Robo-Advisors vs. Human Financial Advisors: Which One Is Right for Your Money?

8.4 min read

Updated: Dec 20, 2025 - 08:12:48

Robo-advisors and human financial advisors now serve different but complementary roles in how Americans invest. Robo-advisors offer low-cost, automated portfolio management ideal for building wealth with simple needs, while human advisors justify higher fees by providing comprehensive planning, tax strategy, and behavioral coaching. The right choice depends less on performance and more on cost efficiency, complexity, and your ability to stay disciplined through market cycles.

- Cost matters most early on: Robo-advisors typically charge ~0.25% annually ($25 per $10,000 invested), compared with ~1% for traditional advisors, making automation more efficient for smaller, straightforward portfolios.

- Scope drives value: Human advisors earn their fees through services robo-advisors don’t offer, multi-year tax planning, Roth conversions, Social Security timing, insurance analysis, and estate coordination.

- Behavioral coaching is decisive: A key advantage of human advisors is helping investors avoid emotional mistakes during market downturns, which can have a larger impact on long-term outcomes than small fee differences.

- Life stage is the pivot: Robo-advisors often fit best during early accumulation (around $10,000–$100,000 invested), while human advisors tend to add more value as assets approach six figures and financial decisions become more complex.

- Hybrid models reduce tradeoffs: Many investors combine low-cost robo-advisors for core investing with hourly or limited-scope human advice, aligning the cost of guidance with the complexity of their financial lives.

The rise of robo-advisors has significantly changed how Americans invest. Portfolio management that once required large account balances and high advisory fees is now widely accessible through low-cost digital platforms, often with modest minimums and mobile access. At the same time, human financial advisors have not disappeared, they have adapted. Many now focus on comprehensive planning, tax strategy, behavioral coaching, and complex financial decisions that extend beyond automated investing. Understanding the strengths and limitations of each approach helps investors choose the option that best fits their financial needs and circumstances.

The Cost Divide

Price differences between robo-advisors and human advisors remain clear. Most robo-advisors charge around 0.25% of assets under management annually, or about $25 per year for every $10,000 invested. This level has become the industry standard, though some platforms offer lower rates or tiered pricing based on services provided.

Human financial advisors typically charge more. Traditional advisors commonly charge about 1% of assets under management, roughly four times the typical robo-advisor fee. On a $100,000 portfolio, that equals about $1,000 annually versus $250 with a robo-advisor. Over long time horizons, this difference can compound into meaningful gaps in net returns.

However, percentage fees alone don’t tell the full story. The higher fee charged by human advisors generally covers broader financial planning services beyond portfolio management, including tax strategy, retirement planning, insurance analysis, and estate coordination. Robo-advisors, by contrast, focus mainly on automated portfolio management with limited support for complex financial decisions.

Some firms offer hybrid models to narrow the gap. Betterment Premium charges 0.40% annually and includes access to certified financial planners, while Vanguard Personal Advisor Services charges 0.30% and provides human advisor support. These options appeal to investors seeking limited human guidance without paying full traditional advisory fees.

What You Get With Robo-Advisors

Robo-advisors automate the core mechanics of investing. After answering questions about goals, time horizon, and risk tolerance, algorithms build diversified portfolios using low-cost exchange-traded funds. The platforms handle rebalancing, dividend reinvestment, and ongoing portfolio monitoring automatically.

This hands-off approach suits investors comfortable with passive investing. Many robo-advisors offer very low account minimums, often $50 or less, while most others require $5,000 or less, making them accessible for new and younger investors.

Tax-loss harvesting is a common feature for taxable accounts. The automated process sells investments at a loss to offset capital gains, which can improve after-tax returns over time, though results depend on market conditions and individual tax situations.

Robo-advisors also provide goal-based investing tools that track progress toward objectives such as retirement or buying a home. Their limitations appear in more complex situations, as they typically do not provide guidance on Roth conversions, Social Security claiming strategies, estate planning, or insurance decisions, nor do they account for a fully personalized financial picture.

The Human Advisor Advantage

Human advisors become most valuable as financial situations grow more complex. There is often a point where portfolios, taxes, insurance needs, and long-term planning intersect in ways that automated tools struggle to manage. Beyond investment oversight, human advisors provide guidance on insurance analysis, estate planning, and multi-year tax strategies.

The behavioral component of human advice is a major advantage. During market downturns, many investors react emotionally, selling at market lows and missing recoveries. A human advisor offers perspective, reassurance, and accountability, helping investors stay disciplined during periods of volatility when poor decisions can be most costly.

Research consistently shows that human advisors can improve long-term outcomes through behavioral coaching, asset allocation discipline, tax efficiency, and withdrawal planning. In many cases, this added value can exceed the typical advisory fee, resulting in a net benefit over time.

