Coinbase Launches DEX Trading: Millions of Assets Now Accessible to U.S. Users

6.3 min read

Updated: Jan 19, 2026 - 10:01:26

As of October 8, 2025, Coinbase now lets U.S. users (except in New York) trade directly on decentralized exchanges (DEXs) within its mobile app. This update marks a shift in how Coinbase integrates decentralized trading access into its existing retail platfor. Users can now swap tokens through protocols like Uniswap and Aerodrome using liquidity routers such as 1inch and 0x, all without leaving the Coinbase interface.

- Direct DEX Access: Coinbase users can now execute decentralized swaps within the app using onchain liquidity, keeping full custody of their funds until transaction confirmation.

- Gas Fees Waived (Temporarily): Coinbase is covering all network fees during the initial rollout, removing initial cost barriers for users unfamiliar with decentralized trading.”

- Base Ecosystem Focus: Launch includes Base-native tokens like Virtuals AI Agents and Reserve Protocol DTFs, expanding Coinbase’s existing Layer 2 ecosystem on Base.

- New Listings Auto-Enabled: Tokens such as Noice (NOICE), Syndicate (SYND), and Linea (LINEA) are available instantly via the DEX layer, allowing near-instant token availability through decentralized routing.

- Regulatory Scope: New York remains excluded; Coinbase continues to face SEC oversight while using this feature to test hybrid DeFi compliance models.

Coinbase has introduced decentralized exchange (DEX) trading directly within its mobile app, a change that could alter how millions of U.S. users access crypto markets. Announced on October 8, 2025, the rollout allows users to trade tokens on decentralized platforms without leaving the Coinbase interface. The feature is currently available across the United States except for New York, where regulatory restrictions remain in place.

How Coinbase’s DEX Integration Works

Coinbase’s latest update integrates DEX functionality into its app, enabling users to swap onchain assets through decentralized protocols like Uniswap and Aerodrome via liquidity routers such as 1inch and 0x.

The company began limited testing in August 2025 and is now expanding access nationally. Users can trade with their existing Coinbase balances or USDC, and all transactions are settled directly onchain through a self-custodial walletbuilt into the app.

According to Coinbase CEO Brian Armstrong, the goal is to enable users to trade newer tokens that often appear on decentralized markets ahead of centralized listings.

At launch, the new feature focuses on Base-native assets, including projects such as Virtuals AI Agents, Reserve Protocol DTFs, SoSo Value Indices, Auki Labs, and Super Champs. Base, Coinbase’s Ethereum Layer 2, supports faster and cheaper onchain transactions.

How It Works

Trades executed through the DEX integration are routed automatically to decentralized marketplaces, with Coinbase acting as a front-end interface rather than a counterparty. This means users retain full control of their funds until the transaction is confirmed onchain.

During the initial rollout, Coinbase is covering all network gas fees, so users can transact without holding additional gas tokens such as ETH or BASE. This temporary incentive lowers a common barrier to entry for decentralized trading.

The system also includes risk disclosures and transaction previews, giving users transparency on price impact and slippage before confirming trades. Scott Shapiro, Coinbase’s Head of Trading, said the integration aims to simplify onchain access for retail users. “This integration lets users execute DEX trades within a familiar environment.”

New Token Listings

Alongside the DEX rollout, Coinbase listed three additional tokens on October 9, 2025:

-

Noice (NOICE): Built on Base, it recorded the strongest initial price activity among newly available Base-linked assets.

-

Syndicate (SYND): Deployed across Base and Ethereum, offering multi-chain exposure.

-

Linea (LINEA): Not native to Base but included through Coinbase’s extended token-access framework.

Making assets tradable soon after they appear on decentralized networks. Instead, they appear automatically through the decentralized trading layer, giving users access to assets almost immediately after launch onchain.

Safety Features and Risk Warnings

Coinbase has introduced several on-chain safeguards to mitigate common risks in decentralized marketsSafeguards include third-party analytics to detect tokens flagged for suspicious activity. These include integration with third-party analytics to automatically block tokens identified as scams or potential rug pulls, as well as liquidity and price-impact warnings for thinly traded pairs.

The platform also provides transparent on-chain data feeds that allow users to view market conditions before executing a trade. Despite these protections, Coinbase emphasizes that DEX-listed tokens are not vetted by the company.

Users retain full self-custody of their assets and are solely responsible for conducting due diligence. This development signals a structural change from Coinbase’s traditional model, where the exchange reviewed and custodied all listed assets on behalf of its users.

