Emergency Fund Size: Why 3 Months Isn’t Enough Anymore

5 min read

Updated: Dec 20, 2025 - 12:12:30

The old rule of keeping three months of expenses in cash is outdated. With job searches averaging over five months, rising healthcare costs, and record-high credit card debt, households today need at least six to twelve months of savings to stay financially secure. A properly sized emergency fund protects against debt traps, medical shocks, and prolonged income gaps, making it an essential buffer in today’s economy.

- Save more than three months: Experts now recommend 6–12 months of expenses; $18,000–$36,000 for a $3,000/month household.

- Job loss risk: Median job searches last 5+ months, often outlasting small emergency funds.

- Healthcare and caregiving: Medical bills and unpaid leave remain leading causes of financial strain.

- Where to keep funds: Favor FDIC-insured high-yield savings, money market accounts, or partial CDs, avoid stocks and crypto for safety.

- Build steadily: Automate contributions, set milestones ($1,000 → 1 month → 6–12 months), and replenish after use.

For decades, financial advisors preached the same rule of thumb: keep three months’ worth of expenses in cash. This advice once made sense in an era of stable jobs, lower costs, and shorter unemployment spells. But today’s economy tells a different story. Rising living expenses, unpredictable medical bills, and prolonged job searches reveal that the three-month rule is outdated. Building a larger emergency fund is no longer optional, it’s essential.

What Is an Emergency Fund?

An emergency fund is money set aside for unexpected events such as job loss, medical bills, or urgent home repairs. Its purpose is simple: to protect you from turning to high-interest credit cards or loans when life throws a financial curveball. Unlike investments, which are designed for long-term growth, an emergency fund prioritizes safety and liquidity.

The Federal Reserve’s Survey of Household Economics and Decisionmaking (SHED) shows that nearly 37% of U.S. adults would struggle to cover an unexpected $400 expense without borrowing or selling assets. That number alone underscores how underprepared many households remain.

Why the Three-Month Rule Is Outdated

The origins of the three-month guideline date back to a time when the economy was more forgiving. Jobs were plentiful, healthcare costs were manageable, and everyday expenses made up a smaller slice of income. That’s no longer the case.

-

Rising living costs: Housing, food, and healthcare have consistently outpaced wage growth. According to the Federal Reserve Survey of Consumer Finances (SCF), household budgets are tighter than ever, leaving little margin for unexpected costs.

-

Longer job searches: The Federal Reserve’s Economic Well-Being reports reveal that the median job search now lasts more than five months. A three-month fund often runs dry before new income begins.

-

Health and caregiving risks: Academic studies on financial stress and health show that medical bills and unpaid caregiving leave are two of the most common drivers of financial crises. These costs can exhaust a small savings buffer in weeks.

Together, these realities prove that the three-month standard is no longer a reliable safeguard.

How Much Should You Save Today?

Most financial experts now recommend saving at least six months of expenses, with nine to twelve months being ideal for households with unstable income or dependents.

To put that into perspective: if your household spends $3,000 per month, a six-month emergency fund would equal $18,000, while a twelve-month reserve would total $36,000.

