The Best Time To Buy a Car in 2026: A Month-by-Month Plan Backed by 2025 Data

6.1 min read

Updated: Dec 20, 2025 - 08:12:33

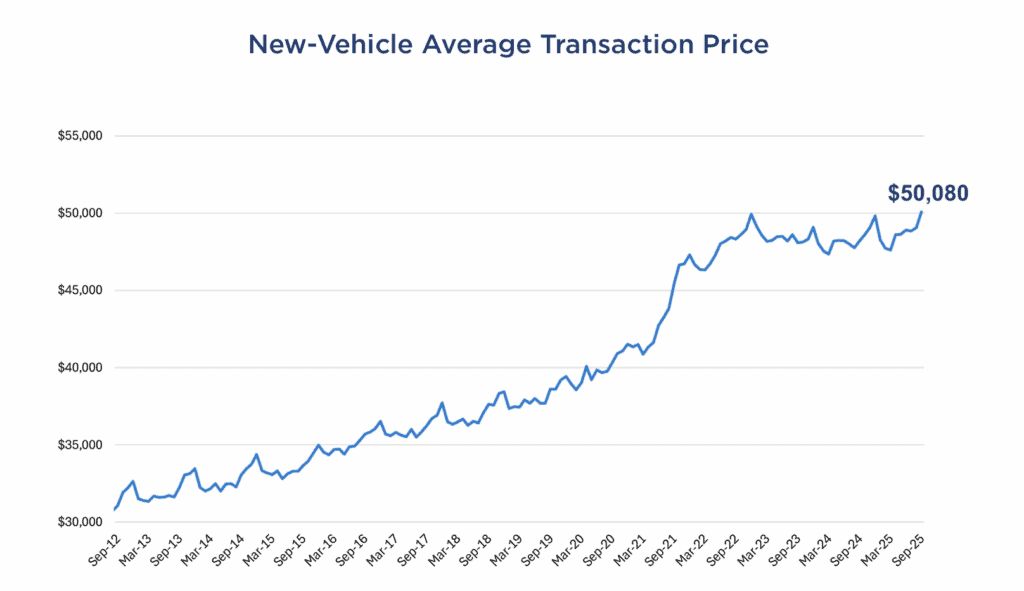

Car prices and incentives are stabilizing heading into 2026, giving buyers more control over timing their purchases. With S&P Global Mobility reporting inventories near 2.9 million vehicles and Kelley Blue Book showing average transaction prices above $50,000 in late 2025, strategic timing can save thousands. Manufacturer discounts averaged 6–7% in mid-2025, per J.D. Power, and those seasonal swings are expected to continue through 2026.

- Best months to buy: Late June and August 2026 are projected to deliver the deepest discounts, repeating 2025’s 6%–7% incentive peaks.

- December 2025 – January 2026: Year-end clearances and early-year slowdowns bring stackable factory cash and negotiable pricing on leftover 2025 models.

- March & September 2026: Quarter-end sales targets create added dealer motivation; aim for the last weekend of each month.

