Would a 50-Year Mortgage Fix Housing Affordability—or Just Inflate Prices Again?

7.7 min read

Updated: Dec 20, 2025 - 08:12:53

The 50-year mortgage is gaining attention as policymakers seek ways to ease affordability pressures amid record home prices and high interest rates. But while a longer term can lower monthly payments, it also dramatically increases total interest costs and inflates demand without adding new housing supply. The result: a temporary illusion of affordability that risks locking borrowers into lifelong debt and pushing prices even higher.

- A 50-year loan cuts monthly payments by roughly 9% compared to a 30-year term, but nearly doubles total interest costs over the life of the loan.

- Longer mortgages expand buying power, which can drive up home prices rather than improve affordability, echoing the 2000s credit boom and the 2020–2022 price surge.

- Slow amortization delays equity growth, keeping owners indebted longer and contributing to the “lock-in effect” that limits housing mobility.

- Housing economists and the U.S. Census Bureau estimate a 4.7 million–unit shortfall; easing credit without boosting supply risks worsening inflation in home values.

- The FHA currently allows 40-year modifications, but expanding to 50 years would mask structural shortages rather than solve them.

For nearly a century, the 30-year mortgage has been the cornerstone of homeownership in the United States. It emerged in the aftermath of the Great Depression, when the Federal Housing Administration (FHA) and later Fannie Mae restructured the housing market to make long-term, fixed-rate loans accessible to average families. The model proved effective, offering predictable payments, full amortization, and a payoff horizon that allowed many homeowners to retire without debt.

That stability, however, is now under strain. Home prices have far outpaced wage growth, while borrowing costs have surged from the ultra-low-rate era of the 2010s. In high-cost markets like California and New York, the 30-year mortgage increasingly feels less like a path to stability and more like a barrier to entry. Against this backdrop, policymakers and lenders are exploring 50-year mortgage options as a potential, though controversial, way to ease monthly payments and restore a measure of affordability.

