Chainlink’s Equity Data Launch: A Mixed Signal for LINK Investors in an Overhyped RWA Market

4.3 min read

Updated: Jan 20, 2026 - 10:01:07

Chainlink’s new Data Streams for U.S. equities and ETFs marks a technical leap beyond crypto-native oracles, signaling progress in real-world asset (RWA) tokenization. Yet, LINK investors face a disconnect: despite these advancements, the token remains stuck near $16.30 after volatility in 2025, underperforming broader crypto markets. With regulatory hurdles, slow adoption, and competitive threats from rivals like Pyth, Chainlink’s tech progress has yet to translate into token price appreciation.

- LINK price lag: Trading near $16.30 after a 2025 peak close to $20, LINK has struggled to sustain bullish momentum, with projections ranging from $15–17 to as high as $32.

- RWA adoption gap: Despite trillion-dollar forecasts, tokenized assets (ex-stablecoins) stood at just $15.2B by end-2024, underscoring hype vs. reality.

- Regulatory + legal hurdles: Tokenization faces complex ownership laws and compliance gaps, slowing scalable adoption worldwide.

- Tokenomics drag: Node operator sell pressure and competition from newer oracles weigh on LINK despite infrastructure growth.

- Institutional pilots, not pivots: BlackRock’s BUIDL and other tokenization projects remain experimental; Bank of America estimates only ~$16B in tokenized assets mid-2024.

Chainlink has announced the launch of Data Streams for U.S. equities and ETFs, a technical milestone in its effort to expand beyond crypto-native oracles. But for investors holding LINK, this development arrives amid persistent underperformance and broader skepticism about the Real World Assets (RWA) sector’s near-term viability.

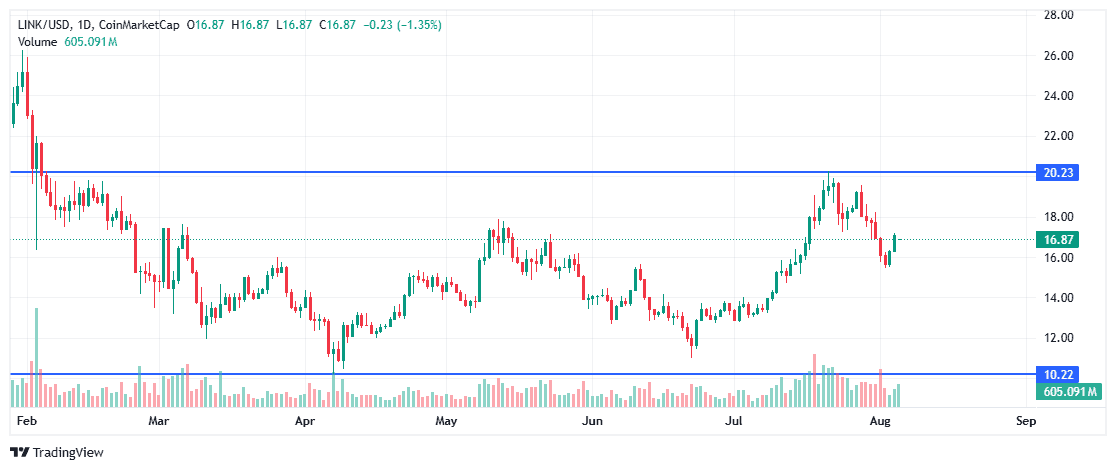

LINK’s Disappointing Price Performance

Throughout 2025, LINK has continued to lag behind broader crypto market movements. Currently trading around $16.30, the LINK price has exhibited notable volatility. After recently peaking near $20, LINK is now facing bearish pressure; it fell to approximately $10 in April, reinforcing its struggle to gain bullish momentum.

Source: CoinMarketcap

While some forecasts point to a potential rise toward $30 by the end of 2025, others offer more tempered projections in the $14.25 to $17.08 range. Despite Chainlink’s ongoing technological achievements, the LINK token has failed to reflect those advancements in price action.

The RWA Hype vs. Reality Check

Chainlink’s Data Stream product targets the growing interest in tokenized real-world assets, a sector often touted as the next trillion-dollar use case for blockchain. While industry projections suggest the RWA market could reach $30.1 trillion by 2034, current reality tells a different story, however, as actual adoption is lagging far behind the hype.

According to market data, the total tokenized RWA market (excluding stablecoins) reached just $15.2 billion by the end of 2024. Meanwhile, the Security Token Market estimates around $50 billion in tokenized assets across all classes, underscoring the significant gap between projections and implementation.

Source: Cointelegraph

Persistent Challenges in RWA Adoption

While infrastructure is developing, the RWA sector continues to face several roadblocks:

-

Regulatory Uncertainty: Legal frameworks for tokenization remain underdeveloped, varying widely across jurisdictions and complicating compliance for issuers and institutions. The importance of this cannot be overstated. Every country in the world has very specific and unique legal structures around the concept of ownership. The idea that these centuries old, and deeply embedded, legal structures can be easily ‘disrupted’ by smart contracts is arguably naive in the extreme.

-

Technical Limitations: The lack of widely accepted standards for tokenizing physical assets creates problems for interoperability, custody, and settlement.

-

Ownership Verification: Authenticating asset ownership on-chain remains a challenge, as blockchain alone cannot guarantee legal title transfer without robust off-chain verification systems. No country in the world currently has a working solution for this.

Token Infrastructure ≠ Token Performance

Despite the technological progress represented by the equity data streams, the market reaction has been muted, highlighting the disconnect between Chainlink’s infrastructure growth and LINK token appreciation.

One reason is the nature of LINK’s tokenomics. The token is used as compensation for node operators, who often sell LINK as part of their operations. This creates ongoing downward pressure. Additionally, Chainlink faces growing competition from newer oracles like Pyth Network and Witnet, which could erode its market dominance.

Institutional Interest: More Pilot Than Pivot

While Chainlink’s announcement highlights integrations with GMX and Kamino, institutional adoption remains cautious. Even high-profile entries such as BlackRock’s BUIDL tokenized fund, seen by some as a watershed moment, are still pilot programs rather than scalable solutions.

Further context comes from Bank of America, which estimates around $16 billion in tokenized assets as of mid-2024, a small fraction of global capital markets. Institutional curiosity, while growing, has not yet evolved into widespread adoption.

Bottom Line for LINK Investors

Chainlink’s equity data streams signal technical advancement and reinforce its position as a leading infrastructure provider in the blockchain space. However, the impact on LINK token holders remains muted.

The broader RWA narrative continues to suffer from execution risks, uncertain regulatory paths, and a significant gap between ambition and current adoption. While LINK might benefit in the long term if RWA tokenization gains traction, investors should temper expectations.

Price targets for LINK range widely, from conservative outlooks around $15–17 to optimistic projections as high as $32, reflecting the market’s uncertainty about both RWA timelines and Chainlink’s role within them.

Until those narratives materialize into measurable token demand, LINK is likely to remain in a holding pattern, supported by tech progress but weighed down by macro realities and competitive pressure.