How to Get a Stated Income Line of Credit Without Proving Your Income

4 min read

Updated: Dec 26, 2025 - 06:12:16

A stated income line of credit (LOC) lets borrowers access revolving funds without W-2s or pay stubs, instead relying on credit scores, collateral, or bank statements. These loans, once common pre-2008, remain available in limited form, mostly through fintech lenders, niche banks, or credit unions. They serve self-employed professionals, small business owners, and real estate investors with legitimate but hard-to-document income. However, they typically come with higher rates, stricter equity requirements, and fewer provider options compared to traditional loans.

- Who qualifies: Borrowers with strong credit (often 680+) and consistent cash flow, including consultants, freelancers, and rental property investors.

- How it works: Lenders may request 6–24 months of bank statements; HELOCs usually cap at 70–80% of property value.

- Where to find: Options include FundingPilot, Sunwise Capital, BlueVine, and some regional credit unions offering no-doc HELOCs.

- Key trade-offs: Higher rates and fees, limited availability, and risks if income is overstated.

- Alternatives: Traditional HELOCs, secured personal lines of credit, or business credit cards often provide lower-cost options.

A stated income line of credit (LOC) is a revolving loan that allows borrowers to access funds without submitting traditional proof of income, such as W-2 forms or recent pay stubs. Instead, lenders assess eligibility using alternative measures like credit history, collateral, or consistent bank deposits.

:max_bytes(150000):strip_icc():format(webp)/LOC-13d791780aa54b6a9a28120d6d1c9f65.jpg)

Source: Investopedia

These products were once common in the mortgage industry before the 2008 housing crisis. While many disappeared after regulators tightened lending standards, a limited number of banks, credit unions, and fintech lenders still offer them today, mostly for business financing or home equity lines of credit (HELOCs).

Who These Loans Are Designed For

Stated income LOCs cater to borrowers with legitimate but difficult-to-document income. Common examples include:

-

Self-employed professionals such as consultants, contractors, and gig workers.

-

Real estate investors who show cash flow from rental properties but little W-2 income.

-

Small business owners and freelancers whose tax returns may understate disposable income.

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

Source: Investopedia

These borrowers are often creditworthy but don’t fit traditional underwriting models.