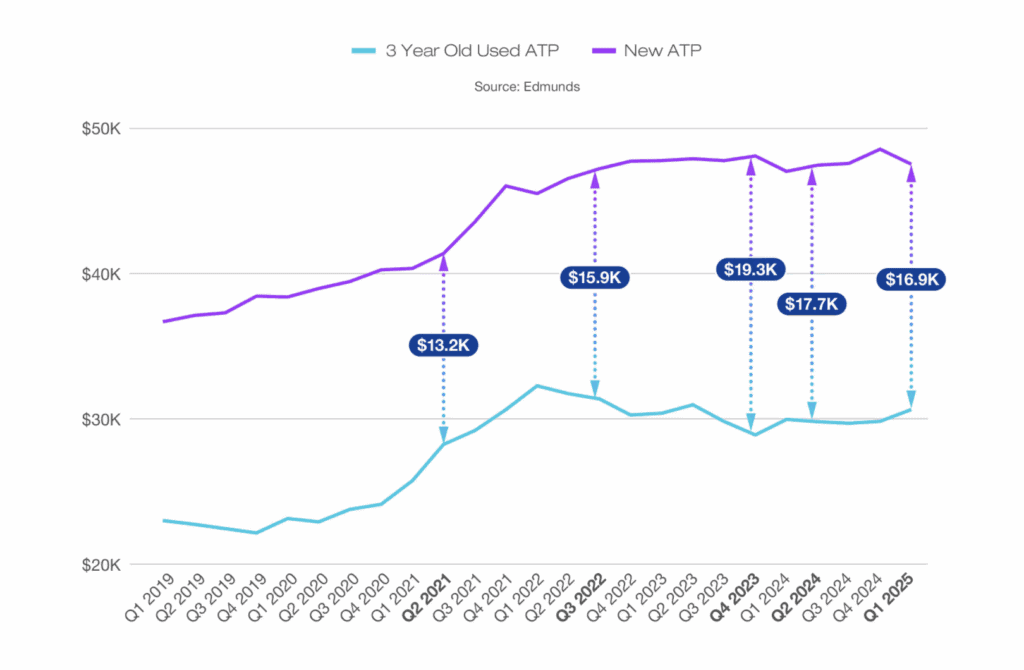

- Used-car values: Three-year-old models averaged $30,500 in early 2025, per Edmunds, narrowing the gap with new cars to about $17,000, worth comparing before buying new.

- Buyer strategy: Track monthly ATPs (average transaction price), monitor inventory on regional dealer sites, and stay flexible on trims and colors to capitalize on markdowns as 2027 models arrive.

If you’re planning to buy a new car in 2026, timing could still make a meaningful difference in what you pay. Data from 2025 show that dealer inventories have largely recovered from post-pandemic lows, manufacturer incentives have increased, and seasonal price patterns are re-emerging. With supply and discounts shifting month to month, planning your purchase around these trends can help you buy when conditions are most favorable.

Market snapshot heading into 2026

By late 2025, U.S. dealers had about 2.8 to 2.9 million new vehicles in stock, according to S&P Global Mobility, marking a sharp recovery from pandemic lows though still below the roughly 4 million units typical before 2020. The average transaction price (ATP) briefly exceeded $50,000 in September 2025, based on data from Cox Automotive, reflecting steady demand even as inventories normalized.

Source: Cox Automotive

Manufacturer incentives also rebounded, averaging around 6-7% of transaction prices through mid-2025, according to J.D. Power. After peaking in early summer, incentives eased slightly toward 5–6% by October, as noted by Cox Automotive, suggesting automakers were balancing sales volume with profitability. With more vehicles available and discounts shifting month to month, timing purchases strategically now matters more than luck.

What Are Buyer ‘Incentives’?

Manufacturers and dealers use buyer incentives to reduce the effective cost of a new car, especially during strong promotion months like June. These incentives include direct cash rebates, subsidised finance offers, lease discounts, special bonuses for trade-ins or brand switching, and even free add-ons or service packages. The purpose is to stimulate sales, clear inventory, and make monthly payments more affordable. Incentives can come from the manufacturer, the dealer, or both, and they can significantly lower the out-of-pocket price or long-term financing cost for buyers.

Typical Car Buyer Incentives

-

Cash rebates: upfront discounts, loyalty bonuses, or “conquest” cash

-

Dealer incentives: behind-the-scenes dealer cash used to reduce price

-

Low-APR financing: 0% or below-market interest rates

-

Lease incentives: reduced money factors, lease cash, or $0-down leases

-

Trade-in bonuses: extra value added to your old vehicle

-

EV/hybrid incentives: manufacturer EV cash, passed-through tax credits

-

Free add-ons: free maintenance, warranties, accessories, or tech packages

Best Time To Buy a Car in 2026 – Month-by-Month Guide

The following month by month guide details what is motivating dealer discounts at every stage of the year. Knowing what is on the sales person’s mind (quarterly targets, new models arriving etc) will empower buyers during every time frame.

