How Parents Can Future-Proof Their Children’s Education Funding Amid Policy Shifts

4.7 min read

Updated: Dec 19, 2025 - 08:12:13

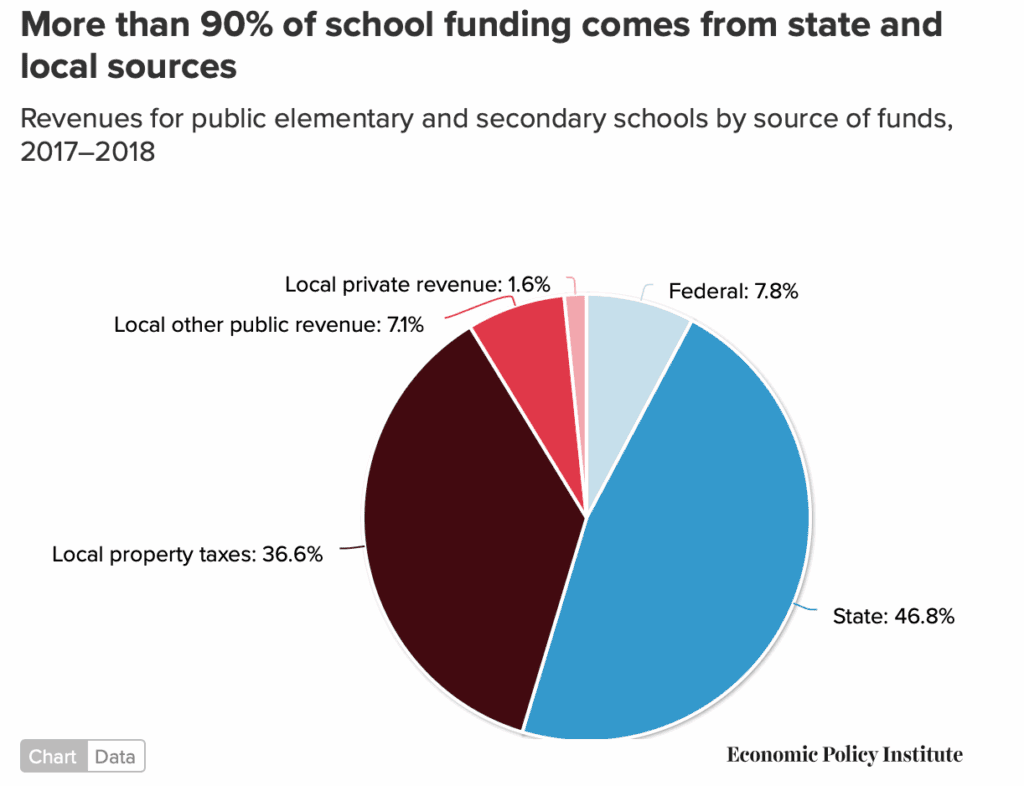

Parents worried about potential U.S. Department of Education restructuring can protect long-term education plans by focusing on factors that remain stable regardless of federal oversight. Tuition increases historically outpace inflation, most K–12 funding is already state-based, and state-run 529 plans continue to offer tax-free growth even as political priorities shift. The most reliable strategy is a diversified savings approach that reduces dependence on future loan programs, which are the area most likely to change if federal roles shrink or shift.

- Rising tuition trends persist across administrations, making early saving and diversified accounts, such as 529 plans, critical hedges.

- More than 90% of K–12 funding comes from states, so core education financing remains stable even during federal restructuring debates.

- Aid programs like Pell Grants may shift with congressional priorities, the area where parents should anticipate future variability.

- Reducing reliance on student loans lowers exposure to changing interest rates, repayment rules, or lender structures.

- Cost-cutting levers parents control, AP/dual enrollment, in-state colleges, community-college transfers, early scholarship searches, remain unchanged.

