How the Tax System Actually Works – And Why Strategy Matters

10.2 min read

Updated: Jan 8, 2026 - 02:01:21

Most people experience taxes as a once-a-year filing task, but in reality, the U.S. tax system operates continuously and structurally throughout the year. Tax outcomes are not accidental or the result of clever tactics; they are the predictable consequence of how income timing, investment realization, and account structures interact with the tax code. Legitimate tax strategy is not about loopholes or avoidance, it is about understanding these rules well enough to anticipate outcomes and make better financial decisions before they are locked in. This is general information, not tax advice.

- Tax planning is forward-looking: Filing reports the past, compliance follows the rules, but strategy means structuring decisions, like Roth vs. traditional retirement contributions or when to realize gains, before taxes apply.

- Tax outcomes are structural by design: Differences between wages, capital gains, retirement accounts, and HSAs exist intentionally in the tax code to encourage certain behaviors, not by accident.

- Timing and account type often matter more than tactics: When income is recognized and where investments are held can materially change after-tax results, even if the dollar amounts are identical.

- The real goal is after-tax wealth, not lower taxes: Paying more tax today (for example, via Roth contributions in a low bracket) can sometimes improve long-term financial security.

- System-level understanding helps prevent costly mistakes: Misunderstanding brackets, RMDs, or credit phaseouts can undo years of savings and planning, often more than any single tax “hack” could ever save.

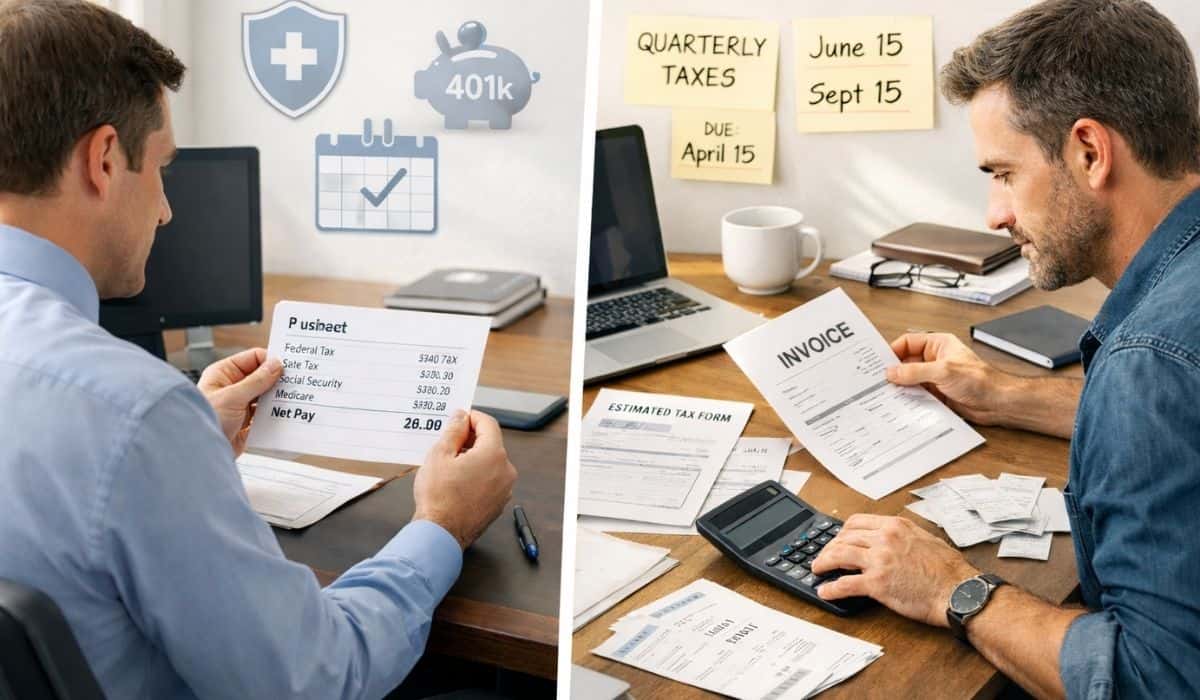

Most people experience the tax system as an annual event, filing a return, receiving a refund, or paying a balance due. In reality, taxation operates as a continuous, year-round framework. Through withholding, estimated payments, realization rules, and account structures, the tax system influences financial outcomes throughout the year, shaping decisions about income timing, investment activity, retirement contributions, and major life events.

