The Student Loan Rate Spread: Why Your Roommate Pays 4% While You Pay 17%

11.8 min read

Updated: Dec 26, 2025 - 06:12:39

As of October 2025, private student loan rates can vary by as much as 15 percentage points based on creditworthiness, not merit. Borrowers with excellent credit or well-off co-signers may pay 4–7%, while those with limited credit or no co-signer can face double-digit rates above 12–17%. This gap, driven by risk-based pricing models, reinforces existing wealth disparities rather than academic differences.

- Credit drives cost: Borrowers with credit scores above 720 see average fixed rates near 7.3%, while scores under 670 often face 12% or higher.

- Co-signers matter: Roughly 90% of private undergraduate loans include a co-signer; strong co-signers mean lower rates.

- Income amplifies inequality: Lower-income families often have higher debt-to-income ratios, which push them into higher-rate tiers even with decent credit.

- Federal loans first: Federal Direct Loans charge all undergraduates a fixed 6.39% (for 2025–2026) regardless of credit and include income-driven repayment and forgiveness protections.

- Shop and refinance: Compare offers from multiple lenders before applying, improve your credit, and consider refinancing after graduation, but never refinance federal loans into private ones.

Private student loan interest rates can differ by as much as 15 percentage points depending on a borrower’s creditworthiness. Two students sitting in the same classroom may face vastly different borrowing costs, one paying three times what the other does, based entirely on credit scores, income levels, and family wealth. These differences have nothing to do with merit or academic performance; instead, they reflect existing financial privilege and access to credit.

The 15-Point Spread Nobody Talks About

When private student loan lenders advertise rates “as low as 2.85%,” they’re not lying, but they’re not telling you the whole truth either. Those ultra-low rates go only to top-tier borrowers with credit scores above 750, strong income, and often, well-off co-signers.

For everyone else, the reality looks very different. As of October 2025, average fixed rates on 10-year private student loans for borrowers with credit scores above 720 hover around 7.3%, according to Forbes. Drop below 670, and you’re likely facing double-digit interest rates, often 12% or higher, if you qualify at all. Platforms like Credible and Bankrate show that most borrowers see offers ranging from 7% to 17.99%, depending on credit and loan term.

Source: Forbes

Here’s what that means in dollars: on a $40,000 loan over 10 years, a borrower with excellent credit paying 4% interest will pay roughly $6,600 in total interest. Someone with fair credit at 12% will pay around $22,600, a $16,000 penalty for having less established credit. And if you’re stuck near the top of the range, around 17%, you’ll pay over $37,000 in interest, nearly double what you originally borrowed.

Why Credit Scores Control Everything

Private lenders use a risk-based pricing model, meaning they charge higher interest rates if they believe you’re more likely to default. Not that you have defaulted before, just because, statistically, someone with a credit profile similar to yours is more likely to. Your credit score is one of their primary tools for making that judgment, along with your income, debt-to-income ratio, and whether you have a creditworthy co-signer.

Most private student loan lenders require a minimum credit score of around 660–670 to qualify for approval, though the most competitive rates generally go to borrowers with scores of 700 or higher. For reference, the average American credit score was 715 as of 2025, according to FICO, but that figure isn’t evenly distributed across generations.

The Credit Score Divide

Gen Z consumers, who make up the largest share of current college students, have an average credit score of about 676, roughly 40 points below the national average. That gap often prevents them from accessing the lowest advertised loan rates, especially without a co-signer.

The problem is worse for students from lower-income families. If your parents have poor credit or limited credit history, they can’t effectively co-sign for you. And without a qualified co-signer, many students either don’t qualify for private loans at all or face interest rates approaching credit card levels.

