Bitcoin ETF or Direct BTC? The Tax Trap You Must Know

5.6 min read

Updated: Dec 18, 2025 - 11:12:15

The launch of spot Bitcoin ETFs in January 2024 gave U.S. investors a mainstream way to gain Bitcoin exposure without using crypto exchanges. But while ETFs simplify taxes, custody, and portfolio integration, they trade off control and cost transparency compared to direct Bitcoin ownership. Choosing between the two depends on whether investors prioritize convenience and simplified reporting or autonomy and deeper participation in the Bitcoin ecosystem.

- Tax treatment differs: Bitcoin ETFs are taxed like stocks with straightforward 1099 reporting, while direct ownership is treated as property by the IRS, requiring detailed transaction-level reporting.

- Costs vary: ETFs carry ongoing fees (as low as 0.12% with BlackRock IBIT, 0.25% for Fidelity FBTC, ~1.5% for Grayscale GBTC), while direct ownership involves exchange fees, spreads, and one-time storage costs.

- Control trade-off: Direct owners hold private keys, eliminating counterparty risk and enabling Bitcoin-native use cases, while ETF investors rely on custodians like Coinbase Prime.

- Accessibility vs. autonomy: ETFs integrate with retirement accounts (401(k), IRA) and brokerages, whereas direct Bitcoin offers 24/7 liquidity and ecosystem engagement.

- Hybrid strategy potential: Many investors may combine ETFs for retirement portfolios with direct Bitcoin for long-term autonomy and ecosystem participation.

The introduction of spot Bitcoin ETFs in the U.S. in January 2024 marked a major milestone in cryptocurrency investing. These ETFs offered traditional investors a familiar vehicle to gain Bitcoin exposure without needing to interact with crypto exchanges. While convenient, this approach comes with trade-offs that go beyond accessibility. Investors need to carefully weigh tax treatment, costs, and control differences between ETFs and direct Bitcoin ownership to avoid unexpected complications and optimize returns.

The Rise of Bitcoin ETFs and Market Adoption

Spot Bitcoin ETFs quickly gained traction among both retail and institutional investors. BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC) emerged as frontrunners, attracting billions in assets under management. Their success reshaped how investors can participate in Bitcoin markets, with major brokerages incorporating these ETFs into standard investment portfolios.

Competition has been fierce on fees. BlackRock’s IBIT initially offered a temporary fee waiver, bringing the expense ratio down to 0.12%, while Fidelity’s FBTC maintain a 0.25% ongoing fee. Grayscale’s GBTC, transitioning from its trust structure to an ETF, still carries a much higher fee of roughly 1.5%, which has led to significant outflows as investors seek lower-cost alternatives. This fee disparity underscores the importance of comparing ETF costs, not just convenience.

Bitcoin Tax Treatment: ETFs vs Direct Ownership

The tax implications are a major differentiator between ETFs and direct Bitcoin ownership.

-

Bitcoin ETFs: Treated as traditional securities, ETFs fall under standard capital gains rules. For assets held longer than one year, long-term capital gains rates between 0% and 20% apply depending on income. ETF investors typically receive simplified tax reporting through 1099 forms, making compliance straightforward.

-

Direct Bitcoin Ownership: The IRS classifies Bitcoin and other cryptocurrencies as property, not currency. This creates taxable events not only for sales into fiat but also for crypto-to-crypto trades and purchases made with Bitcoin. Recordkeeping is intensive, as every transaction must be tracked for cost basis calculation and reported on tax returns. The complexity increases for investors frequently trading or using Bitcoin in daily transactions.

In essence, ETFs simplify tax reporting but relinquish control over the underlying asset, whereas direct ownership allows autonomy but increases the tax reporting burden.

Evaluating Costs Beyond the Surface

Understanding costs requires looking beyond surface-level fees.

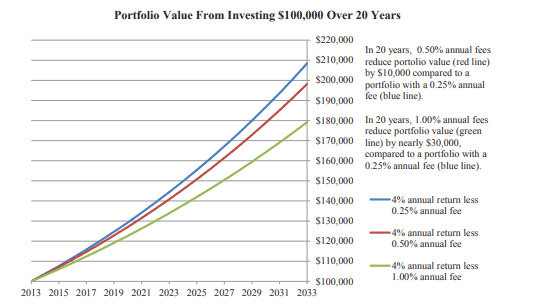

For ETFs: Expense ratios are clearly stated and applied annually, reducing returns over time. A 0.25% expense ratio on a $10,000 investment results in $25 per year, which compounds over long-term holdings.