Understanding how this system actually works is not about exploiting loopholes or using aggressive tactics to avoid taxes. It is about recognizing that tax outcomes are largely structural rather than accidental. Choices about when income is earned, how investments are held or sold, and which types of accounts are used lead to predictable tax consequences under existing law. Legitimate tax strategy simply means understanding these structures well enough to anticipate those outcomes and make informed financial decisions.

What Tax Strategy Actually Means

Tax strategy is often misunderstood as a set of tactics to reduce tax bills. In reality, it is the practice of understanding how the tax code interacts with financial decisions. The U.S. tax code, enacted by Congress, contains provisions such as deductions, credits, income exclusions, and timing rules that are designed to encourage or accommodate certain behaviors, including retirement saving and homeownership.

Legitimate tax strategy involves three distinct but related concepts:

Tax filing is the administrative act of reporting what occurred during the tax year. It is backward-looking and focused on documenting income, deductions, and credits.

Tax compliance means following the rules correctly and reporting income accurately. This is foundational, without compliance, no legitimate tax planning is possible.

Tax planning is forward-looking. It means structuring decisions with an awareness of their tax consequences before they occur. This can include choosing between traditional and Roth retirement accounts, deciding when to realize investment gains, or timing major income events around life changes.

The distinction matters because planning happens before decisions are made, while filing simply reports what already occurred. Strategy is not about changing the rules, it is about understanding them well enough to navigate them intelligently.

Why Tax Outcomes Are Structural, Not Accidental

The tax code does not treat all income the same way. Ordinary income from wages is taxed differently than long-term capital gains. Contributions to traditional retirement accounts reduce taxable income in the year they are made, while Roth contributions do not, but withdrawals are treated oppositely. Health savings accounts can provide triple tax advantages when contributions are made while eligible and withdrawals are used for qualified medical expenses.

These differences are not accidents or loopholes. They are deliberate structures built into the tax code, often designed to encourage specific behaviors such as retirement saving or health coverage. The tax outcome an individual experiences is not random, it is the predictable result of how income, timing, and account types interact with these rules.

Consider two people earning $80,000 per year. One contributes $6,000 to a traditional 401(k), reducing current taxable income. The other contributes $6,000 to a Roth 401(k), which does not reduce taxable income. Their current-year tax liabilities will differ, not because one person is avoiding taxes, but because the tax code intentionally treats these contributions differently. Paycheck withholding may differ depending on how each person completes their W-4, but the underlying tax treatment is determined by the contribution type itself.

This structural reality extends to investment decisions. An investor who holds an asset for more than one year may see that gain taxed at a significantly lower rate than if it were sold earlier, because long-term capital gains are taxed at preferential rates compared with short-term gains. This distinction exists by design to encourage longer-term investment behavior.

How Tax Interacts With Income, Investing, and Retirement

Tax does not exist in isolation from other financial decisions. It threads through nearly every major financial choice, shaping outcomes across income, investing, and long-term planning.

Income and Timing

Income recognition, when income becomes taxable, does not always align with when work is performed or when income is earned. For most employees, bonuses are generally taxed in the year they are paid, not the year they are earned, unless the income was constructively available without restriction in an earlier year. This means a bonus paid in January is typically taxable in that calendar year, even if it was calculated in December.

Many self-employed individuals using the cash method recognize income when it is actually received, which can provide limited timing flexibility that W-2 wage earners generally do not have. Understanding these rules helps explain why accelerating or deferring income between tax years can sometimes make sense, particularly when marginal tax rates are expected to change.

Investing and Account Structure

Where investments are held often matters as much as what is invested in. A bond fund generating regular interest income produces very different tax outcomes in a taxable brokerage account compared with an IRA or 401(k). The investment itself has not changed, only the tax treatment has.

This is the foundation of tax-aware investing. It is not about avoiding taxes entirely, since investment gains are often taxed when realized. Instead, it involves understanding how different accounts treat income and gains, and how those treatments affect long-term after-tax returns. In some cases, such as Roth accounts or assets that receive a step-up in basis at death under current law, investment gains may never be taxed.

Retirement Accounts and Long-Term Planning

Retirement accounts such as 401(k)s, IRAs, and Roth accounts are long-term tax structures, not just savings vehicles. Traditional accounts defer tax until withdrawal, potentially at lower rates in retirement. Roth accounts require paying tax upfront but allow tax-free growth and qualified withdrawals later.

Neither option is universally better. The appropriate choice depends on current income, expected future tax rates, benefit phaseouts, and how retirement income will ultimately be structured. While research suggests many individuals face lower tax rates in retirement, this outcome is not guaranteed, and the effects of these decisions can compound over decades.