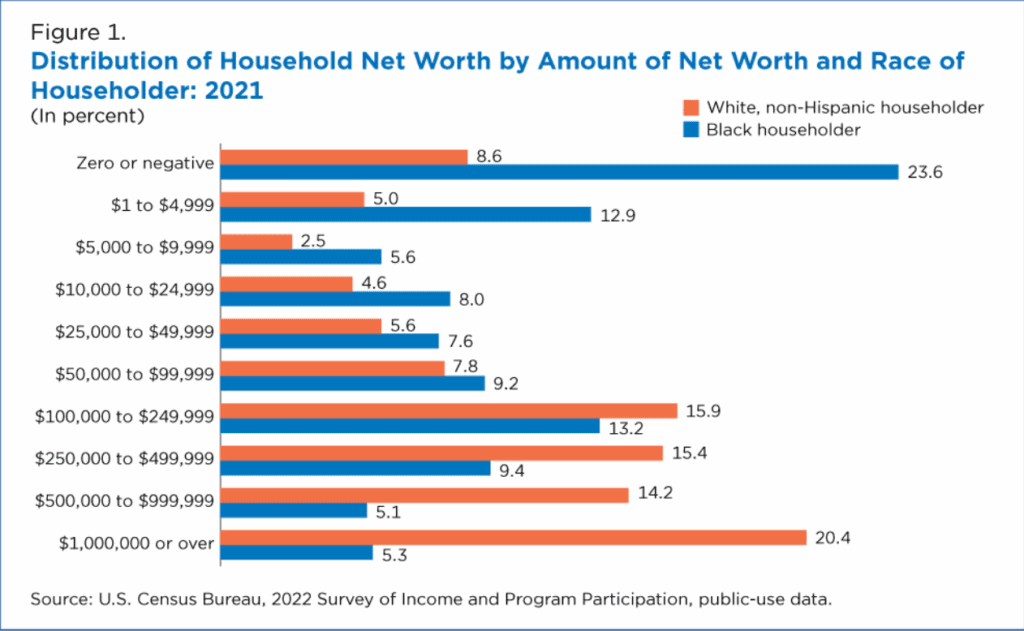

Here’s the uncomfortable truth: Black families have a median household income nearly $28,000 lower than white families, and borrowers from lower-income backgrounds consistently report lower credit scores. This isn’t about individual responsibility, it’s about systemic access to credit and generational wealth that shapes who gets affordable loans and who doesn’t.

Source: Census

The Co-Signer Advantage

About 90% of undergraduate private student loans include a co-signer, usually a parent or guardian, who is equally responsible for repayment. That co-signer is effectively putting their credit score and financial standing on the line for your ability to repay the loan.

Adding a co-signer with excellent credit can make a major difference. Lenders view you as less risky, often lowering your interest rate by a few percentage points. Even a 3-point difference can translate into tens of thousands of dollars saved over the life of a large loan.

But not everyone has access to creditworthy co-signers. Students whose parents have poor credit, no credit history, or are immigrants without established U.S. credit are effectively locked out of competitive rates, and some are locked out entirely.

A small number of lenders offer no-co-signer loans to students with limited credit history, but these come at a cost. Interest rates typically range well into the double digits, often between 12% and 15%, making repayment far more difficult after graduation.

Income: The Hidden Factor

Beyond credit scores, private student loan lenders also evaluate income stability, both yours and your co-signer’s. They look for steady employment and enough income to cover existing debts plus the new loan payments. Most lenders prefer a debt-to-income (DTI) ratio below 50%, but the most competitive interest rates generally go to borrowers with DTI ratios under 20%.

This is where inequality deepens. Students from low-income households, those most reliant on loans, often have parents with limited savings, lower incomes, and higher debt burdens. Even if those parents maintain decent credit scores, higher DTI ratios can push them into higher-rate tiers, reducing access to affordable financing.

Meanwhile, wealthier students often don’t need loans at all. When they do borrow, their families’ higher incomes and lower debt levels qualify them for the lowest available interest rates. In effect, those who need credit the least receive the best terms, while those who rely on borrowing pay a premium, highlighting the systemic inequities built into risk-based lending models.

Variable vs. Fixed: The Rate Gamble

Lenders offer two types of interest rates: fixed and variable. Fixed rates remain the same for the life of the loan, while variable rates fluctuate based on market conditions, often tied to benchmarks like the Secured Overnight Financing Rate (SOFR).

Variable rates typically start slightly lower than fixed rates, usually about half to one percentage point less, making them appealing at first glance. However, those lower rates come with a risk: if market rates rise, so will your loan’s rate. A variable loan that begins at 5.5% today could climb to 9% or higher over a 10-year repayment period, depending on economic conditions.

For borrowers from high-income families who can repay loans quickly or refinance if rates increase, variable-rate loans can offer meaningful savings. But for students who expect to make only minimum payments for years, variable rates are a risky bet that often costs more in the long run. Ironically, the students least able to handle rising payments are often the most drawn to the lower initial costs of variable loans, a financial trap that can add thousands of dollars in extra interest over time.

