVE was offering approximately 10% APY for USDT and Fulcrum was offering 31.85%. Today AAVE is offering 2.7% for deposits of the popular stablecoin, and Fulcrum is offering 5.7%.

Interest rates on DeFi platforms are always more volatile than those on CeFi platforms like BlockFi and Holdnaut, but things appear to be on the move there as well.

Effective from the 18th of April, Hodlnaut says due to the “unpredictability of the market” it has decided to revise its interest rates down. In addition, the Singapore based company says it will now review its interest rates on a monthly basis and will make an announcement in the fourth week of the month as to any imminent rate changes.

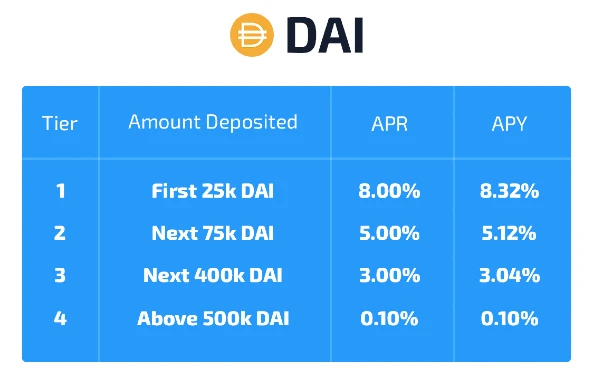

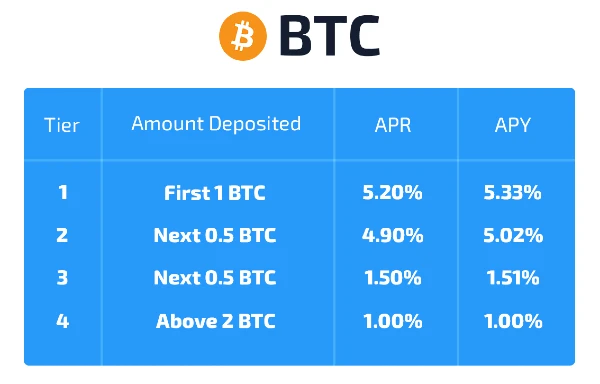

Unlike its rate changes in February, Hodlnaut’s latest updates will see rates change for stablecoin deposits as well as for BTC, ETH and WBTC. At 12.73%, Hodlnaut’s rates for USDT and USDC deposits have been consistently amongst the highest rates for crypto lending across all platforms.

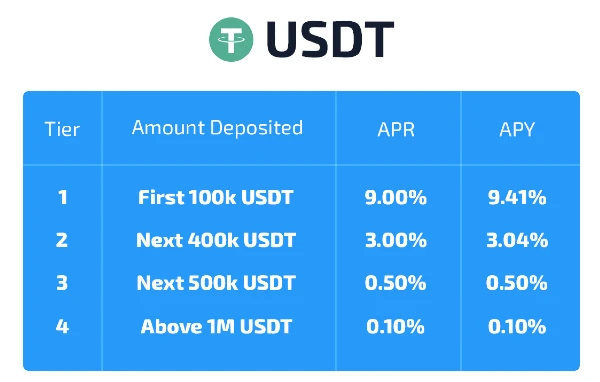

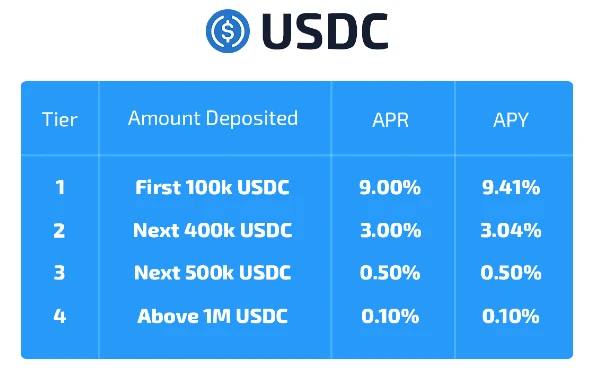

With USDT and USDC moving to an APY of 9.41% from April 18th, the new rates are in line with those offered by Coinloan, Coinrabbit, Inlock and Pokket for stablecoins.

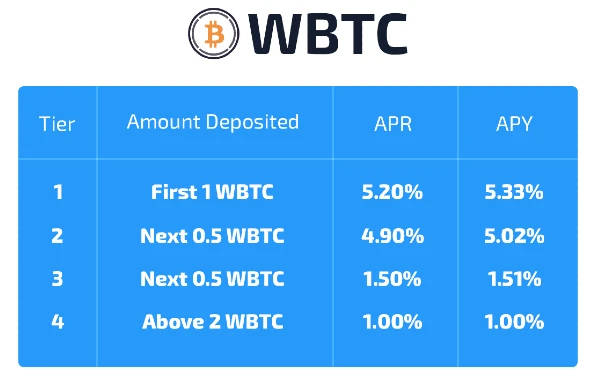

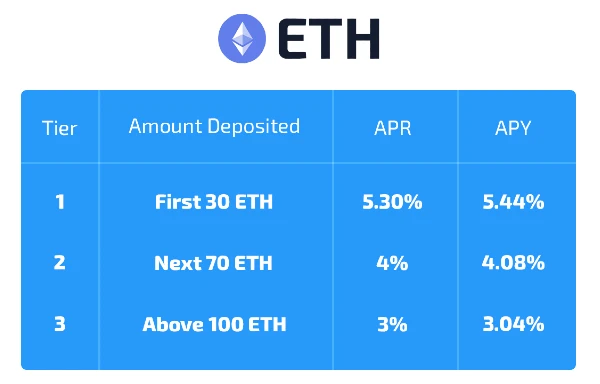

The new rates and tiers for Hodlnaut lending are below.

Stablecoin interest rates from CeFi platforms like Hodlnaut, Celsius, BlockFi and YouHodler were relatively stable throughout 2021, but most platforms have moved their rates lower this year.