Trust Funds 101: A Practical Guide to Building Lasting Family Wealth

7 min read

Updated: Dec 19, 2025 - 08:12:08

Trust funds are legal tools that help individuals and families manage and transfer assets efficiently, often avoiding probate, reducing taxes, and protecting wealth from creditors. In 2025, rising estate values and updated IRS limits make trusts especially valuable for preserving family wealth and ensuring privacy in estate planning.

- Revocable vs. Irrevocable: Revocable trusts allow full control and probate avoidance but no estate tax savings. Irrevocable trusts, while permanent, remove assets from the taxable estate and provide stronger asset protection.

- Tax Advantages: The 2025 federal estate tax exemption is $13.61 million per person, with a 40% rate above that threshold. Annual gift tax exclusion: $19,000 per recipient. Tools like GRATs and ILITs can transfer appreciation or life insurance proceeds tax-free.

- Probate Avoidance: Probate averages 20 months and costs 3–7% of estate value. Trusts transfer assets privately and immediately to beneficiaries.

- Typical Costs: Median trust size is $285,000. Setup runs $1,000–$3,000 for revocable trusts; irrevocable or complex trusts exceed $5,000. Ongoing trustee fees average 0.5–1% of assets.

- Choosing the Right Trust: Revocable trusts fit those seeking flexibility and privacy; irrevocable or specialized trusts, like special needs, spendthrift, or charitable, serve tax, protection, or legacy goals. Professional legal and tax advice ensures compliance and optimization.

A trust fund is a structured legal arrangement designed to hold, manage, and distribute assets, such as cash, securities, businesses, or real estate, for the benefit of specific individuals or organizations. It is established by a grantor, overseen by a trustee, and ultimately benefits designated beneficiaries. The grantor sets the rules in the trust document, giving clear instructions on how and when beneficiaries should receive their share.

Trust funds play a central role in estate planning. They allow families and individuals to manage wealth across generations, avoid probate, the court-supervised process of distributing estates, and provide protections against creditors or lawsuits. Trusts can be active during a grantor’s lifetime (living trusts) or take effect after death (testamentary trusts).

Beyond inheritance, trusts are often used to finance education, charitable giving, and long-term care for dependents, offering greater control over wealth transfers than a simple will.

Revocable vs. Irrevocable Trusts

The two most common categories are revocable trusts and irrevocable trusts, each serving very different purposes.

| Feature | Revocable Trust | Irrevocable Trust |

|---|---|---|

| Control | Full control; can be altered or revoked during lifetime | Permanent; generally cannot be changed |

| Tax Impact | Assets remain part of taxable estate | Removes assets from taxable estate |

| Creditor Protection | Minimal | Stronger, assets shielded |

| Probate Avoidance | Yes, for assets retitled into trust | Yes, for trust-owned assets |

| Typical Use | Flexibility in estate transfer | Tax minimization, asset protection |

A revocable trust is often favored for its flexibility. The grantor retains control, making it possible to amend terms or even dissolve the trust entirely. However, since assets remain part of the grantor’s estate, there are no estate tax or creditor protections.

By contrast, an irrevocable trust is rigid but powerful. Once assets are placed inside, they generally cannot be removed or reassigned without consent. The benefit is substantial: the assets are no longer considered part of the grantor’s estate, lowering estate tax liability and protecting wealth from creditors or legal claims.

According to Wealth Enhancement Group, irrevocable trusts are widely recognized as effective tools for reducing taxable estates and preserving wealth across generations.

Setting Up A Trust

While no law in the United States requires you to hire an attorney to establish a trust, whether revocable or irrevocable, the practical question of whether you should use one depends heavily on your circumstances. For simple revocable living trusts with straightforward assets, many people successfully use DIY software or templates. However, irrevocable trusts present significantly higher stakes as they are permanent, carry complex tax implications, and mistakes can be extraordinarily costly to correct.

Common pitfalls in self-drafted trusts include improper asset funding, ambiguous beneficiary designations, missing provisions that could invalidate the structure, and failure to meet state-specific requirements that vary considerably across jurisdictions. The complexity increases dramatically with blended families, special needs beneficiaries, business ownership, substantial real estate holdings, or tax planning objectives.

While an estate planning attorney typically costs between $1,000 and $3,000 for trust creation, this investment often proves worthwhile against potential litigation costs, tax penalties, or distribution problems that beneficiaries might face from a flawed document. For most people, particularly those establishing irrevocable trusts or dealing with estates exceeding $500,000, professional legal guidance provides both technical accuracy and peace of mind.