Source: AP News

The Appeal — and the Hidden Cost

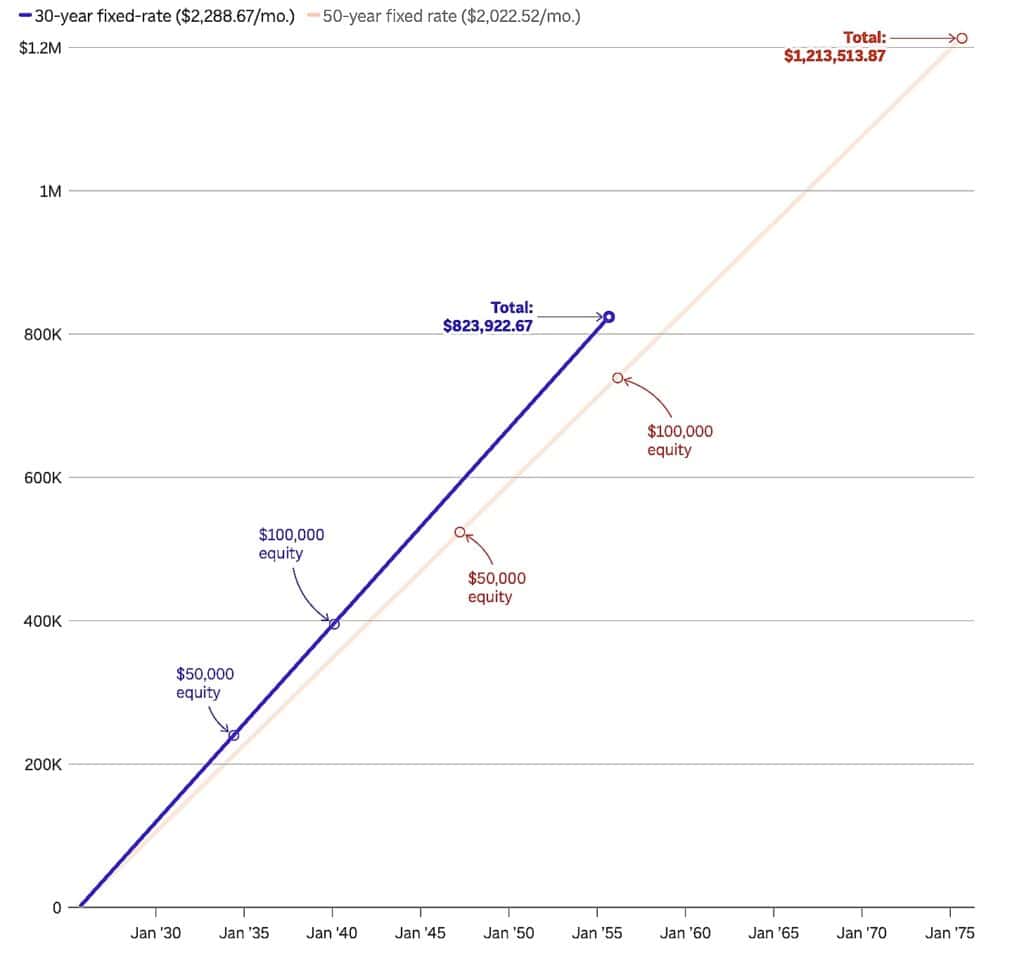

At first glance, the concept seems practical. Extending a loan’s term spreads repayment over more years, reducing the monthly burden. A $400,000 mortgage at a 6.5% fixed interest rate costs about $2,528 per month on a 30-year schedule, according to SoFi. Stretch it to 50 years, and the payment drops to roughly $2,300, a reduction of about 9%. For households living close to the edge, that difference can determine whether homeownership feels possible.

However, what looks like relief on paper carries a steep long-term cost. Because borrowers pay interest for two extra decades, the total interest paid nearly doubles. That same $400,000 loan would accrue about $510,000 in interest over 30 years, but close to $980,000 if stretched to 50 years, based on standard amortization formulas. The monthly payment is smaller, but the total cost of the home soars past $1.3 million. The trade-off is clear: lower payments today mean far greater debt tomorrow.

The Paradox of Affordability

This tension lies at the core of what housing economists often describe as the paradox of affordability. When credit becomes easier or cheaper, home prices tend to rise. Because housing supply is limited, expanded borrowing capacity doesn’t lower prices, it simply enables buyers to bid more for the same homes. A 50-year mortgage would not change that dynamic; it would likely amplify it.

History bears this out. In the early 2000s, the surge in adjustable-rate and subprime mortgages dramatically broadened credit access. Millions of Americans became homeowners, but when interest rates reset higher, defaults soared, triggering the 2008 financial crisis.

A similar pattern re-emerged during the pandemic. When the Federal Reserve cut interest rates to near zero, the 30-year fixed mortgage rate fell below 3% for the first time on record. Buyers flooded the market, and according to the National Association of Realtors, the median existing-home price rose from roughly $274,500 in 2019 to about $413,800 by mid-2022, a more than 40% surge, the sharpest in modern U.S. history. Cheap credit reduced monthly payments, but it also inflated prices to unprecedented levels.

Long Loans, Lifelong Debt

A 50-year mortgage would likely repeat a familiar pattern. Lower monthly payments may expand buying power, but with limited housing supply, especially in major cities, demand would push prices even higher. Other countries have already seen similar outcomes.

In the United Kingdom, 35- to 40-year mortgages have become increasingly common as buyers struggle with affordability. Yet longer terms haven’t reduced prices; they’ve only allowed borrowers to take on larger loans and make higher bids. In Japan, some lenders offer ultra-long or even intergenerational mortgages, where payments can extend across decades and, in rare cases, between generations. This model helps families access ownership but also perpetuates long-term debt and inflated home values.

The personal trade-offs are significant. A borrower taking a 50-year loan at age 30 would still be paying at 80. Even with refinancing, the slow amortization means equity builds at a crawl. For much of the first 15 years, most of each payment goes toward interest rather than principal. This leaves homeowners vulnerable if property values fall, increasing the risk of negative equity, owing more than the home is worth.

That slow equity growth has broader implications. Owners with little equity are less likely to sell or move, a phenomenon economists call the lock-in effect. Reduced mobility limits housing supply and can drive prices even higher. Ironically, a policy meant to make housing more accessible could end up making it less affordable over time.

The Real Problem: Supply, Not Credit

Supporters of longer mortgages argue that the approach fits modern realities. People are living and working longer, and household income often peaks later in life. Extending repayment across 50 years, they say, aligns with longer earning horizons. As long as rates remain fixed, borrowers avoid the payment shocks that devastated subprime borrowers in the 2000s.

In theory, the 50-year mortgage is simply another tool, a bridge between stagnant wages and record-high home prices. Yet this argument overlooks the core issue: supply and demand.

According to the U.S. Census Bureau, the United States faces a housing shortfall of roughly 4.7 million units after decades of underbuilding. As the Brookings Institution notes, financial tools can ease payments but can’t fix supply shortages, without large-scale construction, easier credit only drives prices higher. Financial innovation can adjust how we borrow, but it can’t build more homes.

