Considering Retirement? How to Rewire 30 Years of Saving Habits

5.6 min read

Updated: Dec 19, 2025 - 08:12:12

Many retirees, even with $1M+ saved, feel paralyzed when it comes to withdrawing money. This “spender’s block” stems from decades of saving habits, loss aversion, and fear of running out. Yet research shows most retirees underspend, often leaving large balances untouched. The key is reframing withdrawals as income, not losses, and adopting structured strategies that balance security with lifestyle. Here’s how to shift from accumulation to confident distribution.

- Psychology matters: Loss aversion makes withdrawals feel like losses, but research from the Employee Benefit Research Institute shows many retirees preserve most assets for decades.

- Mindset shift: Treat your portfolio like a dividend-producing business, withdrawals are income, not sabotage. Use “guilt-free spending buckets” to normalize withdrawals.

- Portfolio design: Shift from pure growth to income stability. Consider a bucket strategy (cash/bonds for 0–5 years, conservative assets for mid-term, growth for long-term) per Vanguard and Schwab.

- Withdrawal rules: The 4% rule still provides a baseline ($52,000/year on $1.3M), though many planners suggest 3.5% today for longevity and market safety.

- Practical steps: Start small with discretionary spending, use tax-efficient withdrawal sequencing (taxable → traditional → Roth), and adjust annually for performance and needs.

The Psychology of “Spender’s Block”

Mike, 62, stares at his quarterly investment statement showing $1.3 million across his retirement accounts. After 30 years of disciplined monthly contributions and careful portfolio management, he should feel triumphant. Instead, he feels paralyzed. His financial advisor keeps saying he’s “won the game” and can start enjoying his money, but every time Mike considers withdrawing funds, his stomach churns. The thought of reducing that balance feels like breaking a sacred rule he’s followed for three decades.

If this sounds familiar, you’re not alone. The transition from accumulation to distribution represents one of the most challenging psychological shifts in personal finance.

For successful savers like Mike, spending retirement funds triggers genuine anxiety. After decades of conditioning to save every month, increase contributions with raises, and watch balances grow, the brain interprets withdrawals as financial self-sabotage. This isn’t about being cheap, it’s about rewiring deeply ingrained behaviors.

Loss aversion, a well-documented psychological bias, makes every withdrawal feel like a permanent loss rather than the intended use of saved money. The fear of running out of money battles against the equally troubling prospect of dying with millions unspent, leaving many retirees in financial limbo.

Research from the Employee Benefit Research Institute (EBRI) shows that many retirees preserve the majority of their savings well into retirement, often spending only income from Social Security, pensions, or interest. In fact, wealthier retirees who began retirement with at least $500,000 in non-housing assets had spent down only about 11–12% after nearly two decades. Moreover, about one-third of retirees actually increased their assets during retirement, highlighting a tendency to live below their means despite having adequate resources.

The Mindset Shift Toolkit

The key to overcoming spender’s block lies in reframing how you view your portfolio. Instead of seeing it as a shrinking pile of money, think of it as a dividend-producing business that you own. You’re not spending down capital, you’re collecting income from 30 years of investments.

Start with practice runs. Before you actually need the money, take small withdrawals for specific purposes: a vacation, home improvement, or gifts to family. This helps normalize the process of accessing your savings while creating positive associations with spending.

Create a “guilt-free spending bucket” by mentally separating withdrawal money from your main investment accounts. Once you transfer funds to a dedicated spending account, you’ve already made the difficult decision to spend, now you’re just using money you’ve allocated for that purpose.

Portfolio Restructuring for Distribution

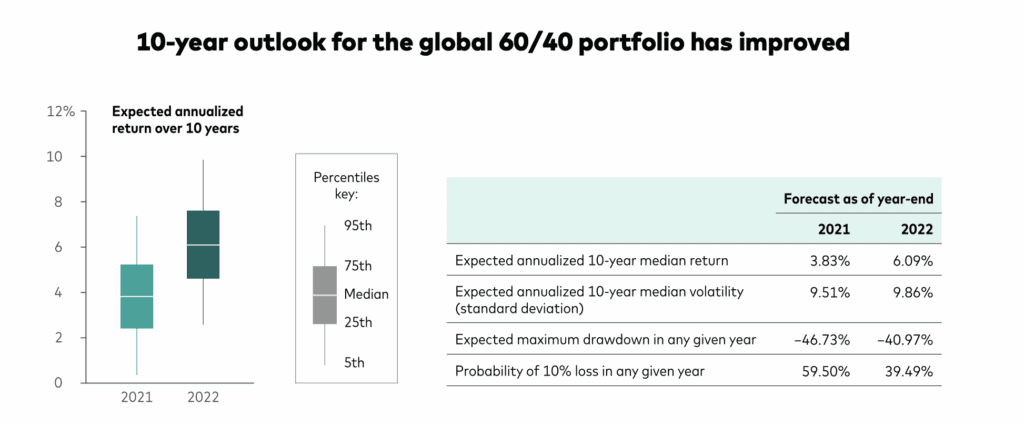

Your investment strategy should evolve from pure growth toward reliable, sustainable income as you transition into retirement, chiefly to reduce volatility during withdrawals and manage sequence-of-returns risk. The traditional 60/40 allocation is a benchmark, but the right mix varies by risk tolerance, time horizon, and spending needs.

