Ledger Unveils Recovery Key: A Physical “Spare Key” That Could Transform Crypto Self-Custody

4.4 min read

Updated: Jan 19, 2026 - 05:01:02

Ledger has launched the Recovery Key (July 24, 2025), a $39 NFC smart card designed to replace fragile paper seed phrases with a faster, more secure offline backup. Unlike Ledger Recover, it requires no KYC, internet, or subscription, and setup takes just two minutes. The Recovery Key is free with new Ledger Stax and Flex devices, or claimable by existing owners through Ledger’s redemption program.

- Offline Security: Encrypted private keys never touch the cloud or Ledger servers; restoration requires only a PIN and NFC tap.

- Durable & User-Friendly: Resistant to fire/water damage and far faster than 10-minute paper phrase setups.

- No KYC or Fees: Unlike the controversial 2023 Ledger Recover service, no identity verification or ongoing cost is required.

- Limits: Only works with NFC-enabled Ledger Stax and Flex wallets; still carries physical loss/theft risks despite PIN protection.

- Market Context: With ~93 million Americans holding crypto (Chainalysis, 2025), Ledger is betting the Recovery Key will ease mainstream anxiety around self-custody.

Hardware wallet manufacturer Ledger has launched the Recovery Key, a PIN-protected NFC smart card designed to address one of cryptocurrency’s most persistent problems: the fragility of traditional seed phrase backups.

Launched on July 24, 2025, the Recovery Key is priced at $39 as a standalone device but comes free with new Ledger Stax and Ledger Flex purchases. Existing Stax and Flex owners can claim a free Recovery Key through Ledger’s redemption program.

What Makes Recovery Key Different

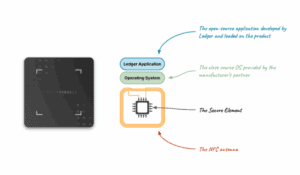

Unlike traditional paper recovery sheets, the Recovery Key stores encrypted private keys on a physical NFC smart card that connects directly to Ledger Flex and Ledger Stax wallets. The device uses the same Secure Element chip technology found in Ledger’s hardware wallets, providing enterprise-grade security with Common Criteria EAL6+ certification.

Source: Ledger

The entire backup process remains offline from start to finish, with no cloud, internet connection, or Ledger server involvement. Users simply tap the card against their Ledger device and enter a PIN to restore wallet access.

How It Compares to Existing Solutions

The Recovery Key addresses several limitations of current backup methods:

-

Traditional Paper Sheets: While free and included with all Ledger devices, paper backups are vulnerable to fire, water damage, theft, and human error. Setup and restoration can take up to 10 minutes and carry a high risk of mistakes.

-

Ledger Recover Service: Launched in 2023, this cloud-based service splits encrypted recovery phrase fragments across multiple secure hardware modules but requires identity verification and personal data collection. The service faced community backlash over privacy concerns.

-

Recovery Key: Offers 2-minute setup and restoration with low risk of mistakes, while remaining completely offline and requiring no personal information.

Why It’s Better (And Potential Drawbacks)

Advantages:

-

No KYC Requirements: Unlike Ledger Recover, the Recovery Key requires no identity verification or subscription fees

-

Offline Security: Never connects to the internet, eliminating remote attack vectors

-

Durability: Resistant to physical damage that destroys paper backups

-

User-Friendly: Recovery process takes just 2 minutes compared to traditional methods

-

Open Source: The Recovery Key’s code is reviewable alongside a comprehensive paper

Potential Limitations:

-

Limited Compatibility: Only works with NFC-enabled Ledger Stax and Flex devices

-

Additional Cost: $39 price point may deter some users, though it’s included with new touchscreen wallet purchases

-

Physical Risk: Like any physical device, it can still be lost or stolen (though PIN protection provides security)

Remaining Self-Custody Risks

Despite the Recovery Key’s improvements, several fundamental cryptocurrency self-custody risks persist:

-

Single Points of Failure: If both the Recovery Key and paper backup are lost or destroyed simultaneously, funds remain inaccessible. While there’s no limit to the number of Recovery Keys that can be created, users must actively create multiple backups.

-

PIN Security: The Recovery Key’s security depends on users choosing strong PINs and keeping them secure. Weak PINs or PIN disclosure could compromise the backup.

-

Physical Security: Though more durable than paper, the Recovery Key can still be stolen. Unlike the Ledger Recover service’s identity verification, a stolen Recovery Key with a compromised PIN could provide immediate access to funds.

-

User Error: While the Recovery Key reduces mistake risk compared to paper backups, users can still make errors during setup or lose access to both backup methods.

-

Technology Dependence: The Recovery Key relies on NFC technology and compatible devices. Hardware failures or obsolescence could create access issues over time.

Market Impact

With crypto adoption growing and total market cap increasing by nearly $1 trillion over the past year, Ledger argues users need modern backup options to stay secure. According to Chainalysis, global crypto activity increased 172%, with approximately 93 million Americans owning cryptocurrency.

An internal Ledger study found 78% of Recovery Key testers reported significantly reduced anxiety about private key management, suggesting the product addresses a real user pain point.

The Recovery Key represents Ledger’s attempt to bridge the gap between crypto’s technical complexity and mainstream usability needs. By offering multiple backup options, traditional paper sheets, cloud-based Ledger Recover, and now the offline Recovery Key, the company aims to serve users across the spectrum from crypto maximalists to mainstream adopters.

However, the fundamental challenge remains: cryptocurrency self-custody requires users to take personal responsibility for their financial security in ways traditional banking does not. While the Recovery Key makes this process more user-friendly, it cannot eliminate the inherent risks of being your own bank.