Understanding Health Savings Accounts – HSAs: A Complete Guide

8.7 min read

Updated: Dec 20, 2025 - 12:12:28

By late 2024, over 39 million Americans held Health Savings Accounts (HSAs) totaling $147 billion, reflecting how HSAs have become a cornerstone of tax-efficient healthcare and retirement planning. For 2025, the IRS increased contribution limits to $4,300 for individuals and $8,550 for families. HSAs’ triple tax advantage, deductible contributions, tax-free growth, and tax-free withdrawals, makes them uniquely valuable for long-term financial health. However, they’re best suited for those comfortable with high-deductible plans and consistent saving.

- Triple tax edge: HSAs are the only accounts offering tax-free contributions, growth, and withdrawals for qualified expenses.

- 2025 eligibility: Must have an HDHP with at least a $1,650 deductible (individual) or $3,300 (family); Medicare enrollees can no longer contribute.

- Top providers: Fidelity (no fees, broad investments), Lively (partnered with Schwab), HealthEquity (Vanguard funds, 24/7 support), and HSA Bank (no maintenance fees).

- Growth trend: HSA assets rose 19% in 2024; investment balances average $22,000 – 9× higher than non-investing accounts.

- Best use: Max out contributions, invest balances, pay current medical bills out of pocket, and save receipts for future tax-free reimbursements.

Health Savings Accounts (HSAs) have become an essential part of modern financial planning for Americans aiming to balance healthcare costs with long-term savings. By the end of 2024, nearly 39 million HSA accounts collectively held about $147 billion in assets, according to Devenir Research. This explosive growth reflects a broader shift toward consumer-driven healthcare and tax-efficient financial strategies.

Whether you’re opening your first HSA or optimizing an existing one, understanding how these accounts function, and which providers offer the best value, can help you make informed, strategic choices.

What Is a Health Savings Account?

A Health Savings Account is a specialized savings account that allows you to set aside pre-tax dollars specifically for medical expenses. Unlike flexible spending accounts that typically require you to use funds within a year, HSA money is yours to keep indefinitely. The account rolls over year after year, and you retain ownership even when changing jobs or health insurance plans.

Think of an HSA as a medical expenses bank account with exceptional tax treatment. You can use it to pay for doctor visits, prescriptions, dental care, vision expenses, and a wide range of other qualified medical costs. Many account holders also invest their HSA funds in mutual funds or other securities, allowing the account to grow substantially over time.

The Triple Tax Advantage

HSAs are the only financial accounts offering a triple tax benefit, unmatched by traditional savings or retirement vehicles:

-

Tax-deductible contributions: Deposits reduce your taxable income for the year.

-

Tax-free growth: Investment gains and interest accumulate without annual taxation.

-

Tax-free withdrawals: Funds used for qualified medical expenses are never taxed.

According to the IRS Revenue Procedure 2024-25, the 2025 HSA contribution limits are $4,300 for individuals and $8,550 for families, with an additional $1,000 catch-up contribution allowed for those aged 55 or older.

This combination of immediate tax savings, compounding growth, and lifetime tax-free withdrawals makes HSAs uniquely powerful for long-term wealth building.

Eligibility Requirements

Opening an HSA isn’t available to everyone. You must meet specific criteria:

- You must have existing health insurance that qualifies as a High Deductible Health Plan (HDHP). For 2025, this means a plan with a minimum deductible of $1,650 for individual coverage or $3,300 for family coverage. The plan’s annual out-of-pocket maximum cannot exceed $8,300 for individual coverage or $16,600 for family coverage. These plans typically have lower monthly premiums but require you to pay more out-of-pocket before insurance coverage begins.

- You cannot have other disqualifying health coverage. While you can have supplemental insurance for specific conditions, dental, vision, disability, or long-term care, you generally cannot have traditional comprehensive health insurance alongside your HDHP.

- You cannot be enrolled in Medicare, which typically begins at age 65. Once you enroll in Medicare, you must stop contributing to your HSA, though you can continue using existing funds.

- You cannot be claimed as a dependent on another person’s tax return.

HSA Providers and Custodians: Understanding the Players

When opening an HSA, you’ll encounter two key entities: providers and custodians. Understanding the distinction helps you choose the right account for your needs.

HSA Custodians

The custodian is the financial institution that actually holds and administers your HSA funds. By IRS regulation, HSAs must be held by an approved custodian, similar to how IRAs and other tax-advantaged accounts work.