Recent headlines about potential restructuring of the U.S. Department of Education have raised understandable concern among parents planning long-term education funding for their children. Political change always generates uncertainty, but education funding in the United States has never been fully predictable.

Tuition costs rise faster than inflation, according to the National Center for Education Statistics, federal aid rules shift with every administration, and state budgets can change dramatically year to year. For families building a financial strategy, the goal is not to forecast politics but to create resilience, a plan that functions regardless of whether federal oversight expands, contracts, or fundamentally changes.

Federal policy shifts could meaningfully affect several areas parents typically rely on. Student loan oversight, currently tied to fixed interest rates determined annually by the U.S. Treasury market, could shift toward states or private lenders if federal involvement declines.

Aid programs such as Pell Grants may see expanded eligibility, reduced availability, or new conditions depending on congressional priorities. Funding for special education and disability support, grounded in federal laws such as IDEA, could change if those responsibilities move more toward state control. These are the areas where federal restructuring may produce real differences in what families can expect.

What Stays the Same: The Core Drivers of Education Costs

Despite federal uncertainty, several fundamentals remain steady. More than 90% of K–12 school funding already comes from states and local districts, meaning the core of public education financing is not determined in Washington. Colleges will continue setting their own tuition regardless of federal changes, and rising tuition trends have persisted across decades, political shifts, recessions, and economic booms. For parents, this combination of uncertainty and inevitability underscores why a durable, multi-layered savings strategy is essential.

Source: Economic Policy Institute

529 plans remain one of the most stable tools available because they are state-run programs, not federal ones. They offer tax-free growth, tax-free withdrawals for qualified education expenses, and, in many states, additional tax benefits. For maximum flexibility, many families combine a 529 with a high-yield savings account or a taxable brokerage account. Long-term performance of broad-market ETFs, tracked by S&P Dow Jones Indices, continues to outpace inflation, making a diversified savings-and-investment approach a strong hedge against rising costs.

Where Federal Changes Could Matter Most

The student loan system is the area most likely to shift if federal structures change. Today’s system provides predictable interest rates and income-driven repayment options through the Federal Student Aid Office. If states, private lenders, or hybrid programs take on a greater role, families could face more variation between regions, fewer standardized borrower protections, or more complicated repayment terms. Reducing reliance on student loans is the simplest way to insulate children from these unknowns.

The Cost-Saving Factors Parents Can Control

Parents also retain significant control over factors that are unaffected by federal policy. High school students can cut costs by earning college credits through AP or dual-enrollment programs. In-state universities remain dramatically more affordable than out-of-state options, a difference consistently tracked by the College Board. Community college transfer pathways continue to offer the lowest-cost route to a bachelor’s degree. And scholarship money, often left unclaimed, becomes more accessible when families begin the search early rather than waiting until senior year.

A small number of bullet points genuinely clarify these levers:

-

Earning AP or dual-enrollment credits to eliminate a semester or a full year of college

-

Choosing in-state public universities, which cost less than half of out-of-state options

-

Using the community-college-to-four-year transfer model

-

Starting scholarship planning early instead of waiting until senior year

These strategies consistently reduce total education expenses and remain untouched by federal restructuring debates.

Building a Resilient Long-Term Plan

Parents seeking the greatest confidence often create a simple long-term “education risk map.” This includes projected costs, a sense of how much the family plans to save versus borrow, an understanding of where policy changes might affect aid, and several alternative pathways if expenses rise faster than expected. This type of planning does not require predicting political outcomes, only accepting that change is inevitable and preparing accordingly.

The news cycle will shift, but the principles of family financial protection remain constant. Saving early matters more than waiting for clarity. A diversified account structure shields families from both market volatility and policy changes. Reducing reliance on student loans protects children from unpredictable borrowing conditions. And equipping teenagers with financial literacy provides lifelong advantages no legislation can alter. Education will remain one of the most significant long-term investments a family makes. Federal structures may evolve, but the responsibility to prepare, calmly, consistently, and strategically, stays the same.