The Dark Truth About Cloud Mining: Fake Promises, Real Losses

5 min read

Updated: Jan 20, 2026 - 10:01:42

Cloud mining has emerged as one of the most pervasive scams in crypto, draining investors of over $500 million in 2024. Despite polished websites and promises of effortless Bitcoin rewards, regulators and blockchain researchers warn that nearly all cloud mining platforms are either outright frauds or financially unsustainable. From fake team bios and fabricated addresses to Ponzi-style payouts and sudden withdrawal “fees,” the evidence is overwhelming: cloud mining is designed to take your money, not generate returns.

- Widespread fraud: NASAA’s 2025 Investor Threat Report confirms crypto scams remain the #1 retail investor risk, with cloud mining at the center.

- Red flags everywhere: Fake teams, false user claims, fabricated addresses, and promises of 100%–800% returns are common markers of cloud mining scams.

- Psychological traps: Scammers often pay small early withdrawals, then lock larger deposits behind bogus “fees” before disappearing.

- No economic logic: Even “legit” contracts usually deliver negative returns after maintenance fees (River, CryptoCompare 2024).

- Smarter alternatives: Safer crypto strategies include staking with regulated exchanges (e.g., Kraken, Coinbase), vetted DeFi yield farming, or long-term asset holding.

After years of investigations and countless victim reports, it’s now undeniable: cloud mining is largely a scam, a polished fraud operation targeting crypto investors eager for easy returns. While the crypto space is full of ventures that could be described as ‘speculative’, cloud mining isn’t that. Despite claims of passive income and low-effort Bitcoin rewards, legitimate cloud mining services are virtually non-existent – and few scams are as pervasive, or as financially devastating, as cloud mining.

The $500 Million Problem

The numbers are staggering. In 2024 alone, crypto-mining scams, largely disguised as cloud mining services, defrauded investors of over $500 million, according to a Medium investigation. Blockchain security researchers now classify cloud mining as part of a multi-billion-dollar scam industry.

The North American Securities Administrators Association (NASAA) warned in its 2025 Investor Threat Report that:

-

Crypto scams remain the #1 threat to retail investors.

-

32% of scams spread through platforms like Facebook and X (formerly Twitter).

-

Another 31% originate on messaging apps like Telegram and WhatsApp.

How Cloud Mining Scams Work

Investigations by Brave New Coin into platforms like Hashbiter, XMiner, Miner Plus, USDminer, and Star-Miner reveal a clear pattern. These platforms use a mix of deception, digital manipulation, and psychology to lure victims in:

Fake Addresses

-

XMiner listed an address in Las Vegas that doesn’t exist.

-

Miner Plus used the location of a Trader Joe’s in Birmingham, Alabama.

Fabricated Teams

-

“Mike Katz,” featured as an executive at Miner Plus, was actually a stock photo model from Storyblocks.

Implausible User Claims

-

USDminer boasted 36 million users within a month of launch.

-

Star-Miner claimed 3 million users despite no verifiable on-chain activity.

Unrealistic Returns

-

These platforms often promise 100%–800% annual returns, which are structurally unsustainable, often paid out using deposits from new victims in Ponzi-style loops.

The Hook-and-Drain Trap

Most scams begin with small “successful” payouts to win trust. For instance, a user may invest $20 and receive $30 back within days. Encouraged, they invest larger sums, like $1,000 or more, only to face sudden “account issues” requiring additional fees. In one common scenario, users are shown they’ve “earned” 0.7495 BTC (≈$89,000), but are told they must pay a $64.03 fee to withdraw. Once paid, nothing is delivered.

New Scam Sites Pop Up Constantly

Exposed platforms are quickly replaced with fresh domains. Just a few recent examples uncovered by researchers include:

-

digitminer.com

-

nebulamining.com

-

sfcrypto.com

-

currencyminer.io

These sites often use identical layouts, stock photos, and falsified testimonials, which suggests they’re all part of the same criminal network. Worse, must of them have been promoted via sponsored content on crypto news platforms, allowing them to appear legitimate.

Even the “Legal” Ones Don’t Make Economic Sense

Even when cloud mining isn’t a direct scam, it rarely turns a profit.

Source: River Learn

A 2024 report from CryptoCompare found that most BTC and BSV cloud mining contracts produced negative returns after factoring in daily maintenance fees, often around $0.01 per GH/s.

If operations are genuinely profitable, it raises a key question:

Why offer strangers a cut instead of scaling in-house?

The answer: They aren’t profitable—or worse, they’re faking it.

