SBA Microloans: The Best Small Business Loan You’ve Probably Never Heard Of

5.5 min read

Updated: Dec 22, 2025 - 09:12:30

For U.S. entrepreneurs shut out of traditional bank financing, microloans offer a lifeline, typically up to $50,000, for starting or expanding a small business. The SBA, USDA, and nonprofit lenders like Accion Opportunity Fund and Kiva provide accessible funding paired with training and technical support. While rates are higher than bank loans, microloans can bridge early funding gaps for entrepreneurs, women founders, and small-scale farmers who lack collateral or credit history.

- Loan size & terms: SBA microloans average $13,000, with repayment terms up to six years; USDA and Kiva offer similar caps of $50,000 or less.

- Eligibility: Startups and small businesses with limited or no credit; approval often based on business plan and repayment ability, not credit score.

- Interest & conditions: Capped by SBA rules, intermediary rate plus 7.75–8.5%; funds cannot be used for real estate or debt payoff.

- Trusted sources: Legitimate programs include SBA, USDA, Kiva, Grameen America, and certified CDFIs, avoid unregulated “microloan” lenders with unclear APRs.

- Key takeaway (2025): Microloans remain one of the most flexible startup finance tools for underbanked U.S. entrepreneurs seeking modest, mission-driven funding.

For entrepreneurs with big ideas but limited capital, the traditional banking system can be unforgiving. A thin credit file, lack of collateral, or simply being too small can shut the door to conventional business loans. That’s where microloans come in – a little-known but powerful financial tool that has quietly helped thousands of U.S. small businesses get off the ground.

What Is a Microloan?

In the U.S., a microloan typically refers to a loan of $50,000 or less, aimed at startups and small businesses that don’t qualify for conventional bank credit. The flagship program is the SBA Microloan Program, which provides funds to nonprofit intermediary lenders across the country. These local organizations receive capital from the SBA and then make loans to entrepreneurs in their communities.

The average SBA microloan is about $13,000, and repayment terms can be up to six years, depending on the borrower’s needs and the intermediary’s policies. The funds can be used for working capital, inventory, supplies, machinery, or equipment – but not for real estate or paying off existing debts, according to the SBA’s official guidelines.

Beyond the SBA, other legitimate microloan programs operate in niche areas. The USDA Farm Service Agency runs a parallel program offering simplified microloans of up to $50,000 to help small, beginning, and niche farmers. Nonprofit networks such as Accion Opportunity Fund and various Community Development Financial Institutions (CDFIs) serve borrowers who are often overlooked by traditional lenders.