December 2025 to Early January 2026 – Year-End Clearances

Dealers push very hard to meet annual targets and clear prior-year models. With inventory now near pre-pandemic levels, buyers can often combine model-year closeouts with factory cash incentives. The last few days of December, especially December 29 to 31, remain historically strong for discounts.

January- February 2026 – Quiet but Negotiable

Winter weather and post-holiday fatigue keep showrooms slow. Early-year incentive boosts, similar to those seen in early 2025, can make this a smart time to negotiate, particularly on leftover 2025 inventory.

March 2026 – Quarter-End Motivation

Automakers and dealers aim to hit first-quarter goals, often layering bonus cash or low-APR (annual percentage rate) financing. Target the final weekend of March when managers close books and must stretch to meet quotas, a pattern confirmed by J.D. Power data.

April 2026 – Monitor Price Direction

Use Kelley Blue Book’s monthly reports to track average transaction prices (ATPs). If ATPs trend flat or down, as they did in spring 2025, April can rival March deals with less competition at the lot.

May 2026 – Memorial Day Specials

National holiday events bring broad promotions. Expect 0.9%–2.9% financing or bonus cash on key models. If interest rates stay elevated, these subsidized offers can significantly lower total cost. Memorial day is the last Monday in May, occurring on May 25th in 2026.

June 2026 – Incentives Peak

Incentives reached roughly 6.9% of ATP in June 2025, the year’s high, as dealers cleared aging models. A repeat pattern would make late June one of the best buying windows of 2026.

July 2026 – New-Model Arrivals Begin

Fresh 2027 models arrive, prompting dealers to discount remaining 2026 stock. Shoppers open to the outgoing year will find solid choices and growing pressure on dealers to make space as new arrivals hit lots.

August 2026 – Model-Year Changeover Deals

August traditionally delivers the best blend of discounts and selection. In 2025, average discounts topped $3,000 per vehicle, about 6% of the manufacturer’s suggested retail price (MSRP), according to Cox Automotive data. Practical buyers seeking value over novelty should act now.

September 2026 – Watch for Price Spikes

September 2025 recorded the year’s highest ATP, over $50,000, while incentives eased slightly. If the pattern repeats, skip early September and shop at month-end when dealers chase quarterly goals.

October 2026 – Incentives Tighten

After the September surge, automakers often trim discounts. In October 2025, incentives averaged about 5.3%. Focus on end-of-month deals or nearby markets where inventory remains high.

November 2026 – Black Friday Promotions

Thanksgiving weekend starts on Thursday, November 26th – and brings aggressive national ads and factory cash events. Deals may not match summer lows but could remain appealing for buyers who missed earlier closeouts.

December 2026 – Year-End Finale

As quotas reset and leftover models linger, manufacturers stack incentives. The final week of December 2026 will again blend strong discounts, high inventory, and motivated dealers eager to close the year, ideal for flexible shoppers.

Used-car dynamics

Used-vehicle prices stayed high through 2025, showing only modest cooling. According to Edmunds’ Q1 2025 Used Car Report, the average three-year-old car sold for about $30,500 in the first quarter of 2025, up roughly 2% from a year earlier, reflecting continued tight supply even as new-car inventories recovered.

Source: Edmunds

The price gap between new and near-new vehicles has narrowed to around $17,000, much smaller than before 2020, making it worth comparing both markets before deciding.

How to plan your 2026 purchase

Choose target months that align with sales cycles, late June or September often strike a good balance between incentives and available inventory. Boost your leverage by shopping at the end of the month or quarter, gathering quotes from multiple dealers, and comparing incentive trends on Cox Automotive or Kelley Blue Book.

Stay flexible on trim and color options to take advantage of end-of-model-year markdowns, which help dealers clear space for new arrivals. Monitor local inventory levels through online dealer listings, regional supply differences can affect prices by several percentage points, depending on demand and availability.

Related: Explore more financial guidance in our Personal Finance Hub, covering budgeting, saving, banking, insurance, and everyday money strategies.