Government Bonds vs. Corporate Bonds: Risk, Returns, and What You Need to Know

7.5 min read

Updated: Dec 19, 2025 - 08:12:04

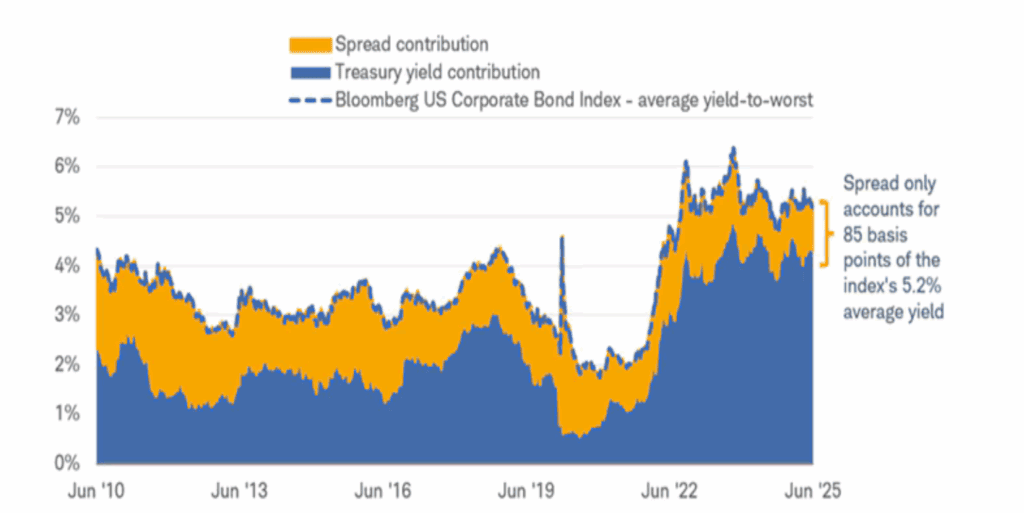

When building a diversified portfolio, understanding the trade-off between government and corporate bonds is critical. Government bonds (like U.S. Treasuries) deliver safety and predictable income, while corporate bonds compensate higher default risk with stronger yields. As of mid-2025, the spread between corporate and Treasury yields remains historically narrow, just ~0.85% – reflecting investor confidence but limited extra reward for risk. Here’s what to know when choosing or blending both.

- Safety: U.S. Treasuries are backed by the federal government, offering near-zero default risk and state/local tax exemption.

- Yield Trade-Off: Investment-grade corporate bonds typically yield 1–2% more than Treasuries, but spreads are at 20-year lows.

- Risk Spectrum: Corporate default risk rises with lower ratings, AAA bonds near 0%, CCC-rated up to 49% as per S&P Global Ratings.

- Market Size: The U.S. Treasury market exceeds $28.6 trillion (Q1 2025), over double the corporate bond market’s size.

- Portfolio Strategy: Blend government bonds for stability with investment-grade corporate bonds for income; adjust allocation based on risk tolerance and time horizon.

When you’re building an investment portfolio, bonds can offer both stability and steady income. But not all bonds are the same. The two main categories, government and corporate bonds, differ in how they function, the risks they carry, and the returns they generate. Understanding these differences is crucial to making informed investment decisions.

What Are Government Bonds?

A government bond is essentially a loan from investors to the government. In return, the government promises to repay the borrowed amount with interest over a specific period. In the United States, these are known as Treasury securities, while in the United Kingdom they’re called gilts.

U.S. Treasury Bonds are issued for terms of 20 or 30 years and pay fixed interest every six months until maturity. Shorter-term options include Treasury Bills (T-Bills), which mature in as little as four weeks to one year and are sold at a discount to their face value, and Treasury Notes (T-Notes), which mature in two to ten years and pay semiannual interest. Another category is Treasury Inflation-Protected Securities (TIPS), where the bond’s principal is adjusted according to changes in the Consumer Price Index (CPI) to help protect investors from inflation.

Because they are backed by the full faith and credit of the U.S. government, Treasuries carry minimal default risk and are considered among the safest investments available. However, they still face interest-rate and inflation risk if sold before maturity. Their safety also comes with a tax advantage: interest income from Treasuries is exempt from state and local taxes but remains subject to federal income tax, according to the Internal Revenue Service (IRS).

What Are Corporate Bonds?

Corporate bonds work similarly but differ in issuer and risk. When you buy a corporate bond, you lend money to a company rather than the government. In exchange, the company makes periodic interest payments and repays the principal at maturity.

Companies issue bonds to expand operations, fund acquisitions, or refinance existing debt. These bonds are categorized by credit quality and structure. Investment-grade corporate bonds, rated BBB- or higher by agencies such as S&P Global Ratings or Moody’s, come from financially stable firms with low default risk. High-yield (“junk”) bonds, rated below BBB-, offer higher returns but carry more risk. Some corporate bonds are secured by assets such as property or equipment, while others are unsecured and rely solely on the issuer’s creditworthiness.

