AI-Driven Financial Planning vs Human Advisors

4.7 min read

Updated: Dec 21, 2025 - 09:12:33

Choosing between robo-advisors and human advisors isn’t about replacement, it’s about matching costs, outcomes, and complexity. Robo-advisors offer low-cost, automated portfolio management, while human advisors provide behavioral coaching, tax strategies, and personalized planning. Many investors now blend both approaches for efficiency and expertise.

- Costs: Robo-advisors average 0.25% AUM (e.g., Betterment, Wealthfront), while human advisors charge 0.5%–1.5% AUM or $150–$400/hour. Over decades, even 1% fee differences can reduce returns significantly.

- Behavior Gap: Investors often underperform due to poor timing. DALBAR (2025) found the average equity investor lagged the S&P 500 by 8.48 points in 2024; Vanguard research shows advisors may add 1–2% annually through coaching.

- Efficiency: Robo accounts open in minutes with daily rebalancing and tax-loss harvesting, while humans take weeks but adapt to complex events like retirement or inheritance.

- Trends: Robo assets are projected to hit $2.06T in 2025 (Statista), but J.D. Power reports 27% of investors still plan to hire an advisor, highlighting enduring demand for trust and judgment.

- Hybrid Use: Many investors use robo-advisors for ongoing management and consult humans during life transitions, reflecting the future of financial planning: automation plus expertise.

Financial planning is central to long-term stability, but approaches to guidance are changing. For decades, investors relied primarily on financial advisors to design personalized strategies, interpret tax rules, and provide accountability.

In recent years, algorithm-driven platforms, commonly called robo-advisors, have expanded rapidly, offering automated services at lower costs. Both approaches are now well established, and the question is not whether one will replace the other but how they differ in costs, outcomes, and suitability.

Cost Structures and Compounding Impact

Robo-advisors generally charge fees around 0.25% of assets under management (AUM). On an account worth $10,000, that equals $25 annually. Firms such as Betterment and Wealthfront use this model.

By contrast, human advisors usually charge 0.5%–1.5% of AUM, with flat fees ranging from $1,000 to $3,000 for comprehensive planning or hourly rates between $150 and $400. Over time, even small differences in fees are meaningful. The SEC highlights that a 1% annual expense can reduce long-term investment returns by tens of thousands of dollars when compounded over two decades.

Source: SEC

The numbers show that robo-advisors are more affordable. However, fees should be weighed against the scope of services, since humans often provide more comprehensive planning.

Investment Returns and Behavior

Performance data shows that the challenge for many investors is not market selection but behavior. The Morningstar Mind the Gap study found that investors underperformed their own funds by about 1.1–1.2 percentage points annually, largely due to poorly timed trades. The DALBAR Quantitative Analysis of Investor Behavior (2025)reported that in 2024, the average equity investor lagged the S&P 500 by 8.48 percentage points.

This “behavior gap” illustrates why guidance matters. Vanguard’s Advisor’s Alpha framework suggests that consistent coaching, discipline, and tax strategies from human advisors can add 1–2% annually to returns. Robo-advisors reduce impulsive trading by rebalancing mechanically, but they cannot anticipate emotional reactions during downturns or major life events.

Efficiency and Process

Opening a robo-advisor account can take under 10 minutes, with automated monitoring, rebalancing, and tax-loss harvesting applied daily or weekly depending on the platform. This ensures consistent rule application at scale.

By comparison, working with a human advisor is more time-intensive. A comprehensive plan can take weeks, requiring document collection, meetings, and detailed analysis. While slower, this process allows for adjustments based on context, such as career transitions, inheritance planning, or managing concentrated stock positions.

Automation offers speed and consistency, while human guidance adapts to nuance.

Adoption and Market Trends

Global assets managed by robo-advisors are projected to reach US$2.06tn in 2025, according to Statista. This reflects growing acceptance of automated solutions, particularly among younger investors.

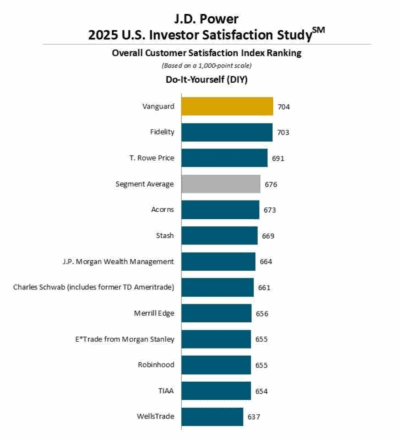

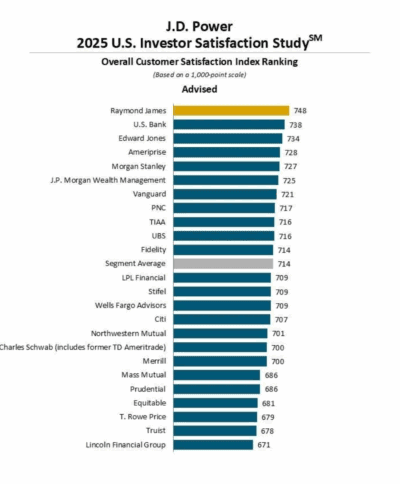

However, demand for personal advice remains. The J.D. Power 2025 U.S. Investor Satisfaction Study reported that 27% of self-directed investors intend to hire an advisor within the next year. Many begin with digital platforms but transition to hybrid or full-service advice as their finances become more complex.

Source: J.D. POWER

These findings suggest that automation addresses accessibility and cost, but trust and judgment continue to drive interest in human advisors.

Case Examples

-

Betterment provides a digital tier at 0.25% AUM and a premium tier with Certified Financial Planners for additional fees.

-

Wealthfront charges 0.25% AUM and applies daily tax-loss harvesting to taxable accounts.

Both publish methodologies and provide model performance data. In 2023, Betterment reached a settlement with the SEC over insufficient disclosure of its tax-loss harvesting practices, underscoring the importance of reviewing regulatory filings carefully.

These examples show how platforms balance automation with regulatory oversight, and why transparency is essential when evaluating providers.

Investor Experience and Blended Use

Research shows differences in what investors value. Vanguard’s studies highlight that human advisors add value through behavioral coaching, especially during volatility. J.D. Power found digital platforms score highly for convenience, while traditional firms earn higher marks for trust and confidence.

In practice, many investors adopt a blended approach: using robo-advisors for ongoing, low-cost portfolio management and consulting human advisors during major life transitions such as retirement, inheritance, or business sales.

Conclusion

Robo-advisors have become a standard option in financial planning, driven by low fees, accessibility, and automated efficiency. Human advisors continue to play a critical role where judgment, personalization, and accountability are required.

Rather than choosing one exclusively, many investors benefit from combining the two, leveraging algorithms for routine management while relying on professionals for complex decisions. This hybrid approach reflects the current direction of financial planning: efficiency supported by expertise.

Related: Explore more financial guidance in our Personal Finance Hub, covering budgeting, saving, banking, insurance, and everyday money strategies.