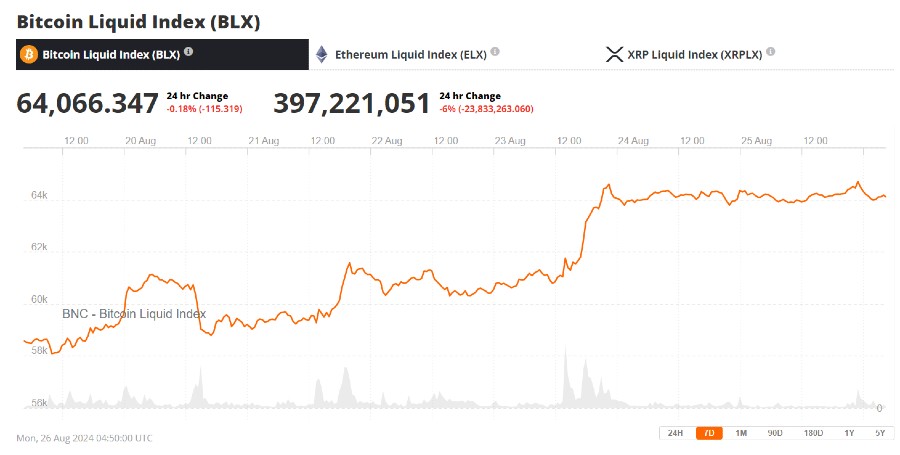

Bitcoin has enjoyed a strong price week, surging past the US$64,000 level. It is up ~7.9% in the last seven days, starting the week around the US$59,500 price level and ending it trading near US$64,200.

Key triggers for the Bitcoin (BTC) price push were a pair of bullish macro triggers emerging from the United States. On Friday, US Federal Reserve Chairman Jerome Powell confirmed that a monetary easing cycle would begin in September. Speaking at the Kansas City Fed’s Jackson Hole Symposium Powell said — “My confidence has grown that inflation is on a sustainable path back to 2 percent,” referring to the journey towards the country’s inflation target. He continued, “Today, the labor market has cooled considerably from its formerly overheated state.”

US interest rates have been higher than usual and rising since March 2022. This was done to cool down rising inflation and a hot labor market in an economy suffering from the consequences of heavy money printing during COVID-19.

The high interest rates have helped cool the economy but have slowed down the demand to borrow and led to capital markets suffering. “The upside risks to inflation have diminished. And the downside risks to employment have increased,” said Powell. “The time has come for policy to adjust,” he concluded, opening the path for a return to an investor-focused economy, boosting Bitcoin bulls.

A Bitcoin Bullrun In September?

In its latest weekly insights piece, onchain data provider Glassnode reports that Bitcoin’s dominance of the overall crypto market has hit a “staggering” 56% of the total crypto market capitalization. They note a factor in this trend is long-term holders having strong conviction during this price cycle and continuing to accumulate BTC under pressure.

While this is net positive for the Bitcoin price moving in September, historically September has been a challenging month for Bitcoin, with the cryptocurrency providing positive returns only three times in the last eleven years.

This trend can be attributed to various market dynamics, including seasonal trading patterns, investor sentiment, and external economic factors. For instance, September has often been marked by profit-taking after summer rallies, leading to price corrections.

Additionally, the overall volatility of Bitcoin, influenced by macroeconomic conditions and regulatory developments, tends to amplify these downward pressures during this month.

Analyzing the broader context, Bitcoin’s performance in September contrasts sharply with other months, where it has frequently experienced substantial gains. For example, the months following significant events, such as halving cycles or major institutional investments, have historically shown stronger positive returns. This inconsistent performance highlights the inherent volatility of Bitcoin and the impact of market psychology, suggesting that while September may often be a down month, it also provides an opportunity for accumulation given October’s history of delivering positive returns nine times out of the last 11 years.