The 3 Account Types Every Millionaire Layers to Build Tax-Free Wealth

5 min read

Updated: Dec 19, 2025 - 05:12:44

Millionaires don’t rely on secret strategies, they build wealth through structure, consistency, and tax-smart planning. Their key advantage is how they layer different account types, retirement, taxable, and specialized (HSA/529), to balance growth, flexibility, and tax efficiency. Understanding these 2025 limits and rules can help everyday investors use the same framework to grow long-term wealth.

- Max out retirement accounts first: In 2025, 401(k)/403(b) deferrals cap at $23,500 plus $7,500 for age 50+; total combined limit is $70,000. IRAs allow $7,000 (+$1,000 catch-up).

- Layer with taxable brokerage accounts: No contribution limits and full liquidity. Wealthy investors use IRS Topic 409 advantages like long-term capital gains rates and tax-loss harvesting to manage taxes efficiently.

- Use HSAs and 529 plans strategically: HSAs offer triple tax benefits with 2025 limits of $4,300 (individual) and $8,550 (family). 529s grow and withdraw tax-free for qualified education expenses, with potential state tax perks.

- Layer for flexibility and control: Retirement accounts drive compounding, brokerage accounts provide access, and HSAs/529s protect against healthcare and education costs, together minimizing lifetime tax drag.

- Bottom line: Millionaires build lasting wealth not by timing markets but by structuring their accounts to maximize every dollar’s growth potential across tax-advantaged, taxable, and specialized vehicles.

Millionaires build wealth through discipline, structure, and careful planning rather than relying on hidden secrets. A central difference between everyday investors and high-net-worth individuals is how they layer different types of accounts, retirement, taxable, and specialized, to maximize growth, reduce taxes, and ensure liquidity when needed. Understanding these account types, their contribution limits, and their unique advantages reveals how strategic wealth-building really works.

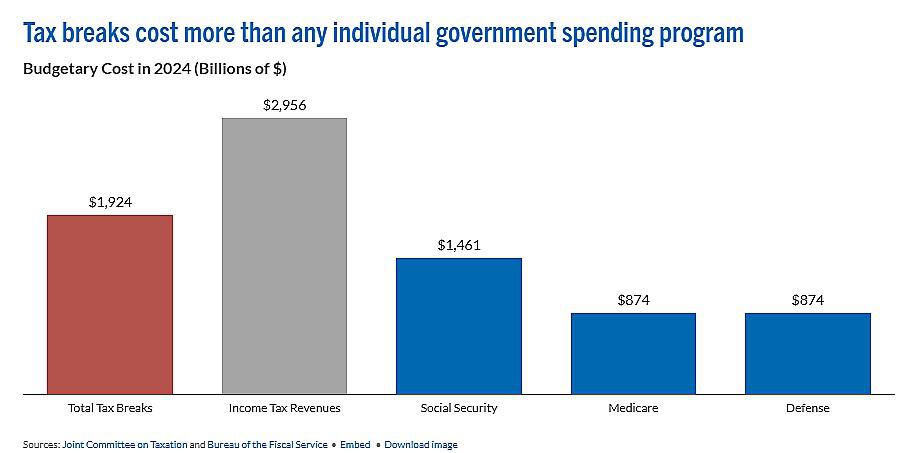

In 2024, the federal government collected $3 trillion in taxes from people and companies. At the same time, the tax code gave out $1.9 trillion in tax breaks, more than the country spends on Social Security, Medicare, or defense. Most Americans don’t claim all the tax breaks they’re entitled to, leaving money on the table. Source: Peter G. Peterson foundation.

1. Tax-Advantaged Retirement Accounts (401(k)/403(b), Traditional & Roth IRAs)

Retirement accounts form the cornerstone of millionaire wealth planning. They are designed to encourage long-term saving and reward investors with powerful tax incentives.

Contribution Limits for 2025:

-

The elective deferral limit for 401(k) and 403(b) plans is $23,500 for those under age 50, with an additional $7,500 catch-up contribution for those 50 and older (Fidelity).

