How to Avoid Health Insurance Claim Denials: A Financial Protection Strategy

5.6 min read

Updated: Dec 20, 2025 - 12:12:39

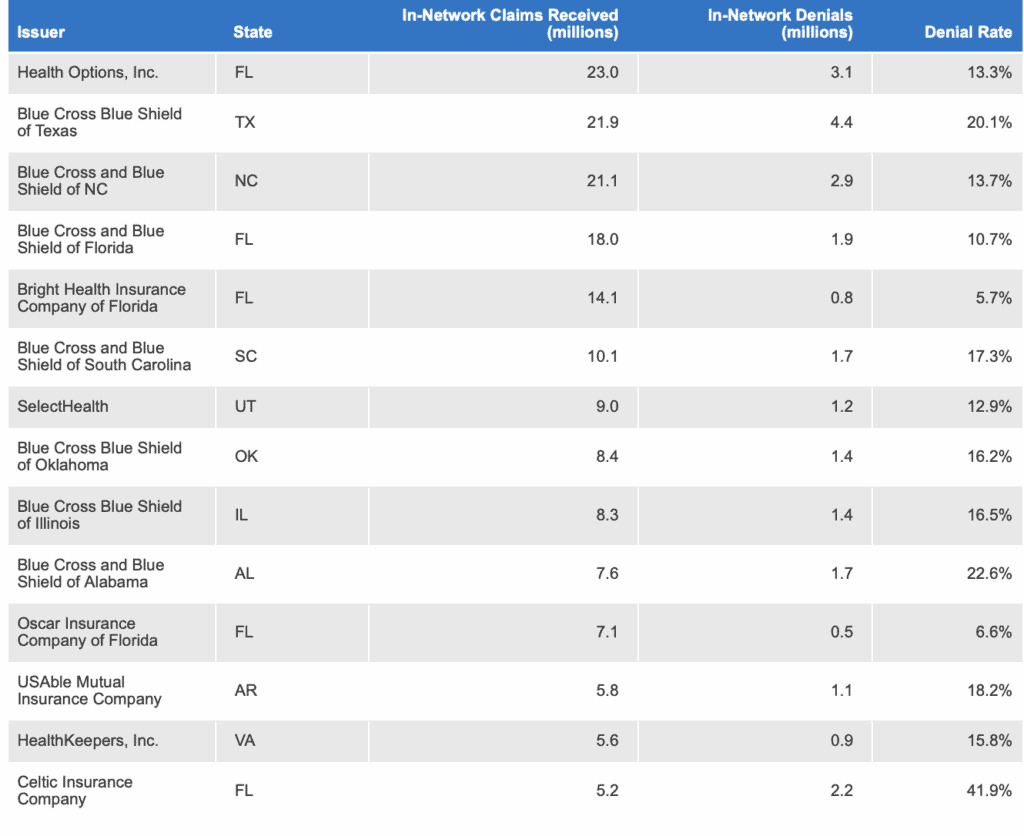

Health insurance claim denials are one of the most overlooked financial risks for U.S. families. While many shoppers compare premiums and deductibles, few account for insurers’ denial rates, which can range from 6% with Kaiser Permanente to nearly 33% with UnitedHealthcare and AvMed, according to KFF.

A single denied surgery can leave families with tens of thousands in uncovered bills, damaged credit, and delayed care. Preventing denials, tracking claims, and mastering the appeals process are as essential to financial security as retirement planning or investing.

- Know your policy: Review coverage rules and exclusions each year; many denials stem from misunderstandings.

- Secure prior authorization: Missing pre-approvals is a top cause of denials per AHIP.

- Check network status: Verify providers before every visit to avoid surprise billing, even at in-network hospitals.

- Document everything: Up to 80% of bills contain errors; detailed records make appeals stronger.

- Appeal denials: Over half of appealed claims are overturned, making persistence worthwhile.

Understanding how to prevent, manage, and fight healthcare denials is essential – not only for your health but also for long-term financial stability.

The Financial Reality of Claim Denials

Data from the Kaiser Family Foundation (KFF) highlights the stark disparity in insurer practices. Kaiser Permanente maintains a denial rate of around 6% in Affordable Care Act marketplace plans, while companies such as UnitedHealthcare and AvMed deny nearly 33% of in-network claims. This difference isn’t abstract, it translates into thousands of dollars of potential out-of-pocket costs for the policyholder.

The financial damage often extends well beyond the initial bill. When claims are denied, patients may be forced into lengthy appeals or even litigation. During that time, collections agencies can pursue the debt, credit scores can suffer, and patients may delay necessary treatment. As reporting from KFF Health News shows, even a single denied surgery bill, potentially costing tens of thousands of dollars, can derail a family’s entire financial plan.

Strategic Prevention: Before You Need Care

Master Your Policy Details

Your insurance contract is not just paperwork, it is a financial agreement with binding terms. Reviewing your benefits summary each year is essential to understanding which services are covered, what exclusions apply, and whether pre-authorization is required. Many denials stem from misunderstandings: for example, undergoing an expensive procedure at an out-of-network facility because you assumed it was covered. That assumption can transform into a catastrophic financial event.

