Crisis or Strategy? Bakkt’s Post-Collapse Pivot to Bitcoin Mirrors MicroStrategy

3.8 min read

Updated: Jan 19, 2026 - 10:01:01

Bakkt Holdings has shed its role as a crypto infrastructure provider and is now repositioning itself as a Bitcoin-heavy holding company. After losing 91% of its operating revenue when Bank of America and Webull ended contracts in early 2025, Bakkt faced investor lawsuits, a stock collapse, and legal probes over disclosure practices. Its $75 million public offering in June 2025 is earmarked largely for Bitcoin purchases, echoing MicroStrategy’s treasury model. For investors, Bakkt is now less about crypto services and more about direct Bitcoin exposure, high risk, high volatility.

- Revenue collapse: Loss of Bank of America and Webull erased 73% of operating revenue (March 2025), triggering lawsuits and a 35% stock plunge.

- Legal scrutiny: Bronstein, Gewirtz & Grossman investigating securities law violations tied to disclosure failures and delayed filings.

- Bitcoin focus: June 2025 policy shift allows treasury allocation into Bitcoin; $75M offering primarily for BTC buys and working capital.

- MicroStrategy playbook: Pivot mirrors firms like MicroStrategy and Coinbase that hold Bitcoin as a treasury asset.

- Investor takeaway: Bakkt is no longer a growth-stage crypto services platform, it’s effectively a Bitcoin proxy, with higher financial risks and less operational strength.

Bakkt Holdings is undergoing a seismic transformation. After losing 91% of its core business revenue, facing legal scrutiny, and shifting toward Bitcoin as its central asset, the company is no longer recognizable as the infrastructure innovator it once claimed to be.

Its recent $75 million public offering, largely intended to fund Bitcoin purchases, suggests Bakkt is now functioning more like a crypto-backed holding company than a business delivering operational services.

The Spectacular Collapse

The downturn began in March 2025, when Bakkt revealed that both Bank of America and Webull would not renew their commercial agreements.

These two clients made up nearly all of Bakkt’s operating revenue:

-

Bank of America: ~16% of loyalty service revenue

-

Webull: ~74% of crypto services revenue (2023–2024)

With these partnerships gone, Bakkt projected a 73% drop in revenue, prompting investor lawsuits and a scramble for a new business model.

The fallout was swift:

-

Stock plunge: Over 35% drop in after-hours trading

-

Long-term decline: Down more than 90% from post-merger highs

Source: Google Finance

Legal and Financial Disclosures Under Fire

Legal trouble soon followed. Bronstein, Gewirtz & Grossman, LLC launched an investigation into potential violations of U.S. securities laws. The lawsuit centers on:

-

Bakkt’s failure to disclose its reliance on two key clients

-

Concerns about corporate transparency and governance

These are clear red flags for investors, especially in a regulated environment.

The Treasury Pivot: Bitcoin Takes Center Stage

In June 2025, Bakkt introduced a revised corporate investment policy that allowed the company to allocate capital into Bitcoin and other digital assets. Shortly after, it sold its loyalty services business for $11 million to focus solely on becoming a “pure-play crypto infrastructure company.”

But filings reveal a different focus: The company intends to use proceeds from its June 2025 public offering for:

-

Bitcoin purchases

-

Working capital

-

General corporate purposes

Copying the MicroStrategy Model

Bakkt’s strategy now resembles MicroStrategy, which holds over 580,000 BTC and has rebranded as the “world’s largest Bitcoin Treasury Company.” That model has inspired more than 70 public companies to adopt a Bitcoin treasury standard, including:

-

Rumble

-

Marathon Digital Holdings

-

Hut 8 Mining

-

Block Inc.

-

Coinbase

-

KULR Technology

Is Bakkt Pivoting or Just Posturing?

✔ The Case for Strategic Pivot

-

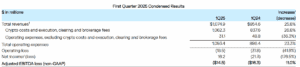

Q1 2025 crypto revenue: $1.0749 billion, up 25.8% year-over-year

Source: Bakkt

-

Maintains custody and trading infrastructure

-

Management claims the loyalty sale allows refocus on stablecoin payments

✖ The Case for Financial Engineering

-

Q4 2024 revenue of $1.79 billion was largely client-concentrated

-

Operating loss: $18.5 million on expenses of $1.093 billion

-

Shift to Bitcoin accumulation as main capital use

-

Financial reliance on speculative crypto assets

Financial Health Snapshot

-

Cash (June 2024): $136.5 million

-

H1 2025 cash burn: $27.54 million

-

Legal liabilities: Up to $10 million

-

Cash reserves (Dec 2024): $39 million

Investor Red Flags: What to Watch

-

Timing: Pivot followed loss of major clients

-

Capital allocation: Most of $75M is going to crypto assets

-

Investor messaging: Prioritizes Bitcoin strategy over new partnerships

-

Financing methods: Dilution and debt echo MicroStrategy tactics

Conclusion: Business or Bitcoin Bet?

Bakkt is no longer a traditional crypto infrastructure company. It’s now a Bitcoin-heavy corporate wrapper, similar to MicroStrategy, but with fewer operational strengths and greater financial risks. This isn’t inherently deceptive. But investors should understand that Bakkt is now offering exposure to Bitcoin, not a growing services platform. For Bitcoin bulls, this may be attractive. For those seeking sustainable crypto service revenue, Bakkt’s trajectory is more concerning.