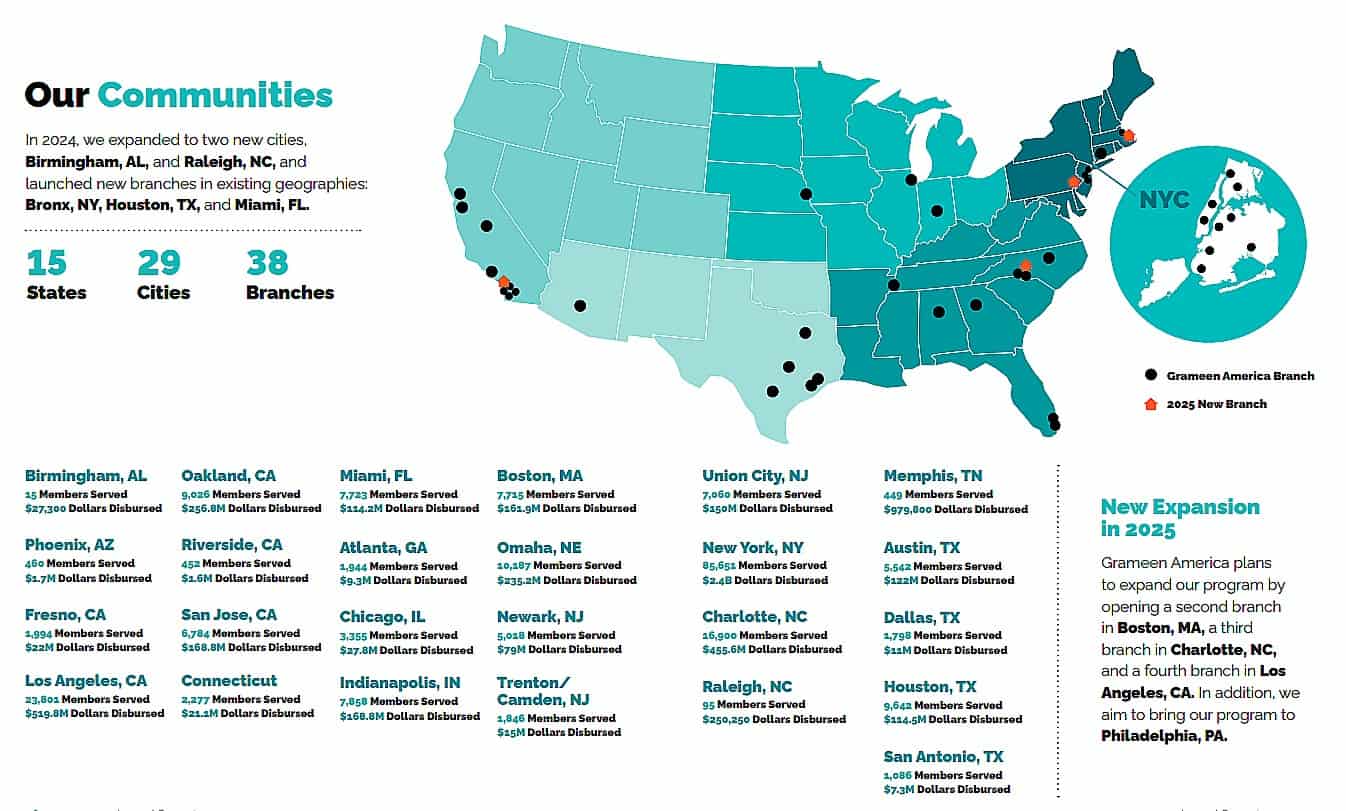

Meanwhile, Kiva U.S. offers zero-interest, fee-free microloans crowdfunded from the public – a unique option for very small startups. Programs like Grameen America focus on women entrepreneurs and use peer-group lending without credit scores.

Grameen Locations. Source: Grameen Annual Report

Who Qualifies

Microloans are designed to reach borrowers who have limited access to conventional credit. Applicants must demonstrate their ability to repay – usually through a business plan, cash-flow projections, or early revenue – but many intermediaries work with borrowers who have little or no credit history. Some even make training or business counseling a condition of the loan, a feature baked into many SBA microloan partnerships.

Women entrepreneurs, immigrants, and first-time business owners are well-served by peer-based programs like Grameen America, which does not use credit scores and instead relies on weekly group meetings and shared accountability. Farmers and ranchers can turn to USDA microloans, which use a simplified application process tailored for new and small-scale agricultural businesses.

How to Apply

Source: SBA.gov

Unlike other SBA loans, you don’t apply directly to the federal government. Instead, borrowers find a local intermediary lender via the SBA’s state-by-state directory. These intermediaries evaluate applications and set loan terms within SBA guidelines.

Applicants typically submit a business plan, recent tax returns or bank statements, proof of identity and business licenses, and sometimes collateral. By law, the maximum interest rate is the intermediary’s SBA borrowing rate plus 7.75 percentage points for loans over $10,000 or 8.5 points for smaller loans.

For Kiva loans, the process is different: applicants fill out an online form, then complete a brief “private fundraising” phase by gathering support from friends or family before the loan is made public for crowdfunding. Kiva loans are 0% interest with no fees, but the process typically takes several weeks.

The Upside

For entrepreneurs who have been turned down by banks, microloans can be a bridge to opportunity. While the loan amounts may be modest, they will cover critical startup costs – inventory, equipment, or working capital – that can mean the difference between a good idea and a functioning business.

Many intermediaries also offer training and technical assistance alongside financing. The SBA emphasizes this support as a core part of the microloan program, which can be especially valuable for first-time founders navigating their early growth stage.

The Downside

Microloans are not a silver bullet. Interest rates are higher than conventional bank loans, reflecting the higher administrative costs of managing many small accounts. Some intermediaries have waitlists, require borrowers to complete training before funds are disbursed, or limit the size of first-time loans.

Borrowers must also use the funds for specific business purposes; SBA microloans cannot be used to pay off existing debt or purchase real estate. And while approval criteria are more flexible than bank loans, applicants still need to show repayment capacity.

Another issue is the lack of uniform disclosure rules for small business lending. Unlike consumer loans, business loans are not subject to the federal Truth in Lending Act. States like California and New York have introduced their own disclosure requirements, but in many states, transparency is limited.

Predatory online lenders and merchant cash advance companies sometimes advertise “microloans” with opaque pricing and triple-digit APRs, so borrowers need to read contracts carefully and stick to trusted programs like the SBA, USDA, Kiva, or recognized CDFIs.

A Growing but Misunderstood Sector

Microloans occupy a unique space in the American lending landscape. They’re neither charity nor conventional commercial finance. At their best, they provide critical capital and support to entrepreneurs who are locked out of traditional credit markets. But success depends on understanding the terms, vetting the lender, and using the funds strategically.

For U.S. entrepreneurs who do their homework, legitimate microloan programs – whether through the SBA, USDA, Kiva, Grameen America, or CDFIs – can offer exactly what’s needed to take the next step.

Related: This article is part of Mooloo’s Business & Entrepreneurship Hub, covering how businesses are started, financed, scaled, and protected over time.