The Risk Difference: Why It Matters

The fundamental difference between government and corporate bonds comes down to default risk, the possibility that the issuer won’t make required payments.

Government Bonds: U.S. Treasury bonds are used as a benchmark by the market because they are considered virtually free of default risk. While no investment is completely risk-free, Treasuries are backed by the full faith and credit of the U.S. government, making their default probability extremely low.

Corporate Bonds: Corporate bonds are generally seen as riskier than government bonds because companies can default on repayments and lack a government’s ability to raise revenue through taxation.

However, default rates vary widely by credit rating. According to data based on S&P Global Ratings, the highest one-year default rates for investment-grade bonds, rated AAA, AA, A, and BBB, were 0%, 0.38%, 0.39%, and 1.02%, respectively. High-yield bonds carry substantially more risk, with maximum one-year default rates for BB, B, and CCC/C-rated bonds of 4.22%, 13.84%, and 49.28%, respectively.

Interestingly, research from New York Life Investments notes that BB-rated bonds have recorded no defaults since 2020, and their 23-year average default rate is just 0.36%, making them much safer than many investors assume, though still classified as speculative-grade.

Returns: The Risk-Reward Trade-Off

Because corporate bonds carry more risk, they must offer higher returns to attract investors. This extra return is called the credit spread or spread. Historically, investment-grade corporate bond yields have averaged about 1–2% higher than U.S. Treasury yields, though the gap varies over time with economic conditions.

Key Differences at a Glance

| Feature | Government Bonds | Corporate Bonds |

|---|---|---|

| Issuer | Sovereign government | Private corporation |

| Risk Level | Backed by taxation power; near risk-free | Depends on company credit |

| Liquidity | Extremely high | Moderate to high |

| Tax Treatment | State/local tax-exempt | Fully taxable |

| Yield | Lower | Higher (to compensate for risk) |

The U.S. Treasury market remains the world’s largest, with about $28.6 trillion outstanding as of Q1 2025 – more than twice the corporate bond market’s size.

Which Type of Bond Is Right for You?

The right mix depends on your goals and risk tolerance. Investors seeking safety, predictability, and capital preservation often lean toward government bonds, particularly near retirement or in volatile markets. Those pursuing higher yields might favor investment-grade corporate bonds from financially sound issuers.

A diversified approach, combining both government and corporate bonds, can balance stability with income potential. Many investors also use a bond ladder to manage interest-rate risk and maintain liquidity.

Understanding Bond Ratings

Credit rating agencies like Standard & Poor’s, Moody’s, and Fitch assess the creditworthiness of bond issuers. These ratings help investors understand default risk:

Investment Grade:

- AAA/Aaa: Highest quality, lowest risk

- AA/Aa: High quality, very low risk

- A: Upper-medium grade, low risk

- BBB/Baa: Medium grade, moderate risk

High Yield (Non-Investment Grade):

- BB/Ba: Speculative, elevated risk

- B: Highly speculative, high risk

- CCC/Caa and below: Substantial risk, very high default probability

Government bonds are not rated in the same way because they’re considered the benchmark for “risk-free” investments.

Recent Market Dynamics

Investment-grade corporate bonds have seen low default rates in recent years, and investors aren’t having to accept significantly more risk within their strategies for the increase in fixed income.

Due to the risk premium, corporate bonds offer a higher yield than government bonds, but the realized volatility is currently lower than that of comparable government bonds, making corporate bonds particularly attractive to some investors in the current environment.

However, market conditions can change quickly. Economic uncertainty, changes in interest rates, and shifting Federal Reserve policy all influence both government and corporate bond markets.

The Bottom Line

Both government and corporate bonds have important roles to play in a well-diversified portfolio. Government bonds provide safety, stability, and a hedge against market volatility. Corporate bonds offer higher yields and can boost portfolio income, especially investment-grade bonds with historically low default rates.

The key is understanding your own risk tolerance and investment goals. Conservative investors may lean more heavily toward government bonds, while those comfortable with moderate risk might allocate more to investment-grade corporate bonds. Many investors find that a mix of both provides the right balance of safety and returns.

Before investing in any bonds, consider consulting with a financial advisor who can help you assess your specific situation and build a bond portfolio that aligns with your needs. Remember that while bonds are generally considered lower-risk than stocks, they still carry risks – including interest rate risk, inflation risk, and (for corporate bonds) credit risk.

The choice between government and corporate bonds isn’t an either-or decision. It’s about finding the right mix that helps you sleep well at night while working toward your financial goals.

Related: This article is part of our broader Investing Hub, where you’ll find guides on market behavior, ETF research, asset allocation, and long-term wealth planning.