Crypto prices are notoriously volatile but it is possible to earn interest on cryptocurrency in both bull and bear runs – at rates much higher than those offered by the savings accounts of traditional banks.

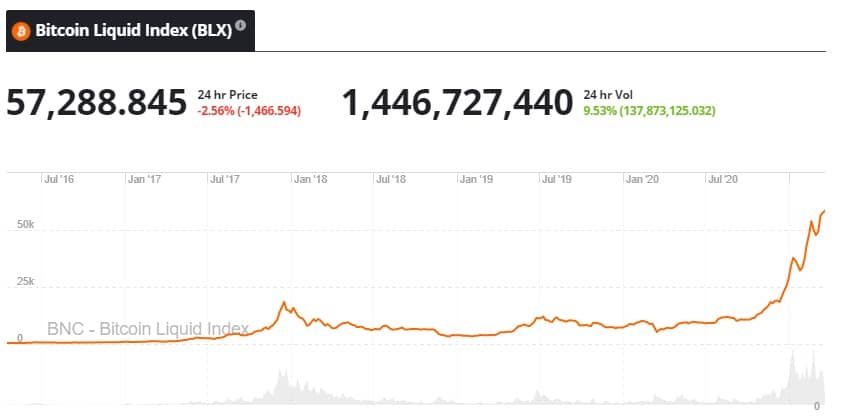

The Bitcoin price has risen from $6,000 to $60,000 in the last 12 months, so anyone who had been holding on to the cryptocurrency hoping it would increase in value has been richly rewarded. The recent price surge is not typical, however, and the Bitcoin price has often tracked sideways or even trended down for months at a time.

For those looking to increase their cryptocurrency yield, many businesses are now offering attractive interest rates for a range of cryptocurrencies, so you can earn while you’re waiting for prices to go up.

How can you earn interest on Bitcoin and other cryptos?

It’s a pretty straightforward process: you deposit your cryptocurrency with a platform such as BlockFi or YouHodler, and they pay you interest for as long as you leave it with them. The interest rates are much better than those on offer from normal banks. Check the current rates on offer here. As you can see, they do vary a lot from provider to provider so it pays to shop around.

What are the interest rates?

How much interest you earn on your crypto will depend on the following criteria:

Which platform you use

While the interest rates offered by savings accounts at traditional banks are all basically the same, crypto savings account rates vary widely from platform to platform, even for the same cryptocurrency deposited for the same period. These services are very new and some providers are offering high rates to attract new clients.

Many platforms will also pay higher yield rates if customers choose to accept their interest in the platform’s native cryptocurrency. Celcius, for example, pays on average a 2% higher annual yield if customers opt to be paid in CEL tokens. Celcius says around 62% of its users choose that option.

Most platforms fund these interest rates by offering crypto loans as well – which means their returns on deposits are potentially higher. Some, like Gemini and BlockFi, will soon be launching crypto credit cards – further boosting the potential return on client deposits.

Deposits are not government-guaranteed, though, so the interest rates in some cases are also a reflection of the risk profile of each of the platforms.

What cryptocurrency you deposit

It is interesting to note that the interest rates on offer for the two most valuable cryptocurrencies – Bitcoin and Ethereum – are amongst the lowest of all cryptocurrencies. Instead, the most popular coins with the platforms that pay the highest interest are stablecoins.

Stablecoins are cryptocurrencies whose value is fixed to the value of the US dollar or other fiat currencies. Whereas the value of Bitcoin or Ethereum may fluctuate wildly over the course of a month, stablecoins do not – remaining constantly pegged to the US dollar. For this reason they offer the platforms certainty – and are popular with borrowers in the case of platforms that offer crypto loans as well.

Interest rates for Bitcoin and Ethereum deposits typically range from 5-8%, whereas stablecoins like Dai, Tether and USDC are routinely earning from 10-18% for deposits. MooLoo has information on the latest rates from the major lenders here.

The term commitment you make

Currently, many platforms like Nexo, Fulcrum, YouHodler and Hodlnaut, do not have any minimum terms and depositors can withdraw their crypto savings at any time. For others, the length of time you are prepared to deposit your crypto will mean higher rates. At Crypto.com, for example, a one month deposit of the stablecoin Tether will earn 10% APY, whereas for a 3-month commitment the rate is 12%.

Others, like BlockFi, set minimum withdrawal amounts and charge fees if you frequently withdraw your crypto. Another way to earn higher interest is instead of receiving your interest in the same cryptocurrency as you have deposited, you can instead have your interest paid in the platform’s native token. Nexo, for example, pays an additional 2% APY if you opt to receive your interest in its native token NEXO.

How often is interest paid?

There is no uniform way that crypto interest is paid out. Each platform has its own policies, and you will need to do your research to choose one. Some pay interest monthly, others weekly and some even pay interest daily. Some pay interest compounding and others don’t. Furthermore, most platforms reserve the right to change their policies at any time. For this reason it is important depositors read the fine print of the platform’s interest policies, as the best deal may not always be the one with the highest advertised rates..

What are the risks?

Another way that earning interest with cryptocurrency differs from earning interest via a bank savings account, is that the risk profile is much higher with cryptocurrency and loss of principal is possible. Although this is not a definitive list, the risks with crypto fall into the following categories

Your deposits are not government guaranteed

In the US. all bank deposits are protected by the Federal Deposit Insurance Corporation (FDIC). This means that if your bank goes broke, the government will step in and ensure you get your money back. Similar schemes exist in most market economies worldwide. The same does not apply with cryptocurrency. If your crypto finance platform goes broke and they have the private key to your cryptocurrencies, then your money is likely gone forever. This is not a remote possibility either – as cryptocurrency sector is in its infancy and businesses continue to fail in the space. To mitigate the risk, look for any statements on the platforms about the extent of private insurance coverage they may have.

Cryptocurrency prices are very volatile

What many savers are looking for is certainty. $100,000 in a bank savings account is going to generate a predictable return. The same will not be true of cryptocurrencies unless you are depositing stablecoins. As mentioned earlier, the Bitcoin price has risen from $6,000 to $60,000 in the year, and it could easily fall just as dramatically. If you are not depositing stablecoins, it will be very difficult to predict what your returns will be. The platforms are also free to adjust their interest rates, withdrawal limits and fees at any time based on market conditions.

Government intervention

The attitudes to cryptocurrencies by governments around the world is generally not supportive. Much legislation is being written globally restricting their use and placing major compliance burdens on businesses trying to operate in the space. It is always possible that governments in the jurisdiction a platform is operating could outlaw cryptocurrency and seize assets. This occurred lin 2020 in China, where withdrawals from the OKEX exchange were stopped for over a month by the Chinese government, before being restored. This type of action is difficult to predict so it pays to be aware of the territory your platform is operating from, and the legal framework it is operating under.

Summary

Although Bitcoin is now over 10 years old, the crypto-finance sector is still in its infancy, with even the most established platforms having only been in business for two or three years. While it is possible to earn interest on cryptocurrencies at much higher rates than those offered by traditional bank savings accounts, the risks are also higher and the reliability of the platforms is not uniform across the sector. For this reason, depositors should spend considerable time doing their own due diligence on potential platforms and their associated risk profiles before they commit their funds.