Personalization further differentiates human advisors. They tailor strategies to individual circumstances, values, and goals, accounting for factors algorithms often miss, family considerations, career changes, retirement timing, or preferences around responsible investing. This creates plans designed for real lives rather than one-size-fits-all solutions.

Human advisors also serve as coordinators across a client’s financial life. By working alongside tax, legal, and insurance professionals, they help ensure strategies remain aligned as wealth and complexity grow, providing clarity and cohesion that automated platforms cannot replicate.

When Each Option Makes Sense

The choice between robo-advisors and human advisors often depends on life stage and asset level. Robo-advisors generally work best during the accumulation phase, when investors are focused on building wealth and do not yet need advanced services such as estate planning or complex tax strategies.

For investors with an emergency fund and around $10,000 to invest, robo-advisors can be an efficient solution. They provide diversified market exposure, automatic rebalancing, and professionally managed portfolios at low cost. Paying a percentage-based fee to a human advisor on a small portfolio often delivers limited value relative to the cost.

Human advisors tend to add more value as assets and complexity increase. Many advisors view $300,000 as a rough point where comprehensive planning becomes more beneficial, as tax optimization, withdrawal planning, and estate considerations grow more important. Some advisory firms also set minimum investment thresholds, commonly between $250,000 and $500,000.

Major life events can warrant human guidance regardless of portfolio size. Marriage, divorce, inheritance, career changes, starting a business, or selling a company introduce complexity that automated platforms are not designed to handle.

Investor temperament also matters. Some people are comfortable managing their own finances, while others prefer professional support to reduce stress and improve decision-making. Choosing the right approach depends on both financial circumstances and personal confidence.

The Hybrid Approach

You don’t necessarily face an either-or choice. Many investors use robo-advisors for core investment management while consulting human advisors for specific planning needs. This hybrid approach captures cost benefits from automation while accessing expertise for complex decisions requiring human judgment.

Industry data shows that 14% of consumers shopped for auto insurance in early 2025, demonstrating that shopping behavior extends beyond investments to all financial products. Similarly, many investors are becoming more strategic about when to use different service levels, optimizing for both cost and value.

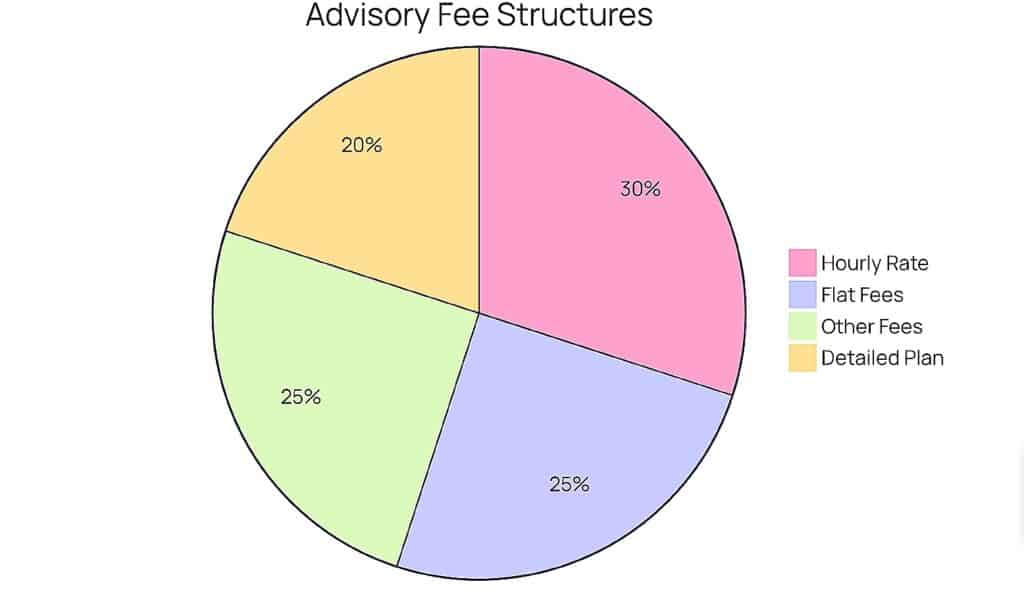

Hourly financial planning has grown in popularity as an alternative to ongoing asset-based relationships. You pay $200-$400 per hour for targeted advice on specific questions, claiming Social Security, analyzing insurance needs, or reviewing investment strategy. This model works well for do-it-yourself investors wanting occasional professional input without committing to full advisory relationships.

Source: Bright Advisers

Some robo-advisors have begun offering à la carte human advice for additional fees. While this feature has evolved, Betterment discontinued standalone planning sessions in 2024, the trend toward flexible service models continues. Investors increasingly expect customizable solutions matching their specific needs rather than one-size-fits-all packages.

Performance Considerations

Do robo-advisors outperform human advisors? There is no definitive answer. Investment performance depends heavily on factors such as risk tolerance, asset allocation, time horizon, and investor behavior, not whether management is automated or human. In practice, both robo-advisors and many human advisors rely on similar principles, including diversified portfolios built primarily with low-cost index funds.

