Term Life Insurance Rates by Age: What You’ll Pay at 30, 40, 50, and 60

8.8 min read

Updated: Dec 21, 2025 - 05:12:20

Term life insurance stays cheapest when you buy early, and 2026 rate data shows how sharply premiums rise with each decade of age for healthy, non-smoking applicants. Insurers use updated mortality tables and digital underwriting to price risk more precisely, which widens the financial gap between buying at 30 versus buying at 40, 50, or 60. Women consistently pay less because of longer life expectancy, and your underwriting class, Preferred Plus, Preferred, or Standard, can double your premium at older ages. Choosing the right term length also matters: shorter terms force you to reapply later at much higher age-based rates.

- Average 20-year, $500k premiums jump from ~$215 (men) and ~$185 (women) at 30 to ~$2,351 and ~$1,650 at 60, reflecting age-based mortality curve increases.

- Women pay less because CDC life expectancy data shows a ~5.8-year longevity advantage, reducing payout probability during the term.

- Underwriting class (Preferred Plus vs. Standard) often widens with age; a 50-year-old in top health may pay roughly half the cost of someone in Standard.

- Lifestyle factors, driving history, hazardous jobs, high-risk hobbies, substance history, and high-risk travel, can move applicants into more expensive pricing tiers.

- Longer terms lock in younger-age pricing; buying a short 10-year policy at 40 may force a costly re-shop at 50 when premiums rise 9–12% per year.

Term life insurance is one of the simplest financial products: you pay a fixed premium in exchange for a guaranteed payout if you die within a set number of years. But behind that simplicity sits a complex pricing engine built on actuarial science, medical data, and demographic trends.

One factor overwhelms all others: your age at the time you apply. Premiums rise sharply as you get older, and in today’s life insurance market, shaped by digital underwriting and more precise risk segmentation, the financial gap between buying early and buying later has become increasingly significant for consumers.

This article breaks down what typical, healthy, non-smoking applicants can expect to pay for a 20-year, $500,000 term life insurance policy at ages 30, 40, 50, and 60, using real market data from reliable industry sources that clearly show how rates increase across each decade.

The 2026 Market: Real-World Term Life Costs by Age

Every insurer sets its own pricing, but across the industry the pattern is nearly identical: the younger you are when you apply, the lower your premiums, especially for healthy, non-smoking applicants. Data shows the average annual premiums for a $500,000, 20-year term life policy as follows:

| Age | Men (Annual Premium) | Women (Annual Premium) |

|---|---|---|

| 30 | ~$215/year | ~$185/year |

| 40 | ~$331/year | ~$280/year |

| 50 | ~$815/year | ~$640/year |

| 60 | ~$2,351/year | ~$1,650/year |

By age 60, premiums can be around 9–11× higher than at age 30, depending on gender. These figures apply to healthy, non-smoking applicants with no major medical or lifestyle risk factors. Insurers often classify these profiles within their stronger underwriting tiers, commonly referred to as “Preferred” or “Preferred Plus”, though the exact terminology varies by company.