How to Qualify Without Traditional Proof of Income

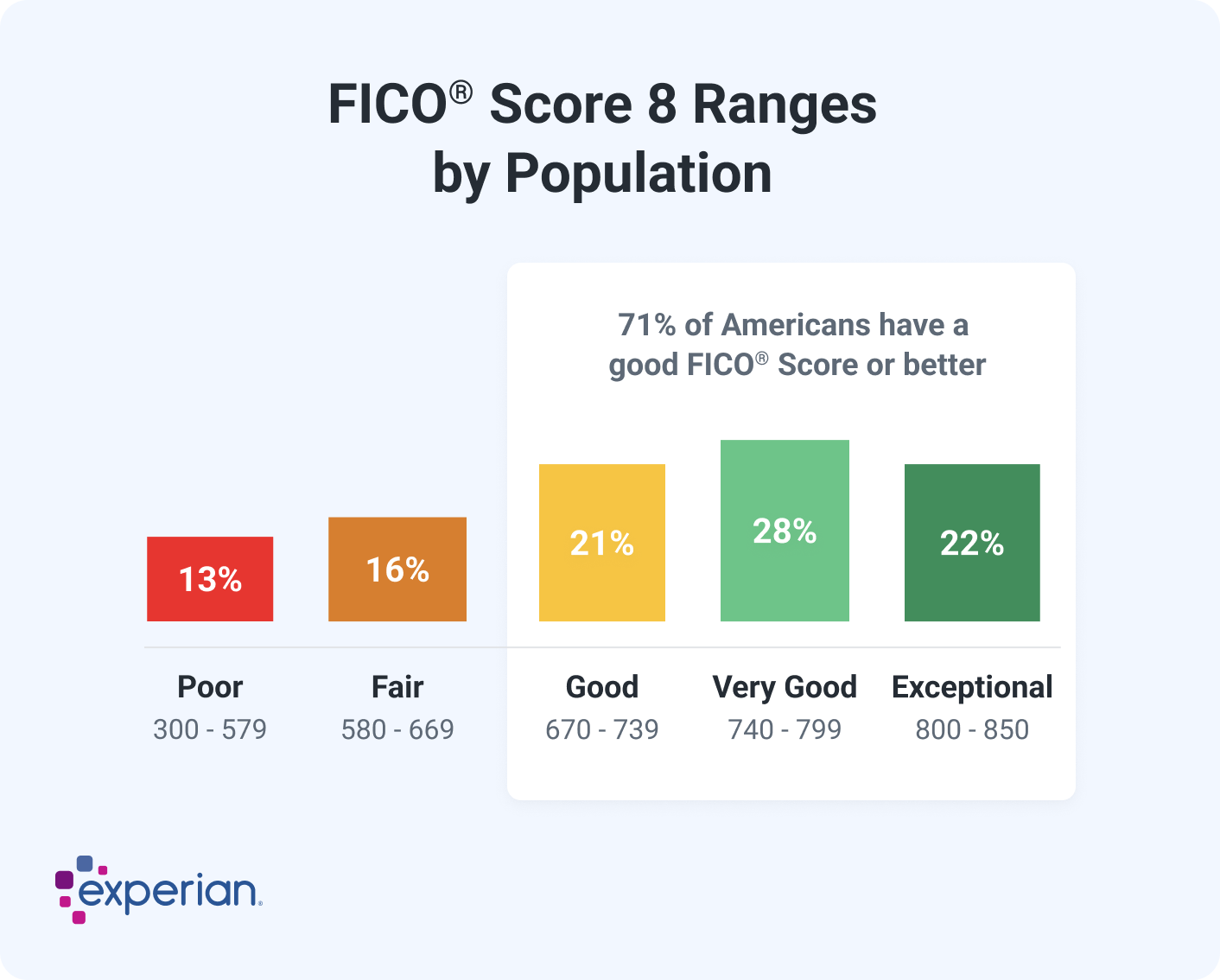

Instead of tax returns or pay stubs, lenders rely on alternative checks. A solid credit score is usually required, often around 680 or higher, though exact cutoffs vary by provider. Many lenders request six to 24 months of bank statements to verify cash flow.

Source: Experian

In the case of HELOCs, borrowing limits are typically capped at 70–80% of the property’s value. Some lenders also require reserves in the form of cash or liquid assets as a cushion.

Where to Find Reputable Providers

While less common than traditional credit products, several legitimate providers offer stated income programs. These include:

-

FundingPilot—business lines of credit for self-employed borrowers.

-

Sunwise Capital—unsecured stated income business loans.

-

BlueVine—LOCs based on bank statement underwriting.

-

Regional banks and credit unions—some still provide no-doc HELOCs for borrowers with strong equity.

These differ from payday lenders, or “loansharks,” because they operate under regulatory oversight, provide structured repayment schedules, and require credit checks.

Risks and Downsides to Consider

The biggest trade-off for borrowers is cost. Interest rates and fees are often higher than with traditional lines of credit. Availability is also limited, with far fewer lenders offering these products compared to standard loans. Finally, borrowers who exaggerate or misstate income run a significant risk of default, which can damage both credit and financial stability.

What a Stated Income Loan Is Not

It is important to distinguish stated income LOCs from predatory lending. They are not payday or title loans with extreme interest rates. They are not unregulated lending products; lenders remain bound by state and federal laws. Nor are they a source of “easy money.” Lenders still require credit and asset verification to reduce risk.

Alternatives Worth Comparing

For many borrowers, traditional financing options may prove more affordable. A conventional HELOC usually offers lower rates if standard documentation can be provided. Business credit cards can serve as flexible short-term financing tools, often with rewards. Another option is a secured personal line of credit, which uses savings or certificates of deposit as collateral and is often easier to qualify for.

Final Takeaway

A stated income line of credit can serve as a lifeline for self-employed professionals, real estate investors, and small business owners who cannot easily prove income through tax returns or pay stubs. These products are legitimate but niche, typically more expensive, and reserved for borrowers with strong credit profiles or assets. For most, traditional loans or HELOCs will remain the more cost-effective path.

Related: This topic is part of the broader credit system. For an overview of how credit scores, loans, and debt work together, see our Credit & Debt guide.