What Is Tax Loss Harvesting? Why 90% of Investors Miss This Tax Break

4.8 min read

Updated: Jan 8, 2026 - 11:01:05

Tax loss harvesting lets U.S. investors sell losing investments to offset taxable gains, which may lower annual tax bills and improve after-tax returns. Despite IRS rules permitting up to $3,000 in annual deductions against ordinary income (after netting gains and losses), many investors overlook this strategy and miss potential long-term benefits. Acting before year-end and avoiding wash sale violations are key to using it effectively.

- IRS rules: Losses can offset capital gains; excess losses up to $3,000/year may reduce ordinary income, with carryforwards generally allowed in future years (subject to IRS rules).

- Why missed: Behavioral biases, wash sale restrictions, and timing/recordkeeping issues can prevent households from harvesting losses.

- When it helps: Often most useful in taxable brokerage accounts, especially after large realized gains (for example, trimming concentrated stock positions or selling appreciated assets).

- Pros vs. cons: Can reduce taxes and support portfolio rebalancing, but may involve trading costs, temporary tracking differences, and compliance errors if handled incorrectly.

- Practical steps: Review portfolios before year-end, consider substitute investments to stay invested, or use automation through robo-advisors and guidance from qualified tax/financial professionals.

Tax loss harvesting is a widely used tax-management strategy in investing. By selling investments at a loss to offset taxable gains, investors may reduce tax liability and improve after-tax portfolio efficiency. Even so, IRS data suggests many taxpayers with taxable accounts do not consistently apply loss-harvesting strategies. Academic research similarly finds that many retail investors do not prioritize tax optimization, focusing on pre-tax returns while overlooking after-tax outcomes.

What Is Tax Loss Harvesting?

At its core, tax loss harvesting is about turning investment losses into potential tax savings. When you sell an asset for less than you purchased it, the IRS allows you to use that loss to offset gains from other investments, subject to specific rules.

-

Capital gains occur when you sell an investment for more than its purchase price.

-

Capital losses are realized when you sell below cost.

The IRS lets you offset these amounts against each other. If losses exceed gains, you can deduct up to $3,000 per year against ordinary income like wages (for most individual filers). Unused losses don’t disappear; they generally roll forward into future years under IRS carryforward rules, which may create tax benefits over time.

Example: Imagine selling Stock A for a $10,000 profit. Meanwhile, Stock B in your portfolio is down $7,000. By selling Stock B, you harvest that loss. Your taxable gain drops to $3,000. If you’re in the 20% capital gains bracket, your tax bill falls from $2,000 to $600, a $1,400 tax reduction (before considering other tax items and rules).