-

The combined employee and employer contribution limit under Section 415 is $70,000.

-

IRA contribution limits are $7,000, with an additional $1,000 catch-up for savers over 50.

Why They Matter to Millionaires

Traditional accounts lower taxable income now, while Roth accounts grow tax-free and provide tax-free withdrawals in retirement. Employer matches effectively act as “free money,” boosting returns from the very beginning. High-net-worth investors also take advantage of required minimum distribution (RMD) planning, ensuring they minimize tax burdens when withdrawals start at age 73.

By consistently maxing out contributions and harnessing decades of compounding, retirement accounts become a reliable engine of long-term wealth.

2. Taxable Brokerage Accounts

After retirement contributions are maxed, the next layer is the taxable brokerage account. This type of account doesn’t provide upfront tax breaks, but it offers unmatched flexibility and a wide array of tax-management strategies.

Advantages and Strategies:

-

No contribution limits: Investors can deposit as much as they want, making it ideal for large sums of capital.

-

Liquidity: Funds can be accessed at any time without age-based penalties, though capital gains taxes may apply.

-

Tax management: Wealthy investors often use strategies like tax-loss harvesting (selling losing investments to offset gains) and carefully managing holding periods.

-

Asset location: They optimize by placing tax-efficient assets (like ETFs or growth stocks) in taxable accounts, while keeping tax-inefficient ones (like REITs or bonds) inside retirement plans.

According to IRS Topic 409, long-term capital gains, from assets held over one year, are taxed at preferential rates compared to ordinary income. This advantage makes taxable brokerage accounts especially attractive for building flexible, tax-smart wealth.

3. Health Savings Accounts (HSAs) and 529 College Savings Plans

Millionaires also use specialized accounts designed to reduce costs tied to healthcare and education, two of the largest long-term expenses for families.

Health Savings Accounts (HSAs):

-

Offer a triple tax advantage: contributions are pre-tax, growth is tax-free, and withdrawals for qualified medical expenses are also tax-free.

-

2025 contribution limits: $4,300 for individuals, $8,550 for families, plus a $1,000 catch-up for those 55 and older.

-

Unlike Flexible Spending Accounts (FSAs), HSAs roll over indefinitely, no “use it or lose it” rule.

Plus – Bonus Account For Parents

529 College Savings Plans:

-

Investments grow tax-free, and qualified withdrawals for education are tax-free as well.

-

Many states add extra incentives such as deductions or credits.

-

High-income families often use the five-year front-loading rule, contributing up to five years’ worth of annual gift tax exclusions at once to accelerate growth and reduce estate taxes.

These accounts act as focused wealth tools, ensuring that major life costs can be funded tax-efficiently without eroding core investments.

How Millionaires Layer Their Accounts

Wealthy investors rarely rely on a single account. Instead, they layer multiple account types to optimize for both growth and flexibility:

-

Start with retirement accounts: Maximize employer-matched 401(k) or 403(b) contributions, then contribute to IRAs.

-

Add taxable brokerage accounts: Once retirement contributions are maxed, use these accounts for liquidity and advanced tax strategies.

-

Use HSAs and 529 plans strategically: Channel funds into healthcare and education accounts for targeted tax savings.

This layered approach provides three critical advantages: tax minimization, compounding growth, and capital access at different stages of life. By deliberately diversifying account types, millionaires ensure that no matter what life stage or economic condition they face, they can access funds in a tax-efficient way.

Key Takeaways

Millionaire investing is not about chasing exotic opportunities, it’s about using available tools strategically. Retirement accounts build long-term security, taxable accounts provide flexibility, and specialized accounts address predictable expenses with tax efficiency. By layering accounts effectively, high-net-worth individuals accelerate compounding, preserve more of their wealth from taxes, and maintain access to capital when they need it most.

Related: This article is part of Mooloo’s Tax Strategy Hub, covering tax planning, investment taxes, retirement strategies, and after-tax wealth decisions: