Why Top AI Stocks Are Beating the S&P 500 This Year

5.1 min read

Updated: Dec 19, 2025 - 07:12:52

Artificial intelligence is no longer just a tech theme, it is the central engine of equity markets in 2025. The S&P 500 is up 11% year-to-date, but AI leaders such as Palantir (+110%) and Nvidia (+30%) have far outpaced that baseline. Market performance is now shaped by a small cluster of mega-cap firms whose AI investments, capital spending, and industry influence are reshaping both index returns and the broader economy.

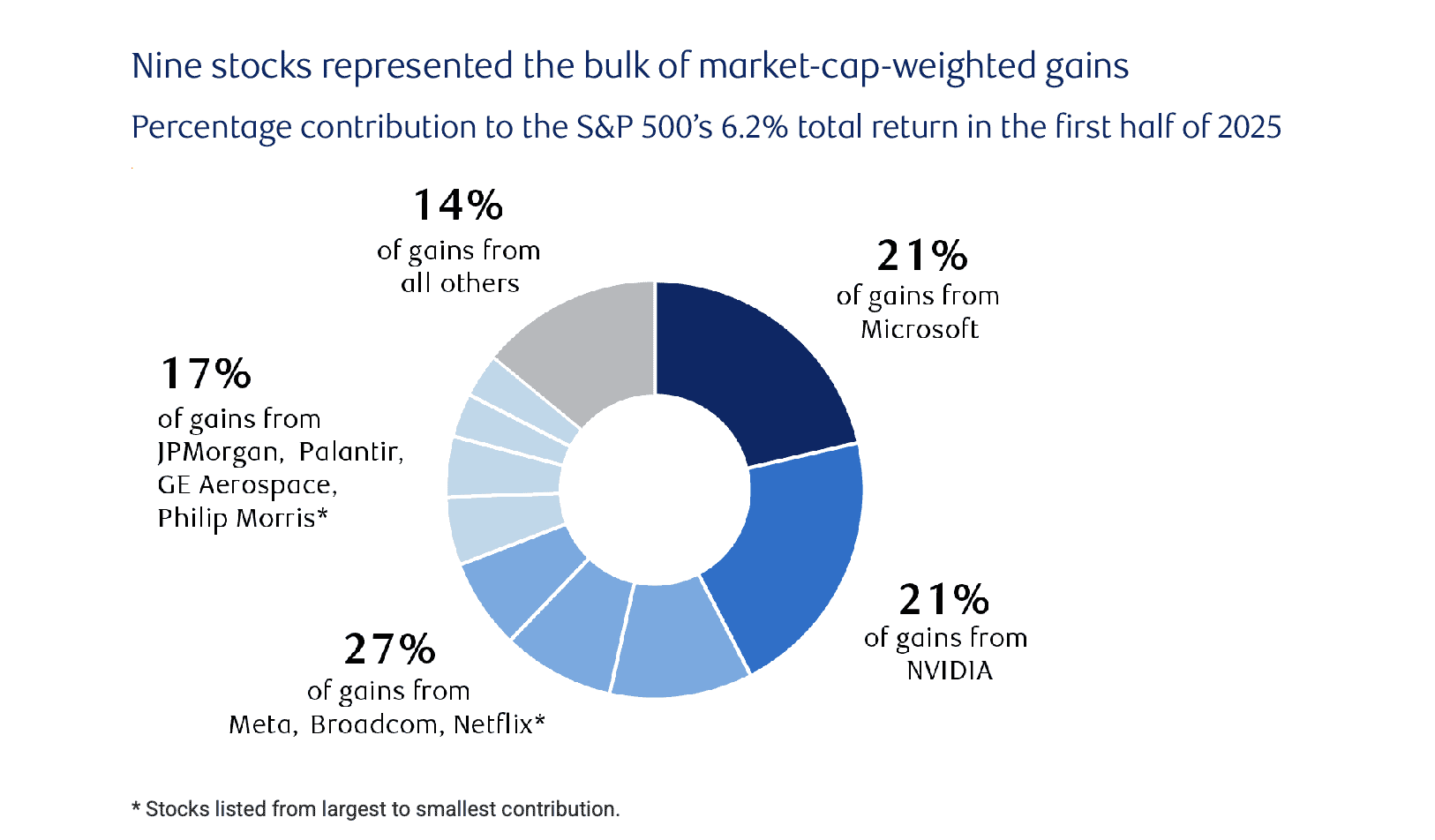

- Concentration risk: Microsoft and Nvidia generated 42% of S&P 500 gains in early 2025, with nine stocks driving 86% of returns.

- Massive capital spending: Meta has pledged $600B through 2028, while Microsoft, Amazon, Alphabet, and Meta plan $300B in 2025 alone on AI data centers and chips.

- Market scale: The AI compute and networking market could reach $2T annually by 2030, fueling suppliers like Nvidia, Broadcom, and Super Micro Computer.

- Beyond tech: Industries from automotive (Ford) to aerospace (Boeing) and utilities are embedding AI, proving its role as a structural driver of productivity.

- Risks remain: With the S&P 500 trading at 22x forward earnings, high valuations, rising rates, and regulatory scrutiny could test AI’s staying power.

Artificial intelligence has become the centerpiece of equity markets in 2025, reshaping not just technology investing but the very structure of the S&P 500. While the index has delivered an 11% return so far this year, AI-driven firms have surged far beyond that baseline.

Palantir has gained more than 110%, Nvidia has risen nearly 30%, and other leaders in the space have captured the bulk of market enthusiasm. To understand why, it helps to examine the three layers driving this phenomenon: index mechanics, capital expenditure, and broad industry adoption.

The Weight of Giants

The S&P 500’s returns are increasingly dictated by its largest players. Research from RBC Wealth Management shows that Microsoft and Nvidia alone generated 42% of the index’s gains in the first half of 2025. Adding Meta, Broadcom, and Netflix brought the total to 69%, while a handful of other companies, including JPMorgan and Palantir, pushed the combined contribution of nine stocks to 86%.

Source: RBC Wealth Management

This level of concentration is striking, but it also reflects the reality that mega-cap firms are not only investing in AI, they are defining it. Their scale allows them to secure the best chips, build the most advanced data centers, and hire talent at levels most competitors cannot match. The result is a flywheel effect where size begets dominance, and dominance translates directly into market performance.

Capital Flows on an Unprecedented Scale

Investment in AI infrastructure is unlike anything the corporate world has seen. Meta has committed over $600 billion through 2028, signaling that its vision for the future depends almost entirely on AI integration. At the same time, hyperscale cloud leaders, Microsoft, Amazon, Alphabet, and Meta, are projected to spend $300 billion in 2025 on data centers, advanced semiconductors, and global networking capacity.

This spending spree is not limited to short-term expansion. It lays the groundwork for AI markets estimated to reach $2 trillion annually in compute and networking by 2030. For suppliers such as Nvidia, Broadcom, and Super Micro Computer, this ensures years of sustained demand. Investors are not simply betting on growth; they are buying into the creation of an entirely new layer of the digital economy.

The “Magnificent Seven” and Market Shape

Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla, make up the “Magnificent Seven”, and now account for one-third of the S&P 500’s value. Their combined heft is unprecedented, raising concerns that a small cluster of companies is steering the direction of the world’s most important stock index.

Yet unlike past cycles of concentrated market leadership, these firms are not buoyed by speculative momentum alone. They have deep cash reserves, entrenched business models, and clear pathways to monetizing AI across multiple verticals. Analysts argue that the comparison to bubbles overlooks the structural shift underway: AI is not a peripheral technology but a foundational one, set to permeate every major sector.

Beyond Technology: AI’s Real-World Expansion

The reach of AI is spreading beyond Silicon Valley and into traditional sectors. Companies across industries are integrating AI into core operations, reshaping their efficiency and competitiveness. Examples include:

-

Automotive: Ford is embedding AI in vehicle design and autonomous driving systems.

-

Aerospace: Boeing is using AI tools to optimize engineering and streamline manufacturing.

-

Utilities: Grid operators are deploying AI for real-time energy balancing and predictive maintenance.

-

Industrials: Manufacturers are adopting AI to improve supply chain logistics and reduce operational costs.

This broader adoption shows AI is not just a tech story; it is becoming a universal driver of productivity across the economy.

Risks That Shadow the Boom

The optimism surrounding AI does not eliminate risks, however. The S&P 500 currently trades near 22 times forward earnings, a level that leaves little cushion if growth falters. This means the total market cap of the S&P 500 is 22 times greater than the projected earnings of its constituent companies in the next 12 months. Rising interest rates could increase the cost of capital for large-scale data projects, while global economic headwinds may dampen demand. Regulators are also sharpening their focus, particularly on antitrust issues and the ethical use of AI in consumer products.

Despite these challenges, market strategists such as Evercore ISI expect continued expansion. Their forecast places the S&P 500 at 7,750 by 2026, with AI spending as the chief driver. If companies can successfully transform capital outlays into sustainable profits, the rally has room to extend.

Source: Bloomberg

Conclusion: The Engine of Today’s Market

AI stocks are outpacing the broader market because they combine massive influence within a cap-weighted index, extraordinary levels of corporate spending, and adoption that is spreading far beyond traditional tech. They are not only driving today’s returns but also shaping the future of global productivity.

For investors, the story is clear: AI is not a speculative theme on the margins of the economy. It is the engine of this market cycle, and its trajectory will define whether the extraordinary gains of 2025 are the start of a long-term structural shift or the peak of concentrated enthusiasm.