Common types of custodians include banks, credit unions, insurance companies, and specialized financial services firms. These institutions handle the regulatory compliance, tax reporting, record-keeping, and day-to-day account administration.

Major national banks serve as HSA custodians. Credit unions often provide HSA services to their members. Insurance companies sometimes offer HSAs directly to policyholders. Specialized providers like Fidelity, HealthEquity, Lively, and HSA Bank focus on health savings accounts and related benefits.

HSA Providers vs. Custodians

The term “provider” is sometimes used interchangeably with custodian, but it can also refer to the broader service package. Some organizations offer a complete HSA solution including the custodial services, investment options, debit cards, online portals, and customer support.

Your employer might select an HSA provider as part of your benefits package. In these cases, the employer has typically negotiated account terms, and contributions are conveniently made through payroll deduction. However, you’re never locked into your employer’s chosen provider. You can open your own HSA with any custodian you prefer and make contributions independently, though you might miss out on the convenience of payroll deduction and potential employer contributions.

Choosing the Right HSA Provider

Selecting the right HSA can significantly impact your long-term returns and convenience. Key considerations include:

-

Fees: Avoid providers that charge monthly maintenance or transaction fees unless offset by strong features.

-

Investment options: Some providers offer a full brokerage window or mutual fund lineup, while others limit choices or require a minimum balance before investing.

-

Interest rates: Cash balances typically earn modest returns, but high-balance accounts can sometimes qualify for better rates.

-

User experience: A clean mobile app and simple reimbursement process are invaluable for everyday use.

-

Customer support: Read independent reviews to gauge service quality and issue resolution times.

Popular HSA Providers

While you should evaluate providers based on your specific needs, the following providers have earned strong reputations:

Fidelity offers no account fees, no minimum balance requirements, and investment options including stocks, bonds, ETFs, and mutual funds. The platform features both self-directed and managed account options, with cash balances swept into interest-bearing accounts. Their platform integrates well for those already using Fidelity for retirement accounts.

Lively features no hidden fees and provides a simple, user-friendly website that clearly displays account details. For investing, Lively partners with Charles Schwab for a self-directed brokerage option (charging $24 annually for balances under $3,000) and offers a guided portfolio through Devenir with a 0.5% annual fee.

HealthEquity is the largest flexible benefit administrator in the U.S., offering HSAs alongside FSAs, HRAs, and other benefits. The provider offers low-cost Vanguard fund options and charges a 0.31% fee on investment accounts, though it provides 24/7 customer support. Account holders can access funds through debit cards, online banking, or mobile apps.

HSA Bank eliminated its maintenance fee in 2021 and offers investment options through brokerage accounts. The bank makes it easy for customers to access funds through ATM withdrawals, transfers to external accounts, debit cards, and digital wallet integration.

HSA Market Growth and Trends

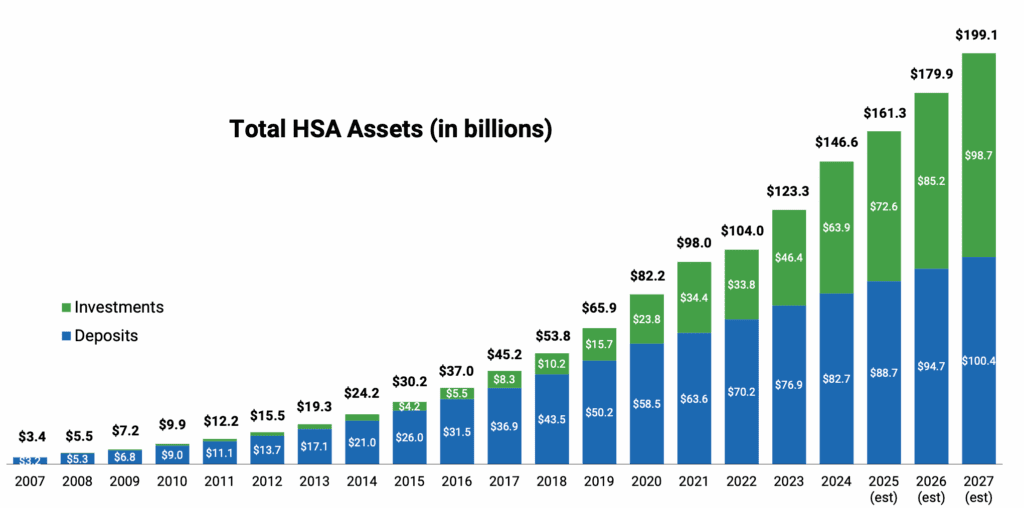

The HSA industry continues to expand rapidly. According to Devenir’s 2024 report, total HSA assets grew 19% year-over-year, reaching $147 billion across 39 million accounts. Of that, $64 billion came from investments, a 38% jumpfrom 2023.

