In a significant development, Nexo, a prominent player in the crypto lending space, has discontinued its practice of providing real-time audits of its assets and liabilities.

The move comes amidst the broader context of audit firms withdrawing from the crypto sector and raises concerns about the transparency and risk management of crypto investments overall.

Nexo’s Real Time Audit

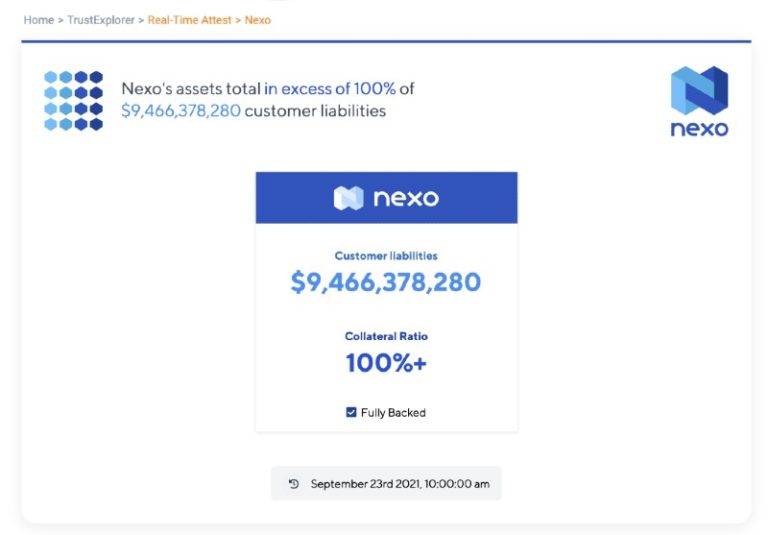

In September 2021, Nexo was the first major crypto lending platform to provide a publicly accessible real-time audit of its assets and liabilities. At the time the audit was housed and delivered via an Armanino project called TrustExplorer which Nexo described as “the world’s first application that provides independent accountant reports in real-time.” Using the TrustExplorer Real-Time Assurance Platform, anybody could download a six-page report that was up-to-the-minute accurate.

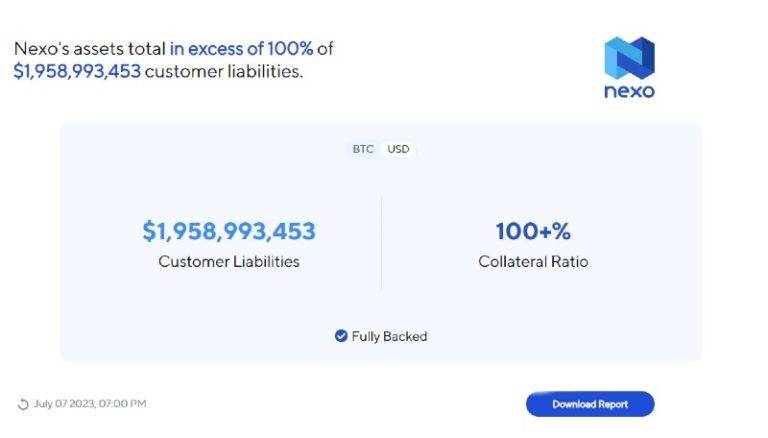

At the time of its launch in September 2021, Nexo’s audit showed its “customer liabilities” totalled $9.4 Billion. In mid-2023, the same audit showed customer liabilities at $1.9 Billion, a decline of around 80% in under two years.

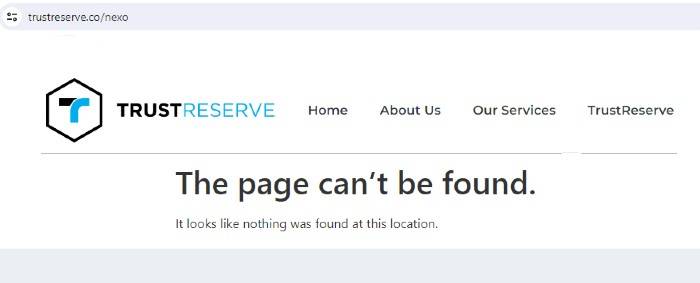

Today Nexo’s audit page ‘can’t be found’.

According to a Nexo spokesperson, the decision to wind up its audit page was forced due to its audit partner (Armanino) having exited the space. Prominent firms like Armanino and Mazars, which provided audit services to various high-profile crypto companies, have recently ceased working with crypto clients.

This retreat is mostly due to the reputational impact and community pushback following the collapse of FTX, which was audited by Armanino. The FTX failure raised questions about the effectiveness of crypto audits in their entirety.

Nexo said in January 2023 that it was exploring alternatives, including developing its own cryptographic tools, to maintain transparency and security for its users. Over a year later it has released no further details or updates.

What Are The Implications for Nexo Investors?

The ending of Nexo real-time audits, coupled with the withdrawal of major audit firms from the crypto space, should be of concern to investors. The lack of transparent and up-to-date financial information makes it challenging to assess the true financial health of most crypto lending platforms.

Nexo says its three core values are “efficiency, transparency and inclusivity” but when asked how it is able to offer rates like 16% for stablecoins, its initial answer was far from transparent – repeated verbatim from its website and its helpdesk “Nexo safeguards your assets and maintains stable rates through overcollateralized, crypto-backed institutional lending and stringent risk management practices.”