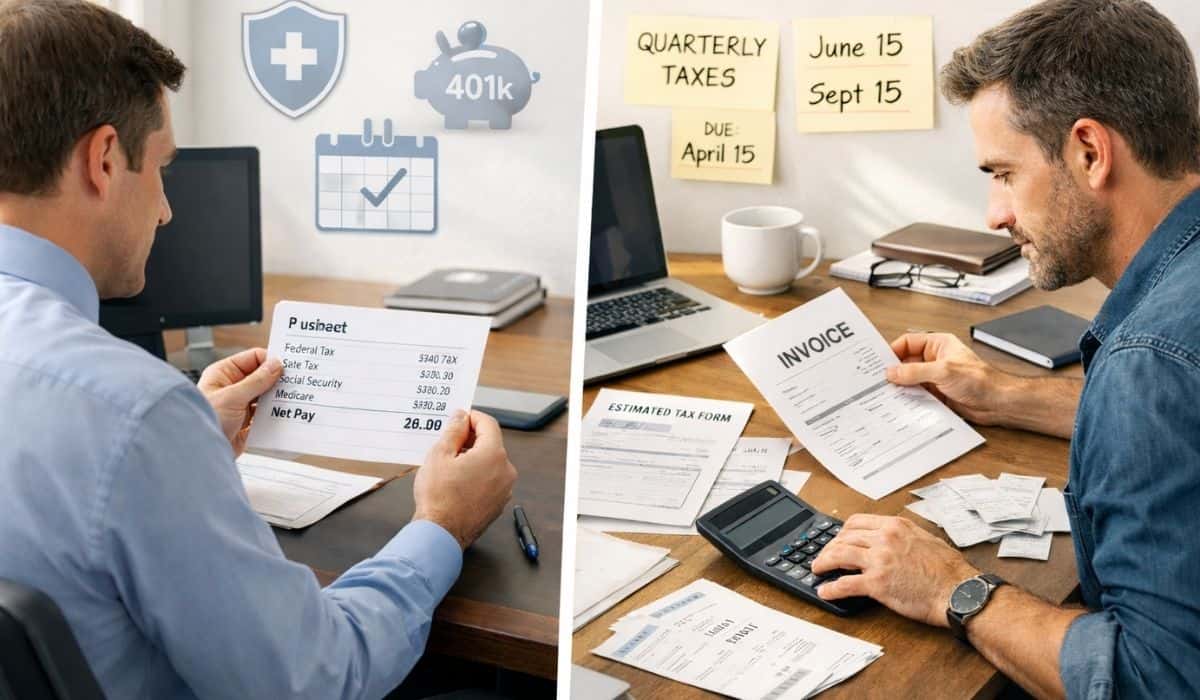

Why Most Investors Miss Out

Even with potential benefits, many individual investors do not optimize around taxes. IRS statistics suggest that systematic loss harvesting is not widely used, including among households with significant taxable investments.

Several barriers explain this gap:

-

The Wash Sale Rule – The IRS prohibits claiming a loss if you repurchase the same or “substantially identical” security within 30 days before or after the sale. This makes timing and security selection important.

-

Year-End Deadlines – Academic research finds that harvesting activity is often tied to calendar-year tax planning, meaning investors who wait until late in the year may have fewer options.

-

Behavioral Finance Factors – Studies document tax-inefficient behavior: some investors focus on returns and overlook strategies that could improve after-tax performance.

In many cases, the issue is less about access to the rules and more about follow-through, recordkeeping, and avoiding common compliance mistakes.

The Pros and Cons

Like all strategies, tax loss harvesting comes with trade-offs:

Advantages

-

Can lower taxable gains, which may reduce your annual tax bill.

-

Can provide a disciplined way to rebalance portfolios.

-

Losses can carry forward, which may create longer-term benefits in future years.

Drawbacks

-

Wash sale restrictions can reduce flexibility.

-

Selling may create temporary tracking differences if you don’t reinvest thoughtfully.

-

Frequent trading can add costs and complexity if not managed properly.

When Tax Loss Harvesting Makes Sense

This strategy works best in taxable brokerage accounts where gains and losses are currently reportable. It generally has limited usefulness in tax-advantaged accounts such as IRAs and 401(k)s, where gains typically aren’t taxed each year.

It’s often more relevant in years when you’ve realized large gains, such as from trimming concentrated stock positions or selling appreciated assets. However, harvesting may not make sense if it forces you to abandon a long-term investment you want to keep. Any tax benefit should be weighed against your overall investment strategy and risk management.

How to Get Started

A structured approach can help. Reviewing your portfolio before year-end may identify underperforming assets that could offset realized gains. Planning helps avoid triggering the wash sale rule while keeping your portfolio aligned with your goals. Many investors use replacement investments that track similar sectors or indexes while avoiding “substantially identical” securities.

For those seeking simplicity, robo-advisors may offer automated tax loss harvesting, scanning portfolios for potential opportunities. Alternatively, a tax professional can help evaluate options and support compliance, especially in years with complex income streams or large gains.

Bottom Line

Tax loss harvesting is a common tax-management approach that many investors do not use consistently. IRS data and behavioral finance research suggest that a meaningful share of households may miss potential tax benefits by not applying it when it fits their situation. By understanding the rules, planning ahead, and aligning harvesting with long-term goals, investors may be able to reduce taxes without undermining their investment strategy.

Because results vary by taxpayer, portfolio, and market conditions, it can help to treat tax loss harvesting as one tool among many rather than a guaranteed outcome. If you want help evaluating whether it fits your situation, consider speaking with a qualified tax or financial professional.