Why Age Drives the Price Curve

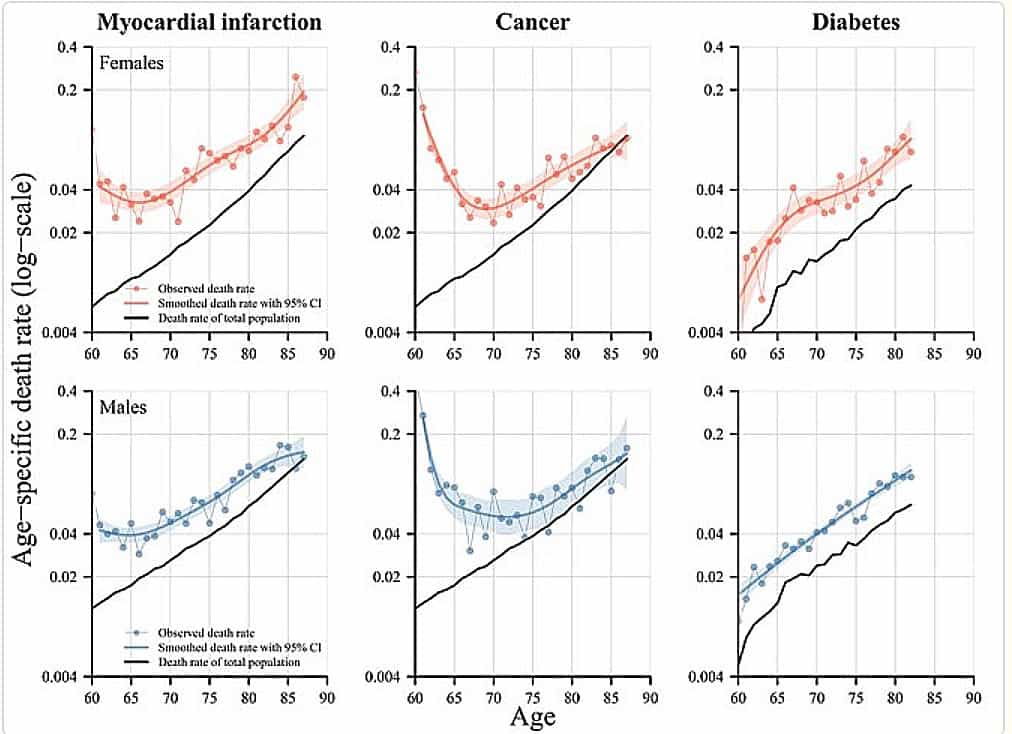

Age is the single strongest factor behind term life insurance costs because your statistical likelihood of dying during the policy term rises each year. Insurers rely heavily on long-running actuarial datasets, including updated mortality tables. These official mortality research tables provide age-specific death probabilities based on decades of population data and form the backbone of modern life insurance pricing.

According to recent updates, mortality risk increases gradually through your 30s and 40s, but the curve steepens sharply in your 50s and 60s. This is why term life premiums climb every year you delay applying: each birthday shifts you into a higher-risk category, raising the expected probability of a payout during the policy term.

Age also magnifies the impact of health conditions. As people grow older, issues such as hypertension, diabetes, high cholesterol, and obesity become more common. These factors often move an applicant into a less favorable underwriting class, which pushes premiums higher even if coverage amounts remain the same.

Source: Pubmed Central

By applying earlier, when both age-based and health-based risks are lower, applicants typically secure the most affordable long-term rates.

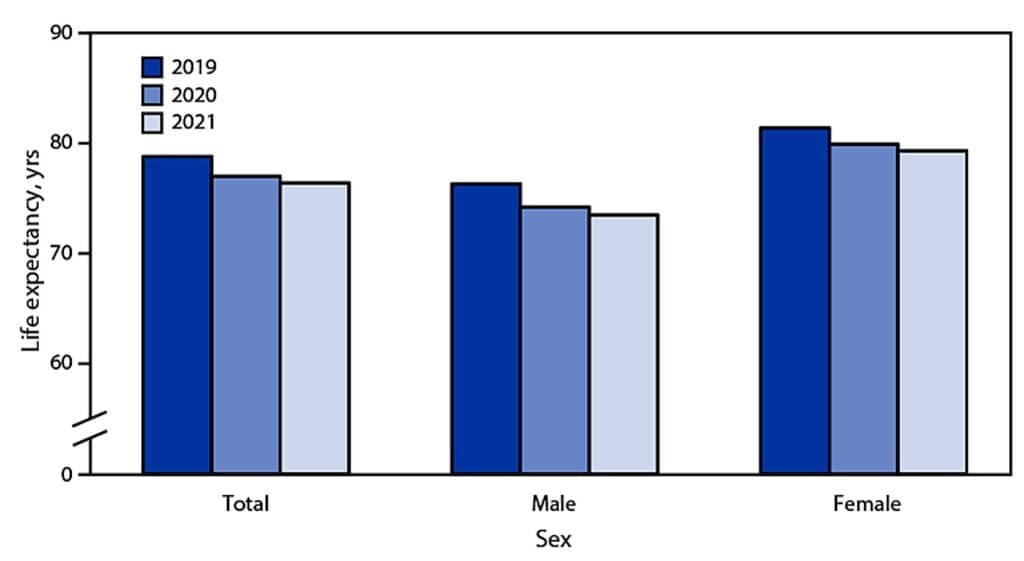

Why Women Pay Less Than Men

Women typically pay lower term life insurance premiums because they live longer on average, which reduces the likelihood that an insurer will have to pay a death benefit during the policy term. This longevity gap is well-documented in national health statistics. According to CDC life expectancy data, women live about 5.8 years longer than men on average.

Source: CDC

Since insurers price policies based on the probability of a claim, this lower risk translates into consistently lower premiums for women, even when the coverage amount, term length, age, and health class are identical.

The Role of Health in Determining Your Rate Class

While age sets the overall price curve, your underwriting category determines where you land on that curve. Every insurer uses a similar tiered system to classify applicants based on medical history, lab results, lifestyle, and overall risk profile. Most applicants fall into one of three broad classes:

-

Preferred Plus: excellent health metrics, clean labs, optimal BMI, no significant medical issues

-

Preferred: generally healthy with minor concerns

-

Standard: applicants with mild or moderate risk factors such as elevated BMI, controlled conditions, or past health events

Industry pricing data shows that the gap between Preferred Plus and Standard widens sharply with age. For example, a 50-year-old in Preferred Plus may pay roughly half the premium of a 50-year-old in Standard for the same coverage and term length. By age 60, that difference can become even more pronounced, sometimes exceeding a 2× spread depending on health conditions and insurer guidelines.

