Choosing Your Crowdfunding Path: Which Platform Matches Your Business Model?

9 min read

Updated: Dec 20, 2025 - 12:12:41

The global crowdfunding market is projected to hit $20.46 billion in 2025, but with average success rates stuck near 22%, most campaigns still fail. The difference between success and stagnation lies in selecting the specific ‘crowdfunding model’ that best aligns with your business stage, goals, and audience engagement. Each pathway, reward, equity, donation, subscription, or debt, serves a distinct funding purpose and carries unique trade-offs. Below are the key takeaways to help entrepreneurs choose wisely.

- Reward-based crowdfunding (Kickstarter, Indiegogo) suits product launches or creative projects. Kickstarter’s 41% success rate and $7.6B pledged prove momentum and strong visuals drive results.

- Equity crowdfunding (Wefunder, StartEngine, Republic) fits startups raising $500K–$5M under Reg CF or Reg A+. Compliance-heavy but offers long-term capital and brand investors.

- Donation-based crowdfunding (GoFundMe, Mightycause) powers charitable and personal causes. GoFundMe users have raised over $30B, though only ~17% of campaigns reach full goals.

- Subscription/patronage models (Patreon) enable recurring income for creators. As of August 2025, Patreon charges ~10% for new creators, rewarding sustained community engagement over one-time campaigns.

- Debt/revenue-share crowdfunding (Honeycomb Credit, SMBX) offers loans or “Small Business Bonds” for revenue-positive small businesses, ideal for founders seeking growth capital without equity dilution.

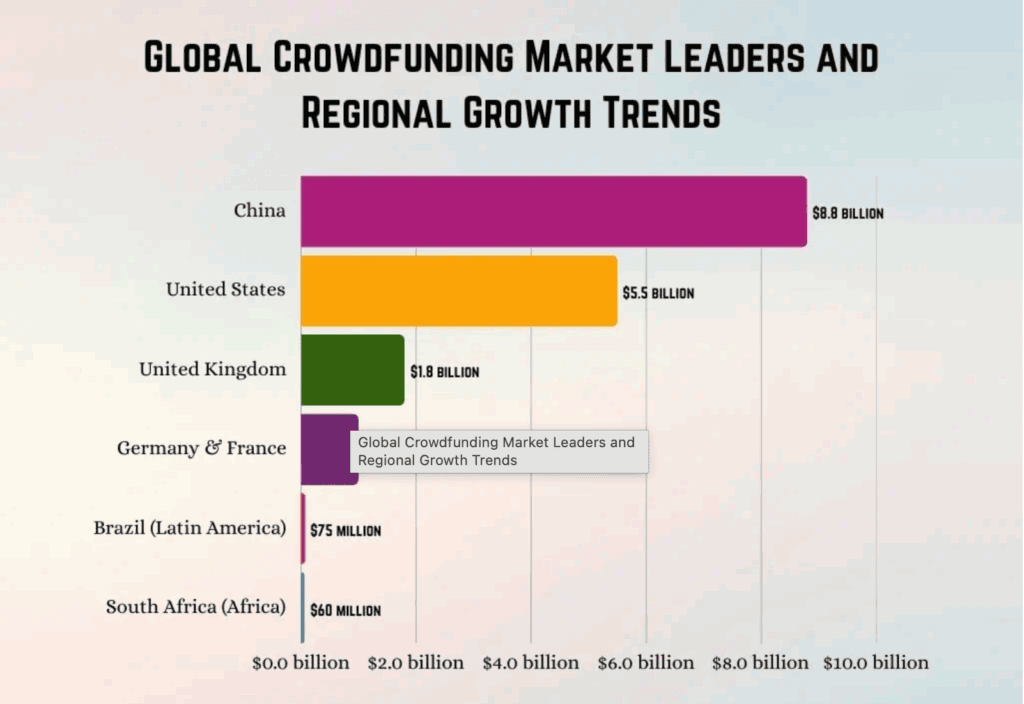

The global crowdfunding market has surged from $17.72 billion in 2024 to $20.46 billion in 2025, marking one of the fastest-growing segments in alternative finance. Yet despite this growth, the average campaign success rate remains just 22.4%, leaving most entrepreneurs questioning where they went wrong.

Source: CoinLaw

The truth is, crowdfunding is not a one-size-fits-all model, and choosing the wrong path can derail even the most promising idea. Understanding the distinct types of crowdfunding and aligning them with your business model is the difference between success and stagnation.

The Four Crowdfunding Pathways

1. Reward-Based Crowdfunding (Product Pre-Sales)

Reward-based crowdfunding, popularized by Kickstarter and Indiegogo, is ideal for entrepreneurs offering tangible products or creative projects. It lets founders raise capital without giving up equity by offering backers early access or special rewards.

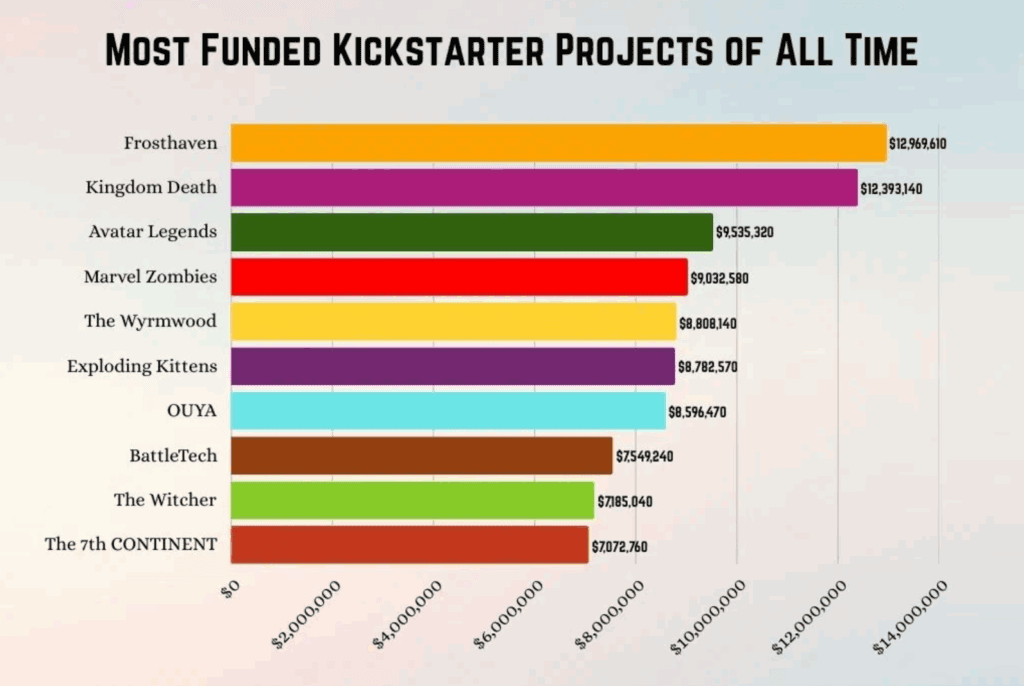

Kickstarter remains the leader here and uses an all-or-nothing model: if the funding goal isn’t met, backers aren’t charged. Its overall success rate is reported around 41%, with more than $7.68B pledged across 609k+ projects.

Source: CoinLaw

In contrast, Indiegogo historically offered “flexible funding,” but as of September 25, 2025, it has retired Flexible Funding and now launches campaigns with Fixed Funding only.

Product category matters. Verified platform data show:

-

Tabletop Games: ~80% success rate in 2024 )

-

Comics: ~66% success rate

-

Technology: ~25% success rate

Momentum and presentation also move the needle. Kickstarter’s data shows 79% of projects that raise more than 20% of their goal end up funded, a key early milestone. Academic research further supports that campaigns with strong videos and visuals perform significantly better, though exact lifts vary by study.

Historic campaigns underline the upside: Pebble Time raised $20,338,986 from 78,471 backers, while Exploding Kittens drew 219,382 backers and $8.78M – proof that creative storytelling and audience engagement drive crowdfunding success.

2. Equity Crowdfunding (Investment for Ownership)

Equity crowdfunding has become a cornerstone of startup finance, allowing both accredited and non-accredited investors to buy shares in early-stage companies. Platforms like Wefunder, StartEngine, and Republic, collectively recognized as the “Big Three”, have democratized access to private markets.

Under Regulation Crowdfunding (Reg CF), startups can raise up to $5 million within a 12-month period, while Regulation A+ expands that limit to $75 million with additional SEC oversight and compliance requirements.

Wefunder has helped startups raise over $600 million in total from hundreds of thousands of investors, charging a 7.5–7.9% success fee depending on campaign structure.

StartEngine, which acquired SeedInvest in 2023, has facilitated more than $1 billion in investments across 1,000+ companies by 2024, solidifying its position as the largest equity-crowdfunding platform in the U.S.

Republic has surpassed $120 million raised for over 200 companies since inception, with a growing user base exceeding 1 million, expanding its reach into real estate and blockchain ventures.

Real-world campaigns highlight the sector’s potential: Monzo Bank raised £1 million in 96 seconds on Crowdcube, while Miso Robotics secured more than $16 million via SeedInvest to fund its AI-powered kitchen assistant Flippy.

Equity crowdfunding best suits founders seeking $500,000 to $5 million who have measurable traction and are prepared to offer 10–20% equity. While campaigns demand strict regulatory compliance, transparent financials, and investor engagement, the trade-off is substantial scalable capital and a community of long-term brand advocates.

3. Donation-Based Crowdfunding (Charitable & Personal Causes)

Donation-based crowdfunding thrives on empathy and social connection. Platforms like GoFundMe, Mightycause, and GiveSendGo empower individuals, nonprofits, and communities to raise funds for medical expenses, emergencies, or charitable causes.

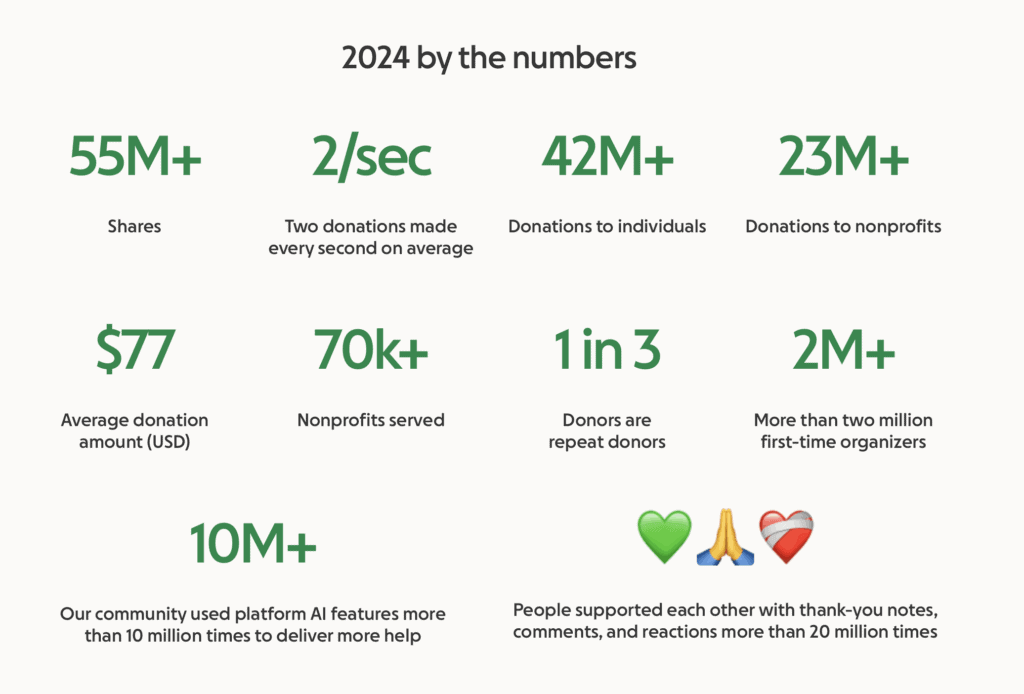

As of early 2024, GoFundMe’s giving community had raised more than $40 billion since its 2010 launch, supported by over 190 million people worldwide. The platform reports that each share generates about $13 in donations, while shares from donors add around $15, illustrating the viral impact of social engagement.

However, success isn’t guaranteed. Independent analyses show that only about 17 percent of GoFundMe campaigns, especially those for medical or emergency needs, reach their stated goals, while many still receive partial funding.

The average donation has risen in recent years, reaching roughly $77 per donor in 2024, according to GoFundMe’s Year in Help report. Although the platform doesn’t disclose official mobile usage rates, most industry estimates indicate that a majority of contributions now occur on mobile devices, reflecting donors’ shift toward convenience and immediacy.

Source: GofundMe

During Hurricane Helene 2024, thousands of campaigns mobilized support across the Southeast. GoFundMe partnerships with relief organizations such as Bonterra and United Way of North Carolina collectively raised tens of millions for recovery efforts, showing how digital generosity can rapidly scale into community-wide impact.

4. Subscription/Patronage Model (Recurring Revenue)

For creators who produce ongoing content, such as writers, musicians, podcasters, and YouTubers, Patreon has transformed how fans support creators. Instead of one-time campaigns, Patreon enables recurring monthly or per-creation payments through tiered memberships offering exclusive perks and behind-the-scenes access.

Founded in 2013 by Jack Conte and Sam Yam, Patreon has grown into a leading platform for creative sustainability. As of August 2025, it applies a 10% platform fee for new creators, while existing users retain legacy rates of 5%, 8%, or 11% depending on their plan, plus varying payment processing and payout fees of roughly 3%.

Although Patreon does not publish official success rates, many top creators reportedly earn full-time incomes by cultivating loyal subscriber bases. According to CBS News, hundreds of thousands of creators now use the platform for regular income. This model best suits creators with established audiences who value long-term connection over one-time transactions, turning followers into paying supporters who help sustain consistent creative output.

5. Debt/Revenue-Share Crowdfunding

Debt-based crowdfunding, led by platforms like Honeycomb Credit, SMBX, and formerly MainVest, offers small businesses an alternative to traditional bank loans. Through this model, entrepreneurs raise capital from individual investors, often community members, and repay it with fixed interest or as a percentage of future revenue, depending on the platform’s structure.

These models gained visibility during 2022 when Honeycomb, SMBX, and MainVest ranked among the top 10 Reg CF portals by funds raised, though MainVest officially shut down operations in mid-2024. Honeycomb specializes in funding local community-based businesses, while SMBX focuses on “Small Business Bonds” that provide fixed monthly interest returns to investors.

For business owners with steady revenue but limited access to traditional financing, this model enables growth without surrendering equity. It’s especially popular among restaurants, retailers, and social enterprises seeking transparent, community-backed funding solutions that preserve independence.

Making Your Decision: The Critical Questions

Question 1: What are you willing to give up?

Nothing → Donation-based crowdfunding (GoFundMe)

Products/rewards → Reward-based crowdfunding (Kickstarter/Indiegogo)

Equity/ownership → Equity crowdfunding (Wefunder/StartEngine/Republic)

Ongoing memberships or content → Subscription-based funding (Patreon)

Future repayment with interest → Debt-based crowdfunding (Honeycomb Credit/MainVest/SMBX)

Question 2: What stage is your business?

Idea or prototype → Reward-based (validate demand before launch)

Early traction → Equity crowdfunding (attract early investors)

Established revenue → Debt crowdfunding or equity (expand with capital)

Ongoing creative or educational content → Patreon (build recurring income)

Question 3: How much time can you dedicate?

Emergency or short-term need → Donation-based (fastest setup and funding)

3–4 months for intensive campaign preparation → Reward-based or equity crowdfunding

Long-term relationship and community building → Patreon (sustained support model)

Question 4: What’s your network size?

The first 25–35% of your goal typically comes from your existing network. If you don’t already have an engaged audience, focus on building one before launching, early traction strongly influences campaign visibility and success.

Success Rate Reality Check

The global crowdfunding industry averages an estimated 22–23% success rate across all campaign types, but results vary significantly by platform and model. Reward-based crowdfunding consistently performs best, with success rates ranging between 35% and 40%, led by Kickstarter, which reports an average of around 39% across its projects. Indiegogo campaigns perform lower, generally between 18% and 30%, while GoFundMe sees roughly one-quarter of campaigns reach their funding targets, though many still secure partial funding and donor support.

Equity crowdfunding maintains an approximate 20% success rate, reflecting its higher risk and stricter regulatory standards. Although exact platform comparisons fluctuate yearly, these averages highlight how campaign type and execution strategy heavily influence outcomes.

One major differentiator is video content. Campaigns featuring videos typically raise up to twice as much as those without, according to Kickstarter and Fundera data, underscoring how visual storytelling can boost trust and engagement. Preparation also plays a pivotal role: research from Kickstarter’s public data shows that projects with clear planning, realistic goals, and strong community outreach are far more likely to succeed, often outperforming repeat creators who rely solely on prior experience.

Final Recommendation: Start With Strategy, Not Platform

Too many entrepreneurs choose a crowdfunding platform before defining their strategy. The first step is to clarify what you’re offering, equity, products, nothing, or content, and then identify your audience. Do you already have 1,000 true fans, or do you still need to find them? Set realistic goals, as over half of all successful campaigns raise between $1,000 and $9,999 on Kickstarter, proving that modest targets often lead to higher success odds.

Once your foundation is clear, choose a platform that aligns with your needs and prepare meticulously, because every successful campaign reflects strong pre-launch planning. Research consistently shows that campaigns with solid preparation and early momentum perform significantly better, with the overall crowdfunding success rate averaging just 22–24% across all platforms according to ABSRBD, while Kickstarter maintains a higher ~41% success rate.

The crowdfunding landscape has evolved into distinct ecosystems, each with its own culture, rules, and success factors, from reward-based pre-sales to equity, lending, and donation models. Understanding these nuances is essential to transforming your vision into reality. The question isn’t whether you should crowdfund, but which crowdfunding path best matches your business model, answer that correctly, and you’re already ahead of the majority who fall short of their goals.

Related: This article is part of Mooloo’s Business & Entrepreneurship Hub, covering how businesses are started, financed, scaled, and protected over time.