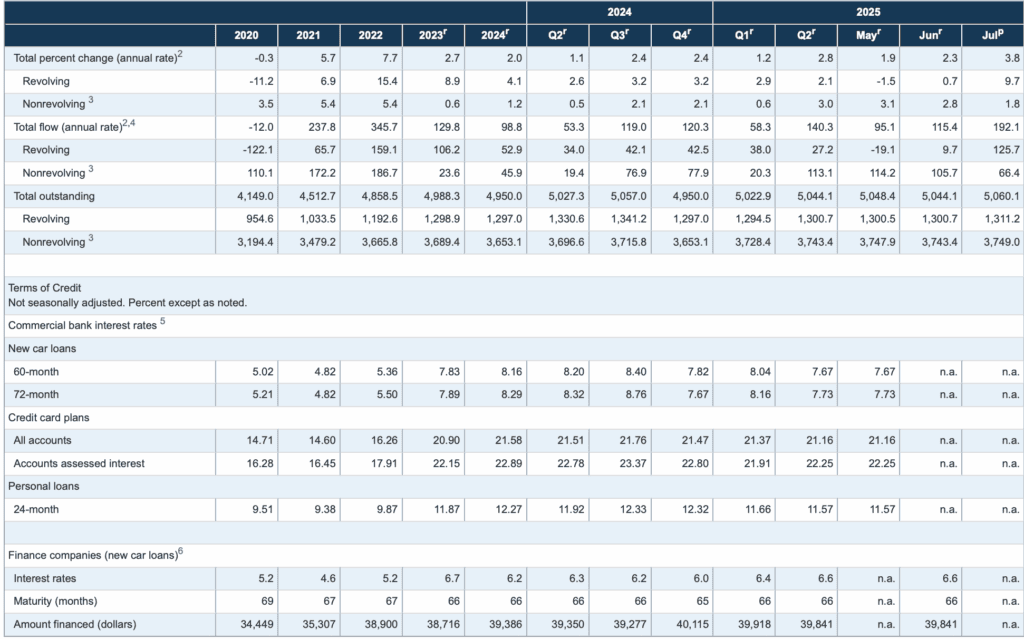

Why aim higher? Because when households fall short, they often fall back on debt. Federal Reserve consumer credit data shows credit card balances reaching record highs, proving that many Americans rely on credit instead of savings when emergencies strike. This reliance not only adds financial strain but also undermines long-term financial security.

Source: Federal Reserve

Factors That Change Your Emergency Fund Size

The right amount varies depending on personal circumstances:

-

Job type and stability: A salaried engineer in a recession-resistant field may need less than a freelancer whose income fluctuates.

-

Household size and dependents: Families with children or aging parents face greater unpredictability and higher expenses.

-

Health, insurance, and caregiving needs: Households with high deductibles, chronic conditions, or family caregiving responsibilities should aim for the upper range.

-

Location and cost of living: Living in expensive urban areas significantly increases the size of the safety net required.

Where to Keep Your Emergency Fund

The goal of an emergency fund is safety and accessibility. It should be liquid and separate from everyday spending. The best options include:

-

High-yield savings accounts (HYSA): FDIC-insured, easy to access, and offering interest above traditional savings.

-

Money market accounts: Provide liquidity and often slightly better yields.

-

Certificates of deposit (CDs): Suitable for a portion of the fund if you can commit to not touching the money for a set period.

Avoid volatile investments like stocks or crypto. Behavioral economics research highlights that funds must be readily available in a crisis, otherwise, people hesitate to use them or are forced to liquidate at a loss.

How to Build Your Fund Steadily

A robust emergency fund doesn’t happen overnight, but small, consistent steps make it achievable:

-

Automate savings: Behavioral economics studies show that automation removes the psychological barrier of decision-making and builds discipline.

-

Set milestones: Begin with $1,000, then progress to one month, three months, and ultimately six to twelve months of expenses.

-

Replenish after use: If you tap into your emergency fund, make rebuilding it a top financial priority.

This steady approach ensures your fund keeps growing without overwhelming your budget.

Conclusion: A New Standard for Financial Resilience

The three-month emergency fund rule may have worked for previous generations, but in today’s economic climate it falls short. With job searches lasting longer, healthcare costs rising, and credit card debt climbing, the modern household requires six to twelve months of expenses saved.

The message is clear: a larger emergency fund is no longer a luxury, it is a necessity. Review your savings annually to ensure your safety net matches your life, risks, and financial goals. Building this buffer not only protects your wallet but also strengthens your peace of mind.

Related: Explore more financial guidance in our Personal Finance Hub, covering budgeting, saving, banking, insurance, and everyday money strategies.