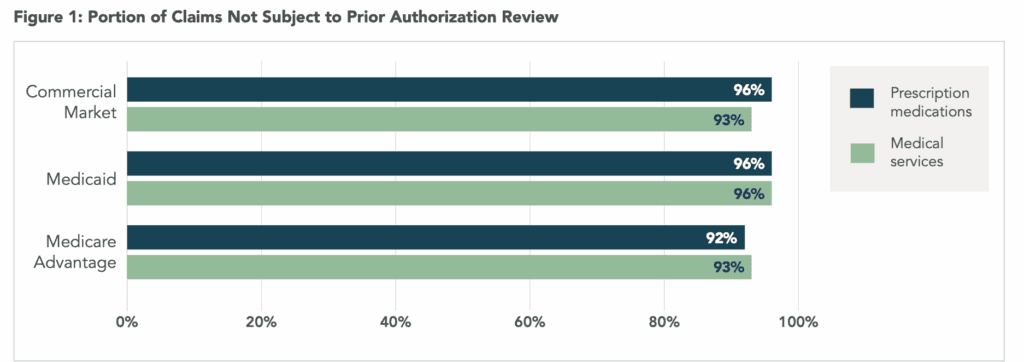

Secure Prior Authorization

According to AHIP survey findings, incomplete or missing prior authorization is a frequent cause of denials, particularly when clinical documentation is lacking. This administrative step can determine whether a procedure costing thousands is approved or rejected outright. Patients should confirm prior authorization requirements before scheduling major procedures, imaging, or specialist visits. Keeping written documentation, including reference numbers, dates, and representative names, can be invaluable during disputes or appeals.

Source: AHIP

Verify Network Status Regularly

Provider networks are fluid, with individual doctors and/or entire facilities joining or leaving every year. Even if you’ve been seeing the same doctor for years, you should verify network status before every appointment. This is particularly important during hospitalizations, where facility coverage does not always guarantee coverage for every physician involved. A patient may receive care in an in-network hospital but still be billed thousands by an out-of-network anesthesiologist or radiologist, a problem known as surprise billing.

Smart Claims Management: After Receiving Care

Document Everything

Every bill, procedure, and provider interaction should be carefully documented. Medical billing errors are widespread, with some industry reports estimating that up to 80% of bills contain mistakes, though the severity of these errors varies. Common issues range from duplicate charges and incorrect codes, which can lead to claim denials or unexpected costs. Maintaining detailed records allows you to spot and challenge discrepancies quickly, reducing the risk that they escalate into serious financial problems.

Review Bills Before Payment

Never assume your medical bill is correct. Cross-check personal information, service details, and procedure codes against what you actually received. Even small clerical errors can result in denial. For example, an incorrect birthdate or misspelled name may cause automated rejection. Contacting your provider’s billing office immediately gives you a chance to correct errors before they reach your insurer’s system.

Recovery Strategy: When Claims Are Denied

Don’t Accept Denials at Face Value

Studies show that over half of denied claims appealed are eventually paid. The American Hospital Association reports about 54.3% of appealed denials are overturned. Many stem from fixable issues like coding errors or missing documentation. Always request an Explanation of Benefits (EOB) to identify the denial reason and work with your provider to resubmit corrected claims.

Leverage Your Healthcare Team

Doctors and hospitals want to get paid, giving them a vested interest in supporting your appeal. Their billing staff often has more expertise in navigating insurer requirements than patients do. Ask them to provide supplemental documentation or letters of medical necessity that strengthen your case. This collaboration significantly increases the likelihood of claim approval.

Master the Appeals Process

Each insurer has a structured appeals pathway with specific deadlines. Missing those deadlines can permanently forfeit your chance to recover payment. Successful appeals often involve submitting detailed medical records, showing proof of medical necessity, and correcting technical errors. While the process can be time-consuming, the potential recovery, sometimes tens of thousands of dollars, makes persistence worthwhile.

Choosing Insurers Strategically

When shopping for health insurance during open enrollment, too many consumers focus only on premiums and deductibles. While these matter, approval rates and claims handling practices may matter more over the long run. An insurer with a lower premium but high denial rates can end up costing far more through uncovered claims.

Publicly available denial statistics are limited, but the data we do have from ACA marketplace plans shows wide variation between companies. Savvy consumers should consider this factor alongside cost, especially when managing chronic conditions that require frequent care.

Source: KFF

Building Financial Protection

Ultimately, health insurance should serve as a safety net, not a gamble. By proactively understanding your policy, verifying authorizations, and meticulously documenting every step of your healthcare journey, you reduce the likelihood of catastrophic denials. And when denials do occur, persistence in appeals can turn rejections into approvals.

Smart financial planning isn’t just about saving for retirement or investing wisely, it’s also about ensuring the money you’ve set aside isn’t drained by unexpected medical bills. In the US system where financial health and medical health are deeply intertwined, mastering claims management is one of the most important wealth-preservation strategies available.

By approaching health insurance with the same diligence you would bring to any other investment, you not only protect your health but also safeguard your financial future.