Market Context

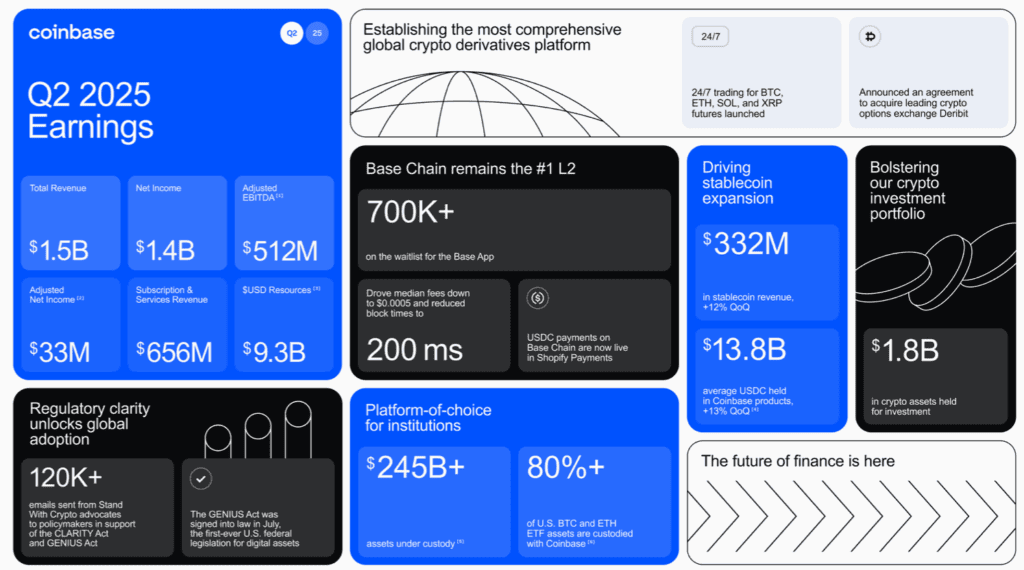

The launch comes as Coinbase navigates mixed financial performance. According to the company’s Q2 2025 shareholder letter, total trading volume reached $237 billion in Q2 2025, with total revenue of $1.5 billion, though transaction revenue declined 39% sequentially to $764 million.

Meanwhile, derivatives (perpetual) trading activity has surged. According to DefiLlama data, 30-day perpetual (perps) volume recently hit about $1.143 trillion, reflecting record-level volumes in the decentralized derivatives sector. Spot DEX (swap) daily volume is currently around $33.092 billion, up from earlier numbers, highlighting the growing role of decentralized platforms.

Expansion Plans

Coinbase expand support to additional blockchain networks. The company intends to expand support to additional blockchain networks, starting with Solana integration. Geographic expansion is also planned, with DEX trading set to roll out to users in more countries globally.

The move fits within Coinbase’s broader expansion into multi-network trading and financial services. Recent moves include acquiring options trading platform Deribit for $2.9 billion, partnering with PNC Bank to offer crypto services, partnering with Samsung to reach 75 million Galaxy owners in the U.S., and expanding staking services to 46 states including New York.

Fee Structure

For now, Coinbase is waiving all network gas fees. Future transactions, however, may incur regular trading costs. Coinbase One members currently enjoy zero trading fees on DEX transactions up to specific volume thresholds. Aggregators such as 1inch may also receive routing fees when executing price improvements.

This setup mirrors how Coinbase handled centralized trading fees during earlier product launches—subsidizing usage to encourage adoption before introducing monetization.

Implications for Base Ecosystem

According to Coinbase’s announcement, the goal is to make liquidity access more direct for developersThe integration consolidates Base’s role in Coinbase’s onchain strategy. Token issuers deploying on Base can now reach Coinbase’s mobile-app user base directly, without going through a formal listing process. According to Coinbase’s announcement, the goal is to make liquidity access more direct for developers.

The model mirrors Binance’s approach with BNB Chain, where tighter integration between the exchange and its native blockchain accelerated both project launches and network activity. Initial market responses to Base-linked tokens such as NOICE suggest increased trading activity on the network.

Regulatory Landscape

New York’s exclusion from the rollout underscores ongoing regulatory complications. Coinbase remains under scrutiny from the U.S. Securities and Exchange Commission (SEC) and state authorities, and offering decentralized access introduces new compliance challenges.

The DEX feature functions as a sandbox for regulatory experimentation, allowing Coinbase to test hybrid access models under its existing licenses. Its transparency about risk exposure and asset vetting could influence how regulators approach centralized-DeFi integrations going forward.

Looking Ahead

Coinbase’s DEX feature combines centralized platform access with decentralized trade execution, aims to give users greater operational autonomy while maintaining a familiar interface. For traders, it offers access to a wider range of tokens; for Coinbase, it may help Coinbase maintain user activity amid growing interest in decentralized trading.

Whether the approach succeeds will depend on liquidity quality, user education, and regulatory tolerance. But in practical terms, it reflects an industry-wide trend toward integrating onchain functionality into centralized platforms