The Autopay Discount Illusion

Almost every major student loan lender offers a 0.25% interest rate reduction when you enroll in automatic payments (autopay) from your bank account. It’s a common incentive, and the “starting at” rates many lenders advertise often assume you’ll take this discount.

But automatic payments can backfire if you’re living paycheck to paycheck. If your balance is too low when the payment is withdrawn, you could face overdraft fees, late payment penalties, and potential credit score damage, all of which can raise the cost of future borrowing. Federal loan servicers like MOHELA explicitly warn that missing multiple autopay withdrawals can lead to the loss of your 0.25% discount.

The autopay discount tends to work best for borrowers with steady income and financial cushions, not students juggling tight budgets. Yet it’s still baked into the “best rate” marketing that helps lenders attract new borrowers, a perk that can easily turn into a pitfall if you’re not prepared to manage your cash flow carefully.

What Private Lenders Won’t Tell You

When you shop for private student loans, most lenders start with a soft credit check to give you a pre-qualification rate estimate. This type of inquiry doesn’t affect your credit score. However, the rate you see at this stage is typically a best-case scenario, an estimate based on limited information, not a final offer.

Once you submit a full application, the lender performs a hard credit check and completes the full underwriting process. This deeper review of your verified credit history, income, debt-to-income ratio, and (if applicable) co-signer details can change the final rate. It’s not uncommon for borrowers to receive a higher interest rate than the initial quote if additional risk factors are found.

Lenders also seldom emphasize how important it is to shop around. Just like with mortgages, you should compare offers from at least three to five lenders before committing. Each lender uses its own underwriting criteria and risk models, meaning the rates you’re offered can vary significantly. Using multiple pre-qualification tools lets you compare potential rates without hurting your credit, helping you find the best possible deal for your financial profile.

The Wealth Gap in Student Lending

The student loan system places heavier burdens on students from lower-wealth families, not necessarily through higher interest rates on federal loans, which are uniform, but through larger relative debt loads and tougher repayment outcomes.