What Users Are Saying

Online forums like Reddit have been flooded with complaints:

-

Delayed or frozen withdrawals

-

Accounts locked after larger deposits

-

“Customer service” disappearing after payment

Users often cite the same scam pattern:

“I got paid $30 once. Then I deposited $500 and never heard from them again.”

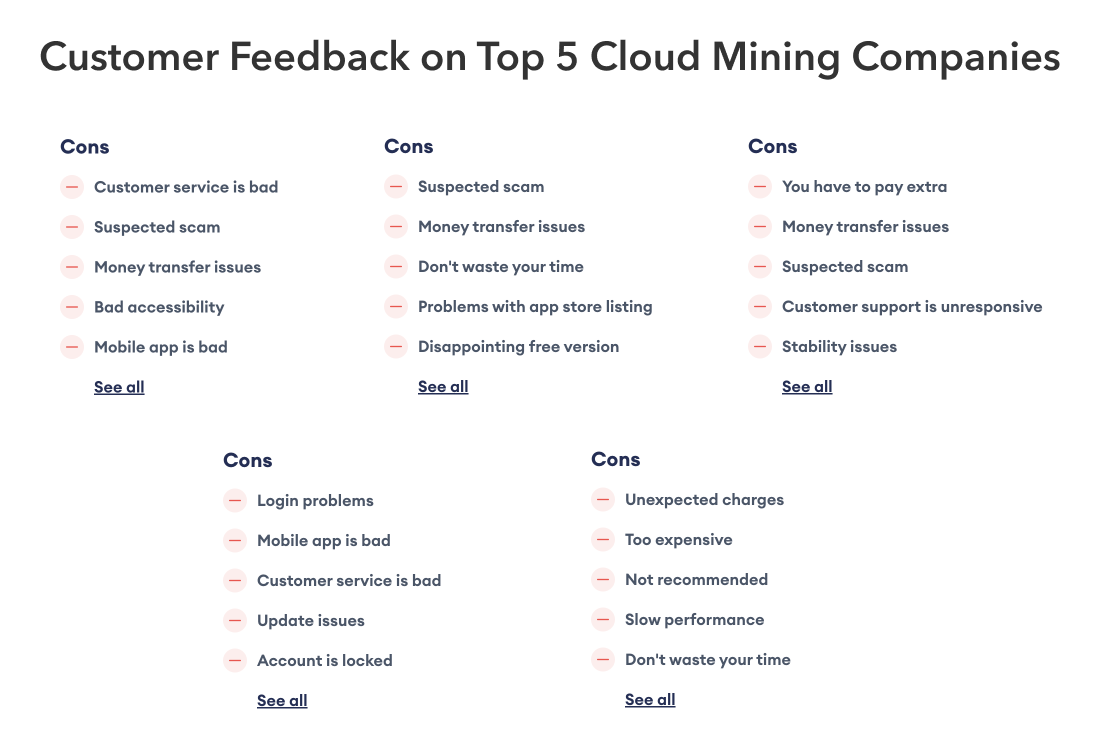

Even “top-rated” cloud mining services receive user feedback containing phrases like “suspected scam,” “no payout,” and “unreachable support.”

Regulators Are Sounding the Alarm

The latest NASAA report reveals that 39% of securities regulators expect scammers to use AI-generated content to increase the realism of their websites and promotional materials.

These AI tools are now used to:

-

Generate fake executive bios

-

Simulate mining dashboards

-

Clone customer reviews and video testimonials

How to Spot a Scam: 5 Key Questions

Before trusting any cloud mining platform, ask:

-

Can you physically visit their mining facility?

-

Do they show on-chain evidence of real mining?

-

Are returns modest and verifiable?

-

Are they endorsed by reputable crypto analysts—without being paid?

If the answer to any of these is no, you’re likely dealing with a scam.

Smarter Alternatives for Crypto Exposure

Instead of risking funds on shady cloud mining platforms, consider:

-

Yield farming on vetted DeFi protocols

-

Buying spot assets and holding for the long term

These options offer realistic, transparent, and sustainable returns.

Final Verdict: Cloud Mining Is a Trap

Cloud mining promises passive income, but the reality is far more sinister. Most platforms are either outright scams or structured in a way that ensures users never see meaningful returns. From fake addresses and fabricated teams to deceptive payouts and unreachable support, the red flags are overwhelming.

Even the few platforms that appear “legit” often leave users with less than they invested, thanks to hidden fees and unsustainable economics. Whether it’s a Ponzi scheme or just a bad deal, the result is the same: you lose money.

Related Posts

Nothing Found