Tax Advantages of Trusts

Estate and Gift Tax Savings

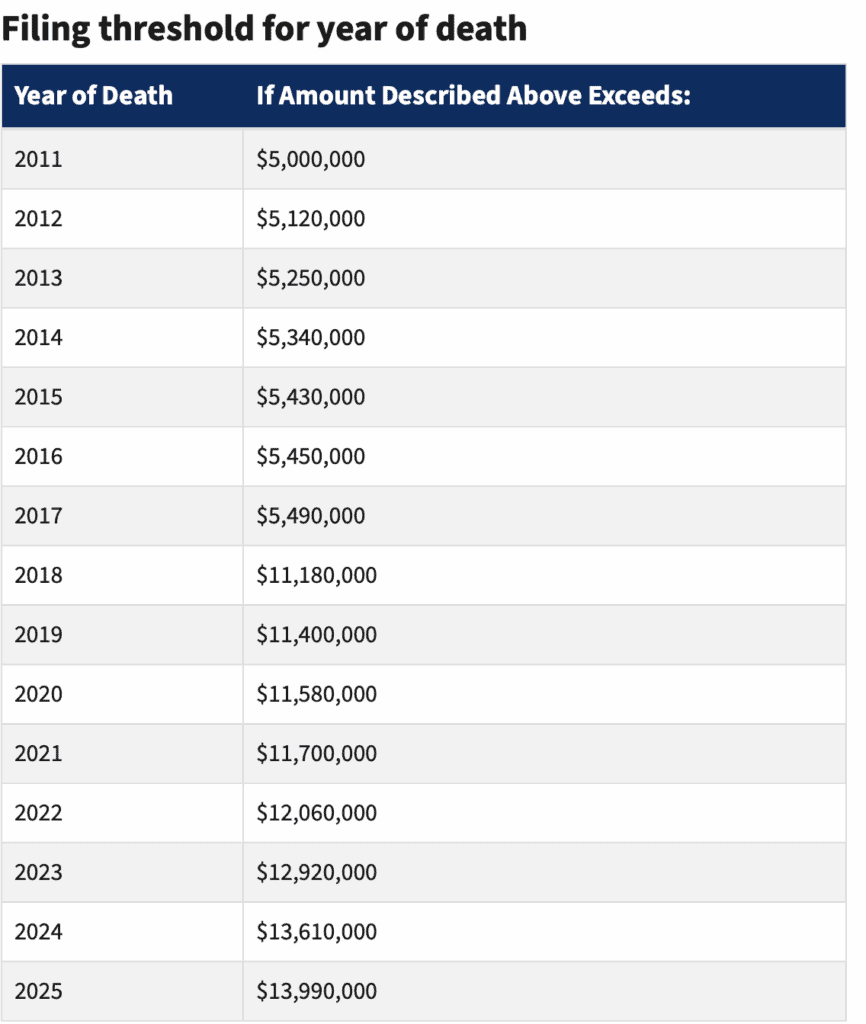

Trusts can provide significant tax relief. As of 2025, the federal estate tax exemption stands at $13.61 million per person. Estates above this threshold face a tax rate of up to 40%. By transferring assets into an irrevocable trust, those holdings are excluded from the estate, reducing or eliminating tax exposure.

