Common Medicaid Myths That Could Cost You Thousands

10.2 min read

Updated: Dec 19, 2025 - 08:12:45

Many Americans misunderstand how Medicaid works, especially when it comes to long-term care and asset protection. With nursing home costs averaging $8,600–$9,000 per month (2025), knowing Medicaid’s real rules can prevent major financial losses. Below are key truths that debunk common myths and clarify how to protect your home, income, and eligibility under current Medicaid law.

- You don’t have to be broke to qualify. Medicaid distinguishes between countable and exempt assets. Your home (up to ~$1,071,000 equity in 2025), one car, and personal items are typically protected.

- Early planning beats gifting. Medicaid reviews financial transfers within a five-year look-back period. Last-minute gifts trigger penalties, but a Medicaid Asset Protection Trust (MAPT) can legally preserve assets if set up early.

- Your home isn’t taken while you’re alive. States may seek estate recovery only after death, and exemptions protect spouses, disabled children, or dependents living in the home.

- Medicaid doesn’t cover everything. It primarily pays for nursing home care. Assisted living and home care often require state waivers or have waiting lists, check your state’s program via Medicaid.gov.

- Income protections exist. Recipients keep a personal allowance ($50–$200/month) and spouses can retain up to $3,948/month (2025 MMMNA) under spousal impoverishment rules.

Medicaid remains one of the most misunderstood government programs in America. Every year, many families make costly mistakes because they believe myths about how Medicaid works. From assuming you must be completely broke to qualify, to fearing the government will automatically seize your home, misinformation can lead to lost assets, delayed care, or even disqualification.

With nursing home care averaging around $8,600 to $9,000 per month nationally, understanding Medicaid’s real rules can make the difference between protecting your savings and losing everything. Medicaid distinguishes between countable assets, such as cash, investments, and additional properties, and exempt assets, including your primary home (up to a state-specific equity limit), personal belongings, and one vehicle.

Recognizing these distinctions, along with understanding the five-year look-back period for asset transfers, is crucial. Knowing the truth about Medicaid eligibility isn’t just about getting benefits, it’s about safeguarding your family’s financial future.

Myth 1: You Have to Be Completely Broke to Qualify for Medicaid

This is one of the biggest misconceptions about Medicaid. It’s true that Medicaid is a needs-based program, but you don’t have to be completely destitute to qualify. Medicaid distinguishes between countable assets, such as bank accounts, stocks, and additional real estate, and exempt assets like your home, one vehicle, personal belongings, and certain prepaid burial funds.

Each state sets its own income and asset limits, but most allow applicants to keep specific property while still receiving coverage. For example, your primary residence is typically exempt if you or your spouse lives there, up to an equity value between $730,000 and $1,097,000 depending on the state. You may also retain household furnishings and personal effects considered necessary for daily living through proper Medicaid planning assistance.

In other words, you don’t have to give up everything to qualify. With proper Medicaid planning, ideally done at least five years before applying for long-term care, you can legally structure your assets to meet eligibility requirements without jeopardizing your family’s financial security. This proactive approach also helps avoid penalties under Medicaid’s five-year look-back rule.

The truth: Medicaid has strict limits, but you can qualify while keeping exempt assets. Smart, early planning, not total poverty, determines eligibility.

Myth 2: You Can Give Away Your Money Right Before Applying

Many people think they can transfer assets to family members and then qualify for Medicaid, but that’s not how it works. Medicaid enforces a five-year look-back rule, which means the agency reviews all financial transactions made within 60 months before your application. If you gave away or sold assets for less than fair market value, Medicaid assumes you were trying to qualify improperly and imposes a penalty period during which you’re ineligible for long-term-care coverage.

For example, if you gave your children $100,000 two years before applying and your state’s average monthly nursing-home cost is $10,000, you could face a 10-month ineligibility penalty and must pay for care out of pocket during that time. The same rule applies to below-market home sales, forgiven loans, or large gifts made within the look-back period, as explained in this guide on Medicaid penalties.

However, early planning changes everything. Creating a Medicaid Asset Protection Trust (MAPT) at least five years before applying can legally protect assets and preserve them for heirs. Some transfers, such as those to a spouse or a disabled child, may also be exempt, but last-minute gifting almost always backfires.

The truth: Giving away assets too close to applying triggers penalties. Plan early, ideally five years ahead, to transfer assets legally, protect your wealth, and ensure Medicaid eligibility.