Why Understanding the System Matters More Than Chasing Tactics

Tax strategy advice often focuses on individual tactics: “max out your 401(k),” “harvest tax losses,” “contribute to an HSA.” These tactics aren’t wrong, but they’re incomplete without understanding why they work and when they don’t.

A tactic without context can be counterproductive. Maximizing traditional 401(k) contributions reduces current taxable income, but if you’re already in a low tax bracket and expect higher earnings later, Roth contributions may produce better long-term outcomes despite offering no current deduction. Tax-loss harvesting can reduce capital gains taxes, but its usefulness is limited when gains are minimal or nonexistent, beyond the ability to offset a small amount of ordinary income, and it can add administrative complexity for modest benefit.

System-level understanding matters because it allows you to evaluate whether a tactic actually fits your situation. It also helps you recognize when conventional wisdom doesn’t apply. Much standard advice assumes stable income, predictable tax brackets, and a typical retirement timeline, assumptions that may not reflect your reality.

More importantly, understanding the system helps you avoid mistakes that are far more costly than any single tactic could save. Confusing marginal and effective tax rates can lead people to avoid income that would increase after-tax wealth. Failing to properly plan for required minimum distributions from retirement accounts can result in unexpectedly high tax bills and penalties for missed withdrawals. Overlooking how income levels affect eligibility for credits or deductions can quietly eliminate benefits worth thousands of dollars.

Common Misunderstandings About Tax Strategy

Several persistent misconceptions create unnecessary confusion and poor decisions:

“Moving into a higher tax bracket means less take-home pay.” This confuses marginal and effective rates. Higher brackets only apply to income above the threshold, never to income you already earned.

“Tax strategy is only for wealthy people.” Tax planning principles apply at every income level. Someone earning $50,000 making informed decisions about retirement account types and timing can see meaningful long-term benefits.

“The goal is to minimize taxes.” The actual goal is to maximize after-tax wealth and financial security. Sometimes paying more tax now results in better long-term outcomes, like choosing Roth contributions when young and in a low bracket.

“I need to do this before December 31.” While many tax provisions operate on a calendar-year basis, effective planning happens throughout the year and considers multi-year time horizons. Year-end scrambling is often a sign of insufficient planning, not strategic sophistication.

How Tax Connects to Other Parts of Personal Finance

Tax isn’t a standalone domain. It intersects with virtually every financial decision:

- Cash management and banking: Where you hold emergency funds and how you structure savings affects interest income and tax reporting. High-yield savings accounts generate taxable interest that must be reported, unlike returns from investments held in retirement accounts.

- Credit and debt: The tax treatment of interest paid varies dramatically. Mortgage interest may be deductible under certain conditions, while credit card interest isn’t. Student loan interest has specific deduction rules tied to income limits.

- Investment decisions: Asset location, which investments go in which account types, can significantly impact after-tax returns over time. Tax-efficient index funds in taxable accounts and tax-inefficient bonds in retirement accounts is a common framework, but it requires understanding both tax rules and investment mechanics.

- Retirement planning: Tax decisions made during working years directly impact retirement security. Someone who exclusively uses traditional retirement accounts and then faces large required minimum distributions in retirement may find themselves pushed into higher brackets than expected, affecting everything from Medicare premiums to Social Security taxation.

- Major life events: Marriage, divorce, home purchases, starting a business, and having children all create tax implications that should inform, not dictate, but inform, how these events are structured and timed.

The Foundation for Sound Financial Decisions

Tax strategy, properly understood, is not about minimizing a single year’s tax bill or chasing clever tactics. It is about understanding a recurring and structural feature of the financial system well enough to make informed decisions over time.

Tax laws change, rates adjust, provisions expire, and new rules are introduced. What remains consistent is the underlying framework: tax outcomes are generally the predictable result of how financial decisions interact with a structured set of rules. When that framework is understood, changes in the law become something to evaluate and adapt to, rather than something that creates confusion or reactive decision-making.

This system-level understanding forms the foundation of effective tax strategy. It includes knowing how income is measured, why timing affects tax outcomes, how different account structures are treated, and how to evaluate decisions based on after-tax results rather than headline figures alone.

The objective is not encyclopedic knowledge of the tax code. That depth of technical interpretation is the domain of tax professionals. The objective is sufficient understanding to ask informed questions, evaluate advice critically, and recognize when a financial decision has meaningful tax consequences that should be considered before the decision is made, not after the outcome is locked in.