MOHELA Student Loan Forgiveness: Why 40% of Borrowers Are Getting Screwed (And How to Fight Back)

4.8 min read

Updated: Dec 26, 2025 - 06:12:38

Nearly 40% of borrowers serviced by the Missouri Higher Education Loan Authority (MOHELA) have faced major errors in their loan forgiveness process, according to a 2024 report from the American Federation of Teachers and the Student Borrower Protection Center. Issues range from denied forgiveness applications to credit reporting mistakes, leaving many borrowers with unexpected bills, damaged credit, and lost access to forgiveness they legally earned. With lawsuits, federal investigations, and borrower complaints piling up, vigilance and documentation are essential for anyone pursuing Public Service Loan Forgiveness (PSLF) or related programs.

- High error rates: 4 in 10 MOHELA borrowers reported servicing failures, including lost payment histories and incorrect forgiveness counts.

- Legal challenges: Federal lawsuits accuse MOHELA of illegally collecting on discharged loans; state attorneys general and senators are investigating.

- Borrower impact: Errors can cost tens of thousands, harm credit with duplicate loan reporting, and cancel earned forgiveness.

- Action steps: Document all loan activity, file complaints with the CFPB and FSA Ombudsman, and consider joining lawsuits or advocacy efforts.

- Bigger picture: Failures raise questions about outsourcing federal loan servicing and whether forgiveness programs are reliable without stronger oversight.

For many student loan borrowers, the promise of loan forgiveness was supposed to offer relief after years of repayment. But for thousands serviced by the Missouri Higher Education Loan Authority, better known as MOHELA, the reality looks very different.

A recent report found that nearly 40% of MOHELA borrowers have experienced servicing failures, ranging from denied forgiveness applications to billing mistakes and credit reporting errors. These problems are more than just paperwork glitches. They can leave borrowers paying thousands of dollars unnecessarily, damaging their credit, and even losing out on forgiveness they legally earned.

Here’s what’s going wrong, why it matters, and what borrowers can do to push back.

What Is Happening with MOHELA Student Loan Forgiveness?

Reports and Investigations

In early 2024, the American Federation of Teachers and the Student Borrower Protection Center released a report finding that 4 in 10 MOHELA borrowers had faced major issues in the loan forgiveness process. Complaints included:

-

Long delays in processing applications

-

Incorrect payment counts for forgiveness programs

-

Lost account histories after servicing transfers

-

Failure to apply Department of Education–ordered discharges

Federal watchdogs echoed these findings. The Consumer Financial Protection Bureau (CFPB) and the Federal Student Aid (FSA) Ombudsman recorded a surge in complaints after payments resumed in 2023, with MOHELA consistently among the top offenders.

source: CFPB

Legal Challenges and Lawsuits

Borrowers and advocacy groups have taken MOHELA to court. A key lawsuit accuses the servicer of illegally collecting payments on loans that should have been discharged and reporting those loans as active to credit bureaus. In mid-2025, a federal judge rejected MOHELA’s attempt to dismiss the case, allowing claims to move forward.

Separately, U.S. senators have questioned MOHELA’s “predatory” website terms of use, which attempt to strip borrowers of certain rights. Multiple state attorneys general are also investigating the company for mismanagement and credit reporting failures.

How Borrowers Are Impacted

Financial Consequences

Borrowers who thought their loans were forgiven have in some cases received bills months later. Others were charged phantom balances, saw automatic payments withdrawn without notice, or had expected forgiveness canceled without explanation.

For a teacher or nurse counting on Public Service Loan Forgiveness (PSLF), these errors can translate into tens of thousands of dollars in unexpected debt.

Credit and Long-Term Risks

The consequences extend beyond loan balances. MOHELA has been linked to nearly 2 million credit reporting errors, leaving borrowers with duplicate or inaccurate loans on their credit reports. Even when corrected, these mistakes can drag down scores for months, making it harder to rent an apartment, buy a car, or qualify for a mortgage.

Beyond financial damage, many borrowers report stress, anxiety, and lost trust in the system designed to support them.

What Borrowers Can Do to Fight Back

Document and Escalate Errors

The first step is documentation. Borrowers should save all correspondence, notices of forgiveness, billing statements, and screenshots of their loan accounts. A paper trail is critical if forgiveness is later denied or reversed.

File Complaints with Oversight Agencies

Borrowers can submit formal complaints through:

Each complaint helps regulators build a case for oversight and intervention.

Consider Legal and Advocacy Options

Borrowers may be eligible to join class-action lawsuits against MOHELA. Legal groups like the Project on Predatory Student Lending and the Student Borrower Protection Center are actively litigating systemic failures.

Advocacy also matters. Sharing stories with borrower coalitions or directly with lawmakers can increase public pressure on MOHELA and federal officials to act. Senators Elizabeth Warren, Richard Blumenthal, and Tammy Duckworth are among those pushing for accountability.

The Bigger Picture

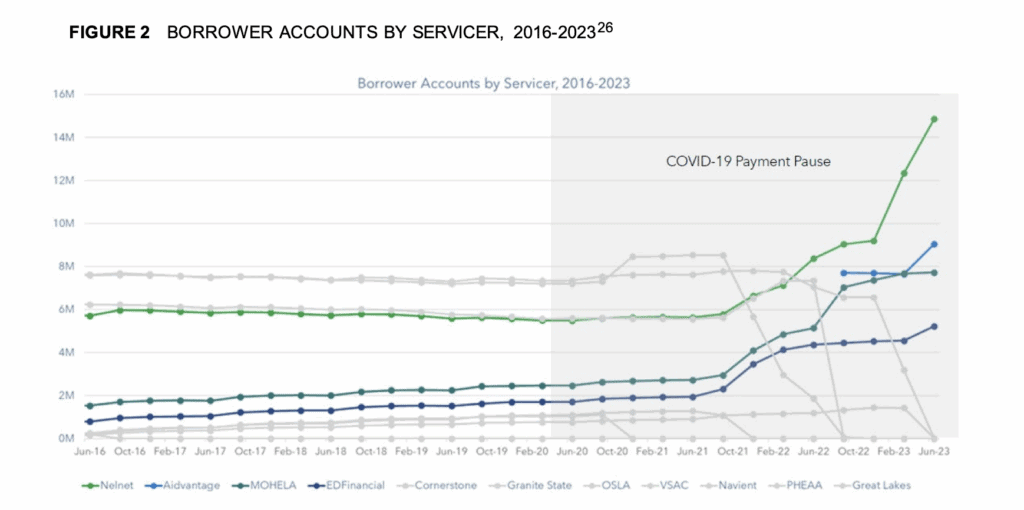

MOHELA is one of the largest federal student loan servicers, managing accounts for millions of Americans. Its failures are not just clerical mistakes, they highlight structural weaknesses in outsourcing essential federal programs to private companies. When such a servicer mishandles payments, forgiveness applications, or credit reporting, the ripple effects can be devastating across households, communities, and even the broader economy.

The controversy has reignited debates over whether the Department of Education should continue relying on private contractors or bring loan servicing entirely under federal management. For borrowers, the lesson is clear: forgiveness is not always automatic, and vigilance is necessary to ensure programs deliver the relief they promise.

In the meantime, affected borrowers must remain proactive, tracking their accounts, escalating disputes, and engaging with legal and advocacy resources. The fight for accountability is ongoing, but each borrower’s action contributes to broader reform.

Related: This topic is part of the broader credit system. For an overview of how credit scores, loans, and debt work together, see our Credit & Debt guide.