Source: SEC

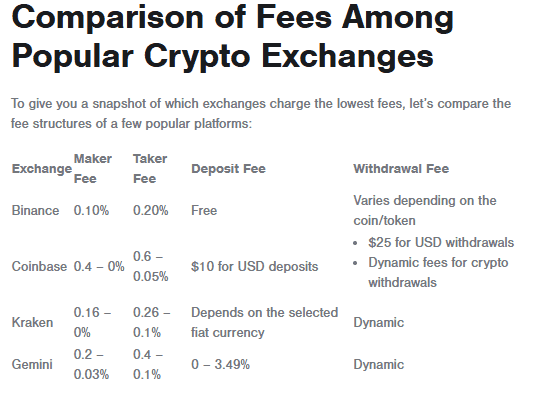

For Direct Ownership: Investors face trading fees (0.1–0.6% per transaction on major exchanges), spreads between bid and ask prices, and optional storage costs. Hardware wallets like Ledger or Trezor range from $50 to $200, and institutional-grade custody solutions can be more expensive. While the initial investment and setup may require effort and cost, there are typically no ongoing management fees once stored securely.

Source: AlphaPoint

Both approaches have costs that impact long-term performance; ETFs incur continuous management fees, while direct ownership involves one-time and transactional fees that can be managed with careful planning.

Custody and Control: Who Really Owns the Bitcoin?

Direct ownership allows investors to hold private keys, staying true to Bitcoin’s core philosophy: “Not your keys, not your coins.” This approach eliminates counterparty risk and enables participation in Bitcoin-native applications such as the Lightning Network and decentralized services.

ETF holders, on the other hand, own shares in a fund rather than the cryptocurrency itself. The underlying Bitcoin is held by custodians, such as Coinbase Prime, meaning investors are exposed to institutional counterparty risk. While ETFs simplify custody and management, they come at the cost of direct control over the digital asset.

Accessibility and Portfolio Integration

Bitcoin ETFs integrate seamlessly with traditional financial systems. They can be purchased in brokerage accounts, included in tax-advantaged retirement accounts like 401(k)s and IRAs, and easily integrated into diversified portfolios. This ease of access has accelerated institutional adoption and simplified Bitcoin exposure for advisors and retail investors alike.

Direct Bitcoin ownership requires navigating exchanges, completing identity verification, and learning secure storage practices. However, Bitcoin markets operate 24/7, giving holders continuous liquidity and the flexibility to transact at any time, an advantage ETFs cannot match due to standard stock market hours.

Long-Term Implications for Wealth Building

The choice between ETFs and direct ownership affects strategic planning for long-term wealth accumulation.

-

ETF Investors: Benefit from professional fund management, simplified reporting, and institutional custody. However, they remain subject to fund management decisions, operational risks, and regulatory changes affecting ETFs.

-

Direct Owners: Gain full autonomy and the ability to interact with Bitcoin’s broader ecosystem. Ownership aligns with Bitcoin’s deflationary supply (capped at 21 million coins) and allows participation in Layer 2 applications and on-chain innovations. Yet, self-custody requires diligence, technical knowledge, and responsibility for security.

Bitcoin’s halving cycles, which reduce mining rewards approximately every four years, influence supply dynamics regardless of ownership method, but direct owners have full engagement in Bitcoin-native applications and emerging decentralized financial services.

Conclusion: Choosing the Right Approach

Deciding between ETFs and direct Bitcoin ownership depends on individual priorities, technical comfort, and investment goals. ETFs offer convenience, simplified tax reporting, and integration with traditional portfolios, making them ideal for investors who value accessibility and professional management. Direct ownership provides complete control, ecosystem participation, and the full Bitcoin experience, albeit with higher operational responsibility and tax complexity.

Many investors may benefit from a hybrid strategy: using ETFs for tax-advantaged retirement accounts while holding direct Bitcoin for long-term accumulation and ecosystem engagement. Understanding these fundamental differences is essential for making informed decisions as Bitcoin continues to mature both as a technology and an asset class.