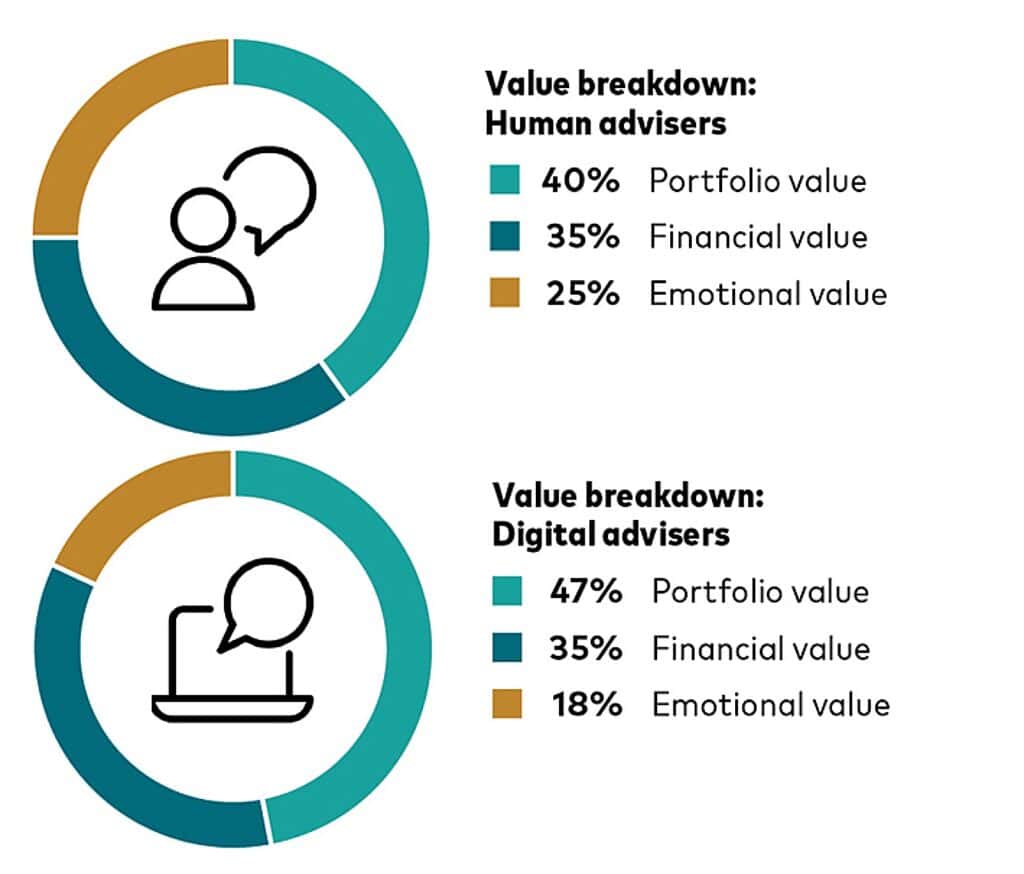

Research from Vanguard highlights the role of investor behavior rather than headline returns. In a study examining investor expectations, clients working with human advisors reported lower expected returns than those using digital platforms. Vanguard noted this difference likely reflected demographics and risk profiles, as digitally advised investors tended to be younger and more aggressive rather than inherently better-performing strategies.

Source: Vanguard

Ultimately, outcomes depend less on marginal return differences and more on consistency. A portfolio that aligns with your goals and that you stay invested in during market volatility will typically outperform a theoretically “optimal” portfolio that you abandon during downturns. Behavioral discipline often has a greater impact on long-term results than small variations in investment performance.

Making Your Decision

Choosing between a robo-advisor and a human financial advisor starts with an honest assessment of your situation. Investors with modest assets and simple financial needs often benefit from robo-advisors, which offer diversified portfolios, automatic rebalancing, and low fees. Many investors use these platforms successfully for years while building long-term investing discipline.

As assets and complexity grow, it’s important to reassess whether automation alone is enough. Building six-figure portfolios, approaching retirement, managing inherited assets, or navigating major life events often signals that human guidance can add meaningful value. Seeking advice proactively is usually more effective than waiting for problems to arise.

Before committing, research any platform or advisor carefully. Compare fees, investment options, and tax features when evaluating robo-advisors. For human advisors, verify credentials, understand fee structures, confirm fiduciary status, and review disciplinary history through official regulatory databases.

The financial advice landscape continues to evolve, with robo-advisors adding advanced features and human advisors using technology to deliver more efficient services. This shift gives investors more flexibility across different needs and budgets.

Ultimately, the right choice aligns the cost of advice with the complexity of your financial life. Avoid paying for services you don’t need, but don’t underinvest in guidance that can improve long-term outcomes.