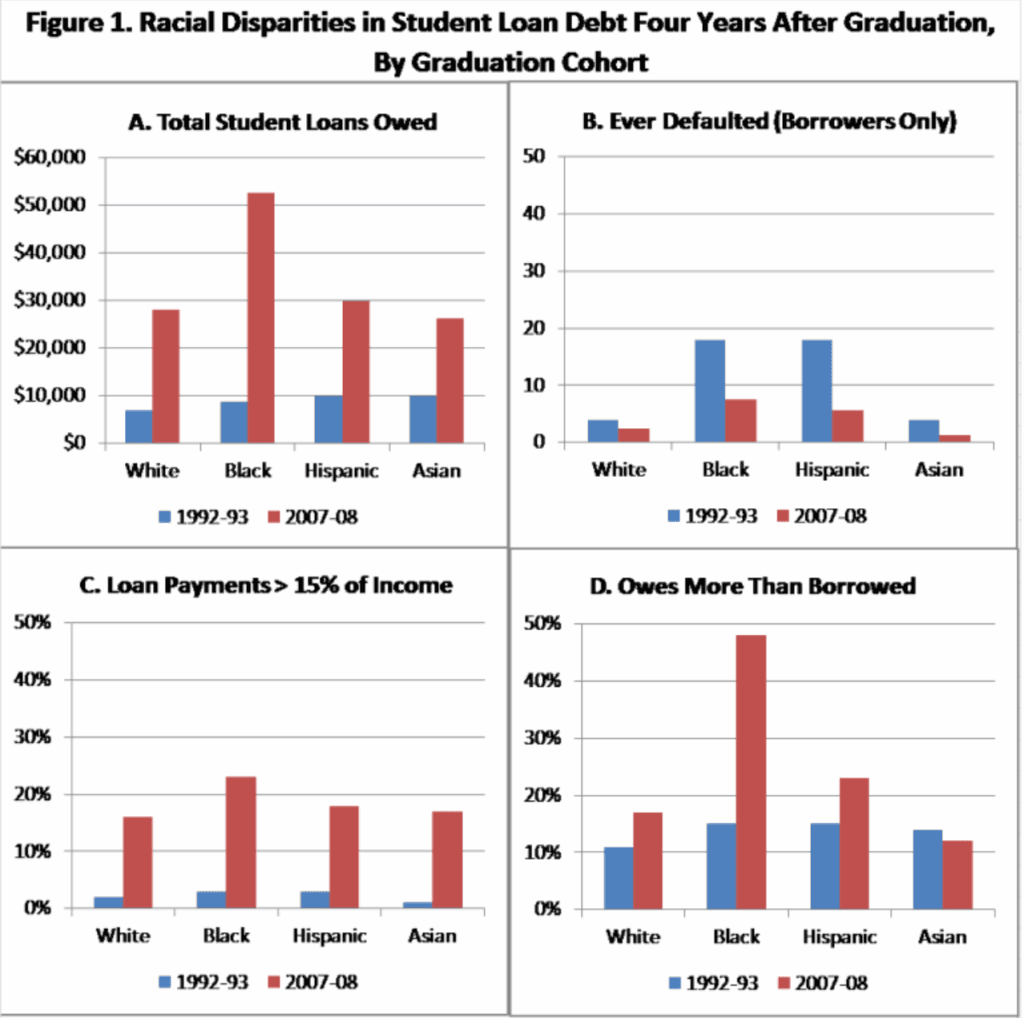

According to the Education Data Initiative, Black college graduates owe an average of $25,000 more in student debt than white graduates. The Brookings Institution reports that four years after graduation, Black borrowers hold about $52,726 in debt compared to $28,006 for white borrowers, a gap that widens with time.

Source: Bookings

Households in the lowest wealth quartile are significantly more likely to hold student debt than those in the top decile, according to research from the Cleveland Federal Reserve and Brookings Institution, though the “six-times-more-likely” figure isn’t directly supported by current data.

It’s also true that lower-income borrowers often pay more over time, not because of higher rates, but because their balances grow through compounding interest, longer repayment terms, and lower post-graduation earnings. Federal data from the National Center for Education Statistics shows that four years after graduation, Black borrowers owe 105% of their original balance, compared with 73% for white borrowers.

In short: students from wealthier families borrow less, pay off faster, and end up paying less overall. Those from poorer families carry more debt for longer, a system that ultimately widens the wealth gap rather than closing it.

What You Can Do

If you’re facing high interest rates on private loans, you have options:

Improve your credit before borrowing: If possible, take 6–12 months to build credit history using a secured credit cardor by becoming an authorized user on a parent’s account. Even a modest 20–30 point increase in your credit score can help you qualify for lower rates and save thousands in interest over time.

Shop extensively: Get rate quotes from at least five private lenders. Each lender uses slightly different risk models, so offers can vary by several percentage points. Always confirm whether advertised “starting at” rates include autopay discounts or assume a co-signer.

Consider federal loans first: Federal Direct Student Loans don’t consider credit scores and charge all undergraduates the same fixed rate, 6.39% for loans first disbursed between July 1, 2025, and June 30, 2026, according to the U.S. Department of Education. That’s typically lower than what most students can secure privately and includes repayment protections unavailable with private loans.

Find a better co-signer: If your parents can’t co-sign, consider asking a grandparent, aunt, uncle, or family friend with strong credit. Many private lenders allow non-family co-signers, and a qualified co-signer can significantly lower your rate.

Plan to refinance: After graduation, if you have a stable job and solid credit, refinancing private loans can reduce your interest rate. But never refinance federal loans into private ones, you’ll lose key benefits like income-driven repayment and potential forgiveness programs.

Borrow less: Every dollar you don’t borrow is money you don’t have to repay with interest. Work during school, apply for scholarships aggressively, consider starting at a community college, or choose a more affordable university. The “dream school” may not be worth decades of high-interest debt.

The Bottom Line on Rate Inequality

The 15-point spread in student loan interest rates isn’t an accident or a reflection of individual merit, it’s a built-in feature of a risk-based lending system that prices credit according to existing wealth. Private lenders base rates largely on credit scores, income, and debt-to-income ratios. Students from wealthier families, whose parents have higher credit scores and lower debt levels, qualify for the best terms. Students from lower-income households face higher rates simply because their families lack those financial advantages.

Understanding this reality doesn’t make it fair, but it does make you a more informed borrower. Always check the actual rate you’re being offered, not just the one advertised in lender marketing. Your credit score, or your family’s, will determine what you pay just as much as your choice of school or field of study.

And most importantly: choose federal loans first. According to the U.S. Department of Education, federal loans charge the same interest rate to all borrowers regardless of credit and offer income-driven repayment plans and forgiveness options. They’re imperfect, but they remain the closest thing to a level playing field in student lending.

Related: This topic is part of the broader credit system. For an overview of how credit scores, loans, and debt work together, see our Credit & Debt guide.