The takeaway: your health class is just as important as your age, and maintaining strong health metrics can significantly reduce your long-term life insurance costs.

Lifestyle Factors That Raise Prices

When insurers calculate your term life insurance rate, they look beyond age and health. Lifestyle-based risk factors also shape your underwriting class and can increase or decrease what you ultimately pay. These factors matter because they influence an insurer’s estimate of your long-term mortality risk, a core input in every pricing model.

- Driving Record: Your driving history is one of the strongest non-medical risk indicators. Recent DUIs, reckless driving charges, speeding violations, or multiple at-fault accidents often lead to higher premiums because they statistically correlate with higher mortality risk.

- Hazardous Occupations: Jobs with elevated workplace danger, such as construction, law enforcement, commercial fishing, logging, electrical line installation, and certain industrial roles, are priced with occupational risk adjustments. If your job appears on an insurer’s “hazardous occupation” list, you may receive a lower underwriting class or face additional charges.

- High-Risk Hobbies: Certain recreational activities fall under what insurers call avocational risks. Skydiving, scuba diving, aviation, rock climbing, motorsports, and similar hobbies are strongly associated with higher accidental-death rates. Insurers often apply a “flat extra” fee or downgrade your risk class to reflect this exposure.

- Alcohol and Drug Use: Evidence of heavy alcohol consumption, past DUIs, or any history of substance misuse significantly impacts pricing. Even moderate alcohol use may trigger closer scrutiny if medical records or labs (such as elevated liver enzymes) suggest increased long-term health risk.

- International Travel to High-Risk Regions: Regular or extended travel to regions identified as high-risk due to political instability, conflict, or limited medical infrastructure can raise premiums. Insurers maintain internal travel-risk lists, updated regularly, and may apply surcharges or temporary exclusions based on your destinations.

Lifestyle factors don’t just influence underwriting, they directly affect premium calculations. Insurers use decades of actuarial data to quantify even slight increases in risk, which is why non-medical behaviors can move you into a more expensive rate class. Understanding these factors helps you anticipate your pricing and improve your profile before applying.

Why Term Length Matters Just as Much as Age

Factually, term length is one of the strongest pricing variables in life insurance. A 10-year term is cheaper than a 20-year, and a 20-year is cheaper than a 30-year, because longer terms expose insurers to more years of mortality risk. This is consistent with how all major insurers price policies using mortality tables and long-run risk projections.

Choosing a term that’s too short can become expensive. For example, if you buy a 10-year policy at age 40, you’ll be forced to shop again at age 50, when premiums are significantly higher. Insurers also tighten underwriting with age, meaning medical changes in your 50s can push you into a more expensive rate class or make preferred pricing inaccessible.

A longer term locks in your younger-age rate for decades. For families with young children, a mortgage, or long-running financial liabilities, securing a 20- or 30-year term often provides the most predictable and cost-efficient coverage over time.

The Financial Penalty for Waiting

One of the biggest hidden costs in term life insurance is the price of delaying your application. Industry data shows that once applicants reach their mid-40s, premiums typically rise by about 9–12% for every additional year of age.

Because insurers price risk based on age-driven mortality curves, each birthday pushes you further into a higher-risk, and therefore higher-priced, bracket. The result is simple but financially significant: buying young isn’t just slightly cheaper, it’s exponentially cheaper over time.

Coverage Is Still Available at 60 — But at a Price

It’s correct that many insurers still offer term life insurance to applicants in their 60s, but the choices shrink considerably as age increases. Most major U.S. carriers impose tighter medical underwriting requirements, limit available term lengths to 10–20 years, and may cap maximum coverage amounts depending on age and health. Premiums also rise sharply, industry rate tables show that term life pricing escalates steeply after age 60, often becoming a major affordability barrier for older applicants.

As a result, many buyers in their 60s end up selecting shorter terms (typically 10–15 years) or smaller coverage amounts to keep premiums manageable.

The Bottom Line

Term life insurance remains one of the most straightforward and data-driven financial products available. Premiums are lowest when you’re young, stay predictable once you lock in a level-term policy, and rise sharply after age 50 as both mortality risk and underwriting scrutiny increase. The 2026 landscape, shaped by more detailed risk assessment and wider premium spreads between age groups, only magnifies this pattern.

If you’re considering coverage, the most financially sound time to buy isn’t “later when the kids are older” or “when the mortgage is bigger.” The best time is before age and health begin to work against you. Securing a policy early lets you lock in long-term protection at the most affordable rate you’ll ever be offered.