With the renewed interest in cryptocurrency that comes with the Bitcoin price reaching an all-time-high, the number of crypto thefts and scams has never been greater. So how can you insure your Bitcoin and other cryptocurrencies?

Can an individual insure their personal cryptocurrency holdings? The answer is yes, but like most things in the crypto finance sector, the process is not as simple as it’s made out to be, and the available insurance products come with many restrictions and limitations.

Why is Bitcoin insurance so hard to get?

The crypto marketplace is divided into two primary groups. There are individual holders, traders and investors – often referred to as the retail market. And there are investment funds, banking interests, and corporations – referred to as the institutional market.

In the scheme of things, the value of the crypto assets held by the ‘retail’ market is low. According to statistics from BitInfoCharts, for example, there are around 54 million Bitcoin wallets with less than $10,000 worth of Bitcoin in them, and only 16,000 wallets with assets worth more than $1 million. From the perspective of insurance companies, millions of low-value accounts is not an attractive business opportunity.

There are other numbers that are also important to the insurance companies. One is the amount of Bitcoin that has been lost. According to statistics from research firm Chainalysis, about 20% of all Bitcoin created so far has been lost. Lost doesn’t mean stolen. Instead, it means a misplaced USB or a Post-it note with a seed phrase on it that got thrown in the trash.

If someone can’t locate their passwords or seed recovery phrases for a lost or damaged hardware wallet, then their Bitcoin is probably gone forever.

Finally, there is the issue of straight out theft, fraud, exchange hacks and phishing attacks. The level of crime in these categories is eye-watering. ZDNet reports the value of crypto stolen during 2020 at over $3 billion. The true figure is probably much higher, as admitting to a major hack is commercial death for a smaller exchange, and many people don’t report internet scams or wallet hacks to the police because they know there is almost nothing that can be done about them.

This is the main reason why individuals can’t insure their crypto as easily as they can their house or their car – it’s just too risky for any insurance company to take it on.

It is possible to insure your Bitcoin

While the insurance companies won’t insure individuals (the retail market), some are dipping their toes in the crypto waters by insuring institutions, and it’s via this channel that an individual can potentially secure some cover. Insurance products by Coincover are an excellent example of how this works.

Coincover is often mentioned in articles about the availability of insurance cover for digital assets. At one time the company even had a website page titled Bitcoin Theft Insurance, where you could indeed buy cover for 100,000 euros worth of crypto for 750 euros per annum. Today, Coincover no longer offers that service and the company’s focus has moved entirely to offering to institutional cover.

In reality, this was always the case. For example, In order to be granted a policy with Coincover previously, you would have had to move the assets you were insuring and your private keys to crypto custodians BitGo.

The BitGo story is that they’re basically the gold standard in crypto custody services – but they only serve institutions. So Coincover is an institution that BitGo will transact with. Coincover deals with smaller institutions and then insists that all the crypto it insures must be custodied by BitGo, who do the heavy lifting of protecting it.

Industry confidence in BitGo was further evidenced in early May 2021, when it was announced that Mike Novogratz founded investment company Galaxy Digital would buy BitGo for $1.2 billion.

From an insurance perspective, the bottom line here is that your private keys must be held by BitGo or it’s no deal. Put another way, you’re not going to be able to get any insurance company to insure the Ledger hard wallet you’ve hidden in a shoe in the bottom of your closet.

So who’s using BitGo? Lots of institutions – Nexo, Bitstamp, Coinjar, BitcoinIRA, Bitgate, and hundreds of other crypto exchanges and businesses. In late April 2021, BItGo announced a significant increase in the amount of insurance it carries – expanding its available cover from $100 million to $700 million. The additional insurance isn’t for all customers, though. It is what’s called ‘Excess Specie Insurance’ and it doesn’t come as a given for BitGo depositors. Instead, it is available for purchase, with clients who pay extra for this cover being named in insurance policies as ‘Dedicated Customer Loss Payees’.

And who insures BitGo? Lloyds of London. But what isn’t widely understood about Lloyds is that it isn’t a ‘single’ company like MetLife or AIG. Instead, Lloyds is like a club and lots of smaller insurance companies join the club and then work together to develop products and spread their risk. For example, Lloyds recently announced the launch of a new policy to insure crypto hot wallets. The companies and syndicates involved in the launch included Atrium, Coincover, TMK, Markel, and a “panel of other Lloyd’s insurers.”