Myth 3: Medicaid Will Automatically Take Your House

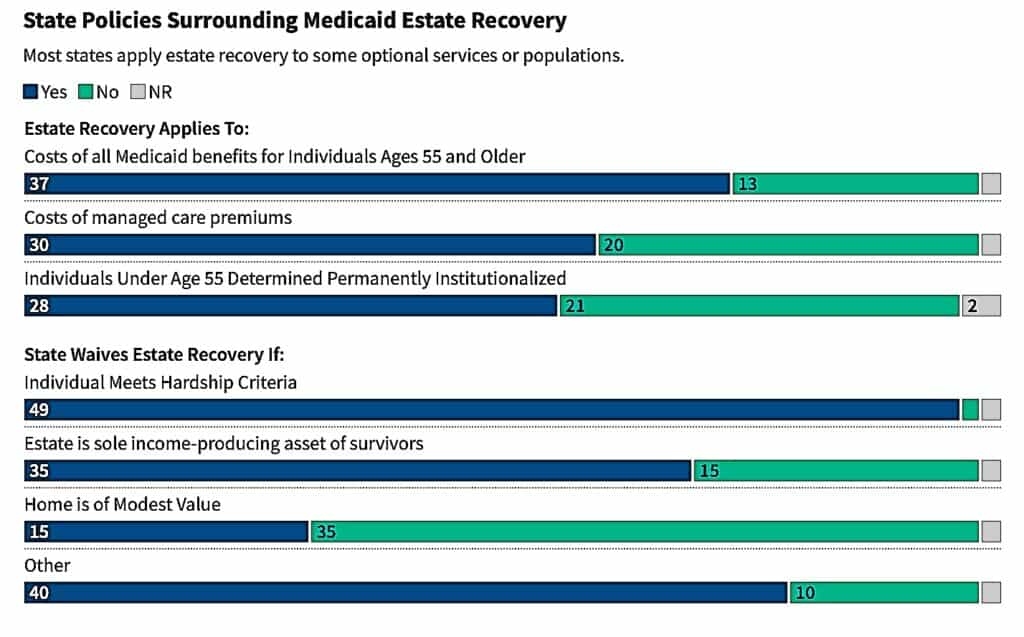

Another widespread myth is that Medicaid will seize your home the moment you apply. In reality, Medicaid does nottake ownership of your property during your lifetime. However, under federal law, states must try to recover certain long-term care costs after your death through a process called estate recovery.

Source: KFF

If you received Medicaid-covered nursing home or home care services after age 55, your state may seek reimbursement from your estate, but not while you’re alive. Importantly, your spouse or family members won’t be immediately evicted. If a spouse, a child under 21, a blind or disabled child, or another dependent relative lives in the home, it typically remains protected as long as they do. Some states may place a lien on the property of permanently institutionalized recipients, but that lien cannot be enforced until after death in most cases, and exemptions often apply.

There are also lawful planning strategies to minimize estate recovery risk, such as creating a life estate, using a transfer-on-death deed, or establishing a Medicaid Asset Protection Trust (MAPT). These must be done carefully and well in advance, ideally more than five years before applying, to avoid violating the five-year look-back rule. Consulting an experienced elder law attorney is essential for proper planning.

The truth: Medicaid does not take your home while you’re alive. But after death, your state may seek reimbursement from your estate unless specific exemptions, protections, or advance planning strategies are in place.

Myth 4: Medicaid Covers All Long-Term Care Costs

Many families are surprised to learn that Medicaid doesn’t cover every type of long-term care. While it’s true that Medicaid is the primary payer for nursing home care in the U.S., coverage has clear limits that vary by state and by care setting.

For instance, Medicaid generally pays for nursing home care once financial and medical eligibility are met and the facility is Medicaid-certified. However, assisted living coverage is limited and often available only through Home- and Community-Based Services (HCBS) waivers, which may have waiting lists. Importantly, room and board costs in assisted living facilities are typically not covered, even when services are.

In-home care may also be available under state Medicaid plans or waiver programs, but the number of hours, eligible services, and caregiver types are often restricted. Certain expenses, such as private rooms, luxury amenities, or non-medical caregiving, usually fall outside Medicaid’s coverage.