Source: IRS

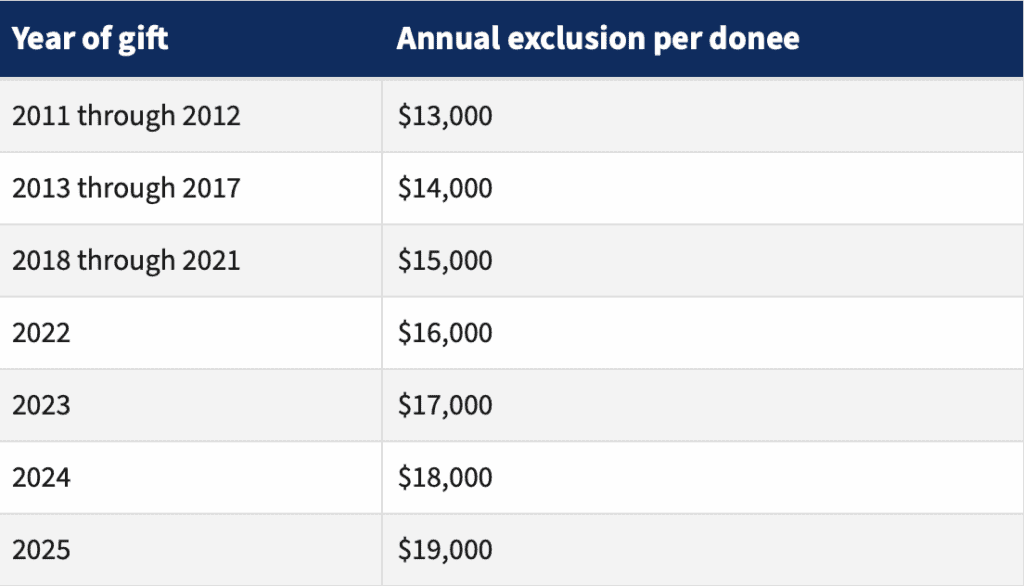

Additionally, the annual gift tax exclusion is $19,000 per recipient in 2025. This allows grantors to transfer assets into a trust each year for multiple beneficiaries without triggering gift taxes.

Source: IRS

Specialized trusts like Grantor Retained Annuity Trusts (GRATs) or Irrevocable Life Insurance Trusts (ILITs) are particularly valuable. GRATs allow appreciation to pass to heirs tax-free, while ILITs shield life insurance proceeds from estate taxes.

Income Tax and Basis Rules

-

Revocable trusts: Taxed directly to the grantor; income flows through to personal tax returns.

-

Irrevocable trusts: Taxed separately. Undistributed income is taxed to the trust, often at higher rates, while distributions are taxed to beneficiaries.

An important benefit is the step-up in basis. Assets in a revocable trust typically reset their cost basis at death, minimizing heirs’ capital gains tax burden when selling.

It is also worth noting that trusts reach the highest tax bracket far faster than individuals. In 2025, undistributed trust income above $15,200 is taxed at the top federal rate, while individuals need income over $609,350 (married, filing jointly) to hit that bracket.

Probate Avoidance by the Numbers

One of the most practical benefits of trusts is avoiding probate, a process often seen as burdensome.

| Metric | Statistic | Source |

|---|---|---|

| Average U.S. probate duration | ~20 months | Trust & Will (2024) |

| Average probate cost | 3–7% of estate value | LegalZoom |

| Public awareness | Only 42% know trusts avoid probate | Jeffrey C. Nickerson Law |

| % of Americans with estate plan | ~45% | LegalZoom |

Probate not only delays asset transfers but also exposes family finances to the public record. With a trust, transfers remain private, saving both time and privacy.

For example, a $750,000 estate could face $22,500 to $52,500 in probate fees, money that could otherwise go directly to heirs.

Typical Trust Sizes and Costs

Trust funds are not reserved for billionaires. According to New York Life, the median U.S. trust fund size is $285,000.

-

Setup Costs: $1,000–$3,000 for a simple revocable trust; more complex irrevocable trusts can exceed $5,000.

-

Trustee Fees: 0.5%–1% annually of trust assets when managed by a professional.

-

Administration Costs: Ongoing filing, legal, and compliance fees may apply.

Experts typically recommend trusts when personal assets exceed $250,000–$500,000, or when an individual seeks specific tax, privacy, or protection benefits beyond what a will provides.

Choosing the Right Trust for Your Goals

Selecting the right trust depends heavily on financial priorities and family needs.

| Goal | Best Trust Type | Key Benefit |

|---|---|---|

| Avoid probate & maintain flexibility | Revocable trust | Control and privacy |

| Minimize estate taxes | Irrevocable trust | Removes assets from estate |

| Protect heirs from creditors | Irrevocable trust | Asset protection |

| Provide for dependents or education | Special needs or spendthrift trust | Structured, controlled distributions |

| Support charitable giving | Charitable lead or remainder trust | Tax deductions and philanthropy |

Specialized trusts offer tailored solutions. For instance, a special needs trust ensures disabled beneficiaries continue receiving government benefits, while a spendthrift trust safeguards funds from irresponsible spending. Charitable trusts not only support causes but also deliver significant tax deductions.

Final Takeaways

Trust funds remain a cornerstone of estate planning, offering privacy, tax efficiency, and security across generations. Revocable trusts are best for individuals seeking flexibility and probate avoidance, while irrevocable trusts serve those focused on estate tax minimization and creditor protection. However, the true power of a trust lies in proper funding and careful design, an unfunded trust has no legal value.

Because trust law intersects with both federal tax codes and state-specific statutes, professional guidance is essential. An experienced estate planning attorney can ensure compliance with evolving regulations, while a tax advisor can optimize the structure for maximum savings. Taken together, these safeguards allow families not only to protect wealth but also to pass it on in a way that reflects their values and priorities for decades to come.