Bitcoin Valuation Scenarios: Assumptions, Constraints, and Risk Factors

4.7 min read

Updated: Jan 20, 2026 - 10:01:54

Adamant Research’s 2025 report, How to Position for the Bitcoin Boom, projects a potential 4–10x price surge, supported by on-chain metrics, inflationary pressures, and accelerating institutional and government adoption. The analysis suggests Bitcoin remains mid-bull, with fundamentals strong and long-term risks manageable. For investors, strategic allocations between 5–50% may hedge against inflation, replace underperforming bonds, or serve as a high-upside retirement bet.

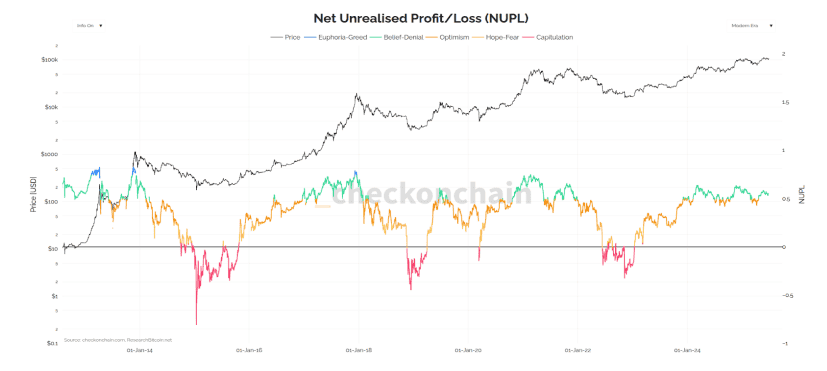

- Mid-Bull Market Signals: Glassnode’s NUPL metric shows sentiment at 50–70% unrealized profit, optimistic but far from euphoric highs of 85–95%.

- Macro Drivers: Persistent U.S. inflation (+40% since 2010), the collapse of the 60/40 portfolio, and real estate headwinds point investors toward alternative stores of value.

- Adoption Trends: U.S. corporations hold 2.5M BTC, ETFs account for 1.4M BTC, and policies like the GENIUS Act support integration; globally, Russia and Pakistan are adding reserves.

- Risks: Exchange hacks, rare government confiscation, and crisis-driven volatility remain, but long-term correlations with money supply suggest recovery benefits.

- Investor Positioning: Adamant outlines three approaches: 5% insurance hedge, 10% speculative exposure, or 20–50% allocation for early-retirement upside.

While much of the financial world remains fixated on traditional markets, Adamant Research’s latest in-depth analysis warns investors not to underestimate what may be one of Bitcoin’s most significant bull runs yet. The report, How to Position for the Bitcoin Boom, projects a potential 4–10x appreciation from current levels, implying price targets north of $500,000.

This is not speculative hype. The research draws on on-chain analytics, macroeconomic fundamentals, and institutional adoption patterns that together suggest Bitcoin is entering a “quiet strength” phase: rising conviction, healthy fundamentals, and accelerating corporate and governmental participation.

Blockchain Data Signals Mid-Bull Sentiment

Bitcoin’s transparent blockchain provides unmatched insight into market dynamics, allowing analysts to track investor behavior directly.

One of the most telling indicators, the HODLer Net Position Change, reveals whether large, long-term holders (“whales”) are selling into rallies or holding firm. Throughout 2025, there have been no net moves exceeding 100,000 BTC in a single day – a level historically associated with late-stage bull market selling. This suggests that sophisticated holders are not exiting, but instead retaining positions in anticipation of higher prices.

Source: Adamant Research Report

Similarly, the Net Unrealized Profit/Loss (NUPL) metric, as detailed in Glassnode’s NUPL methodology, shows 50–70% of all coins in unrealized profit, placing sentiment in the “hopeful-optimistic” zone typical of a mid-bull market. Historically, euphoria only sets in when this range climbs to 85–95%, leaving considerable room for growth.

Source: Glassnode

Macro Drivers Point Toward Higher Valuations

Adamant Research identifies several long-term economic shifts that could accelerate Bitcoin demand:

Persistent Inflation—Since 2010, U.S. consumer prices have risen over 40%, with inflation peaking at 9.1% in 2022, the highest in four decades. With Western governments running record debt and deficits, further currency debasement appears inevitable.

The Death of the 60/40 Portfolio – Bond markets have turned bearish after forty years of positive real returns. Negative inflation-adjusted yields mean bonds no longer hedge equity risk, forcing institutional investors to explore alternative stores of value.

Real Estate Headwinds – Representing 46% of global wealth, property markets face rising interest rates, aging demographics, and mounting maintenance costs, as outlined in McKinsey’s Global Balance Sheet report. Bitcoin offers liquidity, divisibility, and portability that real estate cannot match.

Potential Risks to the Bull Thesis

The report acknowledges that no asset, including Bitcoin, is without risk.

Primary risks include:

-

Large-scale exchange hacks that could temporarily dent confidence.

-

Government confiscation—historically possible but currently unlikely given the U.S.’s pro-Bitcoin policy stance.

-

Market crashes—while Bitcoin can drop sharply in crises, its long-term correlation with global M2 money supply suggests it often benefits from the monetary expansion that follows downturns.

Source: Julien Bittle

Strategic Bitcoin Allocations

Adamant Research proposes three portfolio approaches based on investor goals:

-

Bitcoin as Insurance (5%) – Like homeowners insurance, a modest allocation hedges against systemic financial risks.

-

Bitcoin as a Speculative Hedge (10%)—Offers exposure to a scarce, uncorrelated asset with global liquidity.

-

Bitcoin as an Early Retirement Bet (20–50%)—Aggressive positioning for those seeking potentially transformative returns if Bitcoin adoption accelerates.

Source: @w_s_bitcoin

Nation-State and Institutional Adoption Accelerating

The U.S. now leads global Bitcoin adoption, with corporations holding 2.5 million BTC, 1.4 million in ETFs, and 36% of global mining. Policies under the Trump administration, including the Strategic Bitcoin Reserve and GENIUS Act, signal integration rather than opposition.

Globally, Russia plans to issue Bitcoin bonds, and Pakistan has announced a Strategic Bitcoin Reserve alongside allocating 2,000 MW of energy for mining. Corporate actors like BlackRock and Japan’s Metaplanet are pushing adoption forward, making it increasingly difficult for governments to ignore Bitcoin’s economic relevance.

Secure Storage and Holding Strategies

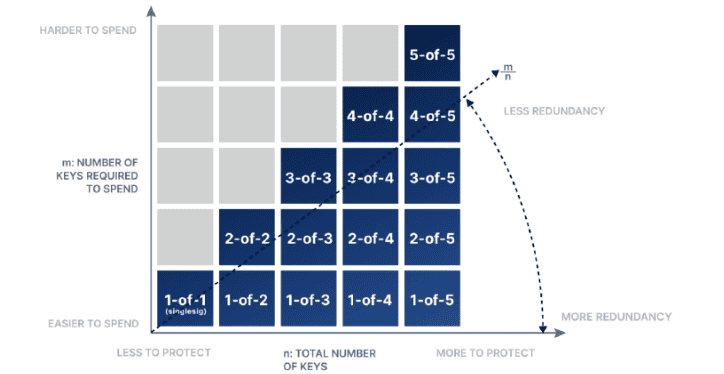

Owning Bitcoin demands a focus on custody. Adamant Research outlines options from hardware wallets for smaller holdings to multi-signature setups for large amounts to collaborative custody services for a balance between self-control and professional oversight.

Source: Unchained

Investors should choose between lump-sum and dollar-cost averaging approaches based on income patterns and risk tolerance. While lump-sum buying can capture gains sooner, DCA smooths volatility and emotional stress.

Conclusion: Positioning for the Potential $500K Era

With monetary instability, institutional adoption, and technological maturation converging, Bitcoin’s long-term investment case has rarely looked stronger. While volatility is inevitable, Adamant Research argues that the real risk lies in being unprepared for a historic wealth transfer.

For investors willing to embrace short-term turbulence, the current phase may be one of the last opportunities to establish a position before Bitcoin enters mainstream saturation.