Before assuming Medicaid will pay for everything, families should review their state’s specific long-term care benefitsthrough official sources like Medicaid.gov, KFF, or MedicaidLongTermCare.org. They should also explore supplemental options such as long-term care insurance or veterans’ programs that help cover additional costs.

The truth: Medicaid primarily covers nursing home care for eligible individuals. Services like assisted living or home care may have strict limits or require special waivers, depending on your state.

Myth 5: Once You’re on Medicaid, You Can’t Keep Any Income

Many people believe that qualifying for Medicaid means losing all control of their income. The reality is more balanced. Medicaid requires recipients in nursing homes to contribute most of their monthly income toward the cost of care, but several deductions and protections apply.

Every state allows a personal needs allowance, funds that the recipient can keep for clothing, toiletries, or small expenses. This allowance typically ranges from $50 to over $200 per month, depending on the state. If the recipient is married, the community spouse (the one still living at home) is entitled to keep a portion of the couple’s combined income under spousal impoverishment protections. For 2025, the Minimum Monthly Maintenance Needs Allowance (MMMNA) ranges from $2,643.75 to $3,948 per month, based on each state’s policy.

In states with income caps, individuals whose income exceeds the Medicaid limit can still qualify by using a Qualified Income Trust (QIT), also called a Miller Trust, which directs excess income toward care costs while preserving eligibility.

The truth: Medicaid recipients may need to contribute part of their income to care, but they can still retain a personal allowance, and spouses at home are legally protected from losing all household income.

Myth 6: Planning for Medicaid Is Illegal or Immoral

Many people believe that qualifying for Medicaid means losing all control of their income. The reality is more balanced. Medicaid requires recipients in nursing homes to contribute most of their monthly income toward the cost of care, but several deductions and protections apply.

Every state allows a personal needs allowance, funds that the recipient can keep for clothing, toiletries, or small expenses. This allowance typically ranges from $50 to over $200 per month, depending on the state. If the recipient is married, the community spouse (the one still living at home) is entitled to keep a portion of the couple’s combined income under spousal impoverishment protections. For 2025, the Minimum Monthly Maintenance Needs Allowance (MMMNA) ranges from $2,643.75 to $3,948 per month, based on each state’s policy.

In states with income caps, individuals whose income exceeds the Medicaid limit can still qualify by using a Qualified Income Trust (QIT), also called a Miller Trust, which directs excess income toward care costs while preserving eligibility.

The truth: Medicaid recipients may need to contribute part of their income to care, but they can still retain a personal allowance, and spouses at home are legally protected from losing all household income.

Myth 7: You Can’t Own a Home and Still Get Medicaid

Owning a home does not automatically make you ineligible for Medicaid long-term care benefits. Under federal guidelines, your primary residence is generally an exempt asset if your home equity is under the state’s limit and you intend to return there, even if doing so is unlikely.

For 2025, states may exclude a home with equity between $713,000 and $1,071,000, depending on local policy. The exemption also applies if a spouse, dependent child, or disabled relative lives in the home. However, the property becomes countable if it’s sold, rented out, or no longer occupied by a qualifying family member.

Selling your home before applying can create problems because the proceeds count as assets that may exceed Medicaid’s financial limits. Likewise, transferring property to relatives without proper timing or documentation can result in penalties under the five-year look-back rule, which reviews all transfers made within 60 months of applying.

The truth: You can own your home and still qualify for Medicaid, but selling or gifting it the wrong way can jeopardize your eligibility and delay care.

Final Thoughts: Get the Facts Before You Apply

Medicaid is one of the most important financial safety nets for older Americans, but it remains one of the most misunderstood. Acting on myths rather than facts can result in serious financial consequences, including delayed coverage and the loss of assets that could have been legally protected.

Before applying, it’s essential to understand your state’s specific income and asset limits, which are set within federal guidelines but vary across states. Proper documentation is equally crucial, under Medicaid’s five-year look-back rule, applicants must disclose all major financial transfers to ensure transparency and avoid penalties.

Finally, consider working with a certified elder law attorney or Medicaid planning specialist who can help navigate complex rules and preserve family resources. With knowledge, preparation, and professional guidance, families can access vital long-term care while maintaining lasting financial stability.

This article is part of Mooloo’s Retirement & Long-Term Planning Hub, covering retirement income, Social Security decisions, investment risk, healthcare costs, and long-term financial security.