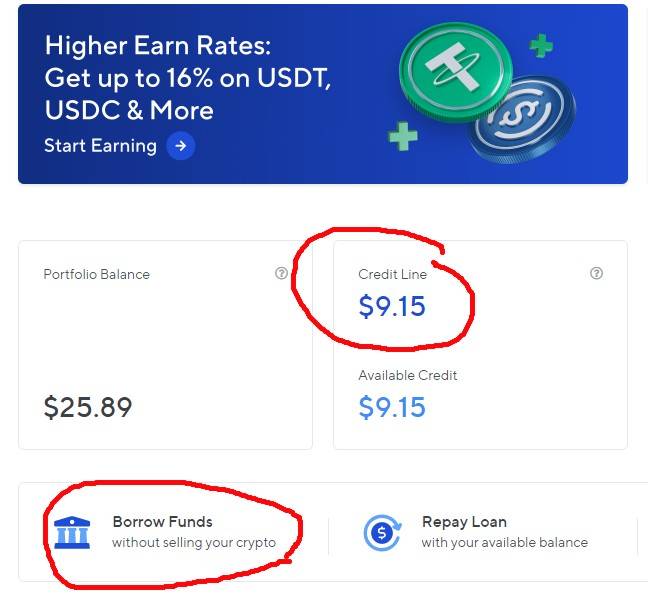

While the phrase ‘institutional lending’ conjures up images of corporate-to-corporate lending only, the fact is Nexo offers overcollateralized lending to any account holder – as the screenshot below reveals.

Nexo Loans Are Not ‘Institutional” Only

Nexo Loans Are Not ‘Institutional” Only

Asked to define “Institutional Lending”, a Nexo spokesperson acknowledged the company doesn’t just lend to institutions – and works with both individual and corporate clients. “Institutional lending refers to the loans granted to corporate accounts which are usually significantly higher in value than individual ones.”

In layman’s terms, this means that loans to corporate clients make up a larger percentage of Nexo’s ‘loan book’ and revenue, than loans to individuals.

Nonetheless, with Nexo offering 16% for stablecoin deposits and charging a maximum of 15.9% for crypto loans, the math still doesn’t quite add up. Mooloo requested additional information relating to how Nexo can offer 16% for deposits when only charging 15.9% for loans. The company responded with a thorough explanation of the Nexo business model, which is summarized below.

How Does Nexo Remain Profitable?

Nexo recently started charging legacy bank-ish fees for withdrawals. In May 2024 Nexo introduced a flat fee of US$25 for withdrawals to fiat bank accounts – a procedure that prior to that time was free.

But fees aren’t enough to stay out of the red. Nexo lends depositors’ assets from its Earn Interest product as loans to other clients looking to borrow against their crypto. In addition to crypto-backed loans, the company also generates revenues from margin lending (the ‘Nexo Booster’) and OTC loans. It also offers exchange-like trading products such as spot, futures, and options.

While it’s true Nexo offers up to 16% on stablecoins, these higher earn rates require depositors to agree to fixed terms, thresholds and that 10% of their entire balance is held in Nexo tokens – which many customers don’t want to do.

As a result, the company says the effective rates paid on its assets under management (AUM) are well below the theoretical maximum. “We are offering interest rates reaching 16% APR for USDT, and even 30% APR for AXS, however, the majority of earning rates are between 5-9% for Platinum tier customers. Hence, the company profits on the positive net interest spread between the interest rate it receives and the yields it pays to interest-earning clients.”

With all that said, a lot of Nexo’s profit generation comes not just from the interest rate spreads, but from ‘finding alpha’. All its activities – exchange services, crypto-backed loans, collateral liquidations, staking, etc. are revenue generators that require Nexo to move balances across a number of exchanges and DeFi protocols.

For example, Nexo’s trading services Nexo Prime and Nexo Pro don’t rely on in-house matching engines and order books (like traditional crypto exchanges) but aggregate liquidity from various venues via smart order routing.

As a byproduct of its holding balances across different exchanges and protocols, the company says it can seize opportunities for alpha generation in market-neutral ways that bolster its own treasury.

Bottom line? Nexo’s depositor’s crypto is not sitting in cold storage custody somewhere. Instead, it is distributed across a host of different exchanges and DeFi protocols where presumedly Nexo’s trading team is actively working it to capitalize on alpha-generating opportunities.

Is Nexo Liquid?

None of this means that Nexo isn’t liquid. Certainly, the company has been one of the straightest actors in the crypto lending space since its founding in 2017 (even so, Nexo was fined $44.5 million by the SEC less than a year ago for marketing its Earn product as a security in the US).

However, the absence of real-time audits means that investors have no way to independently verify a company’s claims about its assets and liabilities. Nexo’s introduction of real-time audits in 2021 was a laudable step towards real transparency, which has now been walked back.

When it was suggested that Nexo might consider making its loan book public to ease its investors’ concerns, the company declined – saying “Transparent as we are, providing internal business information does not fall into the transparency category.”

One could argue that is exactly where it falls.

The calamity of the FTX collapse and the decision of reputable audit firms to exit the sector highlights the challenges of maintaining transparency and trust in a rapidly evolving and often unpredictable market.

For investors, this underscores the importance of due diligence and the need to be cautious, particularly when dealing with platforms offering unusually high returns.