Source: Vanguard

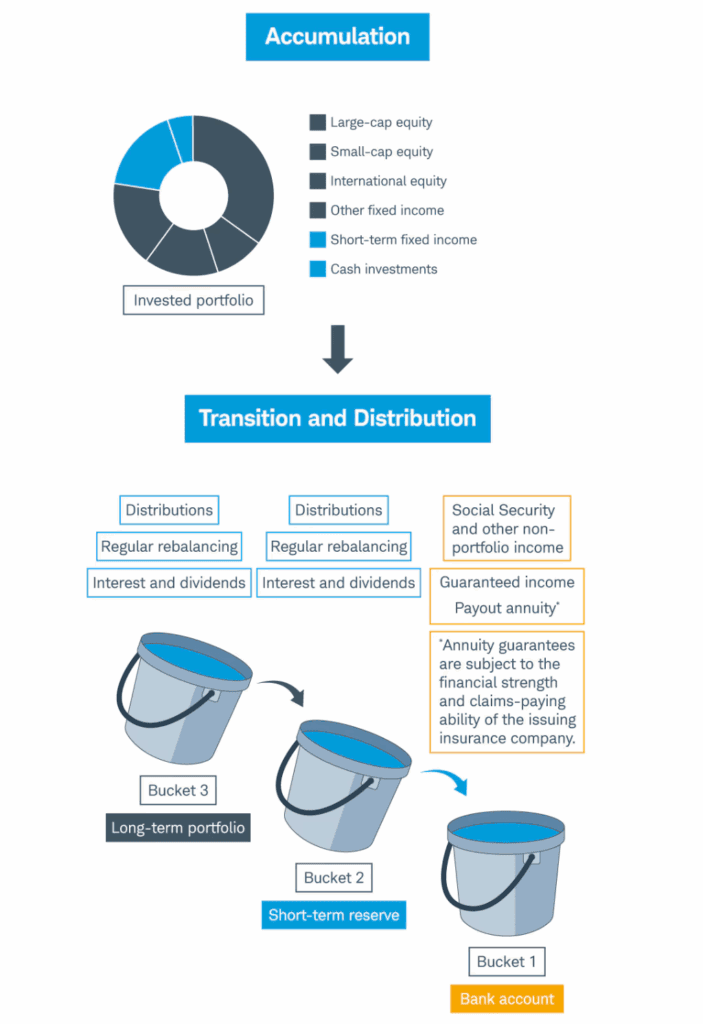

Consider a bucket structure to align assets with time horizons, for example: Bucket 1 (0–5 years): cash and short-term bonds for near-term needs; Bucket 2 (4–10 years): conservative holdings like high-grade bonds and dividend stocks; Bucket 3 (11+ years): growth assets aimed at replenishing future income. Exact ranges are flexible.

Source: SCHWAB

This setup helps avoid forced stock sales in down markets by drawing from the safe bucket, while maintaining growth assets provides inflation protection over 20–30 year retirements.

Important nuance: Buckets are a planning framework, not a guarantee of higher returns. Research shows static rebalanced portfolios can outperform buckets; use them for behavioral clarity and pair with sustainable withdrawal rates.

The Math That Gives Permission to Spend

The widely cited 4% rule suggests withdrawing 4% of your initial portfolio value in year one, then adjusting annually for inflation. For Mike’s $1.3 million, this means $52,000 in the first year, likely more than his current living expenses.

Historical analysis shows this approach succeeds in roughly 95% of 30-year retirement periods. However, some financial planners now recommend 3.5% given current market conditions and longer lifespans.

Dynamic withdrawal strategies offer more flexibility. In strong market years, you might withdraw 4.5-5%. During market downturns, you could reduce withdrawals to 3%, helping preserve capital during volatile periods.

Practical Implementation Steps

Begin with essential expenses, housing, healthcare, food, then gradually add discretionary spending. This creates a foundation of security while allowing controlled expansion of your lifestyle.

Plan tax-efficient withdrawals by understanding the differences between traditional 401(k), Roth IRA, and taxable accounts. Generally, it’s wise to withdraw from taxable accounts first, then traditional retirement accounts, saving Roth assets for last due to their tax-free growth potential.

Schedule annual reviews to adjust your withdrawal rate based on portfolio performance and changing needs. This isn’t a “set it and forget it” decision, it requires ongoing attention and occasional course corrections.

Breaking the Psychological Barrier

Mike eventually started with a simple step: he calculated that his portfolio’s annual dividends and interest alone exceeded $35,000. By withdrawing only the income his investments generated, he could spend without touching the principal. This mental bridge helped him transition from pure saving to thoughtful spending.

Within two years, Mike was comfortable with a more comprehensive withdrawal strategy, taking planned distributions for travel and home improvements while maintaining a growing portfolio balance.

Key Takeaways

The shift from saving to spending requires both analytical and emotional work. Your portfolio isn’t just a number, it’s 30 years of delayed gratification finally ready to provide the security and lifestyle you’ve earned.

Start small, be methodical, and remember that you’ve already done the hard part. Now it’s time to enjoy the fruits of your disciplined investing while maintaining the financial prudence that got you here.

The goal isn’t to spend everything, but to find the balance between financial security and actually living the retirement you’ve worked decades to achieve.