Bitcoin vs Gold: Strategic Allocation for Maximum Portfolio Impact

5.9 min read

Updated: Jan 19, 2026 - 05:01:52

In 2025, Bitcoin is trading above $116,000 while Gold has hit record highs over $3,800. Both assets are surging, but for different reasons: Bitcoin’s rally is driven by post-halving supply shocks and ETF adoption, while Gold’s strength stems from central bank buying and geopolitical risk. For investors, the choice isn’t “either/or” anymore. A blended allocation provides stability from Gold and growth potential from Bitcoin, especially in an era of high U.S. debt, expected Fed rate cuts, and rising currency debasement fears.

- Bitcoin upside: Spot ETFs (IBIT, ARKB) have attracted $17.8B in inflows, post-halving supply is tightening, and projections see $150K–$200K by year-end (CoinShares, VanEck, Standard Chartered).

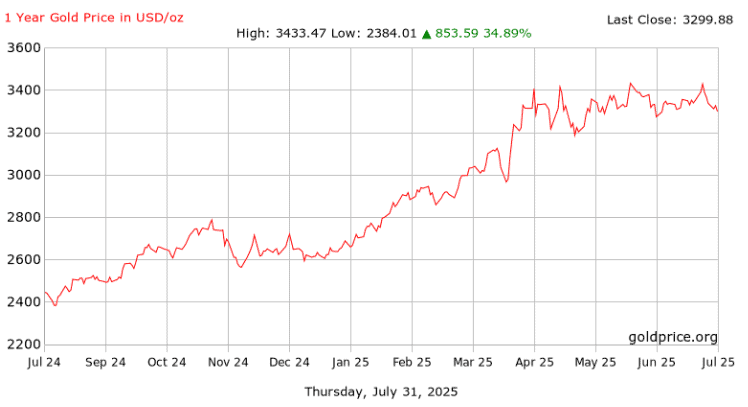

- Gold stability: Prices are up +34.89% YTD (as of July 31, 2025), supported by record central bank purchases (World Gold Council) and capped annual mining output.

- Costs & access: ETFs remain cheapest—IAUM (0.09%) for Gold vs ARKB (0.21%) for Bitcoin—while physical Gold and direct Bitcoin ownership carry higher storage and custody risks (U.S. News).

- Portfolio allocation: Institutions suggest 5–15% in Gold and 1–5% in Bitcoin; Fidelity notes even a 1% BTC allocation boosts portfolio volatility but can enhance returns.

- 2025–2026 outlook: Fed rate cuts, $35T+ U.S. debt, and geopolitical tension provide tailwinds. Gold offers proven wealth preservation, while Bitcoin acts as a high-growth accelerator.

In 2025, two of the most talked-about assets, Bitcoin and Gold, are both experiencing explosive momentum, yet their stories couldn’t be more different.

Bitcoin is trading at $111,845 following a powerful post-halving rally. Projections from major investment firms suggest it could reach $150,000 to $200,000 by year-end, driven by spot ETF adoption, growing institutional demand, and tightening supply.

On the other hand, Gold has soared to an all-time highs over $3,800 per ounce, posting +34.89% year-to-date as of July 31, 2025, fueled by sustained central bank accumulation and mounting geopolitical tensions.

This parallel rally has reignited a longstanding debate: Bitcoin vs Gold, which asset deserves a place in your portfolio?

Bitcoin Gains Ground with Institutions, Gold Holds Its Stronghold

Bitcoin’s credibility as a mainstream investment asset has matured significantly in 2025. Since the approval of U.S. spot Bitcoin ETFs in January 2024, funds like BlackRock’s IBIT and ARKB by ARK Invest have attracted $17.8 billion in total inflows, according to CoinShares.

The 2024 halving slashed Bitcoin’s block rewards to 3.125 BTC, reducing the rate of new issuance by 50%. This supply shock, combined with increasing demand, has driven exchange outflows to their highest level since March 2022, according to Glassnode.

Gold, meanwhile, has remained rock-solid. According to the World Gold Council, central banks purchased 1,045 tonnes in 2024, and Q1 2025 marked a new quarterly record with 244 tonnes added. Countries such as India, Poland, and Turkey continue to de-dollarize their reserves, increasing their Gold holdings as a long-term safe haven.

Macro Tailwinds Are Benefiting Both

The macro environment in 2025 is uniquely supportive for both assets. With the Federal Reserve expected to cut rates from 5.25% to 3.25% by early 2026 (Reuters), non-yielding assets like Gold and Bitcoin are increasingly attractive.

Additionally, U.S. debt levels exceeding $35 trillion, rising trade tensions, and persistent currency debasement fears are pushing both institutional and retail investors toward hard assets. Both Bitcoin and Gold benefit from this narrative, though for different reasons.

Cost of Investment: ETFs Make It Easy

For most investors, low-cost ETFs offer the best way to gain exposure. Here’s how the most efficient options stack up:

-

Bitcoin ETFs:

-

Gold ETFs:

Direct Bitcoin ownership via exchanges like Kraken costs 0.16% to 0.26% in trading fees. Custody can be free if self-stored, but it requires secure key management. Physical Gold, meanwhile, incurs dealer premiums of 1%–5% and storage fees ranging from 0.12% to 0.72% annually (U.S. News).

Cost Comparison (on a $10,000 investment):

-

Bitcoin via ARKB ETF: $21/year

-

Bitcoin via Kraken: ~$26/year

-

Gold via IAUM ETF: $9/year

-

Gold (physical): $239–$572/year

Unless you need 24/7 trading or off-grid custody, ETFs are clearly more efficient for most.

Volatility, Regulation, and Correlation Differences

Bitcoin’s 30-day volatility often exceeds 50%, occasionally spiking to 80%+ during macro shocks. In contrast, Gold volatility remains around 12%, making it more stable and predictable.

Correlation also matters. Gold has almost zero correlation with equities (−0.01 with the S&P 500), according to Investing.com. Bitcoin, however, behaves more like tech stocks during market stress. In April 2025, its correlation with the S&P 500 surged to 1.0, per Bloomberg.

Source: Bloomberg

Regulatory clarity favors Gold. Bitcoin still faces challenges, especially as IRS crypto reporting rules kick in for U.S. investors in 2025 (IRS). While the Biden administration has softened its stance on crypto, inconsistencies across jurisdictions remain.

Gold enjoys well-established global regulations, transparent tax treatment, and widely available custodial infrastructure.

Institutional Allocation Strategies

Major institutions now offer clear frameworks for allocation:

-

BlackRock: Recommends 1–2% Bitcoin, calling it the “Goldilocks zone”

-

Fidelity: Suggests 2–5% Bitcoin

-

VanEck: Allocates up to 6% in BTC and ETH combined

-

Ray Dalio: Prefers Gold (5–15%) over Bitcoin for wealth preservation

Investor Allocation Examples:

| Profile | Bitcoin | Gold |

|---|---|---|

| Conservative | 1–2% | 5–10% |

| Balanced | 2–4% | 3–7% |

| Growth-Oriented | 5–6% | 1–3% |

A Fidelity study found that a 1% allocation to Bitcoin adds 2.7% to total portfolio volatility, while a 2% allocation mimics the risk of holding top tech stocks.

Investment Goals Determine Optimal Choice

Inflation Hedge:

Gold continues to perform well in 2025, supported by its century‑long track record, including a 2,300% surge during the 1970s inflation crisis. As of June 30, 2025, spot gold is up 26.0% year‑to‑date, while Bitcoin has increased by approximately 26.1%

Capital Appreciation:

Bitcoin offers more upside. Projections from VanEck and Standard Chartered place year-end targets between $150,000 and $200,000, with longer-term estimates reaching $1 million by 2030.

Gold’s realistic range is $3,500–$3,900 short term and $5,155 by 2030, per State Street.

Diversification:

Bitcoin’s 10-year correlation with Gold is −0.01, and 0.15 with the S&P 500, excellent on paper. But during stress events, these correlations spike, reducing diversification benefits.

2025–2026 Outlook: The Case for Holding Both

Bitcoin tailwinds:

-

ETF adoption is accelerating

-

Post-halving supply dynamics are working

-

U.S. regulatory clarity is improving, especially with moves like the Strategic Bitcoin Reserve being considered (Bitcoin Magazine)

Gold tailwinds:

-

Central bank buying remains robust (81% plan continued accumulation)

-

Gold mining output remains capped at ~3,500 tonnes annually, limiting new supply

-

Ongoing geopolitical tension keeps safe-haven demand high

With both assets outperforming and offering different benefits, smart investors are no longer choosing one over the other, they’re choosing how much of each.

Practical Investment Framework

-

Start with Gold

Use ETFs like IAUM or GLDM for regulatory simplicity and low cost. Consider physical gold only if privacy or crisis preparation is key. -

Add Bitcoin strategically

Limit to 1–5% of your portfolio. Choose spot ETFs like IBIT or ARKB. Direct ownership is only recommended if you understand private key management. -

Rebalance quarterly

Bitcoin’s volatility demands active monitoring. Gold, being stable, can be funded from stocks or bonds; Bitcoin allocations should come from riskier equities.

Bottom Line

In 2025, Gold is your foundation, trusted, stable, and proven across generations. Bitcoin is your accelerator, volatile but with explosive growth potential.

Together, they form a powerful combo for navigating inflation, geopolitical risk, and market uncertainty. By allocating 5–15% to Gold and 1–5% to Bitcoin, investors can benefit from both resilience and upside in today’s evolving financial landscape.