Trump’s 401(k) Executive Order| What It Actually Means for Your Retirement (And What You Should Do Now)

4.8 min read

Updated: Dec 20, 2025 - 13:12:27

President Trump’s August 7th executive order on alternative assets in 401(k) plans could eventually let over 90 million Americans access private equity and other nontraditional investments in workplace retirement accounts. However, the shift is years away, will hinge on Department of Labor (DOL) rulemaking, and comes with higher fees and liquidity risks. For now, fundamentals like consistent saving, employer match maximization, and cost-efficient diversification remain the cornerstones of retirement success.

- Timeline reality: Even under an optimistic path, alternative assets in 401(k)s are 2–5 years from widespread adoption, with the DOL review process taking at least 6–12 months.

- Fees matter: Private equity funds often charge 1–2% management fees plus performance-based carried interest, compared to traditional index funds with expenses as low as 0.10% or less.

- Investor prep: Learn how private equity and REITs work, evaluate your own risk tolerance, and understand potential lock-up periods before considering future allocations.

- Current savings data: The average 401(k) balance hit $93,054 in June 2024, with employees saving 7.4% of income and combined contributions averaging 14.1%, in line with expert targets of 12–15%.

- Bottom line: Stick to proven retirement pillars, steady contributions, diversification, low costs, while treating alternative assets as potential enhancers, not replacements, if and when they arrive.

President Trump’s August 7th executive order on alternative assets in 401(k) plans has triggered headlines suggesting it will “revolutionize retirement.” The idea of accessing private equity-style returns in a workplace retirement account is alluring, but the reality is far more measured. This policy shift could eventually open doors for more than 90 million Americans in employer-sponsored defined-contribution plans, yet the process will be gradual, and the practical impact will depend heavily on regulatory follow-through.

Understanding the Scope of the Order

The executive order directs the Department of Labor (DOL) to revisit its guidance on fiduciary decisions and clarify its position on incorporating alternative assets into 401(k) plans. The stated aim is to counter what Trump calls “regulatory overreach” and “opportunistic trial lawyer lawsuits” that, in his view, have limited innovation in retirement investing.

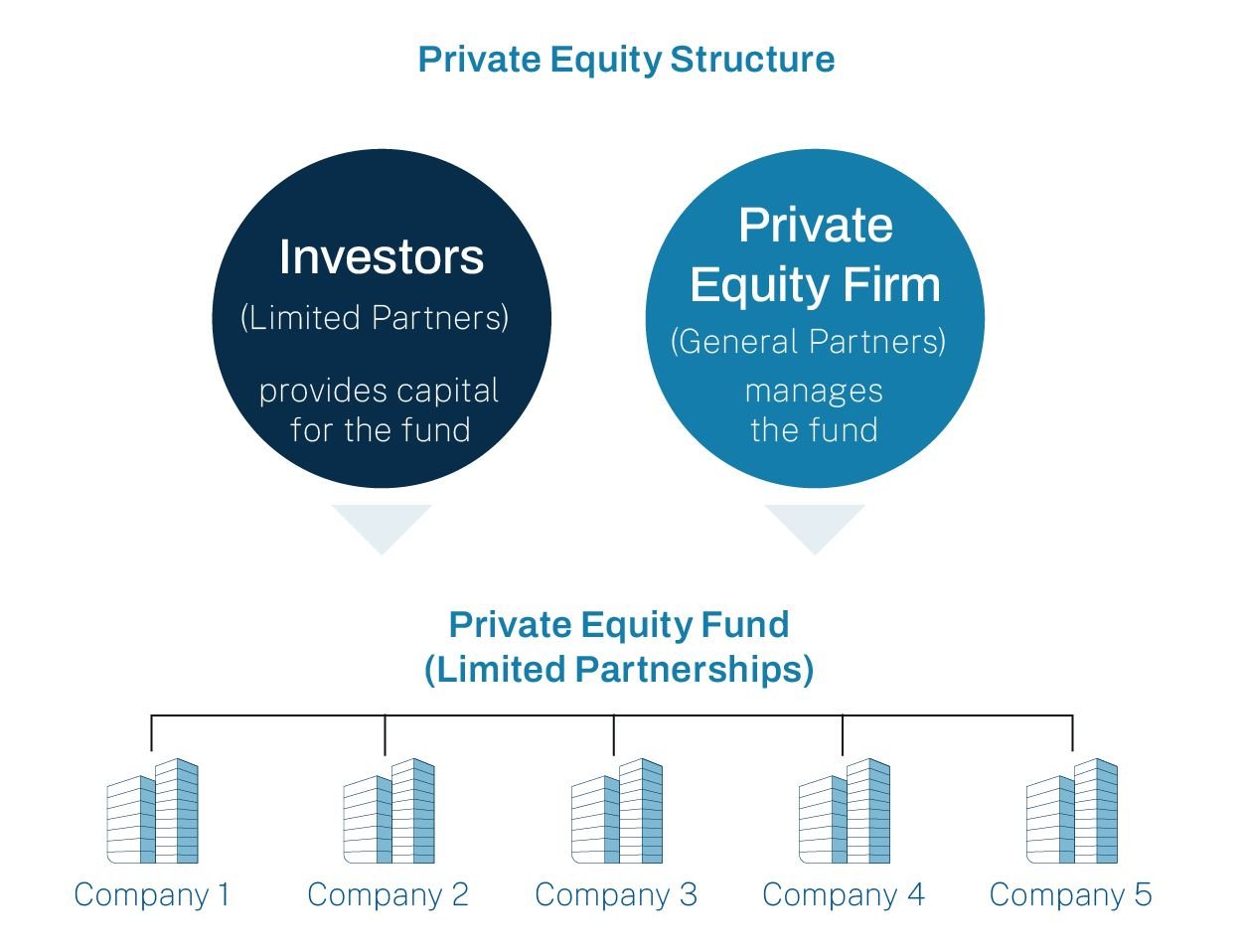

Traditionally, high-return but higher-risk investment classes such as private equity, real estate investment trusts (REITs), and certain alternative funds have been available mainly to institutional investors, government workers with public pensions, or high-net-worth individuals. If fully implemented, this policy could allow retirement savers to diversify into assets with different risk-return profiles. However, this is not an immediate change.

The Timeline Reality Check

Even under an optimistic schedule, this reform is years away from being commonplace.

Likely Implementation Stages

-

3–6 months: Department of Labor reviews existing fiduciary guidance

-

6–12 months: Potential publication of a new regulatory framework

-

12–24 months: First wave of plan sponsors may begin adding options

-

2–5 years: Wider adoption among various employers

What 401(k) Investors Should, and Shouldn’t, Do Right Now

For now, the fundamentals of retirement saving remain unchanged. Your current investment strategy, if diversified and cost-efficient, still works. Reviewing your asset allocation, confirming you are maximizing your employer match, and staying disciplined with contributions matter more than chasing new asset classes that may not appear in your plan for years.

Recent industry data underscores this point. In 2023, the average employee 401(k) contribution rate was 7.4% of income, while the combined employer-employee contribution rate averaged 14.1% in Q3 2024. This aligns with expert recommendations to save 12–15% of salary annually.

Steps to Take in the Near Term

Educating yourself about alternative investments is the most productive preparation. Learn how private equity operates, what liquidity constraints you might face, and the potential fee structures. Equally important is evaluating your own risk tolerance, especially since these assets tend to be more volatile and less liquid than traditional holdings.

The Fee Reality

One of the biggest trade-offs in alternative investing is cost. Traditional 401(k) options, such as index funds, have seen fees plummet, some now charge less than 0.10% annually, with certain funds offering zero-fee structures.

Alternative Asset Fee Structures

Private equity real estate investments can include:

-

Acquisition fees of 1–2% of the deal size

-

Annual management fees of 1–2%

-

Administrative charges around 0.10–0.20%

-

Organizational fees up to 2%

Private equity funds often add carried interest, a performance-based fee applied when returns exceed a set hurdle rate. These higher costs can significantly erode returns if performance doesn’t outpace benchmarks.

Source: Hamilton Lane

When New Options Arrive

If your plan eventually offers alternative investments, a cautious approach is best. Consider starting with a small allocation, around 5–10% of your portfolio, while keeping your core holdings in proven, traditional asset classes.

These assets can provide diversification benefits, but they come with trade-offs. Higher return potential often means higher fees and longer lock-up periods, and tax implications may differ from what you’re used to. Not all products will be of equal quality, and careful evaluation of each offering’s track record, cost structure, and accessibility will be essential.

Keeping Perspective

Trump’s executive order does not guarantee higher retirement returns or immediate access to alternative investments. Historical data shows that traditional strategies still work for most savers. The average 401(k) balance in June 2024 was $93,054, up 8% from the end of 2023, and the average annual return from 2019 to 2023 was 9.7% for long-term participants.

Research also indicates that private equity real estate closed-end funds have not consistently outperformed other options on a risk-adjusted basis, especially after fees. In reality, the factors that drive retirement success have not changed: maintaining steady contributions (with 86.7% of participants keeping their rate unchanged in Q2 2024), capturing the average employer match of 4.6% of pay, keeping costs low, and staying invested through market cycles.

The Bottom Line

This policy shift could eventually expand investment menus for millions of retirement savers, but it is not a short-term game-changer. Your best move is to stick to the proven pillars of retirement planning: save consistently, diversify appropriately, control costs, and maintain discipline. When alternatives do arrive, treat them as potential portfolio enhancers, not replacements for strategies that already work.