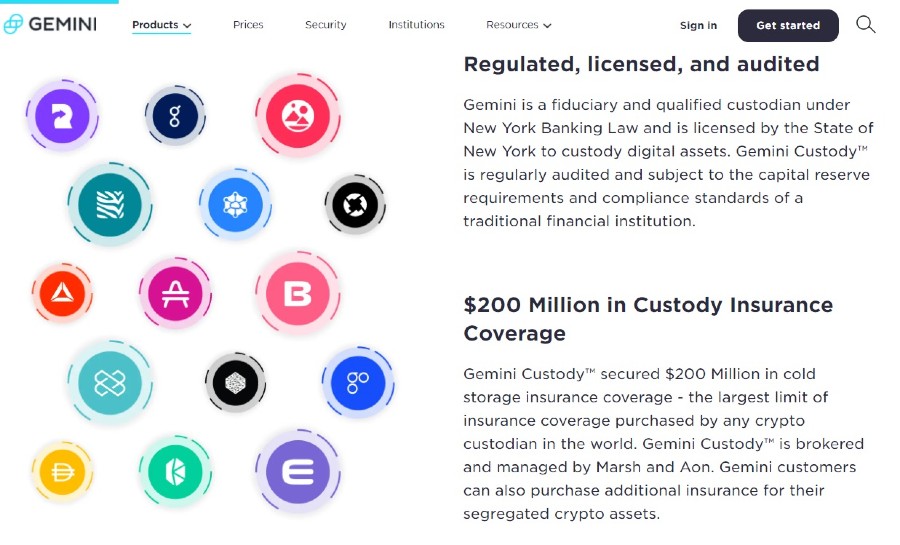

Gemini Custody is another example of an institution that will safeguard your crypto in insured accounts. Like BitGo, Gemini is another gold standard crypto organization. Founded by Cameron and Tyler Winklevoss, Gemini is a qualified custodian under New York Banking Law and is licensed by the State of New York to custody digital assets.

Similar to BitGo, other companies also use Gemini Custody to store the assets you deposit with them – for example, BlockFi, CoinList, CI Global Asset Management, Eaglebrook Advisors, and WealthSimple all custody digital assets with Gemini. But Gemini isn’t an insurance company, and actually had to work with insurance brokers Aon and Marsh to incorporate a company in Bermuda called Nakamoto Limited which now provides $200 million in offline cold wallet insurance to Gemini Custody.

Only a fraction of the assets are actually covered

While BitGo and Gemini are about as safe a place as you could get to store your digital assets, the reality is that only a tiny fraction of the crypto they custody is actually insured. For example, Gemini currently claims to have $20 billion of crypto in its custody, but its insurance policy only covers $200 million.

This means only 0.1% of the assets Gemini stores are actually insured. The story at BitGo is similar. BitGo has recently announced it is holding around $16 billion in digital assets, but only has $100 million in insurance cover – so only about 0.65% of its assets are covered. Even if you add in the additional $600 million of cover BitGo announced in April, it still means less than 1% of the assets in its custody are covered by insurance.

Conclusion

It is possible to get some form on insurance cover for your Bitcoin but in order to get one you will have to agree to pass your private keys to a third party like BitGo for safekeeping. Alternatively, you could deposit your crypto to earn interest with companies like Nexo or BlockFi, and your assets will be stored with a provider like Gemini, who in turn, has insured a tiny percentage of those assets. While it is extremely unlikely that any breach of security at custody providers like Gemini or BitGo would ever see their entire vaults drained, if such an event occurred, around 99.9% of crypto in their care would not be covered by insurance.

Unfortunately, this is the reality of the Bitcoin insurance sector today. Things are changing, though. The Galaxy Digital purchase of BitGo and new DeFi entrants like Nexus Mutual, Cover Protocol, and Unslashed Finance are developing some interesting solutions, but for now, the market remains immature and underserved.

Download a free ShapeShift report into Nexus Mutual and Cover Protocol here.