Source: Devenir

Still, only about 9% of account holders invest their HSA funds, underscoring the untapped potential of using HSAs as long-term vehicles rather than short-term expense accounts. Average investment account balances now approach $22,000, nearly nine times higher than non-investing HSAs.

Analysts expect the market to surpass 45 million accounts and $199 billion in assets by 2027, as awareness and employer adoption continue to grow.

Who Benefits Most from HSAs?

HSAs provide the most value for financially disciplined individuals and families who can manage higher deductibles and maximize the tax advantages. They are particularly beneficial for:

-

Healthy individuals with low annual healthcare costs.

-

High-income earners seeking additional tax shelters beyond 401(k)s or IRAs.

-

Retirement planners looking to offset future medical expenses with tax-free funds.

-

Long-term investors who pay out-of-pocket now and save receipts for future tax-free reimbursements.

Because withdrawals for medical expenses are tax-free indefinitely, an HSA can double as a stealth retirement account for healthcare costs later in life.

When an HSA Might Not Be Ideal

HSAs aren’t a one-size-fits-all solution. They may not suit those with chronic medical conditions, families with frequent healthcare visits, or individuals lacking an emergency fund to meet the deductible. For these groups, a traditional low-deductible plan may offer greater peace of mind despite higher premiums.

Additionally, those nearing age 65 should consider the short window for contributions before transitioning to Medicare, which halts new deposits though existing balances remain available for qualified withdrawals.

Maximizing Your HSA

The key to unlocking an HSA’s full potential lies in treating it as a hybrid healthcare and investment account. Contribute the annual maximum if possible, pay current medical expenses out of pocket to preserve tax-free growth, and invest the balance strategically.

Keep detailed receipts for all qualified medical expenses paid from other sources, you can reimburse yourself later, even years down the line, tax-free, as long as the expenses were incurred after your HSA was established and properly documented. According to the IRS and Fidelity, there is no time limit on when you can reimburse yourself, provided you keep receipts showing the expenses were qualified and not previously deducted.

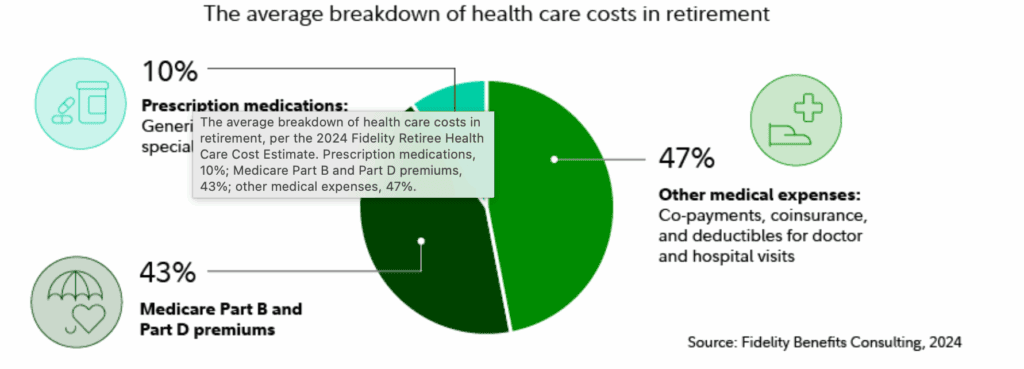

Health care costs remain one of the biggest financial worries for retirees. According to Fidelity’s 2024 Retiree Health Care Cost Estimate, a 65-year-old retiring in 2024 can expect to spend approximately $165,000 on health care throughout retirement, a figure that rose to $172,500 in Fidelity’s 2025 estimate.

Source: Fidelity

Final Thoughts

Health Savings Accounts represent one of the most tax-efficient and flexible financial tools available today. When paired with a suitable High Deductible Health Plan, an HSA provides an unmatched combination of savings, investment potential, and long-term healthcare security.

For individuals who can manage the higher deductible and commit to consistent contributions, an HSA isn’t just a medical savings account, it’s a cornerstone of holistic financial planning. As healthcare costs continue to rise, leveraging an HSA’s triple tax advantage may be one of the smartest financial decisions you make.

Related: This article is part of Mooloo’s Tax Strategy Hub, covering tax planning, investment taxes, retirement strategies, and after-tax wealth decisions: