Prenuptial Agreements in the U.S.: What Every Couple Should Know Before Saying “I Do”

5.1 min read

Updated: Dec 22, 2025 - 09:12:58

With nearly half of U.S. marriages ending in divorce, a prenuptial agreement is less about romance and more about realism. These contracts, governed by state law, not federal, ensure financial transparency, fairness, and peace of mind for both partners. While most states follow the Uniform Premarital Agreement Act (UPAA), rules differ, so couples should consult local family law attorneys before signing. Properly drafted prenups clarify ownership, protect separate assets, and prevent future disputes.

- State-specific rules apply: Prenups are governed by state law, not federal; California and New York, for example, have distinct procedural requirements.

- Attorney guidance is key: Each partner should have independent counsel to ensure fairness and prevent future claims of coercion.

- Legal essentials: Prenups must be written, signed before marriage, entered voluntarily, and include full financial disclosure.

- Scope limits: Prenups can cover assets, debts, and spousal support, but not child custody or support, which are decided by courts.

- Modern purpose: Beyond wealth protection, prenups help couples clarify financial expectations, secure future inheritances, and support business planning.

For many couples, discussing a prenuptial agreement before marriage can feel uncomfortable or even unromantic. Yet, with nearly half of all U.S. marriages ending in divorce according to data from the American Psychological Association and the U.S. Census Bureau, these agreements have become a vital financial planning tool, not merely a contingency for the worst-case scenario. A well-drafted prenup can provide both partners with peace of mind, ensuring that financial transparency and fairness guide the relationship from the start.

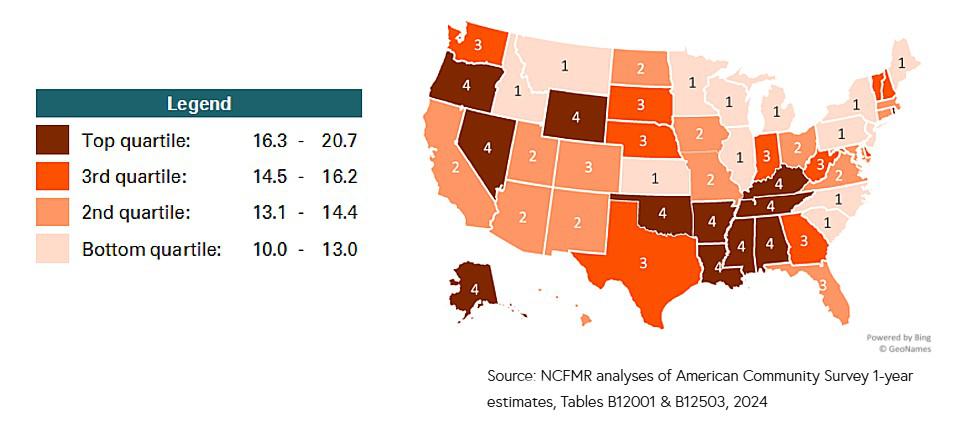

2024 divorce rates per thousand women in the United States. Source: Bowling Green State University

State, Not Federal, Law Governs Prenups

In the United States, prenuptial agreements, also known as premarital agreements, fall entirely under state law rather than federal jurisdiction. This means that the legal enforceability and procedural requirements for these contracts vary from one state to another. Most states have adopted the Uniform Premarital Agreement Act (UPAA), which was drafted in 1983 by the Uniform Law Commission to provide standardized guidance for the creation and enforcement of prenups.

However, not all states follow the UPAA to the letter. For example, California has adopted the UPAA but adds key consumer protections, such as a mandatory seven-day waiting period between the presentation of the agreement and signing, allowing both parties adequate time to review. New York, in contrast, relies on its own statutory framework and tends to enforce properly executed prenups as long as they are in writing, signed, and acknowledged with the same formality required for a deed.

Because laws differ significantly between states, couples should always seek advice from an experienced family law attorney in the state where they plan to marry or establish residency. This ensures the agreement complies with local regulations and stands up in court if ever challenged.

Who Drafts Prenuptial Agreements

While you technically could write a prenup yourself, in practice these agreements are drafted by attorneys, often one representing each partner, to ensure the contract is legally sound and fair.

Each partner typically hires their own lawyer to avoid future claims of coercion or lack of independent counsel. This is particularly important if the prenup will significantly affect property rights, spousal support, or inheritance.

Key Legal Requirements for a Valid Prenup

Although details differ by jurisdiction, several core principles determine whether a prenup will hold up in court:

-

Written and Signed: Oral agreements are not valid. A prenup must be in writing and signed by both parties before marriage.

-

Voluntary Consent: Both individuals must enter the agreement willingly. Any evidence of pressure or duress can invalidate it.

-

Full Financial Disclosure: Each party must provide a transparent account of assets, debts, income, and liabilities. Concealing information could render the agreement void for fraud or unconscionability.

-

No Unconscionable Terms: Courts can strike out provisions that are excessively one-sided, such as clauses leaving one spouse destitute or denying access to jointly accumulated wealth.

-

Executed Before Marriage: The contract must be finalized and signed before the wedding. If created afterward, it’s considered a postnuptial agreement, which has its own legal framework.

-

Proper Formalities: Some states require notarization, witnesses, or specific acknowledgment clauses. Failing to meet these standards can make the prenup unenforceable.

What Prenups Can and Can’t Cover

Prenuptial agreements can address a broad range of financial and property-related issues, providing a roadmap for how assets will be handled during marriage and divided in the event of divorce. Common provisions include:

-

Division of property and debts, clarifying which assets remain separate and which become marital property.

-

Spousal support (alimony) terms, specifying whether either spouse will receive financial support after a divorce and under what conditions.

-

Business ownership and future income, particularly for entrepreneurs or professionals with growing practices.

-

Inheritance and estate planning considerations, ensuring that family heirlooms, trusts, or future inheritances remain protected.

-

Financial management during marriage, such as how joint accounts will be funded or how household expenses will be shared.

However, prenups cannot decide issues related to child custody or child support. These matters are determined by the courts at the time of divorce based on the child’s best interests, not on prior agreements between parents.

Why Couples Choose Prenups

Modern prenups aren’t just for the wealthy. More couples are using them to:

-

Protect separate assets, such as a home owned before marriage or an expected inheritance.

-

Clarify financial expectations early, reducing conflict later.

-

Safeguard children from previous relationships, ensuring assets pass to them rather than a new spouse.

-

Plan for future businesses or intellectual property developed during the marriage.

The Bottom Line

A prenuptial agreement isn’t about mistrust, it’s about clarity, transparency, and mutual protection. When thoughtfully drafted, it helps couples build a relationship on open communication and financial honesty. It also prevents misunderstandings that could otherwise lead to costly and emotionally draining disputes later on.

Because family law is highly state-specific, couples should consult experienced family law attorneys early in the engagement process to create an agreement that’s fair, enforceable, and reflective of their shared intentions. A well-crafted prenup can offer more than protection, it can lay the groundwork for a financially confident and cooperative marriage.