Redefining the American Dream

The 30-year mortgage once embodied the promise of the American Dream, a stable path for ordinary families to own their homes and build generational wealth. Extending that to 50 years changes the meaning of ownership itself. Instead of offering security, it risks becoming a lifelong obligation. Many borrowers could still be paying off their homes well into retirement, leaving heirs with both the property and the remaining debt.

That shift carries cultural and economic weight. A housing market built on 50-year loans suggests home prices have grown permanently detached from household incomes. Rather than solving the affordability crisis, longer terms could normalize it, making unaffordable homes appear attainable while deepening dependence on debt. In doing so, the foundation of the American Dream transforms from a symbol of independence into one of perpetual repayment.

Political Appeal, Economic Reality

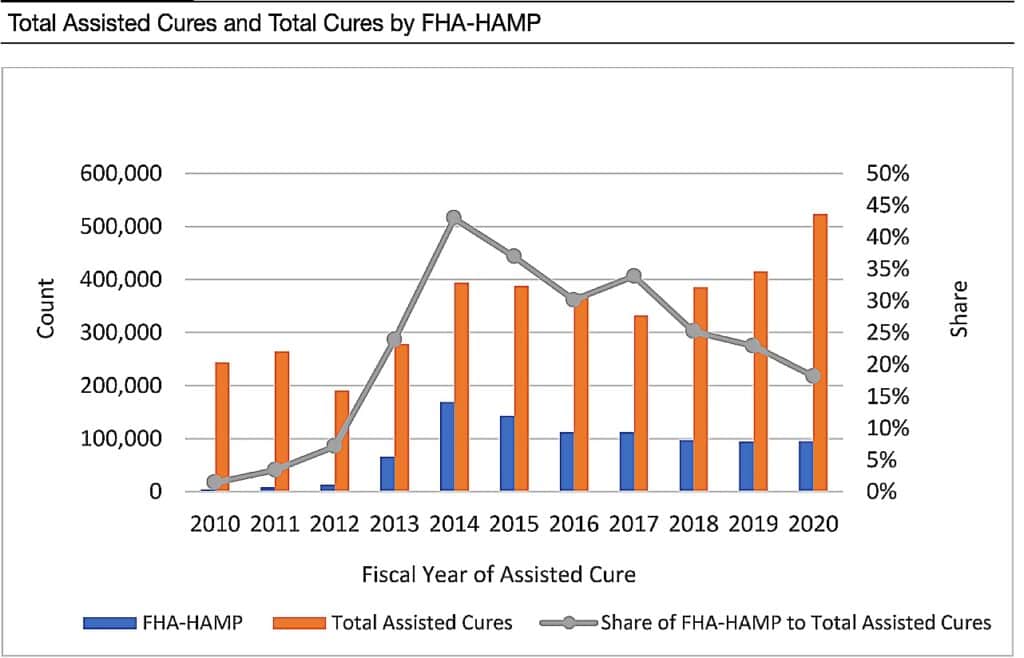

Some policymakers may still find the idea of a 50-year mortgage politically appealing. It offers a quick way to claim progress on “affordability” without tackling harder reforms such as zoning laws, construction bottlenecks, or land-use restrictions. The Federal Housing Administration (FHA) already allows 40-year terms for certain loan modifications, a policy introduced in 2023 to help distressed borrowers refinance and avoid foreclosure. Extending that to 50 years would be a natural, if controversial, next step.

But the math tells a harsher truth. Longer mortgage terms lower monthly payments in the short run but greatly increase total borrowing costs over time. They also boost housing demand without creating new supply, pushing prices even higher.

History shows the pattern clearly, from the credit expansion of the 2000s to the pandemic-era housing boom, when easier financing fueled price spikes rather than fixing affordability. Extending debt maturity doesn’t solve a housing shortage; it only delays the pain.

The Bottom Line

The 50-year mortgage may find a place as a niche product for certain borrowers, but as a national solution, it risks deepening rather than easing the affordability crisis. Extending repayment horizons can temporarily shrink monthly payments, yet history shows the trade-off is steep: higher lifetime costs, slower equity growth, and ultimately higher prices driven by inflated demand.

Financial innovation can change how Americans borrow, but it cannot create more homes. Without addressing the chronic shortage of housing supply, longer mortgages merely stretch the same pool of buyers over a limited number of properties, fueling price escalation rather than affordability.

In the end, the 50-year mortgage is less a breakthrough than a symptom of imbalance. It reflects an economy where wages lag behind housing costs and policymakers reach for credit tools instead of construction reforms. The arithmetic remains constant: lower payments today, higher prices tomorrow.

Related: This article is part of Mooloo’s Loans & Credit Hub, covering credit scores, loans, mortgages, credit cards, and smart borrowing decisions: